Table of Contents

- What Makes A Mortgage Company The Best In Fort Lauderdale?

- Which Loan Types Should Fort Lauderdale Buyers Compare In 2025?

- What 2025 Rate Mechanics Matter In South Florida?

- How Should You Evaluate Fees And Total Cost In Fort Lauderdale?

- What Documentation Will A Strong Mortgage Company Request Up Front In 2025?

- How Fast Should Preapproval And Clear To Close Happen In Broward Right Now?

- Do You Need A Fort Lauderdale Company With Deep Condo And Coastal Insurance Know How?

- What Local Programs Could Lower Your Upfront Cash In 2025?

- How Should Fort Lauderdale Investors Compare Options In 2025?

- What Makes A Company Truly Local To Fort Lauderdale?

- How Do You Vet Reputation And Service Quality In 2025 Without Guesswork?

- What Questions Should You Ask On Your First Call?

- How Do Fort Lauderdale Closing Costs And Taxes Work In 2025?

- What Should You Expect During Underwriting And Appraisal In Broward?

- How Can You Compare Two Strong Finalists Without Stress?

- What Fort Lauderdale Living Facts Should Shape Your Mortgage Choice In 2025?

- FAQs

- Why Do People Say The Doce Mortgage Group Is The Best Mortgage Company In Fort Lauderdale?

Top 3 Take-a-Ways

- Compare real 2025 rates, fees, and timelines before choosing your Fort Lauderdale mortgage company.

- Pick a local expert who understands condo rules, insurance costs, and Broward market nuances.

- Verify transparency, speed, and communication to find the Best Mortgage Company in Fort Lauderdale.

Fort Lauderdale buyers face unique choices in 2025 when it comes to home financing. This comprehensive guide shows you how to pick the Best Mortgage Company in Fort Lauderdale for your exact goals. You’ll see how to compare options with real numbers, how local condo rules shape approvals, and what 2025 programs can reduce your upfront cash. We’ll stick to clear steps, local tips, and fresh data so you can move with confidence in Broward County.

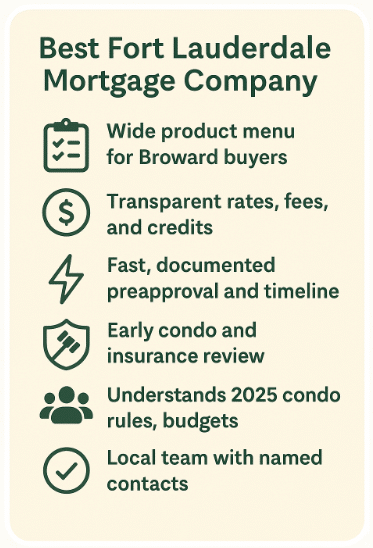

What Makes A Mortgage Company The Best In Fort Lauderdale?

Start with a simple checklist you can verify in minutes:

Product Depth

A top mortgage company should offer a full menu of loan types for Broward buyers. That means conventional options up to the current 2025 conforming loan limit, government backed choices like FHA and VA, renovation choices for older homes, and solutions for investors who plan to rent short term or long term. Check that condo and townhome paths are active, since Fort Lauderdale has a high share of attached housing.

Pricing Clarity You Can Verify

Insist on a written fee worksheet with an itemized estimate of rate, points, credits, and third party costs. Ask for the same loan term and the same lock period on every quote so your comparisons are fair. In 2025, the weekly national average for a 30 year fixed has been moving lower, with the October 23 reading at 6.19 percent per the Freddie Mac weekly survey. A strong company will explain how that headline rate translates to your credit score, condo type, and lock length.

Decision Speed And Local Control

You want a team that can issue a true preapproval within hours when you provide documents. In Fort Lauderdale, condo files can slow down if the association documents and insurance are not ordered early. The Best Mortgage Company in Fort Lauderdale will start the condo review and insurance checks at the same time as your credit and income review, not later.

