Weston, Florida, is celebrated for its beautiful neighborhoods, lush landscapes, and affluent lifestyle, making it one of the most desirable places to live in the state. However, buying a home here can sometimes be challenging due to the area’s competitive real estate market. Over the past 37 years, I’ve had the privilege of helping dozens of homebuyers purchase their dream homes in this vibrant community. Through my experience, I’ve worked with a wide range of mortgage loan options to meet the unique needs of each buyer. In this guide, I’ll share the most reliable and effective loan options I’ve utilized in the past and can offer to you as well.

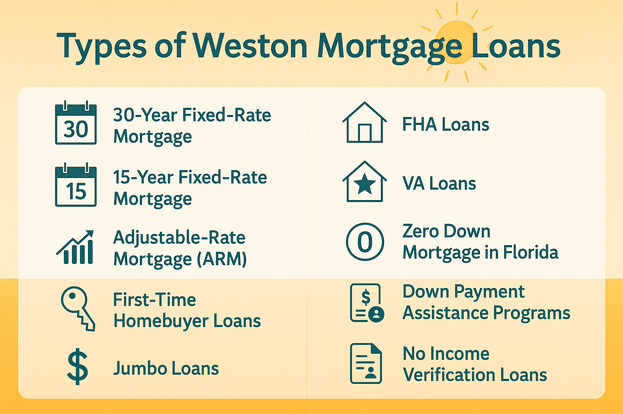

Popular Mortgage Loan Options for Weston Florida

With so many mortgage types available, it’s important to choose the one that best fits your financial situation. Here are some of the most popular options available to homebuyers in Weston.

30-jährige Hypothek mit festem Zinssatz

A 30-year fixed-rate mortgage is one of the most popular mortgage loan options for Weston Florida homebuyers. This mortgage type offers a fixed interest rate, meaning your monthly payments remain consistent throughout the life of the loan. The stability of this loan makes it a practical choice for those who plan to stay in their home long-term. With predictable payments, homeowners can manage their budgets more efficiently without worrying about rising interest rates.

One of the key benefits of a 30-year fixed-rate mortgage is the lower monthly payment compared to shorter-term loans. Because the loan term is spread out over three decades, it significantly reduces the amount you need to pay each month, making it an attractive option for buyers who want to balance a mortgage with other financial commitments. Additionally, since interest rates are locked in from the start, you’re protected from potential increases in the future.

This mortgage is particularly well-suited for homebuyers who value stability and predictability. It’s ideal for families and individuals planning to stay in their home for many years. Whether you’re a first-time homebuyer or refinancing your current mortgage, the 30-year fixed-rate option can be a reliable and budget-friendly choice. Plus, it allows you to take advantage of historically low interest rates, which makes it even more appealing in today’s market.

15-jährige Hypothek mit festem Zinssatz

A 15-year fixed-rate mortgage is another great option for Weston Florida homebuyers who want to pay off their home faster. Unlike a 30-year mortgage, this loan has a shorter repayment period, which means higher monthly payments. However, the benefit lies in the long-term savings on interest. Since the loan is paid off in half the time, you build equity more quickly and reduce the overall cost of your home.

The interest rates on 15-year fixed-rate mortgages are typically lower than those of 30-year loans. This means that, although you’re paying more per month, the interest portion of your payment decreases faster, allowing you to save significantly over the life of the loan. For those who prioritize building equity quickly or want to eliminate mortgage debt sooner, this loan type is worth considering.

While the higher monthly payments might seem daunting, this option is ideal for financially stable buyers who can manage the increased cost. It’s particularly attractive for homeowners who want to reduce interest expenses and secure their financial future more quickly. Many buyers who choose a 15-year fixed-rate mortgage appreciate the sense of accomplishment that comes with paying off their home faster and freeing up funds for other investments.

Hypothek mit variablem Zinssatz (ARM)

An adjustable-rate mortgage (ARM) is a flexible option that typically starts with a lower interest rate compared to a fixed-rate mortgage. This introductory rate often lasts for a set period, such as five or seven years, before it adjusts based on market conditions. For Weston Florida homebuyers looking to reduce their initial costs, an ARM can be an excellent option, especially if they plan to move or refinance before the rate changes.

One of the main attractions of an ARM is the potential for lower payments during the initial period. This can make homeownership more affordable at the beginning, which is especially helpful if you’re planning to increase your income or sell the home within a few years. However, once the fixed-rate period ends, the interest rate may increase, resulting in higher monthly payments.

