Table of Contents

- What Is a Zero Down Mortgage Loan in Fort Lauderdale?

- 2025 Loan Options Offering Zero Down in Fort Lauderdale

- How Much Can You Save Upfront in 2025

- Other Costs to Consider Beyond the Down Payment

- Potential Tradeoffs with a Zero Down Mortgage

- Who Qualifies for Zero Down Mortgage Loans in 2025

- How a Zero Down Mortgage Helps First-Time Buyers

- How the HomeZero Program Makes Zero Down Possible in Fort Lauderdale

- Why People Love Living in Fort Lauderdale

- Neighborhoods Worth Considering

- Customer Experiences and Trust

- Your Next Step Toward a Fort Lauderdale Home

Keynotes

- Zero down mortgages can save Fort Lauderdale buyers $30,000 or more upfront.

- The HomeZero Program offers 100% financing with flexible credit and income guidelines.

- Fort Lauderdale’s strong market and unique lifestyle make buying now a smart move.

Fort Lauderdale offers year-round sunshine, beautiful beaches, a vibrant boating culture, lively nightlife, top-tier dining, and a strong job market. As a resident of this amazing city myself, I’m always excited to show people how a Zero Down Mortgage Loan in Fort Lauderdale can make purchasing a home here easier than they ever thought possible.

What Is a Zero Down Mortgage Loan in Fort Lauderdale?

A zero down mortgage lets a buyer skip the typical down payment, often the biggest hurdle to homeownership. Instead of saving for years to gather enough cash, buyers can purchase a home sooner while keeping their savings intact.

This type of loan works by either rolling the down payment into the mortgage or eliminating it entirely through a qualifying program. Common benefits include:

- Eliminating the need to save tens of thousands before buying

- Allowing more flexibility with personal savings for moving, furniture, or emergencies

- Potentially combining with other programs to also reduce or cover closing costs

These programs are popular with buyers looking to purchase in higher-cost areas like Fort Lauderdale, where the median home price is well above the national average.

2025 Loan Options Offering Zero Down in Fort Lauderdale

There are several ways to qualify for a Zero Down Mortgage Loan in Fort Lauderdale in 2025. The most common include:

- VA Loans – For veterans, active-duty service members, and some surviving spouses. These require no down payment and often have no private mortgage insurance.

- USDA Loans – For eligible rural and suburban areas. While most of Fort Lauderdale is too urban for USDA, some nearby areas may qualify.

- Special State or Lender Programs – Florida offers programs that may waive the down payment or combine with Down Payment Assistance Programs to help with upfront costs.

If you want to quickly compare potential monthly payments across different loan types, our Mortgage Calculator is a great starting point.

How Much Can You Save Upfront in 2025?

Fort Lauderdale’s median sale price was $575,000 in June 2025, down 1.4 percent year over year.

Here’s how the upfront costs compare:

Conventional Loan (3%-5% down, depending on whether a first time homebuyer)

- Down payment: $17,250-$28,750

- Closing costs: $13,225

- Total upfront cash: $30,336-$41,975

Florida buyer closing costs average about 2.3 percent of price.

Zero Down Mortgage Loan in Fort Lauderdale (VA or USDA example)

- Down payment: $0

- Closing costs: about $13,225 (sometimes covered by seller or lender credits)

- Total upfront cash: $12,000

- Immediate savings compared to conventional: $17,111-$28,750

This means buyers using zero down financing could keep around $18,000-$30,000 in their pocket when purchasing at Fort Lauderdale’s median price. That’s money that could stay in savings, go toward home improvements, or be invested elsewhere.

Other Costs to Consider Beyond the Down Payment

While a Zero Down Mortgage Loan in Fort Lauderdale removes the need for a large upfront down payment, buyers should still budget for other costs.

Common expenses include:

- Closing Costs – Typically about 2.3 percent in Florida on average. For a $575,000 home, that is about $13,225.

- Property Taxes – Broward’s average effective property tax rate is about 0.95 percent, though bills vary by city and exemptions.

- Homeowners Insurance – Costs vary by location and coverage, but Fort Lauderdale’s coastal position means higher-than-average premiums. In 2025, Fort Lauderdale averages about $16,096 per year for common coverage profiles.

- HOA Fees – If buying in a condo or planned community, monthly fees commonly run about $300 to over $1,500 depending on the building and amenities.

- Maintenance and Utilities – Even with new homes, budget for upkeep and higher electric bills during Florida’s hot months.

Factoring these in from the start helps buyers avoid surprises and keeps the mortgage affordable over time.

Want to see exactly what your payment could look like, including taxes and insurance? Try our Mortgage Calculator to get a clear breakdown before you start shopping.

Potential Tradeoffs with a Zero Down Mortgage

Zero down loans are a great way to get into a home quickly, but they do come with some considerations:

- Higher Loan Balance – Without a down payment, you’re borrowing more, which can mean higher monthly payments.