Condo Fluency For 2025 Rules

Florida law now requires milestone inspections and structural integrity reserve studies for taller condo buildings. The state’s DBPR keeps a public page that explains the current rules for milestone inspections and reserve studies, which shape association budgets and dues in 2025. You can read the DBPR guidance on inspections and reserve studies. A local expert knows how these rules affect your approval and your monthly costs.

Reputation And Service

Read 2025 reviews, test response times with a quick email, and ask for named contacts. The Best Mortgage Company in Fort Lauderdale will give you a short, direct path to your processor and your loan officer assistant so you never guess who is handling your file.

Which Loan Types Should Fort Lauderdale Buyers Compare In 2025?

Conventional Up to 2025 Limits

For a one unit home, the 2025 conforming loan limit is $822,550. This higher cap helps many Fort Lauderdale buyers stay in the conventional box even on pricier homes and townhomes. If your target price or condo warrants a larger balance, a reputable mortgage company should describe next step options without pushing you into a product that raises risk.

FHA And VA For Flexible Credit Or Cash

FHA can help buyers who want a smaller down payment and need more forgiving credit rules. VA helps eligible service members and veterans with strong benefits, often with no down payment and capped fees. In condo heavy Broward, ask early if the building meets the current project rules for each program. The Best Mortgage Company in Fort Lauderdale will pre check the condo status and lay out a backup plan if the project needs a different path.

USDA In The Edges Of Broward

Most of Fort Lauderdale is urban and does not qualify for USDA, but parts of western Broward and nearby areas can. If your search expands, ask your company to verify the map for your exact address.

Renovation For Older Homes

Some Fort Lauderdale homes need roof, seawall, or systems work. A renovation product can roll repairs into your financing. That requires extra steps on bids and contractor documents, so choose a company that shows you a calendar for inspections and draws before you go under contract.

Investor Options For Beach And City Rentals

If you plan to buy a property for rent, the Best Mortgage Company in Fort Lauderdale should explain income documentation paths that fit investors. Ask about reserve rules, vacation rental limits, and condo hotel restrictions. The team should also warn you if a building’s rules or budget could block financing in 2025.

If you want the team that checks every box we’ve covered, Get a Free Quote from The Doce Mortgage Group to see your live numbers side by side with the Best Mortgage Company in Fort Lauderdale approach.

What 2025 Rate Mechanics Matter In South Florida?

Rate Versus APR

Rate affects your payment. APR wraps in selected costs and gives you a way to compare options. Ask your company to show both for the same lock length and points choice. In late October 2025, average 30 year fixed rates ticked down to 6.19 percent on the national survey per the Freddie Mac PMMS archive. That national trend does not replace a personalized quote, but it tells you the market backdrop.

Points And Credits Math

Buying points can drop your rate. Using credits can reduce cash to close. The right choice depends on how long you expect to keep the home or the loan. Ask for a breakeven table at 3, 5, and 7 years that shows total interest and total cash across point and no point scenarios. The Best Mortgage Company in Fort Lauderdale will build this for you in writing so you can pick the path that fits your time horizon.

Lock Periods And Float Downs

Match your lock to your contract timeline and HOA screening timeline. Broward condo associations can add days to your process while they complete screening or provide updated questionnaires. Ask about float down features that can capture a lower rate if the market drops after you lock. A strong Fort Lauderdale team will also set clear rules for extensions if an appraisal or condo document takes longer than planned.

ARM Choices

Adjustable rate options can make sense if you plan a shorter hold. The Best Mortgage Company in Fort Lauderdale should explain margin, caps, and index in plain terms, then show payment stress tests if the rate adjusts in year six or later. You should see both the first adjustment limit and the lifetime limit in the same quote pack.

How Should You Evaluate Fees And Total Cost In Fort Lauderdale?

Third Party Fees You Should Expect

Your estimate will show items like title insurance, recording, appraisal, credit report, and in condo cases a questionnaire fee. In 2025, condo associations often need to show current reserve studies and insurance proofs due to the state’s inspection and reserve rules. The Florida DBPR posts updates on milestone inspections and reserve study requirements. When documents are up to date, questionnaires move faster and rush fees can be avoided.

