Table des matières

- Les propriétaires de Wilton Manors espèrent une baisse des taux d'intérêt

- Pourquoi vous devriez refinancer votre hypothèque à Wilton Manors dès maintenant ?

- Qui refinance à Wilton Manors en ce moment ?

- Avantages du refinancement de votre hypothèque à Wilton Manors

- Attention aux coûts de refinancement

- Refinancement avec décaissement : Est-ce une bonne idée en 2025 ?

- Comment se qualifier pour refinancer votre hypothèque à Wilton Manors ?

- Pourquoi les gens aiment vivre à Wilton Manors

- Principales raisons pour lesquelles les propriétaires de maisons se refinancent à Wilton Manors

- Pourquoi travailler avec le Doce Mortgage Group pour votre prêt de refinancement ?

- Refinancer pendant que la fenêtre est encore ouverte

- Questions et réponses sur le refinancement à Wilton Manors

Discours d'ouverture

- Les taux de refinancement en Floride ont baissé, ce qui permet aux propriétaires de Wilton Manors de réaliser des économies.

- L'augmentation de la valeur des maisons peut vous permettre de disposer de plus de fonds propres que vous ne le pensez.

- Le refinancement permet de réduire les paiements, de financer des rénovations ou d'améliorer les plans financiers à long terme.

Si vous habitez à Wilton Manors et que vous envisagez de refinancer votre prêt hypothécaire, 2025 pourrait être le bon moment pour le faire. Les taux d'intérêt s'étant stabilisés après les sommets atteints ces dernières années et la valeur des maisons continuant de grimper, de nombreux propriétaires locaux cherchent à obtenir de meilleures conditions. Mais est-ce vraiment le bon moment pour vous pour refinancer votre hypothèque à Wilton Manors ? Voyons ce qu'il en est.

Les propriétaires de Wilton Manors espèrent une baisse des taux d'intérêt

En 2025, les taux de refinancement hypothécaire en Floride ont baissé par rapport aux sommets de 2023. Selon les données de Bankrate, le taux fixe moyen de refinancement à 30 ans en Floride tourne autour de 6,2%, en baisse par rapport à 7,1% au début de 2024. Cela ne semble pas énorme, mais sur un prêt de $400.000, même une baisse de 1% peut vous faire économiser environ $250 à $300 par mois.

Si vous êtes l'un des nombreux propriétaires de Wilton Manors qui ont acheté pendant le boom post-pandémique avec des taux proches de 7% ou plus élevés, vous pourriez être en mesure de réduire vos paiements mensuels de manière significative. Vous pourriez même raccourcir la durée de votre prêt de 30 à 15 ans et rembourser votre maison plus rapidement sans trop augmenter vos paiements.

Pourquoi vous devriez refinancer votre hypothèque à Wilton Manors dès maintenant ?

Voici les raisons les plus courantes pour lesquelles les gens refinancent en 2025, en particulier dans les régions à forte demande comme Wilton Manors :

- Réduction du taux d'intérêt si vous avez bloqué à 6,75% ou plus dans le passé

- Suppression de l'assurance hypothécaire privée (PMI) si votre rapport prêt/valeur s'est amélioré

- Passage d'un prêt hypothécaire à taux variable (ARM) à un taux fixe plus prévisible

- Exploiter les fonds propres d'un logement pour payer des dépenses importantes ou consolider des dettes à taux d'intérêt élevé

Quel est le principal moteur de ce refinancement ? Les prix de l'immobilier à Wilton Manors ont récemment augmenté de 25,8% au cours de l'année écoulée, avec un prix de vente médian proche de $610 000. Cela signifie que vous disposez peut-être d'un capital immobilier plus important que vous ne le pensiez. Et ce capital vous donne plus d'options.

Qui refinance à Wilton Manors en ce moment ?

Vous devriez surtout envisager un refinancement si

- Votre taux actuel est supérieur d'au moins 1% à la moyenne du jour

- Vous avez accumulé au moins 20% de fonds propres dans votre logement

- Vous souhaitez passer d'un prêt FHA à un prêt conventionnel pour supprimer la PMI.

- Vos revenus ou votre solvabilité se sont améliorés depuis que vous avez obtenu votre premier prêt hypothécaire.

