Quick Answer

Is a Jumbo Loan the Only Way to Buy Luxury Real Estate in Aventura?

In most cases, yes! With home prices in Aventura often above the 2025 conforming loan limit of $822,550, a jumbo loan is usually required to finance luxury properties priced near or above $850,000. Unless you’re paying mostly in cash, a jumbo loan is the go-to option for high-end home purchases in this market.

Table of Contents

- What Is a Jumbo Loan and How Does It Work in Aventura?

- Who Can Qualify for a Jumbo Loan in Aventura in 2025?

- How Much Can You Borrow with a Jumbo Loan in Aventura?

- What Are Jumbo Loan Interest Rates Like in Aventura Right Now?

- Can You Use a Jumbo Loan for Condos or Investment Properties in Aventura?

- What’s the Jumbo Loan Process Like with The Doce Mortgage Group?

- Why Are Home Prices So High in Aventura?

- Top Reasons People Are Moving to Aventura in 2025

- FAQ: Jumbo Loan in Aventura

- My Final Thoughts

If you’re looking to buy a high-end property in Aventura, Florida, you’re probably going to need a jumbo loan. This city is known for its luxury condos, gated communities, and waterfront homes, and the price tags reflect that. In 2025, any home that requires financing above $822,550 falls outside the limit for a traditional conforming mortgage.

That means if your purchase price is more than this amount and you’re planning to put 10 percent down, you’ll be using a jumbo loan in Aventura. These loans are common in areas where real estate values are high, and Aventura definitely fits that profile.

A jumbo loan gives you the flexibility to borrow more than the standard limit without splitting your mortgage into multiple loans. It’s designed for people financing upscale homes, and it comes with unique guidelines that differ from conventional options. A mortgage loan in Aventura can cover one property up to $5,000,000 with just 20 percent down — and with the right structure, it can be much more affordable than many buyers expect.

What Is a Jumbo Loan and How Does It Work in Aventura?

A jumbo loan is a mortgage that exceeds the conforming loan limit set each year by federal housing agencies. In most Florida counties, including Miami-Dade, the 2025 limit is $822,550. Any home loan above that amount is considered a jumbo loan.

These loans are especially useful in places like Aventura, where a large share of homes cost well over that line. Whether it’s a sleek condo in a high-rise or a custom waterfront home, many Aventura properties require financing that only a jumbo loan can provide.

Unlike traditional loans, jumbo loans aren’t backed by Fannie Mae or Freddie Mac. Because of that, they follow different underwriting standards. But this isn’t a bad thing. In fact, jumbo loans often come with more flexible features, especially when you’re working with a mortgage group that specializes in high-end financing.

Here’s what you can expect with a jumbo loan in Aventura from The Doce Mortgage Group:

- Borrow up to $5,000,000 in one single loan

- 10 percent down required on loan amounts up to $2,500,000

- 20 percent down required up to $5,000,000

- No private mortgage insurance (PMI), even with less than 20 percent down

- Competitive interest rates that can rival or beat standard loan rates

- Our jumbo loans allow for credit scores as low as 550!

- A DTI of 43% or lower is preferred. If you can show a lower ratio, you might qualify for better terms.

- Our jumbo loans allow for DTI’s as high as 50%

If you’re purchasing a $1.5 million home, for example, you could put just $150,000 down and finance the rest — all without paying PMI. For buyers who want to hold on to more cash for reserves or renovations, that kind of flexibility is a big deal.

Who Can Qualify for a Jumbo Loan in Aventura in 2025?

You don’t need perfect credit or millions in the bank to get approved. In fact, qualifying for a jumbo loan in Aventura might be easier than you think. These loans are designed for buyers who can show solid financials and who want to finance a home that’s above the standard limit.

Here’s what you’ll generally need:

- A FICO score of 660 or higher

- A stable income that supports your mortgage payment

- A debt-to-income ratio of no more than 55 percent

- Some reserves or savings in the bank

- Documentation that verifies income and assets

These requirements make jumbo loans ideal for professionals, business owners, retirees with investment income, and even self-employed buyers. If your income and credit are strong, there’s a very real path to financing your Aventura home with a single jumbo mortgage.

When you’re ready to take the next step, Get a Free Quote to find out exactly what your options are.

