目录

- 什么是退伍军人贷款以及 2025 年哪些人可以获得退伍军人贷款

- 退伍军人资格如何影响您的公寓购买选择

- 您可以使用退伍军人贷款在西棕榈滩购买公寓吗?

- 如何开始使用 VA 贷款购买公寓的流程

- 在西棕榈滩使用退伍军人贷款购买公寓的步骤

- 为什么公寓较难使用退伍军人贷款(但仍有可能)

- 在西棕榈滩寻找经退伍军人事务部批准的公寓的技巧

- 退伍军人贷款是否涵盖公寓费用或房屋协会会费?

- 退伍军人和军人家属为何喜爱西棕榈滩

- 西棕榈滩针对退伍军人买家的热门公寓社区

- 常见问题:西棕榈滩的 VA 贷款和公寓

- 准备好用退伍军人贷款在西棕榈滩购买公寓了吗?

主题演讲

- 退伍军人贷款可以零首付购买西棕榈滩经批准的公寓。

- 公寓项目必须符合退伍军人事务部的审批标准,才能推进融资。

- 退伍军人每月费用较低,无需私人按揭保险。

如果您正在考虑用退伍军人贷款在西棕榈滩购买一套公寓,那您并不孤单。全年温暖的天气、海滩和城市生活方式使其成为退伍军人和军人家庭的热门选择。但人们经常会问的一个大问题是,西棕榈滩的退伍军人贷款是否真的可以用来购买公寓。简短的回答是肯定的,但您需要知道一些事情才能实现。

在本文中,您将了解到如何 佛罗里达州的 VA 贷款 适用于公寓、西棕榈滩允许的情况、房产类型和价格方面需要注意的事项,以及如何实际操作贷款流程。

什么是退伍军人贷款以及 2025 年哪些人可以获得退伍军人贷款

退伍军人贷款是由美国退伍军人事务部支持的一项抵押贷款计划。它旨在帮助符合条件的军人、退伍军人和部分未亡配偶以更简便的条件购买或再融资购房。这包括免首付、免私人按揭保险和较低的过户费用等选项。

要获得 2025 年西棕榈滩的退伍军人贷款资格,您需要一份有效的资格证书 (COE)。这证明您的兵役符合退伍军人协会的最低兵役要求。通常,这意味着您已经服役:

- 战时服现役 90 天

- 和平时期 181 天

- 或在预备役或国民警卫队服役 6 年

如果您是因服役致残而去世的退伍军人的未亡配偶,您也可能符合条件。如果您不确定自己是否符合条件,Doce Mortgage Group 可以帮助您确认自己的身份并获得 COE。

