Living in Miami is a dream for many. The vibrant culture, beautiful weather, and an exciting lifestyle all make this place special. Over the years I’ve had the privilege of helping countless families and individuals make the move to this beautiful area.

One of the most common questions I often get from potential homebuyers is about the down payment requirements for an FHA loan in Miami. Understanding the minimum down payment is an essential first step in the home-buying process. Here I’ll provide everything you need to know.

Why an FHA Loan in Miami?

FHA loans are a popular choice for first-time homebuyers or those with less-than-perfect credit. Backed by the Federal Housing Administration, FHA loans offer more lenient requirements compared to conventional loans. They are designed to make homeownership more accessible to a wider range of people, including those who may have difficulty saving for a large down payment.

The FHA loan in Miami provides an excellent opportunity for homebuyers to enter the market with a lower upfront cost. These loans are attractive because they allow for a smaller down payment, which is one of the primary concerns for many buyers. But what is the minimum down payment you’ll need to qualify for an FHA loan in Miami?

Minimum Down Payment

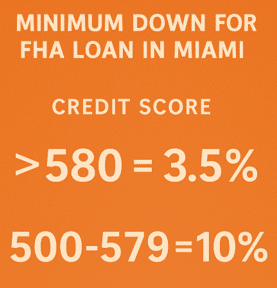

As of June 2025, the minimum down payment required for an FHA loan in Miami depends on your credit score:

- Credit score of 580 or higher: Minimum down payment is 3.5% of the home’s purchase price.

- Credit score between 500 and 579: Minimum down payment is 10%

For example, purchasing a $500,000 home would require:

- $17,500 down with a 580+ credit score (3.5%)

- $50,000 down with a 500–579 credit score (10%)

As of spring 2025, the median sale price for homes in Miami is approximately $620,000. So, if you’re purchasing a home for $600,000, you would need a down payment of $21,000. This low down payment requirement is one of the primary reasons FHA loans are so appealing to first-time buyers and those with limited savings.

It’s important to note that while the minimum down payment is 3.5%, you will still need to meet other requirements to qualify for an FHA loan in Miami. We’ll discuss more about that below.

What Affects the Down Payment Amount?

While the 3.5% down payment is the standard, several factors can impact the amount you need to put down on an FHA loan in Miami. Here are some key factors that can influence your down payment:

- Credit Score: If your credit score is below 580, the minimum down payment requirement may increase to 10%. FHA loans typically require a score of at least 580 for the 3.5% down payment, but if your score falls below that, you may be required to contribute a larger down payment.

- Loan Limits: FHA loans have limits on how much you can borrow, and these limits vary by location. In the Miami-Dade County, the 2025 FHA loan limit is $654,350, which can impact the down payment required.

- Seller Contributions: In some cases, the seller may agree to contribute to the buyer’s closing costs, which can reduce the amount of money you need to bring to the table for your down payment. Is it not uncommon to see 2-4% of salesprice contributions by seller.

- Loan Amount: For higher-priced homes, the 3.5% minimum down payment could be more significant in dollar terms. For instance, if you’re buying a home worth $500,000, a 3.5% down payment would be $17,500.

The Doce Mortgage Group’s HomeZero Down Payment Assistance Program!

The HomeZero Program offered by The Doce Mortgage Group is an alternative to traditional FHA loans in Miami, but it still provides significant benefits for many buyers who might be eligible for FHA financing. This unique program is designed for homebuyers with a minimum FICO score of 580 and a debt-to-income ratio (DTI) of up to 56.99%.

While FHA loans require a minimum down payment of 3.5%, the HomeZero Program eliminates that barrier altogether by offering 100% financing, meaning you don’t need to put any money down at closing. This makes it a great option for first-time homebuyers or anyone looking for a more flexible, zero-down mortgage solution.

In contrast to FHA loans, which typically come with a set down payment requirement based on your credit score, the HomeZero Program is even more accessible, offering 100% financing with flexible credit score and debt-to-income ratio requirements. This program can also help cover up to 1.5% of the home purchase price for closing costs, an added benefit that many FHA loans don’t provide.

While an FHA loan in Miami may still be a great choice for many, HomeZero offers a unique, exclusive opportunity to purchase a primary residence in Florida with no down payment required. Call us today at 305-900-2012 to get started!

Benefits of an FHA Loan in Miami

There are several reasons why many homebuyers choose an FHA loan in Miami, particularly for first-time homebuyers. The key advantages include:

- Lower Down Payment Requirements: As mentioned, the 3.5% down payment is one of the most appealing aspects of FHA loans. This lower down payment requirement allows you to purchase a home without draining your savings account. Some programs like the Homezero from The Doce Mortgage group allows for zero downpayments with credit scores as low as 580 and with no income limitations.