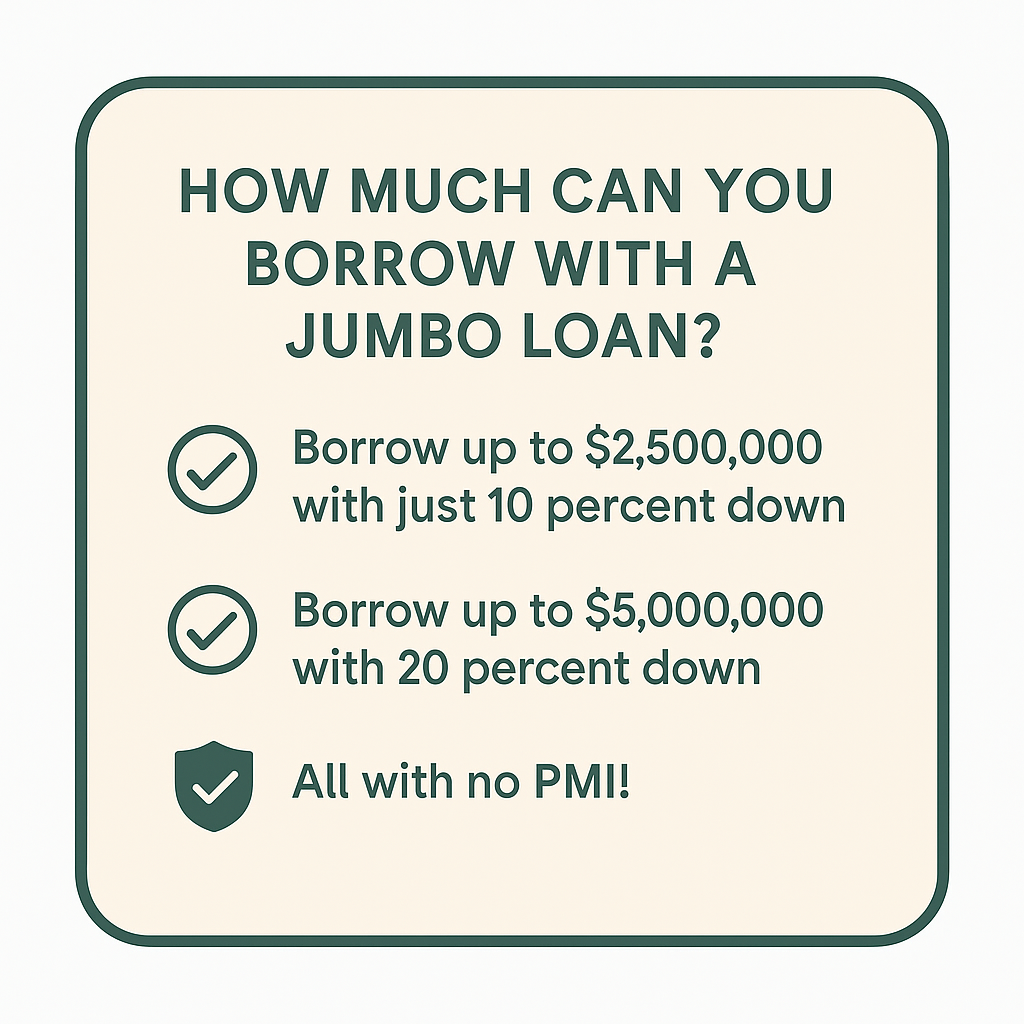

How Much Can You Borrow with a Jumbo Loan in Aventura?

One of the biggest benefits of going jumbo is the borrowing power. You can qualify for a single loan up to $5,000,000 — without needing to stack multiple mortgages together.

Here’s how it breaks down:

- Borrow up to $2,500,000 with just 10 percent down

- Borrow up to $5,000,000 with 20 percent down

- All with no PMI

This structure lets you scale your purchase to fit your needs. Whether you’re buying a condo in the $1 million range or a luxury waterfront estate closer to $4 million, a jumbo loan in Aventura gives you the space to do it with one clean loan.

And since The Doce Mortgage Group doesn’t require private mortgage insurance, you can avoid those extra monthly costs — even if you’re putting down less than 20 percent. That’s a major savings opportunity, especially when you’re financing a high-value home.

If you’re ready to take the next step toward owning in Aventura, you can jump into Our Application portal and get pre-approved in minutes.

What Are Jumbo Loan Interest Rates Like in Aventura Right Now?

Many people assume jumbo loans come with higher rates, but in 2025, that’s often not true. In fact, jumbo loan rates in Aventura can be just as low, or even lower, than those on conforming mortgages. It all comes down to how the loan is structured and who you’re working with.

At The Doce Mortgage Group, rates on jumbo financing are extremely competitive. Because of how the loans are packaged and underwritten, qualified buyers may get better pricing than expected. That’s especially true for borrowers with strong credit scores, low DTI, and sizable reserves.

Here are a few things that can influence your jumbo loan rate in Aventura:

- Your credit score

- The amount of your down payment

- The type of property you’re financing

- Whether the home will be your primary residence

- Your overall financial profile

Rates can also vary slightly depending on whether you’re choosing a fixed or adjustable loan. The right choice depends on your future plans, how long you expect to hold the property, and what your monthly budget looks like. Either way, it’s smart to compare your financing options up front with a team that understands the Aventura market.

Can You Use a Jumbo Loan for Condos or Investment Properties in Aventura?

Yes. You can absolutely use a jumbo loan in Aventura to purchase a condo, a second home, or even an investment property. This city is filled with high-end condo towers, many of which are priced above the conforming loan limit. A jumbo loan is often the only way to finance units in those buildings.