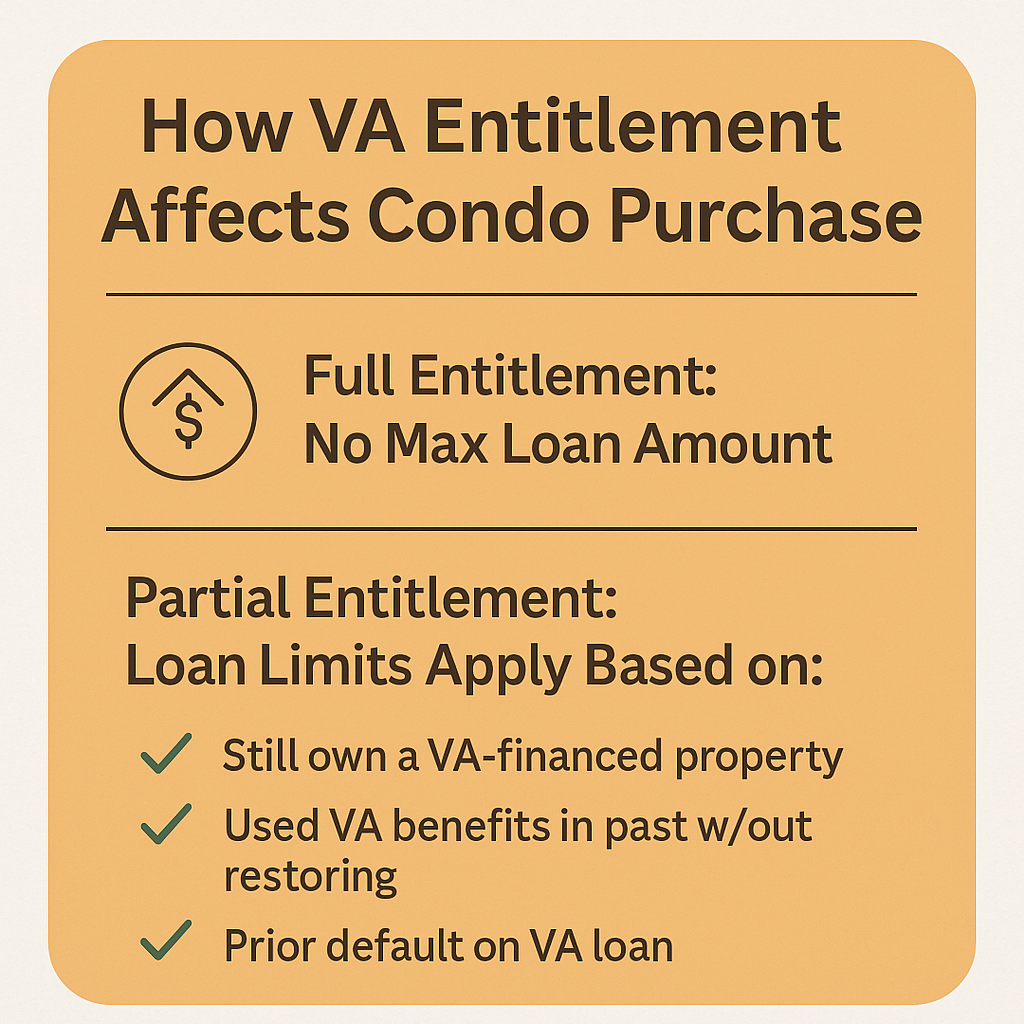

退伍军人资格如何影响您的公寓购买选择

在西棕榈滩使用退伍军人贷款的一个关键因素是您的权利状态--您是拥有全部权利还是部分权利。这种状态会改变您可以零首付贷款的额度,以及何时适用任何限制。

完全权利:无退伍军人上限

如果您完全享有退伍军人福利(即您尚未使用退伍军人福利或已完全恢复),则没有退伍军人福利规定的最高贷款额度。只要您的收入、信用和公寓的评估结果支持,您就可以为价格远高于通常保值限额的公寓提供贷款。贷款人只需看您的还款能力和房产是否符合条件。

何时适用部分权利

当您的应享权利被部分使用时,限额就会发挥作用,例如

- 您仍拥有退伍军人资助的房产

- 您过去使用过退伍军人福利,但没有完全恢复权利

- 您曾拖欠或索要过退伍军人贷款

在这些情况下,您的零首付借款能力与您所在县的联邦住房与家庭管理局(FHFA)合格贷款限额相关联。就 2025 年而言,大多数县的基准合格贷款限额为 $819,000,但在指定的高成本地区,该限额更高(最高可达 $1229,000)。如果公寓价格超过该限额,而您的权利只有部分,您需要携带额外资金来弥补差额。

为什么这对公寓很重要

由于西棕榈滩的公寓价格差异很大,因此了解您的权益状况有助于您锁定切合实际的建筑和价格范围。如果您拥有完全产权,您可以瞄准更高的价格。如果是部分产权,则应选择符合规定限制的单位,或准备弥补差额。

您可以使用退伍军人贷款在西棕榈滩购买公寓吗?

