Réponse rapide

En 2025, la plupart des acheteurs qui utilisent un prêt jumbo à Key Biscayne avancent entre 10 et 20 % du prix de la maison. Étant donné que la valeur moyenne d'un logement à Key Biscayne est d'environ $1 580 837 ZillowCela signifie qu'un acompte se situe généralement entre $158.000 et $316.000. Le Doce Mortgage Group propose des prêts avec un acompte de seulement 10% jusqu'à $2 500 000, et 20% pour des montants de prêt allant jusqu'à $5 000 000 - aucune assurance hypothécaire privée n'est requise. Des prêts plus élevés, jusqu'à $10.000.000, sont disponibles avec des acomptes plus importants.

Table des matières

- Quel est le plafond actuel des prêts conformes en 2025 ?

- Quel est le montant de l'acompte typique pour un prêt Jumbo à Key Biscayne ?

- Quelles sont les principales exigences en matière de prêts Jumbo en 2025 ?

- En quoi les prêts Jumbo diffèrent-ils des prêts hypothécaires conformes ?

- Pouvez-vous obtenir un prêt Jumbo à Key Biscayne avec moins de 20% d'acompte ?

- Quels sont les avantages de choisir le Doce Mortgage Group pour un financement Jumbo ?

- Comment les taux d'intérêt des prêts Jumbo se comparent-ils en 2025 ?

- Quels types de propriétés à Key Biscayne sont éligibles aux prêts Jumbo ?

- Pourquoi les prêts Jumbo sont-ils si courants à Key Biscayne ?

- Pourquoi les gens veulent-ils vivre à Key Biscayne ?

- Quels sont les principaux avantages et attractions de Key Biscayne ?

- Section FAQ

- Prêt à acheter à Key Biscayne ?

Discours d'ouverture

- Les prêts Jumbo à Key Biscayne requièrent généralement un apport de 10% à 20%.

- Les prix moyens des logements font du financement jumbo la norme pour la quasi-totalité des acheteurs.

- Le Doce Mortgage Group propose des programmes jumbo compétitifs jusqu'à $10 millions.

Key Biscayne est depuis longtemps l'un des marchés immobiliers de luxe les plus recherchés en Floride et, en 2025, la plupart des acheteurs auront besoin d'un financement jumbo pour acheter une maison. La valeur des biens immobiliers étant bien supérieure aux limites de prêt standard, le montant de l'acompte devient l'un des facteurs les plus importants pour les acheteurs qui envisagent d'utiliser un prêt jumbo à Key Biscayne.

Si vous envisagez de vous installer dans cette communauté insulaire exclusive, le fait de comprendre le fonctionnement des prêts hypothécaires jumbo peut faciliter le processus. De nombreux acheteurs commencent par explorer des programmes tels que le Hypothèque Jumbo en Floride qui correspondent au type de bien qu'ils recherchent.

Quel est le plafond actuel des prêts conformes en 2025 ?

Chaque année, l'Agence fédérale de financement du logement (Federal Housing Finance Agency) fixe le montant maximum des prêts qui peuvent être considérés comme conformes. Pour 2025, cette limite est de $819 000. Tout ce qui dépasse ce montant est considéré comme un prêt jumbo.

C'est important à Key Biscayne, car le prix médian des maisons y est nettement supérieur à $2 millions d'euros en 2025. Cela signifie que presque tous les achats nécessiteront un financement jumbo. Même les petites copropriétés situées dans des immeubles de premier ordre en bord de mer dépassent souvent le seuil de conformité.

Dans le comté de Miami-Dade, où se trouve Key Biscayne, le financement jumbo n'est pas une option réservée aux acheteurs de luxe. Il est devenu la norme pour la plupart des acheteurs sur ce marché.

Quel est le montant de l'acompte typique pour un prêt Jumbo à Key Biscayne ?

En 2025, l'acompte typique pour un prêt jumbo à Key Biscayne est compris entre 10 et 20 % du prix d'achat. Le montant exact dépend de la taille du prêt et du profil financier global de l'emprunteur.

Le Doce Mortgage Group propose deux options principales pour le financement jumbo :

- Un acompte de 10 % seulement pour des prêts d'un montant maximal de $2 500 000

- 20 % d'acompte pour les prêts d'un montant maximum de $5 000 000

Pour mettre les choses en perspective, si vous achetez une propriété de $2 200 000, un acompte de 10 % équivaudrait à $220 000. Pour une propriété en bord de mer de $4 500 000, un acompte de 20 % serait de $900 000.