- Vous envisagez de rester dans votre logement pendant plusieurs années encore

Dans un endroit comme Wilton Manors où la valeur des maisons continue d'augmenter et où la demande reste forte, le refinancement n'est pas seulement une question de paiement mensuel. Il s'agit de construire une équité plus intelligente et de planifier une stabilité à long terme.

Avantages du refinancement de votre hypothèque à Wilton Manors

Détaillons les avantages. Voici ce que vous pouvez gagner en refinançant :

- Paiements mensuels moins élevés: Un meilleur taux peut vous faire économiser des centaines d'euros par mois

- Des durées de prêt plus courtes: Passez d'un prêt sur 30 ans à un prêt sur 15 ans et économisez des milliers d'euros d'intérêts

- Obtenir des liquidités: Utilisez votre capital immobilier pour améliorer votre maison, rembourser vos prêts étudiants ou financer votre entreprise.

- Meilleure structure de prêt: Passer d'un taux variable à un taux fixe ou se soustraire aux exigences de la FHA

Dans un marché immobilier concurrentiel comme celui de Wilton Manors, les propriétaires profitent de l'occasion pour revoir les conditions de leur prêt hypothécaire afin qu'elles correspondent aux objectifs d'aujourd'hui et non aux taux d'hier.

Essayez de saisir vos chiffres dans notre Calculatrice hypothécaire pour voir combien vous pourriez économiser chaque mois.

Attention aux coûts de refinancement

Le refinancement n'est pas gratuit. Mais les coûts peuvent souvent être récupérés sous forme d'économies en l'espace de quelques années. Voici ce à quoi il faut s'attendre :

- Frais de clôture: Généralement entre 2% et 4% du montant de votre prêt.

- Frais d'évaluation: Souvent nécessaire pour vérifier la valeur marchande actuelle de votre logement.

- Vérification de la solvabilité: Peut entraîner une légère baisse temporaire de votre cote de crédit.

- Réinitialisation du prêt: Si vous refaites un prêt sur 30 ans, vous redémarrez l'horloge, à moins que vous n'optiez pour une durée plus courte.

Avant de refinancer, calculez votre seuil de rentabilité : combien de temps vous faudra-t-il pour récupérer ce que vous avez payé pour refinancer ? Si vous prévoyez de rester dans votre maison de Wilton Manors pendant plusieurs années, les économies réalisées peuvent largement compenser les coûts initiaux.

Refinancement avec décaissement : Est-ce une bonne idée en 2025 ?

Un refinancement en numéraire vous permet de remplacer votre prêt hypothécaire actuel par un prêt plus important et d'empocher la différence en numéraire. Si vous avez accumulé des fonds propres, il peut s'agir d'un moyen judicieux d'accéder à des fonds sans avoir recours à des cartes de crédit ou à des prêts personnels à taux d'intérêt élevé.

À Wilton Manors, les prix de l'immobilier sont restés stables ou ont augmenté, ce qui fait des refinancements une option populaire. Vous pouvez utiliser l'argent pour :

- Rénovation de la cuisine ou de la salle de bains

- Remboursement des dettes à taux d'intérêt élevé

- Financement d'un nouvel investissement

- Couvrir les frais d'éducation ou les frais médicaux

N'oubliez pas que l'utilisation des fonds propres réduit le montant que vous obtiendrez si vous vendez. Il convient donc de l'utiliser à bon escient.

Vous envisagez une refonte de votre prêt hypothécaire ? C'est le bon moment pour obtenir un quote et voir ce qui est possible.

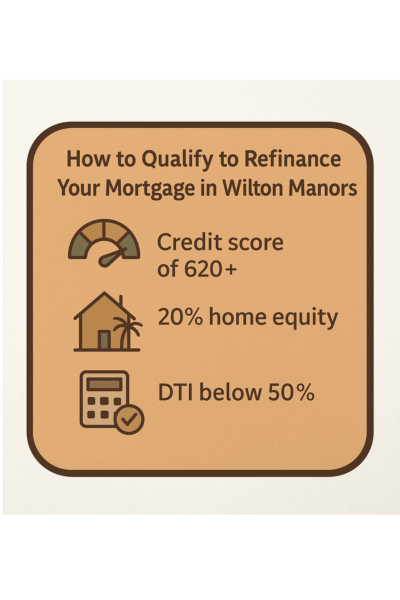

Comment se qualifier pour refinancer votre hypothèque à Wilton Manors ?