- Interest Over Time – Paying interest on a larger loan can increase the total cost over the life of the mortgage.

- Program Restrictions – Some zero down options have specific eligibility requirements or property condition standards.

- Market Fluctuations – In the rare event of a market downturn, you could owe more than the home’s value early in the loan term.

That said, Fort Lauderdale’s strong real estate market and steady appreciation trends make it a favorable location for buyers using zero down financing. As of June 2025, the median sale price was $575,000, down 1.4 percent from a year earlier.

If you’re ready to explore your eligibility, you can start today by filling out Our Application portal and see which programs you qualify for.

Who Qualifies for Zero Down Mortgage Loans in 2025?

Eligibility varies depending on the type of zero down program:

- VA Loans – Must be a qualifying veteran, active-duty service member, or eligible surviving spouse. No income limits and generally a minimum 550 credit score, though most lenders prefer at least 580.

- USDA Loans – Must meet income limits (generally less than 115% of the area median income) and purchase in an eligible rural or suburban area.

- Special Lender and State Programs – May have income caps, credit score requirements (often 640+), and property eligibility rules.

In addition, Florida buyers can often combine these options with Down Payment Assistance Programs to further reduce their upfront costs.

Working with a knowledgeable local mortgage professional is key. Alex Doce has been helping buyers in South Florida for decades and knows which programs are most likely to be approved for each individual’s situation.

If you’d like to get a personalized breakdown of which programs you may qualify for, you can Get a Free Quote today and start your home search with confidence.

How a Zero Down Mortgage Helps First-Time Buyers

For first-time buyers, saving for a down payment can be the biggest obstacle to homeownership. A Zero Down Mortgage Loan in Fort Lauderdale removes that barrier, allowing buyers to enter the market sooner.

Advantages for first-time buyers include:

- Skipping years of saving for a down payment

- Using cash reserves for moving costs, renovations, or investments

- Building equity immediately as the home value appreciates

Florida also offers programs specifically for First Time Homebuyer needs, many of which can be combined with zero down options. Some of these include special rate incentives or assistance with closing costs to make the purchase even more affordable.

How the HomeZero Program Makes Zero Down Possible in Fort Lauderdale

For buyers looking for a Zero Down Mortgage Loan in Fort Lauderdale, the HomeZero Program from The Doce Mortgage Group offers one of the most flexible and inclusive financing options available in Florida. It’s designed to remove the down payment hurdle entirely, giving buyers 100% financing while also helping with closing costs.

Unlike many down payment assistance programs that limit eligibility based on income or first-time buyer status, HomeZero is open to a wide range of buyers. That means first-time and repeat buyers alike can benefit from zero down financing while still enjoying competitive interest rates and long-term stability.

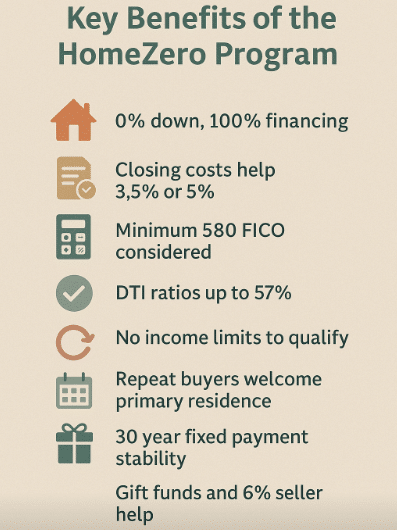

Key Benefits of the HomeZero Program

- No Down Payment Required – Buyers can put 0% down and finance 100% of the purchase price.

- Help with Closing Costs – The program provides a second mortgage covering 3.5% or 5% of the purchase price, which can be applied toward closing costs.

- Flexible Credit Standards – Minimum FICO score of 580, accommodating buyers with less-than-perfect credit.

- High Debt-to-Income Ratios Allowed – Approvals possible with DTI ratios up to 57%, giving more flexibility for buyers with existing obligations.

- No Income Limits – High-income earners can still qualify, even if they’ve been excluded from other assistance programs.

- No First-Time Buyer Restriction – Repeat buyers are eligible as long as the home will be their primary residence.

- 30-Year Fixed Rate Stability – Buyers can lock in predictable payments over the long term.

- Gift Funds & Seller Contributions Allowed – Up to 6% seller contributions accepted, along with gift funds from relatives.

If you want to see what your payment could look like with these terms, you can run the numbers through the Mortgage Calculator.

Who Can Use the HomeZero Program

The HomeZero Program is available for primary residences throughout Florida, including Fort Lauderdale. Eligible property types include:

- Single-family homes

- Planned unit developments (PUDs)

- Townhouses and condos

- Double-wide manufactured homes

- 1–2 unit properties, provided one unit is owner-occupied

However, some properties don’t qualify. These include second homes, investment properties, co-ops, deed-restricted manufactured homes, boarding houses, hotels, motels, and bed-and-breakfasts.