Company Specific Charges

Look for an origination or underwriting line and ask what service it covers. Request a written fee worksheet before you order an appraisal. The Best Mortgage Company in Fort Lauderdale will explain every line in simple terms and remove anything that is not needed for your file.

Insurance Can Swing Your Approval

In 2025, South Florida insurance costs are in motion. Citizens and other carriers have reported targeted changes by county and policy type. Broward homeowners on Citizens saw a mix of decreases and increases based on risk class, with state news noting many South Florida households receiving small cuts on renewal after mid year reviews. You can read updates that mention Broward by checking this WLRN report on 2025 Citizens changes and this CBS Miami brief on Broward rate reductions. Your company should collect quotes early and run your debt to income with the actual premium, not a guess.

Use our Mortgage Calculator to see how rate, taxes, association dues, and insurance change your monthly payment and cash to close.

What Documentation Will A Strong Mortgage Company Request Up Front In 2025?

The exact documents you’ll need will depend on your loan type and property, but most Fort Lauderdale lenders will request the following key items up front:

Income And Assets

W2 earners should gather recent pay stubs, W2s, and two months of bank statements. Self employed buyers should prepare two years of complete federal returns and a current year to date profit and loss. Retired buyers can provide pension letters, Social Security statements, or IRA distribution history. If you expect gift funds, ask for the exact steps for a clean paper trail before any money moves.

Condo Documents

For Fort Lauderdale condos, your company will order a questionnaire, the current budget, proof of master insurance, flood information, and details on any special assessments. Fannie Mae’s condo review path requires specific items during a Full Review, which your company should manage and explain up front. You can see how a Full Review works in the official Fannie Mae guide section. The Best Mortgage Company in Fort Lauderdale will push for these items in week one so your appraisal and underwriting stay on track.

Reserves And Inspections That Affect Approvals

Florida’s building rules in 2025 include milestone inspections and structural integrity reserve studies for taller condo buildings. The DBPR page on inspections and reserve studies outlines these needs and helps explain why associations may raise dues to fund reserves. Your company should factor the current dues and any known assessment into your approval number from the start.

How Fast Should Preapproval And Clear To Close Happen In Broward Right Now?

Preapproval Speed

When you submit a full document set, a strong Fort Lauderdale team can issue a real preapproval within a business day, ast most. If income is complex, expect follow up questions. The Best Mortgage Company in Fort Lauderdale keeps you posted with short updates so you always know what is next.

Contract To Clear To Close

Timelines depend on appraisal access, HOA screening, and title. Condo files add a few moving parts, so ask your company to start the condo review the same day you sign the contract. This is where a team with deep Broward experience stands out. They know which associations respond fast and which ones need a nudge. They also plan your lock to match the likely screening window.

If your goal is to compare real numbers and a real timeline before writing offers, you can Get a Free Quote and ask The Doce Mortgage Group for a written fee and timeline comparison that matches Fort Lauderdale contract norms.

Do You Need A Fort Lauderdale Company With Deep Condo And Coastal Insurance Know How?

Yes, if you want the Best Mortgage Company in Fort Lauderdale, you need a team that knows condos and coastal risk inside and out. Fort Lauderdale has a high share of condos, townhomes, and waterfront homes. That means extra layers during review, plus insurance rules that can change your approval and your payment.

Condo Document Depth

A strong local company orders the full condo packet in week one. Expect the budget, year to date financials, proof of master insurance, flood info, bylaws, rules on rentals, any special assessment notices, and a completed questionnaire. The Best Mortgage Company in Fort Lauderdale will scan the budget for adequate reserves and make sure the association meets current Florida milestone inspection and structural reserve study rules for 2025. If a building is working through repairs, your team should brief you on how that might limit financing, change timelines, or affect dues.

Master Policy And Your HO 6

In a condo, the association carries a master policy. You still need an HO 6 policy that covers the interior and your belongings. Ask your company to model your debt to income with realistic HO 6 quotes rather than a placeholder. The master policy type matters too. If the master policy excludes certain interior elements, your HO 6 may need higher coverage. The Best Mortgage Company in Fort Lauderdale will request the declaration page early and coordinate with a local insurance pro so you are not surprised during underwriting.