Obtenir un accord pour refinancer votre prêt hypothécaire à Wilton Manors en 2025 est plus simple que la plupart des gens ne le pensent. Les prêteurs veulent savoir si vous pouvez rembourser le nouveau prêt et si la valeur de votre propriété est suffisante pour justifier le refinancement.

Voici ce qu'il faut prévoir :

L'importance du score de crédit

Une cote de crédit de 620 ou plus est généralement nécessaire pour un refinancement conventionnel, bien que de meilleurs taux soient souvent accordés aux personnes ayant une cote de crédit de 740 ou plus. Si votre score s'est amélioré depuis que vous avez acheté votre maison, c'est peut-être le moment de vous refinancer à un taux plus bas.

Même si votre score est limite, The Doce Mortgage Group peut vous présenter vos options et vous aider à voir s'il y a une voie à suivre.

Exigences en matière de fonds propres

Vous devez généralement disposer d'au moins 20% de fonds propres pour bénéficier des meilleurs taux et éviter l'assurance hypothécaire privée. À Wilton Manors, la hausse de la valeur des biens immobiliers a permis à de nombreux propriétaires d'accumuler des fonds propres plus rapidement que prévu.

Vous n'êtes pas sûr du montant de vos fonds propres ? Un moyen rapide de le vérifier est de comparer le solde de votre prêt hypothécaire actuel avec la valeur marchande estimée de votre maison. Vous pouvez également demander un refinancement et obtenir une évaluation de votre propriété pour savoir exactement où vous en êtes.

Votre ratio d'endettement (DTI)

La plupart des prêteurs souhaitent que vos dettes mensuelles (y compris votre nouveau paiement hypothécaire) ne dépassent pas 50% de votre revenu mensuel brut. Cela comprend votre prêt hypothécaire actuel, les paiements de cartes de crédit, les prêts automobiles et les autres dettes.

Si vous êtes travailleur indépendant ou si vous avez des revenus irréguliers, il peut être plus complexe de remplir les conditions requises. Mais c'est tout à fait faisable avec les bons documents et les bons conseils.

Vous voulez savoir si vous êtes éligible ? Commencez dès maintenant en utilisant notre portail de candidature.

Pourquoi les gens aiment vivre à Wilton Manors

Le refinancement de votre prêt hypothécaire à Wilton Manors est d'autant plus logique que cette ville est très appréciée. Si vous prévoyez de rester sur place à long terme, investir dans votre maison par le biais d'un refinancement est un moyen intelligent de réduire les coûts tout en conservant votre style de vie là où vous le souhaitez.

Voici pourquoi les gens choisissent de rester :

- La marchabilité: C'est l'une des villes de Floride où l'on peut le plus marcher. Vous pouvez aller dîner, assister à des concerts ou faire vos courses sans prendre votre voiture.

- Vie nocturne et culture: Wilton Drive regorge de bars, de restaurants, de boutiques et de galeries d'art. Il s'y passe toujours quelque chose et elle ressemble davantage à un quartier qu'à une zone touristique.

- Proximité de Fort Lauderdale: Vous n'êtes qu'à 10 minutes du centre-ville de Fort Lauderdale et de la plage, ce qui ajoute de la valeur à la région et en fait un lieu de prédilection pour les acheteurs et les locataires.

- Des valeurs immobilières locales élevées: Les prix de l'immobilier à Wilton Manors ont fortement augmenté - en août 2025, le prix médian de l'offre a atteint environ $697 000 - et les prévisions suggèrent une poursuite de la pression à la hausse.

Lorsque vous refinancez votre prêt hypothécaire à Wilton Manors, vous remettez de l'argent dans votre poche tout en restant dans une ville où les gens essaient activement de s'installer.

Principales raisons pour lesquelles les propriétaires de maisons se refinancent à Wilton Manors

Les gens refinancent généralement pour quelques bonnes raisons, qui entrent généralement dans l'une de ces catégories :

- Meilleures conditions de prêt: Les propriétaires de maisons se refinancent pour obtenir un taux d'intérêt plus bas ou pour passer d'un prêt sur 30 ans à un prêt sur 15, 20 ou 25 ans. Cela permet de réduire le montant total des intérêts payés au fil du temps, de se constituer un capital plus rapidement et de rembourser l'hypothèque plus tôt.

- Budget mensuel: Avec l'augmentation du coût de la vie en 2025, la réduction des mensualités de votre prêt hypothécaire peut alléger la pression sur votre budget. Le refinancement peut supprimer la PMI ou prolonger la durée du prêt, ce qui vous permet de disposer d'une plus grande marge de manœuvre financière pour les dépenses quotidiennes ou les factures imprévues.

