Table of Contents

- Why Work With A Mortgage Broker In Boca Raton In 2025?

- How Should You Prepare Before The First Strategy Call?

- Which Documents Will Your Broker Request And Why Do They Matter?

- How Do You Compare Quotes The Right Way In Boca Raton?

- Which Programs Fit Boca Raton Properties Right Now?

- How Do You Win Offers With Your Broker’s Help?

- What Is The Timeline From Application To Closing In Boca Raton?

- Can You Use Down Payment Help In Boca Raton Without Slowing The File?

- How Does Insurance In Florida Affect Your Approval And Payment?

- What Should You Know About Taxes, HOAs, And Real Monthly Cost?

- How Can A Mortgage Broker In Boca Raton Help You Refinance In 2025?

- Which Boca Raton Neighborhoods Should Be On Your Radar While You Shop?

- Why Do People Choose Boca Raton For Long Term Value And Lifestyle?

- FAQs

- How The Doce Mortgage Group Guides You From Start To Finish

Top 3 Take-a-Ways

- Use a mortgage broker in Boca Raton to model taxes, insurance, and HOA accurately.

- Front load condo review to prevent delays and protect approval.

- Align lock timing and credits with contract dates for stronger offers.

Buying a home in Boca Raton can sometimes feel complicated and overwhelming. The right mortgage broker in Boca Raton turns scattered tasks into a clean plan that fits the way this city actually works. This guide shows you how to align goals, budget, and contract timelines with local norms, then keep documents and conditions moving so you reach a quick clear to close.

You’ll tap neighborhood level knowledge on condos, HOA oversight, insurance, and taxes. You’ll also see how to compare quotes correctly, lock at the right time, and negotiate credits with confidence. By the end, you’ll know exactly how to work with a mortgage broker in Boca Raton from first call to funding.

Why Work With A Mortgage Broker In Boca Raton In 2025?

↑ Back to Contents

A mortgage broker in Boca Raton delivers leverage where it counts. Condo governance is tighter in 2025, so your broker requests questionnaires, budgets, and insurance certificates early. That keeps the file aligned with building rules and avoids last minute detours.

Payment accuracy matters just as much. Your broker models real taxes, HOA dues, and insurance, including wind credits and flood. You get a target payment that still passes underwriting and a price range that reflects Boca realities.

Offer strategy is the third edge. Your mortgage broker in Boca Raton syncs with your agent before you write. The pre approval highlights association and insurance diligence, which makes your terms read as stable and fast. In competition near Mizner Park or along the beach, that impression can win.

Want to pressure test monthly numbers before you tour:

Mortgage Calculator

How Should You Prepare Before The First Strategy Call?

↑ Back to Contents

Start with a payment ceiling, not a price guess. Share the monthly number you want for year one. Your mortgage broker in Boca Raton will translate that into price using current taxes, HOA dues, and insurance for your target neighborhoods.

Bring clarity on use. Primary, second home, and investment each trigger different rules and reserve targets. If you expect rental income on a condo, your broker will check whether the association and underwriting actually allow it to count.

Standardize document flow in one folder:

- Two years of W2s or 1099s

- Thirty days of pay stubs if you’re salaried

- Two months of bank or brokerage statements for all funds tied to closing or reserves

- If self employed, two years of personal and business returns plus a simple year to date summary

- If retired, current award letters for Social Security or pension

- If you own rentals, leases and a property list

Share your risk tolerance. Tell your mortgage broker in Boca Raton how you feel about appraisal gaps, inspection credits, and timelines. Structure flows from those preferences.

Which Documents Will Your Broker Request And Why Do They Matter?

↑ Back to Contents

Underwriters want stable income, sourced assets, and a sound property profile. Your mortgage broker in Boca Raton packages the file so an underwriter can say yes without extra rounds of questions.