Par rapport aux prêts conventionnels, qui peuvent nécessiter un acompte de 3 à 5 % seulement pour les maisons à bas prix, les prêts jumbo impliquent des coûts initiaux plus importants. Cependant, les acheteurs bénéficient de la possibilité de financer des propriétés qui dépassent de loin les limites des prêts conventionnels.

Un autre avantage important est que The Doce Mortgage Group n'exige pas d'assurance hypothécaire privée, même lorsque les acheteurs ne versent qu'un acompte de 10 %. Cela permet d'économiser des centaines, voire des milliers de dollars par mois par rapport aux programmes qui exigent une assurance hypothécaire privée.

Quelles sont les principales exigences en matière de prêts Jumbo en 2025 ?

Si les prêts hypothécaires jumbo permettent d'accéder à des maisons de luxe à Key Biscayne, ils s'accompagnent également de conditions spécifiques destinées à confirmer la capacité de l'emprunteur à gérer un prêt important.

Voici les conditions requises pour l'obtention d'un prêt jumbo en 2025 :

- Score FICO minimum de 660

- Ratio d'endettement maximal de 55

- Vérification des actifs, y compris des réserves permettant de couvrir plusieurs mois de paiements

- Un historique de crédit propre et bien documenté

- Acompte compris entre 10 et 20 %, selon le montant du prêt.

Contrairement aux prêts hypothécaires conformes, les programmes jumbo de 2025 n'exigent pas d'assurance hypothécaire privée, même si les acomptes sont moins élevés. Cela les rend plus attrayants pour les acheteurs fortunés qui souhaitent maximiser leur trésorerie.

Les exigences en matière de réserves sont également plus détaillées dans le cas d'un financement jumbo. Les acheteurs doivent généralement présenter des liquidités suffisantes pour couvrir au moins six à douze mois de paiements hypothécaires après la clôture de la transaction. Ceci est particulièrement important sur les marchés de grande valeur comme Key Biscayne, où les paiements mensuels peuvent facilement dépasser $15 000 pour des maisons de plusieurs millions de dollars.

Pour les acheteurs désireux d'explorer les options de paiement mensuel pour différentes tailles de prêt, l'utilisation de la fonction Calculatrice hypothécaire est une première étape utile.

En quoi les prêts Jumbo diffèrent-ils des prêts hypothécaires conformes ?

Le financement Jumbo diffère des prêts hypothécaires classiques sur plusieurs points importants.

Montant du prêt : La distinction la plus évidente est le montant que vous pouvez emprunter. Avec les programmes jumbo de The Doce Mortgage Group, les acheteurs peuvent financer jusqu'à $5 000 000 en un seul prêt. Il n'est donc pas nécessaire de combiner plusieurs prêts hypothécaires pour couvrir le prix d'achat.

Normes de souscription : L'approbation d'un prêt Jumbo implique souvent un examen plus approfondi des revenus, des actifs et des antécédents de crédit que pour les prêts hypothécaires conformes. Cela s'explique par le risque financier plus important associé aux prêts de plusieurs millions de dollars.

Tarifs : En 2025, les taux des prêts hypothécaires jumbo sont très compétitifs. En fait, de nombreux emprunteurs jumbo en Floride bénéficient de taux égaux ou inférieurs à ceux des prêts conformes. Cela fait du financement jumbo une option attrayante même pour les acheteurs qui pourraient techniquement structurer des prêts plus petits.

Évaluations : Pour les prix plus élevés, une deuxième évaluation peut être nécessaire ; certains programmes jumbo exigent deux évaluations à partir d'environ $1,5 million ou en présence de facteurs de risque. Cela permet de confirmer la valeur marchande du bien dans un marché de luxe comme celui de Key Biscayne, où le prix des maisons uniques en bord de mer peut varier considérablement.

Conditions du prêt : Les prêts Jumbo offrent une certaine flexibilité entre les options à taux fixe et les conditions à taux variable. Les acheteurs qui prévoient de conserver un bien à long terme choisissent souvent des taux fixes, tandis que ceux qui achètent des maisons de vacances ou des investissements à court terme préfèrent parfois des prêts hypothécaires à taux variable avec des paiements initiaux moins élevés.