Wind And Flood In Coastal Zones

Fort Lauderdale properties often sit in wind borne debris regions and many are in mapped flood zones. Your approval can shift based on wind mitigation credits and flood premiums. A savvy team will ask for a wind mitigation inspection if the home has a new roof or impact windows, then rerun your numbers with the potential credit. For flood, they will verify the current zone, the elevation certificate if available, and the age of the structure relative to map changes. Even if the property shows as X zone, a local expert can explain optional flood coverage and how it protects your equity in a storm year.

Condo Project Fit For Each Program

Every program has its own condo rules. Conventional paths look at warrantability and budget health. FHA and VA ask for additional project checks. The Best Mortgage Company in Fort Lauderdale will confirm the right review track, warn you if a building leans non warrantable, and explain plan B options before you offer. That reduces stress during the appraisal window and helps you set the right contract contingencies.

Association Screening And Timelines

Broward associations often require buyer screening. That can add days between contract and approval. A local team will contact the association early, confirm application requirements, and set your rate lock to match the likely screening window. If the association is known for slower responses, they will coach your agent on a slightly longer closing date so you do not pay for lock extensions.

If you want a head start on the condo packet and insurance quotes, begin your file in Our Application portal so the team can pre clear the building while you shop.

What Local Programs Could Lower Your Upfront Cash In 2025?

If you are hunting for the Best Mortgage Company in Fort Lauderdale and you want to bring less to closing, ask about local and statewide help in 2025. These programs can change each year, so you want a company that tracks Broward specific rules, county income caps, and class requirements.

First Time Buyer Programs

Florida and Broward options can help with down payment and closing costs when you meet credit, income, and purchase price limits. The strongest companies map your household size and income to the current chart, confirm property type eligibility, and outline whether condos are allowed. Always ask how the assistance is repaid. Some options are deferred and due when you sell or refinance. Others forgive after a set number of years if you stay in the home. The Best Mortgage Company in Fort Lauderdale will put these terms in writing so you understand your long term total cost.

Zero Down Paths

If your profile fits, ask about zero down options that overlay standard programs with additional support. When down payment assistance is a fit, your company should always walk you through both Down Payment Assistance Programs and the The Doce Mortgage Group HomeZero Program in the same conversation. This side by side view helps you compare payment, cash to close, and any required classes or second liens. The Best Mortgage Company in Fort Lauderdale will also show how these programs interact with condo approvals, since some buildings require higher owner occupancy or stronger reserves.

How Assistance Changes Timelines

Assistance adds a couple of steps. Expect an education class, a second layer of approval, and coordination with the title company to stack the funds correctly at closing. Your company should build a calendar that includes the class date, the program approval window, and the association screening dates. That way your lock lines up with the true path, not an idealized path.

When Assistance Is Not Ideal

If you are buying in a building with tight budgets or heavy special assessments, assistance can limit your options or slow the file. A clear team will advise you when a slightly larger personal contribution gets you a better rate, a simpler file, or a faster close. The Best Mortgage Company in Fort Lauderdale will always show both scenarios so you can choose what fits your timeline and stress level.

What You Should Prepare

Have your last two years of tax returns, thirty days of pay stubs, sixty days of bank statements, and proof of any gift funds. If you are using assistance, save extra documentation like completion certificates and signed disclosures. This lets your company submit a clean package to both underwriting and the assistance provider on the same day.

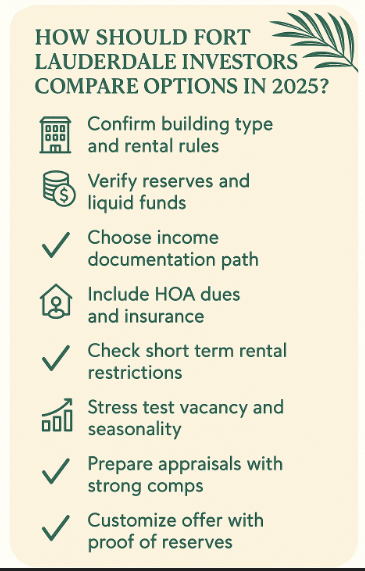

How Should Fort Lauderdale Investors Compare Options In 2025?