Income verification:

- W2 buyers share two years of W2s and recent pay stubs

- Self employed buyers share two years of personal and business returns plus a year to date summary

- Retirees share award letters and any distribution history

- Investors share leases and a simple schedule of real estate

Assets confirm cash to close and reserves. Expect two months of statements for any account used. If a family gift is part of the plan, your mortgage broker in Boca Raton will prepare a clean gift letter and show the transfer path. Boca price points often require several months of reserves. Your broker will set that goal early.

Property and association items are the local twist:

- Present year association budget and proof of reserves

- Master insurance certificate

- A completed condo questionnaire

- Details on any 2025 special assessments

- Estoppel timing if applicable

Ready to start your file and get a strong pre approval

Our Application portal

How Do You Compare Quotes The Right Way In Boca Raton?

↑ Back to Contents

Put every quote on one apples to apples sheet. Ask your mortgage broker in Boca Raton to show rate, points, any credit, projected taxes, insurance, HOA dues, and prepaids side by side. You’ll see real monthly cost and true cash to close without guesswork.

Have your broker model buydowns. A temporary buydown reduces payment in the early years. A permanent buydown reshapes the payment for the full term. Your mortgage broker in Boca Raton will calculate the breakeven and compare that to your expected hold period.

Lock timing should match your contract clocks and any association milestones. If a float down is available, your broker will explain the rules and cost in plain language. The goal is to avoid extensions that add expense.

Want a clean comparison built for your scenario

Get a Free Quote

Which Programs Fit Boca Raton Properties Right Now?

↑ Back to Contents

A mortgage broker in Boca Raton should match property type, occupancy, and building health to structures that will actually close. Shortlist two or three paths, then compare payment, cash to close, and documentation.

Conventional For Primary, Second Home, And Investment

Many single family homes and townhomes fit here. Plenty of condos do too if the building passes review. A mortgage broker in Boca Raton will:

- Confirm condo eligibility before you write

- Target pricing tiers with clean debt to income and adequate reserves

- Verify rental rules for second home or investment use

Condo Review Strategy

Building governance drives approval. Your broker will:

- Order the correct condo questionnaire

- Pull the budget, proof of reserves, and master insurance certificate

- Ask about special assessments and owner occupancy ratios

- Pivot to a non standard path if the building falls short, then explain rate, down payment, and reserve impacts

FHA And VA Where They Fit

These can open doors when credit or debt to income needs help:

- FHA works on eligible condos and on single family homes

- VA shines for qualified buyers and requires verification of building status for condos

- A mortgage broker in Boca Raton will check eligibility on day one to avoid chasing the wrong unit

Jumbo Is Common In Boca

East of Federal and in many gated communities, price points climb.

- Expect stronger reserves and tighter income documentation

- Condo jumbo requires rock solid association and insurance data

- Your mortgage broker in Boca Raton will not green light a contract until the building package looks sound

Fixed Or Adjustable

Pick based on hold period and budget stability.

- Fixed rate favors long holds and buildings with higher dues or rising insurance

- High quality adjustable can fit second homes or shorter holds if the initial period covers your plan

- Your broker will stress test payment at the first adjustment cap so you see the real risk

Credits And Buydowns

Contracts in Boca often include credits.

- Apply credits to closing costs or a permanent buydown

- Consider a temporary buydown if year one and year two cash flow matters

- A mortgage broker in Boca Raton will calculate breakeven and align it with your expected hold

Self Employed And Layered Income

Complex profiles are normal here.

- Reconcile business returns with year to date performance

- Document continuity for distributions, pensions, or RSUs

- Present a clean rental schedule so net impact on debt to income is obvious

Insurance And Tax Reality Check

Never pick a structure in isolation.

- Sync wind and flood quotes with roof age, shutters, impact glazing, and elevation

- Run Palm Beach County taxes at new buyer figures, not last year’s homesteaded number

- Your mortgage broker in Boca Raton will fold these inputs into payment and qualification

Bottom Line

Ask your mortgage broker in Boca Raton for a ranked list that ties program choice to building condition, payment, cash to close, and documentation effort. When the market shifts, a pre built pivot keeps your timeline intact and your negotiating power strong.

