Resposta rápida:

Sim, um empréstimo jumbo costuma ser a melhor estratégia em Golden Beach porque os preços dos imóveis nessa comunidade exclusiva à beira-mar normalmente excedem os limites de empréstimo padrão. Para compradores qualificados, um empréstimo jumbo oferece o financiamento necessário para garantir propriedades de vários milhões de dólares com termos flexíveis e taxas competitivas adaptadas para imóveis de alto valor. Com o Doce Mortgage Group, você pode financiar até $10 milhões em um único empréstimo, dependendo de seu crédito, renda e ativos.

Índice

- O que é um empréstimo Jumbo e como ele funciona em 2025?

- Prós e contras de usar um empréstimo Jumbo em Golden Beach, Flórida

- Quem normalmente se qualifica para um empréstimo Jumbo em Golden Beach, Flórida?

- Como é a entrada para um empréstimo Jumbo em Golden Beach, Flórida?

- Como as taxas de juros se comparam para um empréstimo Jumbo em Golden Beach, Flórida, em 2025

- Um empréstimo Jumbo é a opção certa para seu plano financeiro?

- Por que tantos compradores de luxo escolhem Golden Beach, Flórida

- Morar em Golden Beach: O que a torna única?

- O que saber sobre o mercado imobiliário em Golden Beach em 2025

- PERGUNTAS FREQUENTES: Empréstimos Jumbo em Golden Beach, Flórida

- Torne seu sonho de Golden Beach uma realidade com o financiamento certo

Palestras

- Os empréstimos Jumbo são adequados para a maioria das compras de casas de luxo em Golden Beach, Flórida.

- Os limites de jumbo de 2025 começam em $819.000, com taxas próximas a meados de 6% para compradores qualificados.

- Os preços das casas variam de $7 milhões a mais de $25 milhões, mantendo a demanda alta.

Golden Beach, Flórida, é uma das cidades mais privadas e sofisticadas da Costa Leste e é conhecida pelas casas de cair o queixo que ficam diretamente no oceano. Se você estiver comprando nessa parte do condado de Miami-Dade, provavelmente está de olho em casas na casa dos milhões. Isso significa que você provavelmente precisará de algo maior do que uma hipoteca normal. E é aí que entra o empréstimo jumbo.

A Empréstimo jumbo na Flórida em Golden Beach, Flórida, oferece aos compradores a opção de emprestar mais do que o permitido pelos limites tradicionais de hipoteca. Para casas com preços de $6 milhões a mais de $25 milhões, o financiamento jumbo geralmente é a única maneira de fazer com que os números funcionem - a menos que você esteja pagando tudo em dinheiro.

O que é um empréstimo Jumbo e como ele funciona em 2025?

Vamos começar de forma simples. Um empréstimo jumbo é qualquer hipoteca maior do que o valor permitido pela Fannie Mae e Freddie Mac, que são as duas empresas apoiadas pelo governo que definem a maioria das regras de hipoteca nos EUA. Em 2025, esse limite de empréstimo é de $819.000 na maioria dos lugares, e é mais alto em determinados mercados de alto custo.

Mas em Golden Beach, esse número não chega nem perto de cobrir o preço das casas. Essa comunidade está repleta de mansões à beira-mar, propriedades particulares e vilas à beira-mar - muitas delas com preços que começam em $10 milhões e aumentam a partir daí. Isso coloca quase todas as casas em Golden Beach no território dos empréstimos jumbo.

Então, o que torna um empréstimo jumbo diferente? Primeiro, ele não é respaldado por nenhum programa do governo. Isso significa que as regras são definidas pelas instituições privadas que oferecem os fundos, e elas tendem a analisar melhor sua situação financeira. Mas a contrapartida é que você pode obter o montante de financiamento necessário para comprar um imóvel de luxo em um único empréstimo.

Os empréstimos jumbo típicos variam de $1 a 3 milhões, mas o Doce Mortgage Group pode financiar até $5 milhões em um único empréstimo, dependendo de seu crédito, renda e ativos. Isso possibilita a compra de uma das casas de primeira linha da região e, ao mesmo tempo, mantém seus outros ativos trabalhando para você, em vez de amarrá-los todos em dinheiro.