Whether you’re buying a penthouse at the top of a marina-front building or a modern two-bedroom with views of the Intracoastal, jumbo financing gives you the buying power to secure the property you want. That’s also true for buyers purchasing vacation homes or part-time residences in Aventura.

There are a few extra requirements for condos and investment properties, such as stronger reserves or slightly higher down payments, but nothing outside the reach of a well-qualified buyer. If you’re thinking about using this type of loan for a second property, the same core benefits still apply — high loan limits, no PMI, and solid rates.

To get a clear sense of your monthly payments for different property types, try running the numbers through our Mortgage Calculator.

What’s the Jumbo Loan Process Like with The Doce Mortgage Group?

The jumbo loan process might sound complex, but with the right team, it’s straightforward. You’ll follow a step-by-step flow that gets you from pre-approval to closing without confusion or wasted time.

Here’s how it usually works:

- Initial consultation

You’ll talk about your goals, your budget, and the property you’re looking to buy. This helps your mortgage team understand what kind of jumbo loan in Aventura makes sense for your situation.

- Pre-approval

This step involves reviewing your credit, income, and basic financials. You’ll get a solid picture of how much you can borrow and what your estimated rate will be.

- Full application

You’ll submit income documents, asset statements, and any other required paperwork. This part moves quickly if your finances are organized.

- Underwriting

Your file is reviewed in detail to verify income, assets, property value, and other key factors. The Doce Mortgage Group works closely with clients to keep this part stress-free.

- Clear to close

Once everything checks out, you’ll get final approval and a closing date. Then it’s time to sign, get your keys, and move in.

Working with a local mortgage partner who understands Aventura’s fast-moving market can make a big difference. It means faster answers, local insight, and a better experience from start to finish.

Why Are Home Prices So High in Aventura?

The demand for luxury homes in Aventura keeps prices climbing. This city is one of South Florida’s premier destinations for upscale living. It offers everything from luxury waterfront condos to private, gated neighborhoods with large estates.

Several factors push prices higher here:

- Limited land for new development

- Constant demand from both domestic and international buyers

- Proximity to the beach, shopping, and top-tier schools

- High-end construction and luxury amenities

As of 2025, the average sale price for a luxury home in Aventura is just above $1.1 million. For new construction, that number jumps to $1.5 million or more, especially for waterfront or marina-facing properties. That means jumbo loans are the most realistic financing tool for anyone trying to buy in the area.

If you’re exploring your options and want to get a feel for rates or potential approval amounts, you can Get a Free Quote in just a few clicks.

Top Reasons People Are Moving to Aventura in 2025

There’s a reason people from all over the country — and the world — are buying homes in Aventura. It’s more than palm trees and ocean views. The city offers a lifestyle that blends convenience, luxury, and accessibility.

Here’s why Aventura keeps attracting buyers:

- Beach proximity

You’re minutes from the Atlantic Ocean, but without the chaos of Miami Beach.

- Aventura Mall

One of the largest and most upscale shopping destinations in Florida.

- Walkable neighborhoods

From the Country Club Drive Circle to marina areas, the city is built to enjoy on foot.

- Strong schools and services

Aventura has great options for families and retirees alike.

- International appeal

Buyers from Europe, Latin America, and Canada regularly invest in Aventura real estate.

It’s a city that feels high-end without being overwhelming. And when paired with smart financing, like a jumbo loan in Aventura, it becomes a real opportunity to live where others vacation.

FAQ: Jumbo Loan in Aventura

What credit score do I need to qualify for a jumbo loan in Aventura?

The minimum credit score is 660. However, the higher your score, the better your rate and terms may be.

Can I really get a jumbo loan with just 10 percent down?

Yes. You can finance up to $2,500,000 with as little as 10 percent down and still avoid PMI. For loan amounts up to $5,000,000, 20 percent down is required.

Is private mortgage insurance required?

No. Jumbo loans through The Doce Mortgage Group do not require PMI, even if your down payment is under 20 percent.

Can I use a jumbo loan to buy a second home or condo in Aventura?

Yes. These loans can be used for primary homes, vacation properties, condos, and even investment real estate in many cases.

How long does it take to close a jumbo loan in Aventura?

It usually takes 20 to 30 days, depending on how quickly documents are submitted and the property is appraised.

Can foreign buyers qualify?

Yes. Jumbo financing options are available for international buyers, though additional documentation may be required.

If you’re ready to move forward, you can start your pre-approval now through Our Application portal.

My Final Thoughts

Buying a home in Aventura is a big move, especially if you’re stepping into the luxury market. I’ve helped a lot of buyers navigate the process with jumbo financing, and I can tell you — it doesn’t have to be complicated. With the right guidance, a jumbo loan in Aventura can actually be one of the smoothest parts of your purchase.

Whether you’re looking at a sleek condo with views of the water or a modern home tucked into a private community, this kind of financing gives you the flexibility and power to get what you want without giving up all your savings.

You can also check out what our past clients have said about us. we take pride in helping real people make smart moves.

Call us today at 305-900-2012 to talk about your goals and see exactly what you qualify for.