- Easier Credit Requirements: FHA loans are more forgiving when it comes to credit scores. While conventional loans typically require a higher credit score, FHA loans can be obtained with a credit score as low as 500. This opens up homeownership to individuals who might not qualify for a traditional mortgage.

- Competitive Interest Rates: FHA loans often come with competitive interest rates, which can save you money over the life of the loan. FHA loan rates are often lower than those of conventional loans.

- Assumable Loans: FHA loans are assumable, which means that if you decide to sell your home, the buyer may be able to take over your mortgage at the same interest rate. This can be a selling point if interest rates rise in the future.

- Less Stringent Debt-to-Income Ratios: FHA loans typically allow for higher debt-to-income (DTI) ratios than conventional loans. This makes it easier for people with existing debts to qualify for an FHA loan in Miami. With an FHA loan the DTI can be as high as 56.99%. Conventional stops at 50%, or lower in some instances.

How to Qualify for an FHA Loan in Miami

Qualifying for an FHA loan involves meeting specific FHA loan requirements set by the Federal Housing Administration. In addition to the minimum down payment, here are some other key factors that lenders will consider when evaluating your application:

- Credit Score: To qualify for the 3.5% down payment, you generally need a credit score of 580 or higher. If your score is lower than 580, you may still qualify, but the down payment requirement increases to 10%.

- Income and Employment History: Lenders will look at your income to determine if you can afford your mortgage payments. They also want to see a stable employment history, typically two years in the same job or field.

- Debt-to-Income Ratio: Your debt-to-income (DTI) ratio is an important factor. This ratio compares your monthly debt payments to your monthly income. FHA guidelines allow for a DTI ratio of up to 56.99%.

- Property Appraisal: The home you wish to purchase must pass an FHA-approved appraisal. The appraiser will assess the property’s value and condition to ensure it meets FHA standards.

Common Mistakes to Avoid When Applying for an FHA Loan in Miami

Many buyers make avoidable mistakes during the FHA loan process that can delay approval, increase costs, or even cause their loan to fall through. Knowing what to watch out for can help you avoid setbacks and move through the process more smoothly.

Here are some of the most common mistakes to avoid:

- Ignoring your credit report: Not reviewing your credit early can leave you with unresolved errors or unpaid accounts that lower your score.

- Focusing only on the down payment: FHA loans allow a low down payment or not downpayment with the , but many buyers forget about closing costs, inspections, appraisals, and escrow reserves.

- Skipping pre-approval: Shopping without a pre-approval can lead to unrealistic expectations and weak offers in a competitive market.

- Making financial changes mid-process: Changing jobs, financing new purchases, or opening credit lines during underwriting can derail your application.

- Choosing the wrong lender: Not all lenders have the same experience with FHA loans. Working with a lender familiar with the Miami market can make a big difference.

By avoiding these common missteps, buyers using an FHA loan in Miami can stay on track and enjoy a much smoother homebuying experience.

Why People Choose to Live in Miami

In addition to its appealing FHA loan options, Miami offers a wealth of benefits for those looking to make the move. Miami is often regarded as one of the most vibrant and exciting cities in the United States. It’s a hub of culture, art, and entertainment, making it an ideal place for individuals and families.

Below are the top ten reasons people love living in Miami:

- Beautiful Weather Year-Round: Miami is famous for its tropical climate. With warm temperatures all year long, it’s the perfect place to enjoy outdoor activities like boating, hiking, and lounging on the beach.

- Vibrant Culture and Arts Scene: From the world-renowned Art Basel event to the vibrant Wynwood Walls, Miami is a cultural epicenter. Miami offers a unique mix of modern art galleries, historic architecture, and lively music scenes. You’ll find everything from Cuban influences to contemporary exhibits, making it a great place for creative minds.

- Exceptional Food Scene: Miami boasts an impressive food scene, with a variety of cuisines from Latin America, the Caribbean, and beyond. Whether you’re looking for a traditional Cuban sandwich or fine dining in a trendy restaurant, Miami has it all.

- Outdoor Activities and Parks: Miami’s parks and outdoor spaces provide ample opportunities for recreation. Whether it’s a picnic at Coral Gables’ beautiful Fairchild Tropical Botanic Garden or a day of water sports in Biscayne Bay, outdoor enthusiasts will find plenty to enjoy.