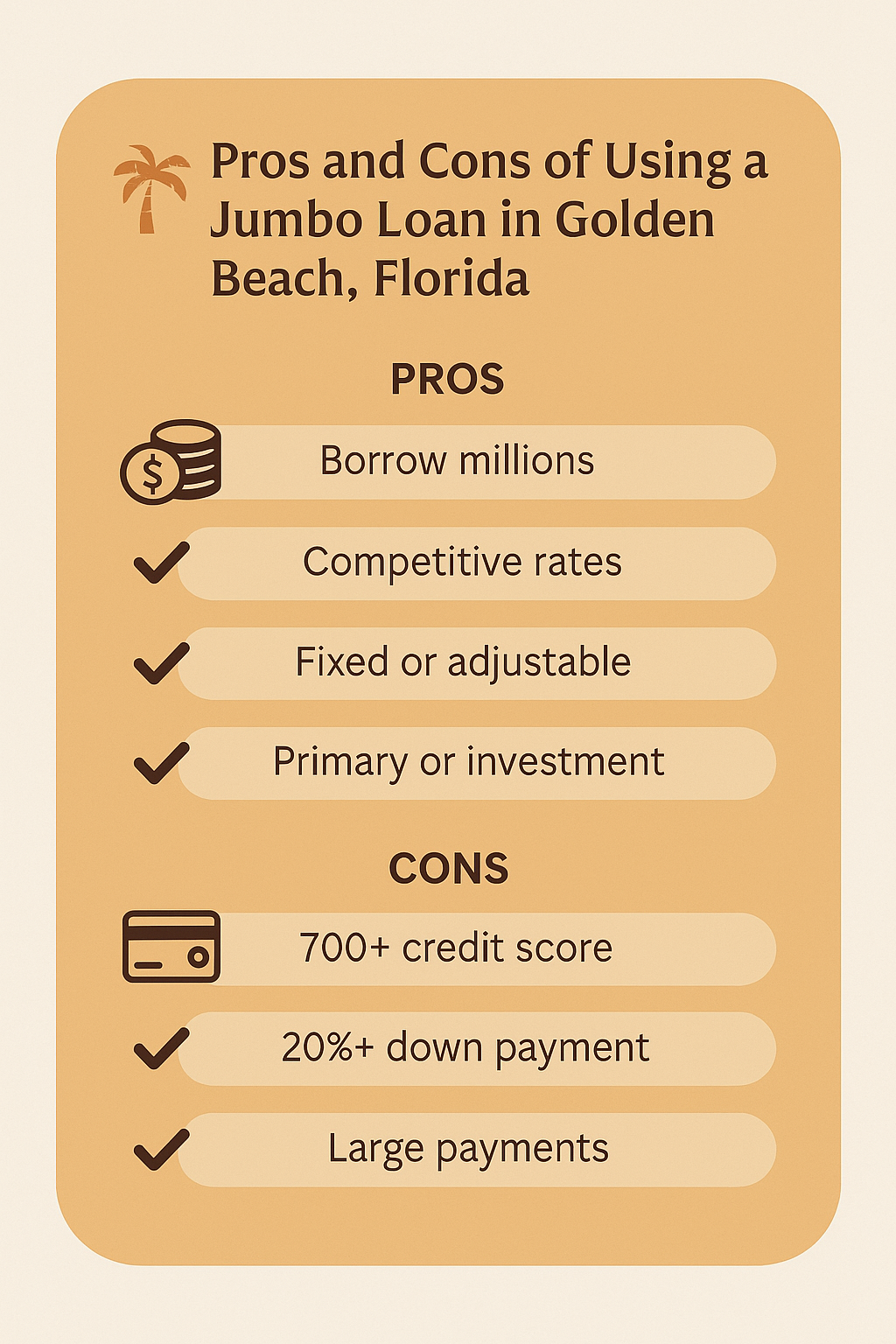

Prós e contras de usar um empréstimo Jumbo em Golden Beach, Flórida

Antes de seguir em frente, é inteligente analisar os dois lados do uso desse tipo de hipoteca.

Aqui estão as vantagens de usar um empréstimo jumbo em Golden Beach, Flórida:

- Você pode tomar milhões emprestados sem acumular vários empréstimos.