Investors need a company that thinks like an analyst and like a property manager. If you want the Best Mortgage Company in Fort Lauderdale for investment property, look for a team that can model cash flow with real numbers and flag building level risks before you spend on inspections.

Know Your Building Type

Standard condos, condo hotels, and short term rental friendly buildings do not perform the same in financing. Ask your company to confirm whether the building allows rentals at your intended frequency and whether the association collects transient taxes through a platform. If the building leans condo hotel, financing choices shrink and timelines can lengthen. You want clear guidance before you write an offer.

Reserves And Liquidity

Investor files usually require stronger reserves than primary homes. Your team should tell you the current reserve requirement by program and by unit count. That includes counting retirement funds that allow penalty free access if needed. The Best Mortgage Company in Fort Lauderdale will map out how many months of reserves you need and which accounts count toward that total.

DSCR Loans For Real Estate Investors

For investors focused on rental income and portfolio growth, The Doce Mortgage Group’s Florida DSCR loans offer unmatched flexibility. Instead of using personal income or tax returns, approval is based entirely on your property’s income potential. You can qualify even without a job, enjoy ratios as low as 0.75 or even 0, and start with down payments as low as 15%. These DSCR programs are tailored for serious investors who want faster closings, lighter documentation, and the freedom to expand across Fort Lauderdale, Broward, and Miami-Dade. It’s a smarter, simpler path for building long-term wealth through real estate.

Income Documentation Paths

Some investors use market rent schedules and lease agreements. Others may qualify through DSCR loans, which base approval on a property’s cash flow rather than personal income, giving investors more flexibility and fewer documentation hurdles. Your company should show both paths when possible and highlight how HOA dues, special assessments, and insurance feed into the coverage number. If the building is in a flood zone, flood premiums must be included in the calculation so you see the true ratio before you offer.

Short Term Rental Realities

If your plan includes nightly rentals, ask your team to check city rules and building bylaws for current restrictions. The Best Mortgage Company in Fort Lauderdale will also ask for actual platform statements on similar units so you can compare projected income to real performance. They should stress test vacancy and seasonality so your cash cushion stays healthy even if your first year runs below plan.

Appraisals And Comps

Investor appraisals lean on recent leases or comparable income data. In mixed use or amenity rich buildings, comps can vary by view line, floor, or renovation level. A seasoned Fort Lauderdale team will give the appraiser a package with association dues, amenity lists, and any recent upgrades, then follow up quickly if the appraiser needs clarifications. If value comes in low, they will outline options like reconsideration requests or contract adjustments and show how each path changes your cash to close.

Offer Strategy

Ask for a preapproval letter customized for investment terms, with proof of reserves ready to share with the listing agent. The Best Mortgage Company in Fort Lauderdale will call the agent after you submit, explain your file strength, and confirm appraisal access and HOA contacts so the seller trusts your timeline.

What Makes A Company Truly Local To Fort Lauderdale?

Contract Norms And Timeline Confidence

Local teams know Broward contracts cold. In 2025 many Fort Lauderdale deals negotiate inspection periods around seven to ten days, but the statewide ‘AS IS’ contract defaults to 15 days if left blank, so confirm what your offer uses. The Best Mortgage Company in Fort Lauderdale builds your lock and appraisal calendar around these norms and confirms HOA turnaround before you sign.

Condo Association Fluency

Fort Lauderdale condos must follow Florida rules for milestone inspections and structural integrity reserve studies. The state outlines these 2025 requirements on the Division of Condominiums pages for inspections and reserve studies and related FAQs. A truly local team requests budgets, reserve disclosures, and special assessment notices in week one, then explains how each item affects approval and dues.