是的,但这里有一个问题:公寓必须是退伍军人事务部批准的公寓项目的一部分。这意味着整个建筑群已经通过了退伍军人事务部的检查程序。这也意味着公寓的业主协会(HOA)符合退伍军人事务部要求的财务和法律规定。

以下是退伍军人公寓项目审查和许多抵押贷款公司常用的基准:

- 至少有 50% 个单元必须为业主自用

- 房屋租赁协会必须有可靠的储备金和财务记录

- 拖欠会费的单位不得超过 15%

- 不得有涉及 HOA 的法律纠纷

如果公寓楼符合这些规定,并且在退伍军人事务部的批准名单上,您就可以在西棕榈滩使用退伍军人事务部的贷款。如果尚未获得批准,房屋协会也有可能提出申请,但这一过程需要时间,而且不一定能成功。

如需查看佛罗里达州获批公寓名单,请访问退伍军人贷款担保网站 网站.

为避免延误,最好与了解当地公寓市场的贷款官合作,他可以指导您选择符合退伍军人事务部规定的方案。

如何开始使用 VA 贷款购买公寓的流程

如果您已准备好向前迈进,以下是在西棕榈滩使用退伍军人贷款购买公寓的步骤:

- 获得预先批准 申请退伍军人贷款

- 寻找经退伍军人事务部批准的公寓 适合您的预算

- 出价 并签署购买协议

- 订购鉴定 并通过 VA 审查

- 提交所有最终文件 用于承销

- 关闭公寓 迁入

在此过程中,明智的做法是使用以下工具 按揭计算器 以了解您的月供情况。这可以帮助您找出适合您预算的价格范围,以及哪些公寓符合您的实际情况。

您也可以直接通过以下方式申请 我们的申请门户网站 以获得预先批准,更快地向前迈进。

在西棕榈滩使用退伍军人贷款购买公寓的步骤

在西棕榈滩开始使用退伍军人贷款购买公寓意味着要遵循清晰的路线图。以下是您如何自信地向前迈进的方法:

预先批准和预算编制

首先,您需要获得西棕榈滩退伍军人贷款的预先批准。这包括提交您的收入、信用记录、服务记录和资格证书。一旦获得预先批准,您就会知道自己能负担多少钱。使用 按揭计算器 测试不同的公寓价格和月供,看看哪种适合您的预算。

寻找经退伍军人事务部批准的公寓

并非所有公寓都符合条件。您必须在已获退伍军人事务部批准的项目中挑选公寓。使用退伍军人事务部’公寓查询 工具 按城市、州或楼盘名称进行筛选。请您的房地产经纪人确认公寓是否在退伍军人事务部的批准名单上。有时,公寓看起来不错,但由于业主协会(HOA)不符合 VA 标准,所以不能用 VA 贷款。

要约与合同

一旦您找到获得退伍军人贷款批准且价格在您的预算范围内的公寓,您就可以像往常一样出价并签订购房协议。请务必将融资条件包括在内,这样您的退伍军人贷款批准就会成为向前推进的一部分。

评估、检查和 VA 审查

将要求进行评估,以确认公寓的价值是否支持贷款。由于公寓有共用部分,评估时还会考虑大楼公共区域的状况。

评估必须符合退伍军人事务部的最低财产要求(MPRs)。如果建筑物存在结构性问题、延期维修或系统不安全,则可能需要进行维修,然后才能推进退伍军人事务部的审批程序。

与此同时,您的贷款人将收集业主委员会文件、财务报表、保险单和公寓的法律条款,以证明该项目符合退伍军人事务部的规定。

最终核保和结算

经过评估和审查后,承销商将给予最终批准。批准后,您就可以办理公寓的过户手续。资金转账后,根据退伍军人抵押贷款条款,您就成为了公寓的业主。

成交后,您的责任包括按照约定支付贷款、房产税和房屋租赁协会会费。在西棕榈滩使用退伍军人贷款购买公寓,可获得与大多数独栋房屋买家相同的保护。

为什么公寓较难使用退伍军人贷款(但仍有可能)

