Quick Answer

Yes, if rising 2025 insurance and escrow costs raised your payment, an FHA refinance can cut the rate or stabilize your budget. Check MIP, loan limits, and closing costs to confirm the savings.

Table of Contents

- How Has Insurance Repricing Affected Homeowners in Deerfield Beach in 2025?

- Can Refinancing with an FHA Loan in Deerfield Beach Help Lower Your Monthly Costs?

- What Are the Requirements for an FHA Refinance in Deerfield Beach?

- Should You Choose a Streamline FHA Refinance or a Cash-Out Option?

- What About Closing Costs for an FHA Loan in Deerfield Beach?

- Can You Use Down Payment Assistance for FHA Refinancing in Florida?

- How Does an FHA Loan in Deerfield Beach Compare to Other Refinance Options?

- Why Are So Many People Moving to or Staying in Deerfield Beach in 2025?

- FAQ: FHA Refinance in Deerfield Beach – What Homeowners Ask Most

- Here’s What I’ve Seen in Deerfield Beach

Top 3 Take-a-Ways

- FHA refinance can offset 2025 insurance hikes and stabilize payments.

- Check MIP, closing costs, and Broward 2025 FHA limits before deciding.

- Streamline saves time if you already have FHA and meet payment history.

If you live in Deerfield Beach, Florida and you’ve seen your insurance costs spike lately, you’re not alone. Homeowners all across Broward County have been hit with major changes in 2025. Premiums are climbing fast, and that’s driving up monthly mortgage payments for many households. So it’s no surprise that a lot of people are now looking at refinancing with an FHA Loan in Deerfield Beach as a way to bring those monthly costs back down to earth.

If you’re feeling the squeeze, you might be wondering if refinancing makes sense right now. The short answer? Yes, it can, especially with the help of the right mortgage strategy. An FHA refinance could offer lower rates, better terms, or a smoother path compared to conventional options.

How Has Insurance Repricing Affected Homeowners in Deerfield Beach in 2025?

Back to Contents

Home insurance prices across Florida, and particularly in Broward County, have gone up sharply in 2025. In 2025 the average annual homeowners premium in Florida is about $5,761 for a home with $300,000 in dwelling coverage, and many coastal communities in Broward County pay well above the statewide average.

This shift is affecting mortgage payments for people with escrow accounts. Since insurance is bundled into many monthly mortgage payments, rising premiums mean you’re likely paying hundreds more each month—even if your mortgage rate hasn’t changed. That’s why homeowners are scrambling for relief, and refinancing is quickly becoming a key strategy.

The good news? FHA refinance options can offer more flexibility and easier approval than many conventional routes. But timing and strategy matter.

Can Refinancing with an FHA Loan in Deerfield Beach Help Lower Your Monthly Costs?

Back to Contents

Refinancing replaces your existing mortgage with a new one—ideally with better terms. The goal is simple: reduce your monthly cost, lock in stability, or tap into equity. When insurance hikes push your monthly payment up, refinancing can help offset the increase by lowering your interest rate or adjusting your loan term.

As of November 2025, the national average 30 year fixed FHA refinance APR is about 7.00 percent, while the overall 30 year fixed mortgage rate tracked by Freddie Mac is about 6.22 percent. That difference can add up. And FHA loans are often more forgiving when it comes to credit score, equity, and debt-to-income ratios.

Here’s a real-world example:

- A homeowner in Deerfield Beach with a $340,000 loan

- Paying 6.9% interest on a 30-year fixed

- Monthly principal and interest: $2,240

- After refinancing into an FHA loan at 6.1%, their payment drops to $2,058

- That’s a $182/month savings, not including other changes like MIP or new insurance quotes

Also, FHA offers a Streamline Refinance program, which lets you skip a full appraisal and documentation process if you’re refinancing an existing FHA loan. That means a much faster process, lower closing costs, and less red tape.

Want to run your own numbers? Try our Mortgage Calculator to see what your payment could look like after refinancing.

What Are the Requirements for an FHA Refinance in Deerfield Beach?

Back to Contents

If you’re thinking about refinancing into an FHA Loan in Deerfield Beach, here’s what you’ll need in 2025:

- Credit Score: Borrowers with a credit score of 550 or higher may qualify if they meet income and employment criteria.

- Property Eligibility: FHA loans are available for 1 to 4 unit primary residences, including approved condominiums, and the home must meet safety and livability standards.