Cette flexibilité permet aux acheteurs de structurer un prêt hypothécaire qui correspond à leurs objectifs financiers et au type de propriété qu'ils achètent.

Pouvez-vous obtenir un prêt Jumbo à Key Biscayne avec moins de 20% d'acompte ?

L'une des questions les plus fréquemment posées par les acheteurs est de savoir s'il est possible d'acheter une maison de luxe à Key Biscayne avec moins de 20 % d'apport. La réponse est oui.

Le Doce Mortgage Group propose un financement jumbo avec un acompte de seulement 10 % pour des montants de prêts allant jusqu'à $2 500 000. Ce programme permet aux acheteurs d'accéder à des biens immobiliers d'une valeur de plusieurs millions de dollars sans avoir à mobiliser une part encore plus importante de leur trésorerie.

Par exemple, si vous achetez une maison de $2 200 000, un acompte de 10 % équivaut à $220 000. Cela vous permet de garder des fonds supplémentaires disponibles pour les rénovations, l'ameublement de la propriété ou simplement pour maintenir une plus grande liquidité.

L'option d'un acompte de 20 % s'applique aux prêts allant jusqu'à $5.000.000. Pour une propriété de $4 500 000 à Key Biscayne, cela signifierait un acompte de $900 000. Bien que ce chiffre soit élevé, il est intéressant pour les acheteurs qui souhaitent réduire les mensualités ou bénéficier des taux les plus compétitifs.

L'un des avantages de travailler avec The Doce Mortgage Group est que l'assurance hypothécaire privée n'est jamais requise pour les prêts jumbo. Même si vous achetez une maison avec seulement 10 % d'acompte, vous ne verrez pas le coût mensuel supplémentaire qui est standard dans de nombreux programmes conventionnels.

Si vous êtes prêt à entamer le processus, vous pouvez commencer dès aujourd'hui en posant votre candidature par l'intermédiaire de Notre portail de candidature.

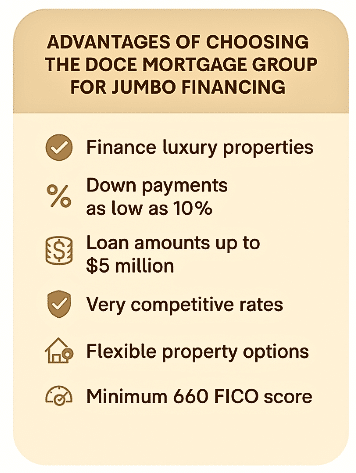

Quels sont les avantages de choisir le Doce Mortgage Group pour un financement Jumbo ?

Lorsque vous achetez à Key Biscayne, le partenaire que vous choisissez pour le financement est tout aussi important que la propriété elle-même. Le Doce Mortgage Group a une grande expérience des transactions jumbo en Floride et offre toute une série d'avantages aux acheteurs.

- Capacité à financer des propriétés de luxe et des maisons de grande valeur

- Un acompte de 10 % seulement pour les prêts d'un montant maximal de $2 500 000

- Jusqu'à $5 000 000 en un seul prêt avec seulement 20 % d'acompte

- Des taux très compétitifs qui rivalisent avec les prêts hypothécaires classiques, voire les dépassent.

- Aucune exigence en matière de PMI, quel que soit le montant de l'acompte

- Options flexibles pour les résidences principales, les résidences secondaires ou les immeubles de placement

- FICO minimum de 660 avec un DTI maximum de 55%.

Ces programmes sont conçus pour rendre plus accessibles les achats de biens immobiliers de grande valeur à Key Biscayne. Au lieu de cumuler plusieurs prêts ou de faire face à des coûts mensuels élevés, les acheteurs peuvent structurer leur financement de manière à soutenir leurs objectifs à long terme.

Le Doce Mortgage Group propose également un processus de demande et d'approbation simplifié, ce qui permet aux acheteurs de conclure plus rapidement dans un marché où les propriétés font souvent l'objet d'offres concurrentielles.

Si vous souhaitez savoir comment ces prestations s'appliquent à votre situation, vous pouvez Obtenir gratuitement Quote aujourd'hui.

Comment les taux d'intérêt des prêts Jumbo se comparent-ils en 2025 ?