Insurance Partners Who Work Fast

South Florida property coverage can move your debt to income number. In 2025 Citizens eligibility and rates shifted by county, with regional coverage adjustments discussed by WLRN in February 2025 and CBS Miami in mid 2025. The Best Mortgage Company in Fort Lauderdale pairs you with local insurance pros, orders quotes early, and reruns numbers once the wind and flood premiums are real.

Appraisers And Title Firms Who Know The Building

Waterfront views, dock rights, parking assignments, and amenity levels can swing value in Fort Lauderdale. Local appraisers understand view lines and recent building upgrades. A neighborhood focused company packages association documents for the appraiser and confirms access with management so the inspection happens on time.

If you want a local team to start pre clearing your target building, you can complete everything securely in Our Application portal.

How Do You Vet Reputation And Service Quality In 2025 Without Guesswork?

Read Reviews The Smart Way

Do not skim star counts. Read the newest reviews and look for Fort Lauderdale specific files such as condos, townhomes, and waterfront addresses. Search for repeated praise on speed, clarity, and condo knowledge. The Best Mortgage Company in Fort Lauderdale will also invite you to read verified feedback on their customer reviews so you can see patterns, not one offs.

Check Complaint Trends

Look up the company in the public complaint database and read issue categories, not just totals. Filter to 2024 and 2025 so the data reflects the current staff and process. The Consumer Financial Protection Bureau maintains a searchable complaint database where you can review responses and timelines.

Test Real Response Times

Send an email at 9 a.m. on a weekday and call once in the afternoon. Note how quickly you get a useful reply. Ask for a named team and a direct line. The Best Mortgage Company in Fort Lauderdale should introduce your loan processor and your primary contact in writing on day one.

Ask For A Written Process Map

Request a simple one page calendar for 2025 that lists preapproval, appraisal order, condo packet arrival, underwriting target, title commitment, and clear to close. A strong Fort Lauderdale team shares this at the start and updates it after each milestone so you never guess.

What Questions Should You Ask On Your First Call?

Pricing And Lock Structure

- Can you send two quotes with the same term and lock length so I can compare rate and APR?

- What are today’s point and credit options and the breakeven at three, five, and seven years?

- If rates improve during my lock, what float down rules apply and how is the price change calculated using live market data such as the Freddie Mac survey?

Condo And Insurance Readiness

- Will you order the condo questionnaire, budget, insurance certificates, and any special assessment documents in the first week?

- How do you model HO-6, wind, and flood using real quotes from local carriers discussed in recent regional coverage updates?

Timeline And Communication

- What is your current turn time for a full preapproval once I upload documents?

- How quickly are appraisals being scheduled in Fort Lauderdale this month?

- Who are my named contacts and how often will I get updates in writing?

Cash To Close And Reserves

- Can you provide a fee worksheet that includes documentary stamp taxes and intangible tax specific to Florida so I can see total cash?

- How many months of reserves do you recommend for my file and how do HOA dues and insurance factor into that number?

Keep the answers in a simple spreadsheet. The Best Mortgage Company in Fort Lauderdale will stand out with clear math, real timelines, and direct contacts.

How Do Fort Lauderdale Closing Costs And Taxes Work In 2025?

State Transfer Taxes You Will See

Florida charges documentary stamp tax on property transfers and on notes, plus a nonrecurring intangible tax on the amount financed. In 2025 the deed documentary stamp rate in Broward is 70 cents per 100 dollars of price, the note stamp is 35 cents per 100 dollars of the amount financed, and the intangible tax is 0.2 percent. The Florida Department of Revenue explains these statewide rates on its pages for documentary stamp tax on deeds, documentary stamp tax on notes, and intangible tax. Your estimate should list each of these clearly.

Title, Recording, And Typical Third Party Items

Expect title insurance premiums, settlement services, recording, and an appraisal. Condo files often include an association questionnaire fee. Ask your company to confirm all association charges so you are not surprised at closing.