在西棕榈滩使用 VA 贷款购买公寓要比购买独栋房屋遇到更多的障碍。但只要有合适的团队和房产,绝对可以成功。

获批的公寓项目减少

一个很大的问题是,只有一些公寓大楼获得了退伍军人事务部的批准。整个项目必须通过退伍军人事务部的审查,而不仅仅是您的单个单元。如果您爱上了一栋不在名单上的建筑,您可能会走入死胡同,除非房屋协会愿意通过审批程序。

严格的房屋租赁和财务规定

VA 批准要求 HOA 符合财务健康规定:

- 拖欠会费的单位不到 15

- 至少 50% 的单元必须由业主居住(不得出租)

- 房屋租赁协会必须有储备金、适当的保险以及无重大法律索赔。如果您选择的公寓不符合这些条件,申请程序可能会停滞不前。

评估和维护风险

由于公寓共用墙壁和共用系统,估价师可能会发现共用空间的结构问题、屋顶问题、电梯系统或管道问题。如果建筑需要维修,卖方或房屋协会可能需要在成交前解决这些问题。此外,在棕榈滩县,任何 3 层或 3 层以上的公寓建筑都必须经过持证建筑师或工程师的里程碑检查。这些检查可能会发现在贷款批准前需要修复的问题。

项目审批延误

如果公寓项目尚未获得退伍军人事务部的批准,获得批准可能会很耗时。房屋协会必须提供所有必要的文件,而退伍军人事务部必须对这些文件进行审查。有时项目会被拒绝。这就意味着要拖延或另觅房产。由于存在这种风险,许多贷款人倾向于只与已获批准的公寓合作。

考虑到这些障碍,与知识渊博的抵押贷款团队和在退伍军人公寓方面经验丰富的房地产经纪人合作是明智之举。

在西棕榈滩寻找经退伍军人事务部批准的公寓的技巧

以下是在西棕榈滩使用退伍军人贷款购买公寓时提高成功几率的实用建议:

- 根据 VA 批准情况开始公寓搜索。在参观单位之前,请使用 VA 的查询工具。

- 向您的房地产经纪人索取一份已经获得 VA 批准或正在申请中的公寓楼盘名单。

- 在您做出承诺之前,请查看房屋租赁协会的财务状况、会议记录、保险和储备金。

- 仔细检查大楼的入住率,确保一半以上的单元是业主自住的。

- 确认拖欠业主大会会费的业主不超过 15%。

- 与了解公寓审批规则的房贷专员合作。

- 对新项目或改建项目要慎重--它们有时要求售出 75% 的单元后才能获得完全批准。

- 请务必向退伍军人事务部或您的贷方确认,根据退伍军人事务部的规定,该项目仍然有效(批准可能过期或变更)。

如果您找到的公寓通过了所有检查,您就可以放心地在西棕榈滩使用退伍军人贷款。如果您想立即推进,请使用 我们的申请门户网站 快速获得预先批准。

退伍军人贷款是否涵盖公寓费用或房屋协会会费?

如果您在西棕榈滩使用退伍军人贷款购买公寓,最常见的问题之一就是有关业主协会费用的问题。简而言之:是的,您可以购买需要缴纳业主委员会费用的公寓,但退伍军人事务部不会在贷款范围内支付这些费用。

房屋租赁费用必须由房主单独支付,不计入贷款余额。不过,这些费用在贷款审批过程中会被考虑在内。贷方在决定您的贷款额度时,会考虑您每月的住房总成本,包括房屋租赁管理费。

有些公寓的房屋管理费低至每月 $200 美元,而有些公寓,尤其是那些有游泳池、健身房或海滨景观的公寓,可能会收取 $700 美元或更高的费用。这种差异可能会影响您的审批,因此在签订合同之前,请确保您了解了房屋租赁协会的费用。

