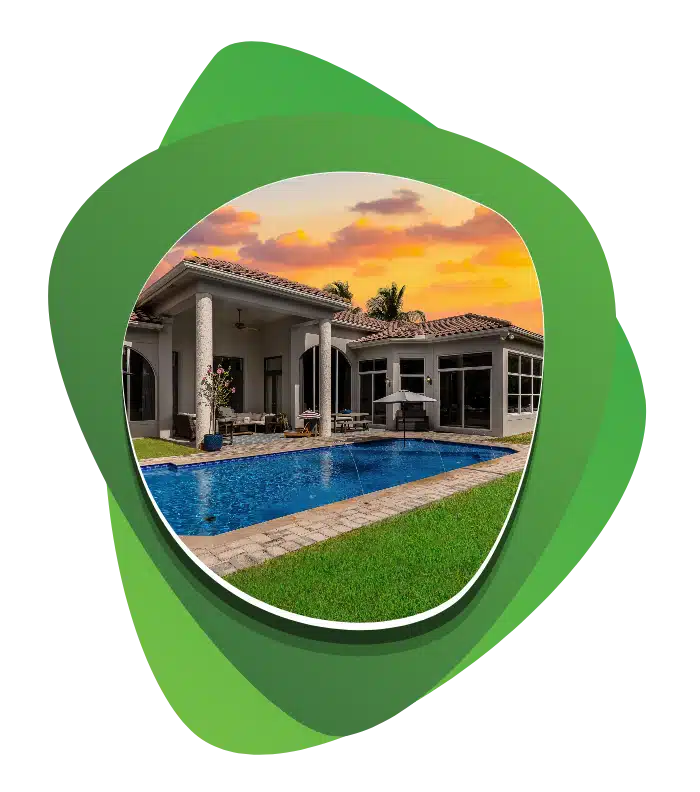

佛罗里达州巨额抵押贷款助您实现豪宅梦想。The Doce Mortgage Group 的巨额贷款旨在帮助您为超出标准机构贷款限额的高端房产提供融资。根据您的需求和抱负,量身定制佛罗里达州巨额贷款,超越传统融资方式,在竞争激烈的市场中提升您的购买力。

获得高于传统贷款限额的融资,非常适合高成本地区和豪宅。

与标准贷款相比,首付比例更低,让您更容易实现置业梦想。

您可享受极具吸引力的利率,而且每月的房贷支出绝不会超出您的预算。

对于佛罗里达州的购房者来说,巨额贷款是购买高端房产或在房地产价格超过一般贷款限额的竞争激烈的市场中购买房屋的理想解决方案。

利用迈阿密巨额贷款为完美的顶层公寓提供资金,或利用劳德代尔堡的巨额贷款购买海滨住宅--无论您想在哪里安家、 多斯抵押贷款集团 可以为您提供实现这一目标所需的财务杠杆。我们的巨额贷款提供更高的借款限额,因此您可以投资豪华房地产,而不受标准抵押贷款产品的限制,为您提供如此大额投资所需的灵活性和安全性。

我们的巨额贷款计划适用于佛罗里达州的各种高价值房产,无论是主要住宅、第二住宅还是投资房产。为了获得贷款资格,借款人需要接受对其信用度、收入稳定性和整体财务健康状况的全面评估,借款标准较高,与不合格贷款的高风险相一致。

Doce Mortgage Group 很荣幸成为您在豪华房地产领域的合作伙伴。我们的专家顾问让您在佛罗里达州轻松获得巨额贷款,提供无缝、透明的流程,为您的豪宅铺平道路。无论您是想在需求旺盛的邮政编码区竞争,还是对一大片高尔夫球场地产虎视眈眈,今天就联系 Doce Mortgage Group,探索定制的佛罗里达州巨额抵押贷款解决方案。

A 特大抵押贷款 是一种房屋贷款,它 超过符合规定的贷款限额 由 房利美和房地美. .截至 2025 年 10 月, 任何贷款金额 $822,550 以上 在佛罗里达州大多数县被认为是 特大号. .这些贷款用于资助 高价值房产 一般要求 良好信誉, 更高的首付和 额外收入核实.

多斯集团 优惠 佛罗里达州各地的巨额抵押贷款计划, 包括迈阿密、劳德代尔堡、博卡拉顿、棕榈滩和那不勒斯。.

佛罗里达州的巨额贷款利率因贷款价值、信用评分、房产类型和占用率而异。请致电 800-355-ALEX 或通过以下方式联系 Alex Doce 本页以获得当今最优惠的价格。

要获得巨额贷款,借款人必须有良好的信用记录、稳定的收入和工作,并有能力为豪宅支付可观的首付款(通常为 10% 以上)。借款人的 FICO 信用评分也必须在 660 分以上。.

是--对贷款人来说,巨额贷款的风险更大 因为它们超过了 房利美和房地美的 这些机构不支持符合规定的贷款限额。因此,借款人必须符合 更严格的信贷、收入和储备金要求.

不过,对于合格的买家而言、, 巨额贷款的风险并非与生俱来-它们只是涉及 更大的贷款额度 和 更严格的审批标准 以保护借贷双方。.

您可以通过巨额抵押贷款再融资来降低利率、减少付款或获取房屋净值。巨额再融资与标准贷款一样,但要求信用良好、有足够的资产净值,过户费用约为贷款额的 1-3%。.

The Doce Group 可以帮助您了解佛罗里达州当前的巨无霸再融资方案,并确定可能节省的资金。.