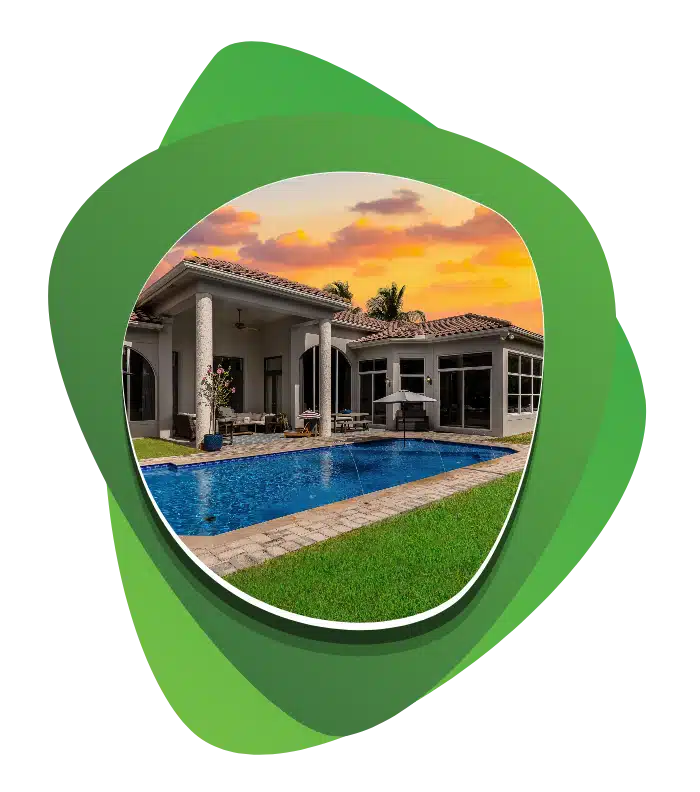

Make your luxury home dreams a reality with our flexible Jumbo Loans, designed to help you finance properties that exceed standard agency loan limits. Experience the freedom to purchase high-value real estate with competitive rates and tailored solutions.

Access financing above conventional loan limits, perfect for high-cost areas and luxury properties.

Enjoy lower down payment options compared to standard loans, making your dream home more accessible.

Benefit from attractive interest rates, making your high-value investment more affordable.

Jumbo Loans are an ideal solution for homebuyers seeking to purchase high-end properties or homes in competitive markets where real estate prices exceed typical loan limits. With our Jumbo Loan options, you gain the financial leverage to buy your dream home without being constrained by the limitations of standard mortgage loan products.

Understanding the unique needs of luxury property buyers, our Jumbo Loans offer higher borrowing limits, giving you the power to invest in premium real estate. These loans are crafted to provide competitive interest rates and flexible down payment options, tailored to suit your financial situation.

The qualification process for a Jumbo Loan involves a thorough assessment of your creditworthiness, income stability, and overall financial health. While this might mean a stricter criteria compared to smaller sized loans, it ensures that your investment is secure and sustainable.

Our Jumbo Loan programs are designed to cater to a wide range of high-value properties in Florida, be it your primary residence, a second home, or an investment property. With our expert advisors guiding you through every step, securing a Jumbo Loan in Florida becomes a seamless and transparent process, paving the way for you to own the luxury property you’ve always desired.

Whether you’re eyeing a sprawling estate, a downtown penthouse, or a seaside villa in Florida, our Jumbo Loan options are here to make your high-value property aspirations in Florida a reality. Contact The Doce Mortgage Group today to explore how we can assist you in financing your dream home with our Jumbo Loans in Florida. Contact us now to take the first step towards realizing your luxury property ownership goals with our specialized Jumbo Loans in Florida.

A Jumbo Loan is a type of mortgage loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA), designed to finance luxury properties and high-value homes.

Borrowers with very good credit histories, stable income and employment, and the ability to make larger down payments typically qualify for Jumbo Loans. 10% or higher down-payments are typically required on Jumbo loans.

Alex Doce NMLS 13817.

The Doce Mortgage Group NMLS 2638131.

For licensing information, go to: www.nmlsconsumeraccess.org.

Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Loan approval and terms are dependent upon borrower’s credit, documented ability to repay, acceptability of collateral property, and underwriting criteria.

The Doce Mortgage Group © 2024. All Rights Reserved.