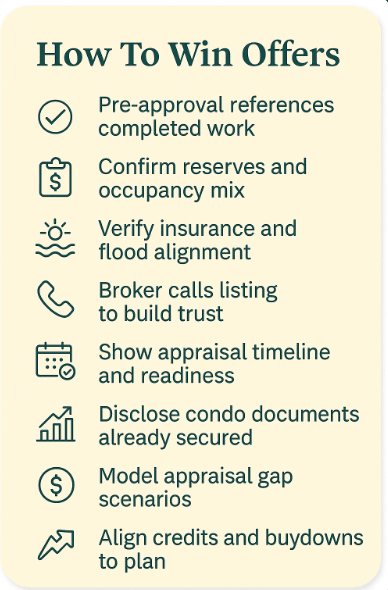

How Do You Win Offers With Your Broker’s Help?

↑ Back to Contents

You want your offer to look certain and fast. That is where your mortgage broker in Boca Raton becomes part of the presentation. Ask for a pre approval that references the work already done. That can include confirmation of association reserves, owner occupancy mix, and insurance alignment. Listing agents see fewer unknowns and give your contract a closer look.

Have your broker speak with the listing side after submission. A short call that outlines file strength, document status, and appraisal timing builds trust. If you plan a condo purchase, your mortgage broker in Boca Raton can note which association items are already in hand. That signals a clean path to closing.

Use your broker to engineer terms that fit the property. If comps suggest a tight appraisal, ask for a written scenario that shows what happens if value lands slightly low. The broker can explain options like adjusting credits or shifting the buydown structure. You walk in with a plan, which makes your offer feel durable.

What Is The Timeline From Application To Closing In Boca Raton?

↑ Back to Contents

Timelines vary by building and season, yet the flow stays similar. Your mortgage broker in Boca Raton should run point on each milestone and send status updates that clarify what is done and what is next.

Typical rhythm you can expect:

- Day one to three, disclosures out, income and asset docs reviewed, appraisal ordered when appropriate

- Week one, association package requested, condo questionnaire and insurance certificates in motion. Underwriting decision, conditions assigned, insurance quotes finalized

- Week two, appraisal in, association answers returned, key conditions cleared

- Week three, final approval, closing figures balanced, clear to close issued

Ask your broker for a written calendar the day you apply. If a step slips, your mortgage broker in Boca Raton should propose a recovery action the same day.

Can You Use Down Payment Help In Boca Raton Without Slowing The File?

↑ Back to Contents

You can, if you coordinate early. Tell your mortgage broker in Boca Raton you want assistance before you shop. The broker will check eligibility and match timelines to contract clocks, especially for condos where association approvals add tasks.

Use these with your broker’s guidance:

- Confirm whether your target property and your income fit the chosen program

- Align assistance underwriting with your primary approval so both decisions land together

- Build in calendar room for any education or document steps

Explore options here with your broker’s help so timing stays tight. Down Payment Assistance Programs also pair well with The Doce Mortgage Group’s zero down path when you qualify and the property allows it. Review details with your broker here. The Doce Mortgage Group HomeZero Program

How Does Insurance In Florida Affect Your Approval And Payment?

↑ Back to Contents

Insurance can move your debt to income more than you expect. Ask your mortgage broker in Boca Raton to model premiums the same day you request quotes. For single family homes, the broker will check roof age, opening protection, and wind credits, then map the likely premium into your worksheet. For condos, the broker will confirm what the master policy covers and what your unit policy must carry, then price both.

Flood is a separate review. If you are east of Federal or near waterways, ask the broker to verify the flood zone and request an elevation certificate when available. Your mortgage broker in Boca Raton will build alternatives with different deductibles and coverage limits so you understand the tradeoffs before you lock.

What Should You Know About Taxes, HOAs, And Real Monthly Cost?