- Os empréstimos jumbo padrão podem oferecer taxas competitivas, mas o Doce Mortgage Group geralmente oferece taxas que rivalizam ou até superam os programas de empréstimo de agências em conformidade.

- Você tem a opção de termos com taxas fixas ou ajustáveis.

- Está disponível para residências primárias, segundas residências ou propriedades de investimento.

Agora, vamos às vantagens e desvantagens:

- Normalmente, você precisará de uma pontuação de crédito de pelo menos 700.

- O pagamento da entrada geralmente é de 20% ou mais.

- Os pagamentos mensais são significativamente maiores do que os de uma hipoteca padrão.

- Você precisará comprovar uma renda forte e estável e ativos sólidos.

Mesmo com os requisitos adicionais, os empréstimos jumbo são a opção preferida dos compradores nessa área porque oferecem acesso direto ao tipo de financiamento necessário para imóveis de alto valor.

Quem normalmente se qualifica para um empréstimo Jumbo em Golden Beach, Flórida?

Esses empréstimos são projetados para compradores com perfis financeiros sólidos. Se estiver planejando solicitar um empréstimo jumbo em Golden Beach, Flórida, veja o que a maioria dos programas está procurando em 2025:

- A maioria dos programas jumbo exige uma pontuação de crédito de cerca de 700, mas o Doce Mortgage Group pode qualificar compradores com pontuações tão baixas quanto 660.

- Os programas jumbo tradicionais preferem uma relação dívida/renda abaixo de 43%, mas o Doce Mortgage Group pode ir até 55%, dependendo de seu perfil financeiro geral.

- Comprovante sólido de renda, especialmente se você for autônomo.

- Reservas de caixa que cubram de 6 a 12 meses de pagamentos de hipoteca.

- Uma entrada de pelo menos 20%, embora isso possa variar de acordo com o empréstimo.

Proprietários de empresas, empreendedores, médicos, artistas e investidores são todos candidatos comuns nesse mercado. Isso se deve ao fato de que os empréstimos jumbo não se limitam à renda tradicional do W-2. Muitas vezes, você pode se qualificar com base em extratos bancários, investimentos ou comprovação de ganhos consistentes ao longo do tempo.

Os programas jumbo flexíveis do Doce Mortgage Group dão aos compradores qualificados acesso a até $5 milhões em financiamento com um único empréstimo, combinando limites altos, opções de entrada baixa e sem PMI.

Como é a entrada para um empréstimo Jumbo em Golden Beach, Flórida?

A maioria dos programas de empréstimo jumbo exige uma entrada mínima de 20%, mas o Doce Mortgage Group oferece opções com apenas 10% para valores de empréstimo de até $2,5 milhões e apenas 20% para empréstimos de até $5 milhões.

Porque os empréstimos jumbo estão fora das regras dos empréstimos em conformidade, programas de assistência para pagamento de entrada não estão disponíveis para eles.

Dito isso, o Doce Mortgage Group trabalha com compradores para ajudar a estruturar empréstimos jumbo que correspondam a suas metas financeiras gerais. Dependendo de sua situação, pode haver espaço para reduzir a entrada exigida ou ajustar os termos para melhor atender à sua estratégia.

Se você quiser estimar o valor de seu pagamento mensal com base em diferentes valores de entrada e taxas de juros, use o calculadora de hipoteca para calcular os números.

Como as taxas de juros se comparam para um empréstimo Jumbo em Golden Beach, Flórida, em 2025

Em 2025, as taxas médias dos empréstimos jumbo de 30 anos têm se mantido mais ou menos na faixa dos 6,3% a 6,6% no início de outubro. Isso está muito próximo das médias nacionais recentes de 30 anos, próximas a 6,34%. Isso é um pouco mais alto do que as taxas de empréstimos em conformidade, que estão mais próximas de 6,3% este ano, mas não muito. Para compradores bem qualificados, os empréstimos jumbo ainda podem ter preços competitivos.