- Equity: For a Streamline Refinance, equity isn’t as important. But if you’re doing a Cash-Out Refinance, expect to keep at least 20% equity in your home.

- Debt to income ratio DTI: Automated FHA approvals can allow for DTIs below 57% with good compensating factors, though many approvals fall lower.

- Appraisal: Not needed for a Streamline Refinance. But for a Cash-Out, you’ll need a new appraisal.

- Mortgage History: Typically, you must be current on your payments with no more than one 30-day late in the past 12 months.

- Seasoning: You must have made at least six payments and at least 210 days must have passed since the prior loan’s closing date to be eligible for FHA Streamline.

It’s easy to trip over small mistakes that can delay or deny your application. For example, switching jobs in the middle of the refinance process or opening a new credit card can throw things off. Make sure to keep your credit stable, income verifiable, and documents ready.

If you’re not sure where you stand, you can Get a Free Quote to see what FHA refinance options might work best for you.

Should You Choose a Streamline FHA Refinance or a Cash-Out Option?

Back to Contents

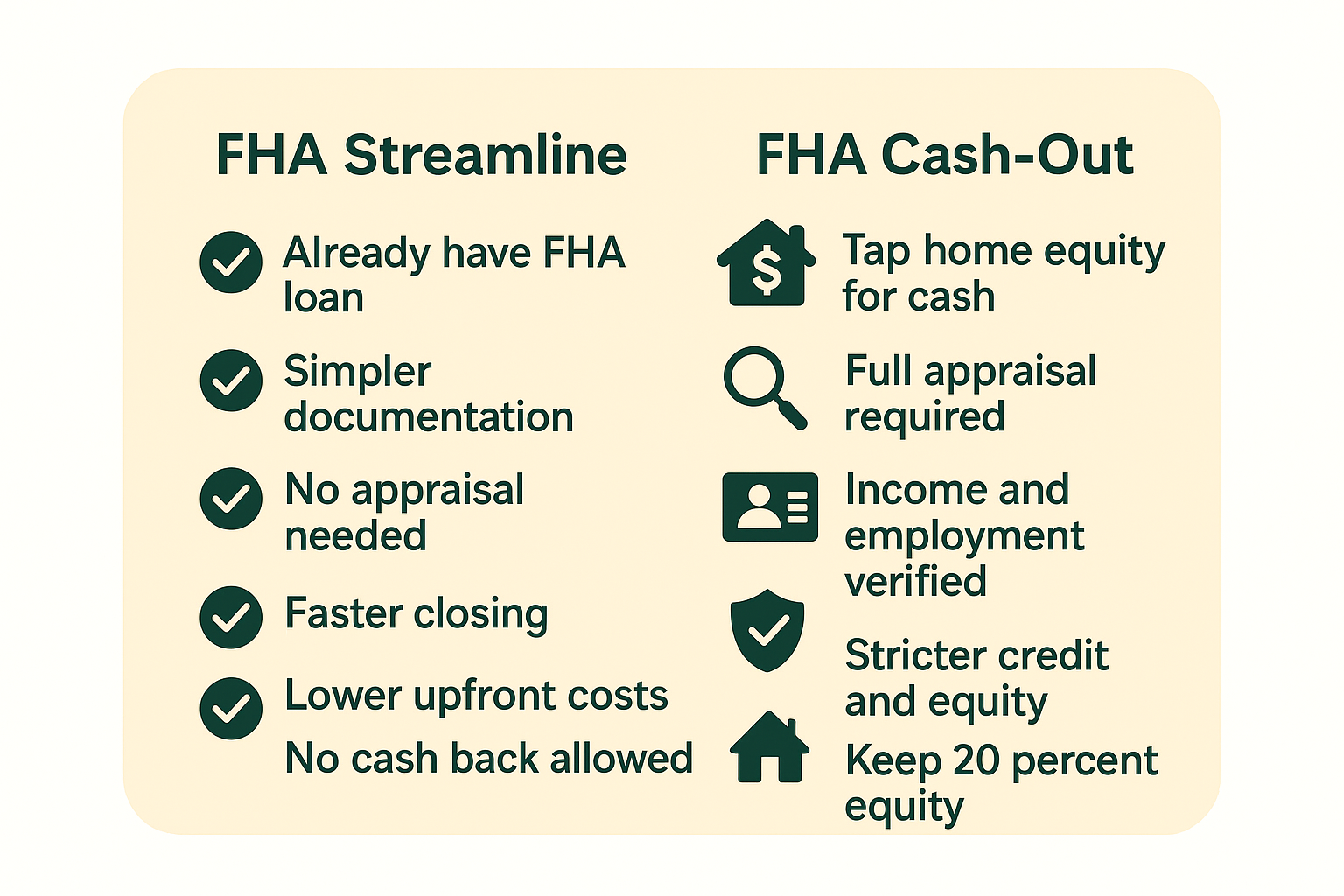

If you’re thinking about refinancing with an FHA Loan in Deerfield Beach, you’ve got two main paths to consider: Streamline Refinance and Cash-Out Refinance. Each one serves a different purpose, so it depends on what you need right now.

FHA Streamline Refinance is the faster, simpler route. It’s designed for people who already have an FHA loan and want better terms—usually a lower rate. Here’s why it’s popular:

- Simplified documentation compared with many other options

- No appraisal required

- Faster closing

- Lower upfront costs

The catch? You can’t take any cash out. This is all about saving money on your monthly payment or shortening your loan term.

FHA Cash-Out Refinance, on the other hand, lets you tap into your home equity and pull out cash for things like renovations, paying off credit cards, or building an emergency fund. But it does come with more steps:

- Full appraisal required

- Proof of income and employment

- Stricter credit and equity standards

You’ll need to keep at least 20% equity in your home after the refinance. This route makes more sense if you have a specific goal for that cash—like paying off 20% APR credit card debt or handling insurance repairs your carrier denied.

If you’re unsure which option fits your situation best, start by checking what rates you qualify for through Our Application portal. It’s quick and gives you a clear picture of your choices.

What About Closing Costs for an FHA Loan in Deerfield Beach?

Back to Contents