↑ Back to Contents

Never rely on the seller’s current tax bill. Ask your mortgage broker in Boca Raton to calculate year one taxes at the contract price and to explain how homestead and portability may help later. For communities with a master association or club requirement, have the broker add those dues to the monthly model so your debt to income stays accurate.

Sit with your broker and build the complete monthly:

- Principal and interest from your chosen quote

- New buyer property taxes based on the offer price

- Home insurance and flood if applicable

- HOA dues and any master or club fees

- A cushion for projects when a building has active or pending assessments

How Can A Mortgage Broker In Boca Raton Help You Refinance In 2025?

↑ Back to Contents

A great broker keeps watch after you close. Ask for periodic equity checks and payment goals in writing. Your mortgage broker in Boca Raton can test whether a refi lowers payment, shortens term, or funds improvements with acceptable risk. If you expect a future rate window, the broker can pre build a file with fresh comps, updated income, and current insurance quotes. When the window opens, you are ready.

Which Boca Raton Neighborhoods Should Be On Your Radar While You Shop?

↑ Back to Contents

Use your broker as a pattern spotter. The goal is not to pick the neighborhood for you, it is to align approval strategy with the way prices and association rules work in each area.

- East Boca, close to Mizner Park and the beach, has a high mix of condos with detailed association reviews

- Central Boca features gated communities and strong school zones, with single family and townhome options that can move fast

- West Boca offers newer builds and parks, often with larger footprints and planned amenities

- Country club and 55 plus communities include dues structures and approval steps that your mortgage broker in Boca Raton will fold into payment models

Why Do People Choose Boca Raton For Long Term Value And Lifestyle?

↑ Back to Contents

Quality of life supports demand, which supports resale strength. Beaches, parks, golf, and cultural venues keep calendars full. Shopping and dining clusters make daily life easy. Universities and healthcare add stability. Your mortgage broker in Boca Raton cares about these factors because they shape appraisal comps, time on market, and the confidence you feel about long term ownership.

FAQs

↑ Back to Contents

How do I choose the right mortgage broker in Boca Raton for my goals?

Pick one who works Boca condos and single family every week. Ask for recent closings that match your price band and property type. Request a sample pre approval and a side by side quote worksheet. Confirm they coordinate HOA documents and insurance quotes. Make sure you’ll get updates on a set schedule by text and email.

What should I bring to the first meeting to avoid delays?

Bring two years of W2s or 1099s, thirty days of pay stubs if salaried, two months of bank or brokerage statements, photo ID, and any award letters if retired. If self employed, add two years of personal and business returns plus a simple year to date profit and loss. If you own rentals, bring leases. Share your target payment range and preferred neighborhoods.

How often will I get updates and what is the typical status cadence?

Expect a kickoff call on day one, then milestone notes. Disclosures sent and docs reviewed. Appraisal ordered. Association package requested. Initial approval with conditions. Appraisal received. Final approval and clear to close. Ask for a weekly touch base even if nothing changes so you always know where you stand.

Can a mortgage broker in Boca Raton manage condo reviews and HOA documents from end to end?

Yes. Your broker should request the condo questionnaire, current budget, proof of reserves, the master insurance certificate, and details on any special assessments. They should track estoppel timing when needed and confirm owner occupancy ratios. You approve outreach and they handle the paper chase.

When should I lock and how will my broker time that with my contract dates?

Lock after the inspection period and once association documents are in motion. Match the lock length to the latest contract clock such as condo review and appraisal delivery. If a float down is available and fits your plan, your broker will price it and explain rules in plain language so you can decide quickly.

How The Doce Mortgage Group Guides You From Start To Finish

↑ Back to Contents

I focus on clarity, speed, and local accuracy. When you work with The Doce Mortgage Group, you get a mortgage broker in Boca Raton who builds your approval around building rules, insurance realities, and real taxes so your offer reads strong and your closing lands on time. We keep a steady status cadence, collect association items early, and present quotes in a single apples to apples view. You can also read what our clients say about our service to see how we work in real transactions.

Call us today at 305-900-2012 to set your strategy, compare paths, and move forward with confidence.