One borrower must complete a homebuyer education course before closing. This ensures buyers are confident in their financial readiness and fully understand the terms of their mortgage.

Important Considerations

While the benefits are significant, there are tradeoffs to understand:

- Borrowers take on a larger loan balance than if they had made a down payment, which can result in higher monthly payments.

- Because the loan covers more of the purchase price, buyers will pay more interest over time compared to loans with a down payment.

- The property must be used as a primary residence, meaning second homes and rental properties aren’t eligible.

These points are worth discussing with a mortgage professional so you can weigh the long-term financial impact against the immediate savings.

Why This Program Stands Out in Fort Lauderdale

In a city where the median home price is around $600,000, skipping the down payment can save a buyer roughly $30,000 upfront compared to a traditional 5% down mortgage. Add in help with closing costs, and the total upfront savings could be $40,000 or more.

For buyers who want to purchase in desirable neighborhoods like Las Olas Isles, Rio Vista, Victoria Park, Lauderdale-By-The-Sea or Coral Ridge, this can mean the difference between continuing to rent and owning a home. With Fort Lauderdale’s property values having risen 5.3% in the past year, getting in sooner can also help buyers start building equity faster.

If you’d like to learn more about the eligibility details or see if your target property qualifies, you can Get a Free Quote or start the process directly through Our Application portal.

Why People Love Living in Fort Lauderdale

Fort Lauderdale offers a mix of lifestyle perks that appeal to both locals and newcomers. The city has over 165 miles of navigable waterways, earning it the nickname “Venice of America.” Residents enjoy boating, fishing, and waterfront dining almost year-round thanks to the warm climate.

The job market continues to expand, with strong employment in tourism, healthcare, and technology. Fort Lauderdale-Hollywood International Airport makes travel easy, and the city’s location puts Miami and Palm Beach within quick reach for work or entertainment.

Cultural life thrives here with events like the Fort Lauderdale International Boat Show, art fairs, live music, and food festivals. The restaurant scene blends fresh seafood with international flavors, offering something for every taste.

If you’re curious about different mortgage options to fit your budget in this desirable city, take a look at All Our Loan Types and see which is right for you.

Neighborhoods Worth Considering

Fort Lauderdale has neighborhoods for every lifestyle:

- Las Olas Isles – Luxury waterfront homes with private docks and quick ocean access

- Victoria Park – A charming, walkable community close to downtown and the beach

- Coral Ridge – Family-friendly area with top-rated schools and spacious homes

- Flagler Village – An arts district with trendy apartments, coffee shops, and galleries

Each of these areas offers unique benefits, from high-end amenities to convenient commuting routes. The right financing, like a Zero Down Mortgage Loan in Fort Lauderdale, can help buyers secure a home in their preferred neighborhood faster.

To see how much you might qualify for in your chosen area, you can Get a Free Quote and start narrowing your search.

Customer Experiences and Trust

The Doce Mortgage Group has built a strong reputation for helping buyers navigate the home financing process with confidence. Client feedback highlights fast communication, clear guidance, and a commitment to finding the best loan fit.

You can see firsthand how our past clients feel about their experience by reading the customer reviews. These stories give a real sense of the personal attention and expertise that make the difference in competitive markets like Fort Lauderdale.

If you’re ready to take the next step toward homeownership, you can Get a Free Quote or start the process in Our Application portal today.

Your Next Step Toward a Fort Lauderdale Home

Fort Lauderdale combines natural beauty, economic opportunity, and a vibrant lifestyle. With a Zero Down Mortgage Loan in Fort Lauderdale, buyers can take advantage of all this without the stress of saving for a large down payment. The savings can be substantial—often tens of thousands of dollars—and the right program from trusted mortgage lenders Fort Lauderdale can help you move into your dream home sooner.

Call Us Today at 305-900-2012 to discuss your options, see how much you can save, and start the path to owning your Fort Lauderdale home.

FAQs

Can I buy a house without a down payment in Florida?

The 100% FHA Zero Down Financing program helps eligible Florida homebuyers purchase a home without a large upfront payment. It covers the full 3.5% FHA down payment and may also help with some closing costs.

Is it harder to get approved with no money down?

Banks won’t approve a no down payment mortgage loan without solid credit. Applying with no credit history and no money down is almost impossible.

What’s the minimum down payment for a $300,000 house?

FHA loans need a minimum down payment of 3.5%, which is $10,500 on a $300,000 home. They also require mortgage insurance to protect lenders in case of default, similar to private mortgage insurance.

How much down payment for a house in florida?

In Florida, first-time homebuyers typically put down about 8%. Repeat buyers usually pay closer to 19%. With an FHA loan, the minimum down payment is 3.5%. The exact amount depends on factors like loan type and credit score.