Prepaids You Control

You will fund prepaid interest through the end of the month, plus initial escrow for property taxes and insurance. Broward County collects property taxes once a year with discounts for early payment, which you can review on the Broward County Records, Taxes, and Treasury Division. Your escrow analysis should reflect the current tax rate for the neighborhood and the specific homeowners or condo policy you choose.

Homestead Exemption And Portability

If the home is your primary residence, apply for the homestead exemption after you close. The county explains filing and the Save Our Homes cap, along with portability rules for moving capped value to a new home, on the Broward County Property Appraiser site. The Best Mortgage Company in Fort Lauderdale will remind you of filing dates so your 2026 bill reflects the exemption if you close in 2025.

For a quick payment and cash to close estimate with real taxes and insurance, plug your draft numbers into the Mortgage Calculator.

What Should You Expect During Underwriting And Appraisal In Broward?

Scheduling And Access

Peak season brings busy calendars. A well prepared Fort Lauderdale team orders the appraisal as soon as your disclosures are signed and confirms building access with management so the appraiser can inspect common areas and amenities that affect value.

Condo Review Depth

Conventional files can follow a Full Review or a Limited Review based on down payment and other factors. Fannie Mae explains the Full Review path in the selling guide. The Best Mortgage Company in Fort Lauderdale will choose the correct path, gather documents, and resolve open items like budget deficits or pending repairs.

If Value Comes In Low

Your team should send a strong reconsideration package that cites recent closed sales, unit lines, and upgrades. They will also show you options such as price talks or cash to close adjustments, then rework your approval with updated numbers so you can decide quickly.

Final Conditions And Clear To Close

Underwriting conditions commonly include updated pay stubs, bank statements, and any missing association items. A seasoned team sends a single clean package back to the underwriter and confirms title, insurance binders, and closing disclosures are aligned so you receive a clear to close on schedule. The Best Mortgage Company in Fort Lauderdale keeps you updated with short, plain language emails at each step.

How Can You Compare Two Strong Finalists Without Stress?

Side By Side Checklist

Create a one page comparison with these rows:

- Rate and APR for the same lock length

- Total cash to close including Florida documentary stamps and intangible tax

- Timeline confidence with firm dates for appraisal, condo packet, and HOA screening

- Condo expertise shown by document list and project review plan

- Communication level with named contacts and update frequency

Tie Breakers That Matter In Fort Lauderdale

If the top choices look equal on price, pick the team that already pulled the condo packet, confirmed insurance quotes, and offered a written lock and float down plan matched to Broward screening. The Best Mortgage Company in Fort Lauderdale wins by removing risk early.

Decision Routine You Can Trust

Schedule a ten minute call, ask your ten questions, update the checklist, then choose by 5 p.m. the same day. Fast, simple, and grounded in facts you can verify with public data like the FHFA 2025 limit update and the Freddie Mac weekly survey.

What Fort Lauderdale Living Facts Should Shape Your Mortgage Choice In 2025?

Neighborhood Snapshots

For example, Victoria Park offers tree lined streets and many townhomes that fall near the conforming limit, which pairs well with the higher 2025 cap noted by the FHFA. Coral Ridge features waterfront lots where insurance and seawall condition need early review. Flagler Village mixes new mid rises and loft style condos that may require careful project review if reserves are still maturing.

Commute, Schools, And Flood Zones

Review flood maps for each address and request any elevation certificate to sharpen your insurance estimate. Ask your company to run payment ranges that include optional flood on X zones to protect your equity in a heavy storm year. The Best Mortgage Company in Fort Lauderdale will also explain how school zone changes and commute plans can influence your long term budget.

Association Culture And Dues

Newer buildings may have strong amenities and higher dues. Older buildings may have pending repairs that lead to special assessments. Your team should model payment using current dues and any known assessment so you see the true number before you offer.

FAQs

How Do I Know A Company Is Truly The Best Mortgage Company In Fort Lauderdale For My Condo Purchase?

Look for condo fluency, not only price quotes. Ask for a written checklist of required association documents, confirmation that the building meets current milestone inspection and reserve study rules, and a realistic timeline that includes HOA screening. The Best Mortgage Company in Fort Lauderdale will show you this in writing before you order an appraisal.