Closing costs are part of any refinance, but they often surprise homeowners who haven’t gone through the process in a while. In 2025, typical closing costs for an FHA refinance in Deerfield Beach are running between 2% and 4% of your loan amount.

So if you’re refinancing a $300,000 loan, you might pay between $6,000 and $12,000 in closing costs. These usually include:

- FHA mortgage insurance premium (MIP)

- Prepaid taxes and insurance

- Title search and insurance

- Origination and processing fees

- Recording and notary fees

The good news? You often don’t have to pay these upfront. FHA loans let you roll the closing costs into your new loan, as long as it still meets FHA loan limits and your payment stays affordable.

That’s why it’s important to work with a team who understands the fine print. And if you want an estimate based on your exact numbers, go ahead and Get a Free Quote.

Can You Use Down Payment Assistance for FHA Refinancing in Florida?

Back to Contents

This question comes up a lot, especially with all the changes happening in 2025. Normally, down payment assistance programs are for people buying a new home, not refinancing. But there’s a key exception that matters if you’re looking to move or swap properties.

If you’re selling your current home and using an FHA Loan in Deerfield Beach to buy a new one, you might be eligible for programs like Florida’s SHIP or Hometown Heroes. You should also take a close look at Down Payment Assistance Programs that help first-time and repeat buyers throughout the state.

On top of that, The Doce Mortgage Group offers the HomeZero Program, which can be a game-changer if you’re buying your next home with no money down. Learn more about how that works here.

If you’re refinancing your current home, assistance programs won’t usually apply—but lowering your rate or switching terms might still save you far more than you’d get from a grant.

How Does an FHA Loan in Deerfield Beach Compare to Other Refinance Options?

Back to Contents

FHA loans aren’t the only path to refinancing in 2025, but they can offer serious benefits depending on your credit, equity, and goals. Let’s break it down with a quick comparison:

FHA vs. Conventional Refinance

- FHA Pros:

- Easier to qualify with lower credit

- Higher debt-to-income flexibility

- Streamline option is fast and simple

- FHA Cons:

- Monthly mortgage insurance stays for most of the loan

- Loan limits may cap your options

- Conventional Pros:

- No mortgage insurance if you have 20% equity

- No upfront MIP

- More flexible with high-value homes

- Conventional Cons:

- Stricter credit score requirements

- Might not qualify if your DTI is high

FHA vs. VA or USDA

If you qualify for VA or USDA loans, those can sometimes beat FHA on rates and fees. But most folks don’t have access to those unless they’re veterans or in rural areas.