- Excellent Schools and Education Options: Miami offers top-rated schools, both public and private, making it an ideal location for families with children. The area is home to some of the best educational institutions in Miami-Dade County.

- Access to World-Class Shopping: Whether you’re looking for high-end boutiques or large shopping malls, Miami has plenty of retail options. From the upscale shops at The Shops at Sunset Place to the unique finds in local stores, shopping is a pleasure here.

- Proximity to Miami’s Best Beaches: Living in Miami means you’re just a short drive away from some of the most beautiful beaches in the world, including South Beach and Key Biscayne, making it easy to enjoy the sun and surf year-round.

- Strong Job Market: Miami benefits from a booming job market, with opportunities in healthcare, technology, finance, and tourism. The area’s proximity to downtown Miami provides residents with access to a wide range of career opportunities.

How to Get Started with an FHA Loan in Miami

The process of getting an FHA loan in Miami is relatively straightforward, but you’ll want to make sure you’re fully prepared. Here’s how you can get started:

- Check Your Credit Score: Before applying for an FHA loan, check your credit score. If your score is below 580, you might need to save a larger down payment.

- Get Pre-Approved: It’s a good idea to get pre-approved for your FHA loan in Miami. This will give you a clearer idea of how much you can borrow and help streamline the home-buying process. You can Get a Free Quote to get an estimate of your loan options.

- Review Your Debt-to-Income Ratio: Lenders will evaluate your DTI ratio to determine how much of your income goes toward existing debt. FHA loans typically allow for a DTI ratio up to 43%, but in some cases, this can go higher.

- Use a Mortgage Calculator: To better understand how your mortgage payment will look, use a Mortgage Calculator. This will help you estimate monthly payments based on your loan amount, interest rate, and down payment.

- Submit Your Application: Once you’re ready, you can submit your application through Our Application Portal. It’s a quick and easy way to get started with your loan application.

Why Choose The Doce Mortgage Group for Your FHA Loan in Miami?

When it comes to securing an FHA loan in Miami, you want a trusted mortgage lender who understands the local market and can guide you through the process. At The Doce Mortgage Group, we’ve been helping residents in Miami and beyond navigate the mortgage process for years. We specialize in making homeownership a reality for first-time buyers, offering expert advice and personalized service to help you get the best possible loan for your needs.

Here’s why you should choose The Doce Mortgage Group:

- Local Expertise: We know the Miami market inside and out. Our deep understanding of local home prices and loan limits means we can help you find the best FHA loan options for your situation.

- Personalized Service: Every homebuyer is unique, and we take the time to understand your individual needs. From your down payment to your credit score, we’ll help you navigate the process and secure the loan that’s right for you.

- Years of Experience: With decades of experience in the mortgage industry, Alex Doce and the team at The Doce Mortgage Group have helped countless clients successfully purchase their homes.

- Streamlined Process: We strive to make the mortgage process as smooth as possible. We’ll guide you every step of the way, from pre-approval to closing.

- Competitive Rates: Our access to a wide range of lenders allows us to offer competitive rates and terms, ensuring you get the best deal possible on your FHA loan in Miami.

Don’t take our word for it. Check out the hundreds of customer reviews to see what others have to say about their experience with us.

If you’re ready to make your dream of homeownership in Miami a reality, don’t hesitate to reach out to The Doce Mortgage Group. We specialize in FHA loans in Miami and are here to help you through every stage of the process. Call today at 305-900-2012 to get started!

FAQs

How much do you have to put down for an FHA loan?

Most buyers pay 3.5% down. If your credit score is between 500 and 579, lenders usually ask for 10%. For example, on a $200,000 home, a 10% down payment would be $20,000. The exact amount depends on your credit score, the lender, and the price of the home.

How do you qualify for a FHA loan in Miami?

To get an FHA loan in Florida, you need at least a 500 credit score, but you may have to pay more upfront. With a score of 580 or higher, you can qualify for a 3.5% down payment. Some lenders will approve scores between 500 and 579, but they usually ask for a 10% down payment.

What is the minimum down payment for an FHA loan?

The minimum down payment is 3.5% if your credit score is 580 or higher. For example, on a $250,000 home, that means you would need about $8,750. This lower down payment is one of the main reasons FHA loans are popular with first-time buyers.

What is the lowest down payment you can get with an FHA loan?

The lowest down payment you can get is 3.5%, but you must meet the credit requirement. Keep in mind that even with a small down payment, you’ll need to pay for mortgage insurance, which adds to your monthly payment. Lenders may also check your income and debt levels before approving.