同样重要的是要注意特别评估,即房屋所有权协会收取额外的维修或升级费用,这是您的责任。这些费用不在贷款范围内,也无法融资。

如果您希望在预算每月全额付款(包括房屋委员会会费)时得到帮助,请尝试我们的 按揭计算器 提前计算数字。

退伍军人和军人家属为何喜爱西棕榈滩

西棕榈滩不仅是使用退伍军人福利的好地方。这里也是许多退伍军人选择长期居住的地方。这是有原因的。

- 全年气候宜人,日照充足

- 可前往西棕榈滩退伍军人医疗中心,这是一个拥有约 254 张病床的大型地区设施

- 许多公寓靠近海滩、游艇码头和高尔夫球场

- 佛罗里达州不征收州所得税

- 强大的军事友好型企业和服务网络

- 大量公园和户外活动场地,适合步行、骑自行车和休闲

- 可快速前往棕榈滩国际机场 (PBI),方便探亲或旅行

在佛罗里达州,如果退伍军人因伤残等级或收入水平而符合条件,还可享受房产税减免。这使得长期拥有房屋变得更加经济实惠。

西棕榈滩针对退伍军人买家的热门公寓社区

西棕榈滩的公寓社区种类繁多,每个社区都能提供不同的生活方式。对于使用 VA 贷款的退伍军人来说,关键是要关注已经获得 VA 批准或很有可能获得 VA 批准的楼盘。以下是几个比较突出的社区:

- Flagler Pointe - 毗邻市中心,拥有水景和一系列便利设施。

- 布里尔湾的科夫 - 这是一个设有泳池、网球场和家庭友好设施的封闭式社区。

- 世纪村 - 一个 55 岁以上的社区,提供经济实惠、活跃的社交俱乐部和现场服务。

- 斯特林村 - 交通便利,靠近主干道和购物区。

- 棕榈俱乐部村 - 以绿地、步行道和多个游泳池而闻名。

每个地区的房屋租赁费用、设施和生活方式都不尽相同。有些吸引那些想要安静社区的退休人员,而有些则更适合那些喜欢靠近夜生活、商店和餐馆的买家。

如果您正在考虑购买公寓,最好与了解哪些项目适合退伍军人事务部的抵押贷款专家合作。Doce Mortgage Group 可以帮助您专注于符合 VA 指南的房产,从而节省您的搜索时间和精力。

如果您已准备好开始查看已获批准的公寓选项,您可以使用 我们的申请门户 现在就开始

常见问题:西棕榈滩的 VA 贷款和公寓

我可以使用退伍军人贷款购买西棕榈滩的任何公寓吗?

不,公寓必须是在退伍军人事务部批准的项目内。如果尚未获得批准,协会也有可能提出申请,但这一过程需要额外的时间。

在西棕榈滩使用退伍军人贷款需要首付吗?

退伍军人贷款允许您零首付购买公寓,但您仍需要一些资金来支付过户费、税费和保险费等。

我可以多次使用退伍军人贷款福利吗?

可以。只要您还有剩余的权利,或者您在出售用退伍军人贷款购买的房屋后恢复了权利,您就可以再次使用这项福利。

准备好用退伍军人贷款在西棕榈滩购买公寓了吗?

西棕榈滩有许多符合退伍军人条件的优质公寓--退伍军人选择在此居住的原因有很多。从无需首付到利率优惠,在西棕榈滩,退伍军人贷款是一种明智的购房方式,而不会打破您的预算。

关键是要选择符合退伍军人事务部规定的公寓,并与了解当地市场的团队合作。这正是 Doce Mortgage Group 可以提供帮助的地方。

想听听与 Doce Mortgage Group 合作过的真实客户的意见吗?查看我们的 评论 了解我们如何帮助其他退伍军人。

立即致电 305-900-2012 开始在西棕榈滩购买退伍军人公寓!