For Deerfield Beach homeowners who want flexibility, speed, and low upfront costs, an FHA Loan in Deerfield Beach remains one of the best refinancing options out there in 2025.

Why Are So Many People Moving to or Staying in Deerfield Beach in 2025?

Back to Contents

Beyond the mortgage talk, let’s not forget why people love calling Deerfield Beach home. Even with insurance bumps and real estate shifts, this coastal city still delivers a lot of value.

Here’s what’s keeping people here—and attracting new buyers too:

- Affordability: Compared to Boca Raton or Fort Lauderdale, home prices in Deerfield Beach are still within reach for many families and retirees

- Beach Access: It’s right there in the name. Deerfield Beach has one of the cleanest, most well-kept beaches on the East Coast, and it’s a draw year-round

- Walkability: The Cove area and the beachfront boardwalk offer walkable dining, shopping, and entertainment

- Quality Schools: Nearby schools like Quiet Waters Elementary and Deerfield Beach High have made solid academic gains in 2025

- Retirement-Friendly: With local medical centers, parks, and condos, it’s a favorite for active seniors

- Low Crime Rates: The city continues to maintain some of the lowest crime rates in Broward County this year

People aren’t leaving Deerfield Beach. They’re looking for ways to stay—and that’s where refinancing with an FHA loan becomes a smart move, especially if rising insurance costs are making things tight.

Need help seeing what a new monthly payment might look like in this area? Try our Mortgage Calculator to get a clear picture.

FAQ: FHA Refinance in Deerfield Beach – What Homeowners Ask Most

Back to Contents

1. Can I refinance an investment property with an FHA loan in Deerfield Beach?

No. FHA refinance options are only available for your primary residence. FHA financing is intended for primary residences only, including eligible 1 to 4 unit homes and approved condos, that meet FHA safety and livability standards If you own a rental or second home, you’ll need to look into conventional refinance options.

2. How soon can I refinance after getting an FHA loan?

For most FHA Streamline refinances, your current loan must be at least 210 days old, and you must have made at least six monthly payments. If you’re doing a Cash-Out Refinance, the waiting period is usually longer.

3. Will my home insurance provider affect my refinance approval?

Not directly. FHA guidelines don’t restrict you based on who insures your home. But high insurance premiums can impact your debt-to-income ratio, which could affect your ability to qualify for a refinance.

4. Can I refinance with an FHA loan if I’ve missed a mortgage payment this year?

It depends. FHA typically requires on-time payments for the past 3 months for a Streamline Refinance, and no more than one late payment in the past year. If you’ve had recent trouble making payments, you’ll need to talk through your options with a mortgage advisor.

5. What if I changed jobs recently—can I still refinance?

Yes, but you’ll need to provide proof of steady income. FHA is generally flexible, but underwriters want to see consistent job history or a clear explanation of job changes. If you’re in the same field or took a higher-paying role, you’re usually fine.

Here’s What I’ve Seen in Deerfield Beach

Back to Contents

I’ve helped a lot of folks in Deerfield Beach who’ve been caught off guard by rising home costs this year. When insurance repricing hit, many didn’t realize how quickly it would change their monthly payments. But here’s the thing—you’ve got options.

For a lot of people, refinancing with an FHA Loan in Deerfield Beach gave them back control. It let them lower their rate, clean up their monthly budget, and stay in the city they love. Some switched to a shorter term to pay off their home faster. Others chose to tap equity and get ahead on repairs. What they all had in common was a smart move at the right time.

Refinancing isn’t always the answer—but when it is, it can make a huge difference. That’s why we take the time to look at your whole picture and make sure the numbers work for you. You deserve clarity, not confusion.

And here’s something worth celebrating: Alex Doce was recently recognized by WalletHub as one of the Best Mortgage Brokers in Several Cities in Florida. This award highlights the most respected and trusted brokers in the state, ranked by the number of glowing client reviews. Alex was listed at the top of that prestigious list. This is a reflection of the care, transparency, and dedication clients experience every day when working with The Doce Mortgage Group.

You can check out for yourself what our clients are saying. Their stories say it better than we ever could.

If you want to know what’s possible for your home, Call us today at 305-900-2012 to see if an FHA refinance could lower your payments or help you stay ahead of rising costs.