Há um mito comum de que os empréstimos jumbo sempre têm taxas mais altas, mas no mercado atual, esse não é o caso. Muitos compradores em Golden Beach conseguem ótimas condições, especialmente quando têm:

- Pontuação de crédito acima de 740

- Baixos índices de endividamento em relação à renda

- Grandes adiantamentos (20% ou mais)

- Reservas de caixa além do mínimo

Os compradores podem escolher entre empréstimos jumbo de taxa fixa e de taxa ajustável. Os empréstimos com taxas fixas fixam sua taxa de juros pelo prazo total - geralmente 15 ou 30 anos - o que simplifica o orçamento. Os empréstimos com taxas ajustáveis (ARMs), como os ARMs 7/1 ou 10/6, geralmente começam mais baixos, mas podem se ajustar com o tempo. Eles podem ser ideais se você planeja vender ou refinanciar antes que a taxa se ajuste.

Para descobrir a que tipo de taxa você pode se qualificar com base em seus próprios números, é inteligente começar com uma gratuito quote. Isso leva apenas um minuto e lhe dá uma visão muito mais clara de suas opções.

Um empréstimo Jumbo é a opção certa para seu plano financeiro?

Comprar em Golden Beach significa jogar em um mercado de alto risco. Essas casas não são apenas caras - elas também são um importante ativo financeiro. Por isso, é importante adequar sua hipoteca às suas metas financeiras mais amplas.

Um empréstimo jumbo em Golden Beach, Flórida, pode ser a opção certa se:

- Você planeja manter o imóvel por um longo prazo e deseja pagamentos previsíveis

- Você prefere manter seus investimentos em crescimento a pagar tudo em dinheiro

- Você se qualifica para termos favoráveis de empréstimo jumbo com base em sua renda e patrimônio

- Você se sente confortável com pagamentos mensais e impostos mais altos

Por outro lado, se suas reservas de caixa forem escassas ou se você não estiver pronto para se comprometer com uma hipoteca mensal grande, o financiamento jumbo pode ser muito caro. Mas para muitos compradores de alta renda, especialmente aqueles que estão se mudando de Nova York, Los Angeles ou do exterior, os empréstimos jumbo oferecem a solução perfeita.

Se não tiver certeza se essa opção se encaixa em seus objetivos, ligue hoje para 305-900-2012 para conversar sobre sua situação com um profissional de hipotecas que conheça o mercado local.

Por que tantos compradores de luxo escolhem Golden Beach, Flórida

Golden Beach não é como os outros bairros do sul da Flórida. É tranquilo, exclusivo e cercado de água por todos os lados. Essa pequena cidade está localizada entre Sunny Isles e Hallandale Beach, com pouco mais de 1.000 residentes e uma política rígida de manter a comunidade residencial e privada.

Aqui estão alguns dos principais motivos pelos quais os compradores com alto patrimônio líquido escolhem esse local:

- Não são permitidas propriedades comerciais ou edifícios altos

- Acesso direto à praia para casas de frente para o mar

- Segurança privada e um departamento de polícia local

- Entradas fechadas e pouco tráfego

- Privacidade de alto nível e luxo discreto

Em 2025, o valor típico de uma casa em Golden Beach é de cerca de $7,3 milhões, e as propriedades à beira-mar geralmente estão listadas na faixa de $15 milhões a $30 milhões ou mais. Essa é uma cidade em que cada propriedade tem sua própria personalidade: casas personalizadas com docas privativas, piscinas na cobertura e vista para o Atlântico ou para a Intracoastal.

Como os preços aqui são muito altos, os empréstimos jumbo são padrão. Quase todos os compradores que trabalham com financiamento acabam usando um empréstimo jumbo em Golden Beach, Flórida, para fechar o negócio.

Morar em Golden Beach: O que a torna única?

Esse não é um bairro típico do sul da Flórida. Golden Beach se destaca em quase todos os aspectos.

- É uma das poucas áreas em que as casas unifamiliares ficam diretamente na praia

- As leis de zoneamento proíbem condomínios, edifícios comerciais ou aluguéis de curto prazo

- Há uma vibração de comunidade aqui, mas ela é baseada em privacidade e discrição

- Os residentes incluem líderes empresariais internacionais, celebridades e moradores locais de longa data

- A cidade oferece seu próprio clube de praia, quadras de tênis e áreas de parques privados

As famílias adoram o bairro por sua segurança e ruas tranquilas. Os pássaros da neve desfrutam do estilo de vida calmo do inverno, e os investidores gostam do valor de longo prazo de possuir imóveis em uma das poucas áreas de residências unifamiliares de frente para a praia no sul da Flórida.