Une idée reçue veut que les prêts jumbo soient toujours assortis de taux d'intérêt plus élevés. En 2025, ce n'est pas le cas. En fait, les taux des prêts jumbo en Floride sont souvent équivalents, voire supérieurs, aux taux des prêts ordinaires.

Il y a plusieurs raisons à cela. Les institutions financières considèrent les marchés de l'immobilier de luxe comme Key Biscayne comme des investissements solides et stables. Les acheteurs de cette catégorie ont souvent des scores de crédit plus élevés et des profils financiers plus solides, ce qui réduit le risque.

Le taux exact dépendra de plusieurs facteurs, notamment

- Le montant de l'acompte

- Votre cote de crédit

- Votre ratio d'endettement global

- Que vous choisissiez un prêt hypothécaire à taux fixe ou à taux variable

Par exemple, un acheteur ayant une cote de crédit de 720 et achetant une maison de $3 000 000 avec un acompte de 20 % peut bénéficier d'un taux presque identique à celui d'un emprunteur bénéficiant d'un prêt conforme et achetant une propriété de $600 000.

Les acheteurs qui versent un acompte de 10 % peuvent bénéficier d'un taux légèrement plus élevé, mais cette différence est souvent compensée par la possibilité de conserver davantage de liquidités pour d'autres investissements ou dépenses.

Sur un marché comme celui de Key Biscayne, où l'appréciation des biens immobiliers est forte, les avantages à long terme de l'accession à la propriété l'emportent souvent sur les petites différences de taux.

Quels types de propriétés à Key Biscayne sont éligibles aux prêts Jumbo ?

L'un des atouts du financement jumbo est qu'il peut s'appliquer à une grande variété de types de biens. À Key Biscayne, cela inclut presque toutes les catégories de biens immobiliers.

Voici quelques-uns des exemples les plus courants :

- Propriétés unifamiliales: Les maisons de luxe sur Harbor Drive ou Mashta Island se vendent souvent entre $4M et $10M, nécessitant facilement un financement jumbo.

- Résidences au bord de l'eau: Les maisons ayant un accès direct à l'océan ou des quais privés dépassent généralement $3M.

- Condos en bord de mer: Les penthouses dans les immeubles le long de Crandon Boulevard ou de Key Colony peuvent aller de $2M à $6M.

- Immeubles de placement: Les acheteurs peuvent également utiliser le financement jumbo pour les locations de vacances ou les biens immobiliers productifs.

En bref, si vous achetez presque n'importe quel bien immobilier à Key Biscayne en 2025, il y a de fortes chances que vous ayez besoin d'un financement jumbo pour couvrir le prix d'achat.

Pourquoi les prêts Jumbo sont-ils si courants à Key Biscayne ?

Le marché de Key Biscayne présente des caractéristiques qui font des prêts jumbo la norme plutôt que l'exception.

Tout d'abord, les valeurs immobilières sont parmi les plus élevées de Floride. En 2025, le prix médian des maisons y est supérieur à $2 100 000, soit plus du double du seuil fixé pour les prêts jumbo. Les prêts conformes ne sont donc pas pertinents pour la plupart des acheteurs.

Deuxièmement, la demande est constamment élevée. Réputée pour être l'une des communautés les plus exclusives du comté de Miami-Dade, Key Biscayne attire des acheteurs de tous les États-Unis ainsi que de marchés internationaux tels que l'Amérique latine et l'Europe.

Troisièmement, l'inventaire limité stimule la concurrence. L'île est petite et les parcelles en bord de mer sont rares. Lorsqu'une maison recherchée arrive sur le marché, elle se vend souvent rapidement, parfois à un prix supérieur à celui demandé. Les acheteurs qui disposent d'un financement jumbo prêt à l'emploi ont un avantage majeur.

Enfin, les facteurs liés au mode de vie jouent un rôle. Key Biscayne est connu pour sa sécurité, son intimité et sa beauté naturelle, autant d'éléments qui contribuent à la hausse de la valeur des biens immobiliers. Tant que ces qualités resteront demandées, les prêts jumbo continueront à dominer les transactions immobilières locales.

Pourquoi les gens veulent-ils vivre à Key Biscayne ?

Bien que le financement soit un élément essentiel de l'achat d'une maison, la plupart des acheteurs sont attirés par Key Biscayne pour son style de vie. Cette communauté insulaire allie la commodité d'être à quelques minutes du centre-ville de Miami à l'intimité et à la tranquillité d'un village côtier.