This type of mortgage is best suited for buyers who anticipate changes in their living situation or financial status. If you’re confident in your ability to refinance or sell before the rate adjustment, an ARM can be a smart financial move. However, it’s important to be prepared for potential rate increases if you decide to stay in the home longer than planned.

First-Time Homebuyer Loans

Buying your first home can be both exciting and overwhelming, but there are mortgage loan options for Weston Florida that make it more accessible. First-time homebuyer loans often come with low or no down payment requirements and reduced mortgage insurance, helping buyers get into their first home without a substantial upfront cost. These programs are designed to support individuals or families who may not have saved a significant down payment but still want to achieve homeownership.

Many first-time homebuyer programs also offer assistance with closing costs, making the process even more manageable. Additionally, these loans often have more lenient credit requirements, which can be a huge benefit for buyers who are just starting to build their credit history. By choosing the right loan, first-time buyers can move into their dream home without worrying about burdensome upfront expenses.

This option is particularly well-suited for those who might be renting or living with family but are ready to make the leap into homeownership. Whether it’s a conventional loan with reduced requirements or a government-backed option like an FHA loan, first-time homebuyers have various paths to consider. Working with a knowledgeable mortgage expert can help you navigate these choices and find the best fit for your situation.

Government-Backed Loans for Weston Homebuyers

Government-backed loans are a great option for Weston Florida homebuyers who might not meet the requirements for conventional mortgages. These loans are secured by federal agencies and offer unique advantages, making them accessible to a broader range of borrowers. FHA and VA loans are the most common types, each serving specific buyer groups with tailored benefits.

FHA-Darlehen

FHA loans, backed by the Federal Housing Administration, are designed for buyers with lower credit scores or limited savings. They allow for a down payment as low as 3.5% and often have more flexible qualification standards. This makes them especially popular among first-time homebuyers or those looking to rebuild their credit. The lower upfront costs can make purchasing a home more feasible for many buyers.

VA-Darlehen

VA loans are exclusively available to veterans, active-duty military personnel, and eligible family members. These loans are backed by the Department of Veterans Affairs and offer remarkable benefits, including no down payment and no private mortgage insurance (PMI). VA loans also tend to have lower interest rates compared to conventional loans, making them an excellent choice for those who qualify.

Government-backed loans help bridge the gap for buyers who might otherwise struggle to secure a mortgage. Whether it’s through lower down payments, reduced insurance premiums, or more flexible approval criteria, these loans provide valuable options for Weston homebuyers seeking financial assistance.

Null-Prozent-Hypothek in Florida

Null-Down-Hypotheken are an appealing choice for Weston homebuyers who want to purchase a property without making a down payment. These loans are designed for those who qualify based on specific criteria, allowing them to move into a home without needing to save for a large upfront cost. There are no income limits for this program and can also be used by non-first-time home buyers. The FICO score requirement is also more lenient, allowing for scores as low as 580. One of the other well-known zero-down options is the USDA loan, which is available for homes in designated rural and suburban areas.

Another option is the VA loan, which also offers zero down payment for eligible veterans and service members. These loans not only make homeownership more attainable but also reduce the financial stress associated with buying a home. However, zero-down mortgages may come with slightly higher interest rates or mortgage insurance to offset the increased risk to the lender.

Buyers interested in zero-down options should assess their long-term plans and financial stability. While these loans eliminate the immediate need for savings, they may result in higher monthly payments compared to loans with significant down payments. Consulting with a mortgage professional can help you determine if a zero-down mortgage is the best fit for your financial goals.

Null-Prozent-Hypothek in Florida

Programme zur Unterstützung bei der Anzahlung

One of the biggest challenges for many homebuyers in Weston, Florida, is saving enough money for a down payment. With property values being higher than average, coming up with the required funds can feel overwhelming. Fortunately, there are Programme zur Unterstützung von Anzahlungen designed to help make homeownership more attainable. These programs offer financial support in the form of grants, low-interest loans, or deferred payment loans, which can significantly reduce the upfront costs associated with buying a home. A FICO score of 640 or higher is required on most of these programs.

In Florida, various assistance options are available, including state and local government initiatives as well as nonprofit programs. Some of these programs offer grants that do not need to be repaid, while others provide loans that may be forgivable after a certain period, especially if the homeowner remains in the property for a set number of years. This can be especially beneficial for first-time buyers or those who are purchasing in targeted areas.

Down payment assistance is particularly helpful for buyers who have steady income but struggle to save due to high rent or other living expenses. By reducing the amount of cash needed upfront, these programs make it possible to buy a home sooner rather than waiting years to save the entire down payment. Consulting with a mortgage professional who is familiar with these assistance options can help identify which programs you may qualify for and how they can ease your path to homeownership.