- Consolidation de la dette: Les cartes de crédit et les prêts personnels à taux d'intérêt élevé peuvent miner vos finances. Un refinancement en numéraire vous permet de regrouper ces dettes en un seul paiement mensuel moins élevé, en utilisant la valeur nette de votre maison pour prendre le contrôle et réduire les coûts d'intérêt totaux.

- Projets d'amélioration de l'habitat: Des rénovations telles que la modernisation de la cuisine ou l'amélioration de l'efficacité énergétique peuvent augmenter le confort et la valeur de revente. Un refinancement avec sortie de fonds donne aux propriétaires le financement dont ils ont besoin pour améliorer leur maison sans avoir recours à des prêts personnels ou à des lignes de crédit à taux d'intérêt élevé.

- Planification de la retraite: À l'approche de la retraite, de nombreuses personnes choisissent de refinancer leur prêt à plus court terme ou de réduire le montant de leurs versements afin de pouvoir bénéficier d'un revenu fixe. C'est une décision intelligente qui permet de réduire les coûts à long terme et de créer une base financière plus stable pour les années à venir.

Dans un endroit comme Wilton Manors, refinancer signifie investir dans un style de vie qui vaut la peine d'être conservé.

Si vous pensez qu'il est temps de faire des calculs, n'essayez pas de deviner. Obtenir un devis gratuit et recevez une analyse personnalisée en fonction de votre prêt actuel et de vos objectifs.

Pourquoi travailler avec le Doce Mortgage Group pour votre prêt de refinancement ?

Si vous envisagez de refinancer votre prêt hypothécaire à Wilton Manors, il est important de travailler avec une équipe qui s'y connaît.

De la conclusion rapide à l'orientation intelligente, The Doce Mortgage Group a aidé des milliers de propriétaires à améliorer leur hypothèque pour qu'elle corresponde à leur vie d'aujourd'hui, et non aux taux qu'ils ont bloqués il y a des années.

Voir ce que des centaines de nos clients ont à dire sur leur expérience de travail avec nous !

Refinancer pendant que la fenêtre est encore ouverte

Les taux sont meilleurs qu'il y a un an et la valeur des maisons à Wilton Manors se maintient. Cette combinaison ne dure pas toujours. Si vous attendez de refinancer votre prêt hypothécaire à Wilton Manors, c'est peut-être le moment le plus judicieux, tant sur le plan financier que personnel.

Appelez-nous aujourd'hui au 305-900-2012 pour commencer votre refinancement avec The Doce Mortgage Group et découvrir combien vous pourriez économiser.

Questions et réponses sur le refinancement à Wilton Manors

Combien de temps faut-il pour refinancer un prêt hypothécaire ?

La plupart des refinancements en Floride prennent de 20 à 30 jours, mais cela dépend de la rapidité avec laquelle vous pouvez fournir les documents et planifier l'évaluation.

Quel est le coût d'un refinancement à Wilton Manors ?

Attendez-vous à payer 2% à 4% du montant du prêt en frais de clôture. Certains de ces frais peuvent être intégrés au prêt, en fonction de votre situation.

Puis-je refinancer si je suis indépendant ?

Oui, mais vous devrez présenter davantage de documents, comme deux années de déclarations fiscales et éventuellement des déclarations de bénéfices et de pertes.

Le refinancement affecte-t-il mon score de crédit ?

Il se peut que vous constatiez un léger fléchissement à la suite de l'enquête de solvabilité, mais la situation se rétablit généralement rapidement. À long terme, un paiement mensuel moins élevé ou un meilleur prêt peut réellement améliorer votre crédit.

Quels sont les documents dont j'ai besoin pour demander un refinancement ?

Les documents habituels comprennent la vérification des revenus (talons de chèque de paie, W-2 ou déclarations d'impôts), les relevés des prêts hypothécaires en cours, une pièce d'identité et une preuve d'assurance habitation.

Que se passe-t-il si j'ai très peu de fonds propres ?

Vous avez peut-être encore des options comme le FHA Streamline Refinance ou le VA Interest Rate Reduction Refinance Loans (prêts de refinancement avec réduction du taux d'intérêt). Consultez The Doce Mortgage Group pour explorer la voie à suivre.