Les résidents bénéficient de rues parmi les plus sûres du comté de Miami-Dade, ce qui en fait un choix populaire pour les familles. Les écoles de l'île et de ses environs sont réputées, et la communauté jouit d'une atmosphère familiale qui la distingue des quartiers plus animés de la ville.

L'emplacement est un autre attrait majeur. Vivre à Key Biscayne signifie que vous pouvez être à Brickell ou à l'aéroport international de Miami en 20 à 30 minutes, tout en étant entouré de plages, de parcs et de marinas lorsque vous rentrez chez vous. Cet équilibre entre accessibilité et exclusivité est l'une des raisons pour lesquelles le marché est resté fort année après année.

Quels sont les principaux avantages et attractions de Key Biscayne ?

Au-delà de la sécurité et de la commodité, Key Biscayne offre un mode de vie en plein air inégalé. L'île est entourée d'eau, ce qui la rend idéale pour la navigation de plaisance, la pêche et les sports nautiques.

Les attractions les plus populaires sont les suivantes

- Bill Baggs Cape Florida State Park avec son phare historique et ses plages naturelles

- Parc de CrandonLe site est connu pour son littoral familial et ses aires de pique-nique.

- Ports de plaisance et clubs nautiquesqui sont au cœur de la culture nautique de l'île

- Restaurants locaux et boutiques qui s'adressent aux résidents à la recherche d'un environnement décontracté et haut de gamme

Ces équipements font de Key Biscayne un lieu de prédilection pour les professionnels, les retraités et les acheteurs internationaux qui apprécient à la fois le luxe et le style de vie.

Pour ceux qui envisagent d'acheter ici, c'est le moment idéal pour appeler The Doce Mortgage Group au 305-900-2012 pour connaître les options de prêt jumbo conçues spécifiquement pour ce type de marché.

Section FAQ

Quel est le montant de la mise de fonds nécessaire pour un prêt jumbo à Key Biscayne ?

La plupart des acheteurs auront besoin d'un acompte compris entre 10 et 20 %. Le Doce Mortgage Group propose des options d'acompte de 10 % jusqu'à $2,5M et de 20 % jusqu'à $5M.

Quelle est la cote de crédit minimale pour les prêts jumbo en 2025 ?

Un score FICO de 660 est requis pour être éligible. Des profils de crédit plus solides peuvent permettre d'obtenir des taux encore plus intéressants.

Les taux des prêts jumbo sont-ils plus élevés que ceux des prêts hypothécaires classiques ?

En 2025, les taux jumbo sont souvent égaux ou inférieurs à ceux des prêts conformes. Les taux dépendent de la cote de crédit, de l'acompte et du profil financier global.

Puis-je utiliser un prêt jumbo pour une résidence secondaire ou un bien d'investissement ?

Oui, le Doce Mortgage Group autorise les financements jumbo pour les résidences principales, les résidences secondaires et les biens d'investissement.

Les prêts jumbo doivent-ils être assortis d'une PMI ?

Non. Même si vous achetez avec un acompte de 10 %, l'assurance hypothécaire privée n'est pas requise pour les prêts jumbo accordés par The Doce Mortgage Group.

Prêt à acheter à Key Biscayne ?

Si vous envisagez d'acheter une maison à Key Biscayne, la compréhension de l'acompte typique n'est que la première étape. Le financement Jumbo permet d'acheter des propriétés de grande valeur avec seulement 10 % d'acompte, et The Doce Mortgage Group propose des programmes spécialement conçus pour les acheteurs de Floride.

Vous pouvez étudier vos options de paiement mensuel à l'aide de l'outil Calculatrice hypothécairePour obtenir un devis personnalisé, il suffit d'utiliser le formulaire de demande de devis en ligne. Obtenir gratuitement Quote ou encore de commencer votre candidature en ligne via l'outil Notre portail de candidature.

Pour avoir l'esprit tranquille, vous pouvez également lire ce que d'autres clients ont dit en lisant avis des clients. De nombreux acheteurs soulignent le bon déroulement de la procédure, les taux compétitifs et le soutien dévoué qu'ils ont reçu lors de l'achat de leur maison.

Appelez-nous aujourd'hui au 305-900-2012 pour commencer à financer la maison de vos rêves à Key Biscayne.