Programme zur Unterstützung bei der Anzahlung

Jumbo-Darlehen

In a desirable and affluent area like Weston, Florida, home prices often exceed conventional loan limits. When purchasing a high-value property, a traditional mortgage may not cover the entire cost. This is where jumbo loans come in, offering financing beyond the standard conforming loan limits. A jumbo loan allows buyers to purchase luxury homes or upscale properties without being restricted by conventional mortgage caps.

Jumbo loans typically have higher interest rates compared to standard mortgages because they carry more risk for lenders. Additionally, qualifying for a jumbo loan can be more stringent, requiring higher credit scores, substantial income documentation, and a more significant down payment. While these requirements may seem daunting, they are designed to protect both the borrower and the lender, given the larger loan amount involved.

Despite the stricter criteria, jumbo loans are an excellent choice for homebuyers aiming to purchase premium real estate in Weston. They offer flexibility in terms of borrowing power, allowing you to finance a property that would otherwise be unattainable with a conventional mortgage. Whether you’re looking to buy a spacious single-family home or a luxury condo, a jumbo loan can make it possible to secure the property you want without compromising on your expectations. Working with a knowledgeable mortgage expert will help you navigate the application process and maximize your chances of approval. The Doce Mortgage Group offers jumbo programs with as little as 10% down, and with no PMI.

Darlehen ohne Einkommensprüfung

For many self-employed individuals or those with non-traditional income, getting approved for a conventional mortgage can be challenging. Lenders typically require extensive income documentation, including tax returns and pay stubs, which may not accurately reflect the financial stability of someone who runs their own business or earns through various streams. No income verification loans/no job required simplify this process by focusing on assets or bank statements rather than traditional income proof.

These loans are particularly useful for entrepreneurs, gig workers, and freelancers who may have fluctuating incomes or non-traditional financial records. Instead of relying solely on W-2 forms or tax returns, lenders evaluate the borrower’s overall financial health, including assets, savings, and consistent bank deposits. This approach allows borrowers to demonstrate their ability to repay the loan without going through the usual income verification procedures.

While no income verification loans may come with slightly higher interest rates due to the increased risk for lenders, they offer a practical solution for those who cannot easily produce standard documentation. These loans also tend to have faster approval times since they skip some of the more traditional underwriting processes. If you’re self-employed or have unconventional income sources, exploring no income verification loans could be the key to purchasing your dream home in Weston. Speaking with a mortgage professional can help determine if this option is the right fit for your financial situation.

Mortgage Tools and Resources

To better understand your mortgage options, consider using a Hypotheken-Rechner to estimate your monthly payments. You can also view Alle unsere Darlehensarten to compare different mortgages.

Why Choose Weston Florida for Your Home?

Weston, Florida, is a vibrant and sought-after community known for its picturesque neighborhoods, lush parks, and top-rated schools. Its well-planned layout and clean, well-maintained streets make it an appealing place to live for families, retirees, and professionals alike. The city offers a unique blend of suburban tranquility and urban convenience, with easy access to Palm Beach, Miami and Fort Lauderdale. This prime location means residents can enjoy the benefits of a peaceful lifestyle while still being close to major employment hubs, cultural attractions, and beautiful beaches.

In addition to its scenic environment, Weston boasts a low crime rate, high-quality public services, and a strong sense of community. Local amenities include excellent recreational facilities, shopping centers, golf courses, and dining options. Whether you’re looking for a family-friendly environment or a relaxing place to retire, Weston’s reputation as one of Florida’s best places to live makes it a top choice for homebuyers.

How to Apply for a Mortgage in Weston Florida

Applying for a mortgage doesn’t have to be overwhelming. Start by gathering your financial documents, including proof of income, credit reports, and asset statements. Use Our Application Portal to begin your application quickly and securely.

If you’re unsure about which mortgage loan options for Weston Florida are right for you, Kostenloses Angebot einholen to receive personalized advice from our experts.

Why Work with The Doce Mortgage Group

The Doce Mortgage Group, led by Alex Doce, has decades of experience guiding homebuyers through the mortgage process. As a trusted local expert, Alex provides personalized service to help you find the best mortgage loan options for Weston Florida. By working with The Doce Mortgage Group, you gain access to a dedicated team that understands Weston’s real estate market and can find the right mortgage solution for you.

Call Alex today at 305-900-2012 to discuss your mortgage needs and discover the best loan options for your new home in beautiful Weston, Florida.