Além disso, o Golden Beach fica a apenas alguns minutos de lojas de classe mundial em Bal Harbour, restaurantes em Aventura e acesso rápido aos aeroportos de Miami e Fort Lauderdale.

Se estiver pensando em comprar aqui, é inteligente obter uma pré-aprovação com antecedência. Você pode iniciar sua solicitação por meio de nosso portal de aplicativos e iniciar o processo hoje mesmo.

O que saber sobre o mercado imobiliário em Golden Beach em 2025

As listagens do Golden Beach continuam escassas em 2025, e a demanda por propriedades à beira-mar é forte. Os instantâneos recentes do mercado mostram uma ampla gama de preços de listagem devido ao mix de propriedades. As estimativas de listagem mediana variam de acordo com o rastreador, com a Rocket informando cerca de $8,95 milhões em meados de 2025 e a Realtor.com mostrando aproximadamente $14,4 milhões em agosto de 2025. As listagens ativas normalmente estão na casa dos 30 anos, e os dias no mercado podem se estender bem além de 150 para muitas propriedades, refletindo o segmento de ultra luxo.

Se você está pensando seriamente em comprar aqui, esteja pronto para agir rapidamente. Isso significa alinhar seu financiamento jumbo com antecedência, saber seu preço máximo de compra e ter a documentação da oferta pronta para ser entregue.

Comece usando nosso calculadora de hipoteca para descobrir sua zona de conforto.

PERGUNTAS FREQUENTES: Empréstimos Jumbo em Golden Beach, Flórida

Qual é o valor mínimo de entrada para um empréstimo jumbo em 2025?

A maioria dos empréstimos jumbo exige uma entrada mínima de 20%. Para mutuários muito fortes com crédito excepcional e renda alta, pode haver flexibilidade, mas você deve planejar esse 20% como linha de base.

Posso obter um empréstimo jumbo se for autônomo?

Sim, mas você precisará mostrar pelo menos um ou dois anos de renda consistente. A maioria dos programas quer ver declarações de imposto de renda, declarações de lucros e perdas e atividades bancárias que reflitam ganhos constantes.

Os empréstimos jumbo são apenas para residências primárias?

Não. Você pode usar um empréstimo jumbo em Golden Beach, Flórida, para comprar uma segunda casa ou até mesmo uma propriedade de investimento, dependendo do programa e de suas qualificações.

Os empréstimos jumbo demoram mais para serem fechados?

Às vezes. Como esses empréstimos envolvem valores mais altos e uma análise financeira mais profunda, o processo pode ser mais detalhado. Dito isso, o Doce Mortgage Group trabalha rapidamente e mantém as coisas em andamento com comunicação clara durante todo o processo. Normalmente, fechamos empréstimos jumbo em até 30 dias após o recebimento da solicitação.

Como posso saber qual é o valor para o qual me qualifico?

Você pode ter uma vantagem inicial usando o calculadora de hipoteca para estimar o que você pode pagar. Quando você estiver pronto, obtenha um quote e converse com um especialista em hipotecas especializado no mercado de Golden Beach.

Torne seu sonho de Golden Beach uma realidade com o financiamento certo

O financiamento de uma casa de alto padrão em Golden Beach exige mais do que apenas um bom timing. Você precisa da estratégia certa. Um empréstimo jumbo em Golden Beach, Flórida, dá aos compradores qualificados a capacidade de comprar propriedades de vários milhões de dólares sem precisar de todo o seu dinheiro. É uma jogada inteligente para aqueles que querem ser proprietários em uma das comunidades à beira-mar mais exclusivas do país.

No Doce Mortgage Group, somos especializados em ajudar compradores como você a navegar pelo processo de hipoteca jumbo com rapidez, clareza e confiança. Quer esteja comprando a casa dos seus sonhos, fazendo um upgrade em sua propriedade atual ou mudando-se para a região, estamos aqui para orientá-lo em cada etapa do processo.

Confira o que outros compradores de imóveis estão dizendo lendo nosso comentários de clientes.

Se você estiver pronto para começar, Entre em contato conosco hoje mesmo pelo telefone 305-900-2012 para falar com um especialista local sobre suas opções de hipoteca jumbo em Golden Beach.