What Credit Score Helps With Strong Pricing In 2025?

In 2025, many conventional paths price best when your middle score is in the mid to high 700s, though approvals can work well below that when the overall file is strong. The Best Mortgage Company in Fort Lauderdale will run side by side quotes at different score tiers and show how a small improvement changes rate and cost.

Can I Use Assistance With A Condo In Broward, And How Does HomeZero Fit?

Often yes, if the building qualifies and you meet income and class rules. Ask your company to verify condo eligibility, then compare Broward friendly Down Payment Assistance Programs with the The Doce Mortgage Group HomeZero Program. The Best Mortgage Company in Fort Lauderdale will show cash to close, payment, and any second lien details so you can decide quickly.

How Long Does Closing Take In Fort Lauderdale Right Now?

With a clean file in 2025, many single family deals can finish in about thirty days. Condo files can take longer when associations need extra time for questionnaires or screening. The Best Mortgage Company in Fort Lauderdale will set the lock to match the true calendar after calling the association manager on day one.

Do I Need Reserves For A Condo In Broward?

Expect at least a small cushion, and more for investment properties. HOA dues, insurance, and any special assessments count in the math. The Best Mortgage Company in Fort Lauderdale will tell you exactly how many months are required for your program and property type.

What If My Appraisal Comes In Lower Than The Contract Price?

You have options. Your team can request a reconsideration with stronger comps, negotiate a price change, or adjust cash to close. The Best Mortgage Company in Fort Lauderdale will model each path so you can choose without guesswork.

How Big Of A Cash Cushion Should I Keep After Closing?

Aim to keep at least 3 months of costs in reserve. Include HOA dues, insurance, and an annual property tax set aside. The Best Mortgage Company in Fort Lauderdale will help you build a simple post closing budget so your plan feels safe.

Should I Buy Points In 2025 Or Save Cash For Repairs?

It depends on how long you expect to keep the home or the loan. Ask for a breakeven at three, five, and seven years that compares a points option to a no points option. The Best Mortgage Company in Fort Lauderdale will run that table and include repair estimates so you can see the full picture.

Why Do People Say The Doce Mortgage Group Is The Best Mortgage Company In Fort Lauderdale?

Local Condo Mastery

We work Fort Lauderdale condos every day, from waterfront high rises to boutique buildings near Flagler Village. Our file starts with the condo packet, not after. That means budget review, reserve status, insurance checks, flood zone review, and a quick call with the association manager. This is how the Best Mortgage Company in Fort Lauderdale avoids late surprises.

Transparent Numbers You Can Trust

We send a clean written estimate that lists rate, APR, points, credits, Florida documentary stamps, intangible tax, and every third party fee we expect in Broward. You see cash to close and payment, plus a breakeven table if you want to compare points to a no points path. That clarity is one reason clients call us the Best Mortgage Company in Fort Lauderdale.

Speed, Updates, And Named Contacts

You get a direct email and phone number for your primary contact on day one. We provide a short calendar that shows preapproval target, appraisal order, condo packet due date, underwriting target, and clear to close goal. During 2025’s busy seasons, this keeps everyone aligned and helps your offer stand out. Sellers and agents trust timelines backed by a real plan from the Best Mortgage Company in Fort Lauderdale.

Help With Lower Upfront Cash

If assistance fits your profile, we compare Down Payment Assistance Programs with our HomeZero Program so you can choose the path that balances payment, speed, and long term cost. We also explain how each option works with condos, since association rules matter in Broward.

Real Feedback You Can Read

You do not have to take our word for it. Browse our recent client stories at our customer reviews. You will see detailed notes about communication, speed, and condo wins that reflect how we operate in 2025 as the Best Mortgage Company in Fort Lauderdale.

Your Next Step

I’d love to learn about your goals and map a clear plan for your Fort Lauderdale home. If you want a fast preapproval, a condo ready file, and numbers that make sense, I’m here to help. Call us today at 305-900-2012 to compare options and lock in a plan with The Doce Mortgage Group.