Table of Contents

- What is a VA Mortgage Loan And How Does it Help Veterans?

- Eligibility And The Certificate Of Eligibility

- 2025 VA Funding Fee And Who May Be Exempt

- Loan Amounts, Entitlement, And Down Payment Scenarios In 2025

- Rates, Credit, DTI, And Residual Income

- Appraisals, Property Standards, And The Tidewater Process

- VA Versus FHA And Conventional In 2025

- Closing Costs, Seller Credits, And Ways To Reduce Cash To Close

- First Time Buyers And Extra Help In Florida

- Step By Step: From Quote To Keys With The Doce Mortgage Group

- Living In Weston: Neighborhood Vibe And Daily Life

- Schools And Education Options

- Commuting, Jobs, And Quality Of Life

- Home Prices, Inventory, And Market Trends In 2025

- Common Questions From Weston Veterans

- Why Choose The Doce Mortgage Group

Keynotes

- VA loans offer no down payment and no monthly mortgage insurance.

- Weston combines great schools, parks, and easy access to major cities.

- The Doce Mortgage Group has hundreds of positive reviews and local expertise.

Weston Florida blends quiet neighborhoods with lots of parks, well regarded schools, and easy access to the Everglades, Fort Lauderdale, and Miami. Families enjoy the miles of walking paths, sports programs, and community events. Review sites consistently give Weston high marks for schools and quality of life, which is why veterans who are looking to more into southern Florida should strongly consider getting a VA mortgage loan.

What is a VA Mortgage Loan And How Does it Help Veterans?

A VA mortgage is a home loan backed by the U.S. Department of Veterans Affairs. The program’s big advantages are no required down payment for most eligible borrowers, no monthly private mortgage insurance, limited fees, and competitive rates. The benefit can be used again over a lifetime. For an eligible buyer, a VA mortgage loan in Weston often means less cash up front and a lower monthly payment than other options.

Eligibility And The Certificate Of Eligibility

Borrowers qualify based on service history and duty status. The Certificate of Eligibility confirms this benefit for the lender. Occupancy must be as a primary residence, and certain surviving spouses may qualify. The Doce Mortgage Group helps request the COE online in minutes so buyers can start shopping for a VA mortgage loan in Weston with confidence.

Quick next step: run scenarios with the Mortgage Calculator or Get a Free Quote.

2025 VA Funding Fee And Who May Be Exempt

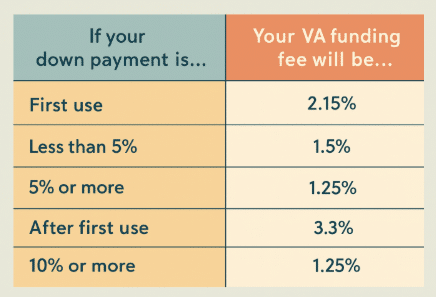

Most VA purchase loans include a one time VA funding fee. The percentage depends on first use or subsequent use and down payment tier. In 2025, a typical first use with less than five percent down is 2.15 percent. With five percent down the fee is 1.5 percent. With ten percent down it is 1.25 percent. Some borrowers are exempt, including those with a qualifying service connected disability, active-duty service members that are Purple Heart recipients, or borrowers who are the surviving spouse of a veteran who died in service or from a service-connected disability. Exempt buyers can reduce total cash to close even more on a VA mortgage loan in Weston.

Loan Amounts, Entitlement, And Down Payment Scenarios In 2025

Buyers with full entitlement do not have a loan limit as long as they qualify for the payment and the property appraises. There is no limit on the loan amount on VA loans. If you have full entitlement the VA will guarantee 25% of any loan amount no matter how high but you must still qualify under the lender’s criteria. That is why a VA mortgage loan in Weston can work for a wide range of prices. If a buyer has partial entitlement tied up in another VA loan, lenders use the conforming loan limit to determine if any down payment is needed. For 2025 the baseline conforming limit for a one unit home in the contiguous states is 806,500. The lender calculates remaining guaranty, then applies the 25 percent guaranty rule to see if a small down payment is needed for the target price.

Get started in minutes with Our Application portal.

Rates, Credit, DTI, And Residual Income

Rates move with the market, and VA loans are often among the lowest available for eligible buyers. As a current data point, Freddie Mac’s weekly survey reported an average 30 year fixed rate of 6.63 percent for the week ending August 7, 2025, which helps set expectations while shopping. Lenders still review credit, debt to income, and the VA’s residual income guideline by region and household size to confirm the budget works. The residual income test is unique to VA and is one reason default rates have been historically low. A strong file on these items can make a VA mortgage loan in Weston very competitive in today’s market.

Appraisals, Property Standards, And The Tidewater Process

A VA appraisal checks two things. It confirms the home’s value and it makes sure the property meets health and safety standards. That protects the buyer without adding monthly mortgage insurance to the payment. In Weston, this can be a real advantage because a VA mortgage loan in Weston often reaches competitive price points without a down payment.

If the appraiser thinks the value may come in short, the Tidewater process allows the lender and real estate agent to submit added comparable sales before the final value is set. This gives buyers one more shot to support the price. If the value still lands below contract, the team can explore options that keep a VA mortgage loan in Weston on track. These include a seller price change, a targeted credit toward closing costs, or a second look at the comparable sales that were used.

Minimum property standards focus on things like a solid roof, working systems, safe access, and clean water. Many Weston homes clear these items with minor fixes. If repairs are flagged, the lender works with the agent and seller to resolve them so the buyer can move forward with a VA mortgage loan in Weston.

VA Versus FHA And Conventional In 2025

For many eligible buyers, the monthly payment on a VA loan is hard to beat. VA has no monthly mortgage insurance, even when there is no down payment. FHA adds both upfront and monthly mortgage insurance, which can raise the payment compared to a VA mortgage loan in Weston. Conventional loans use private mortgage insurance when the down payment is under twenty percent, which can be cost effective for some buyers but often still lands above a similar VA scenario.

Another difference is how flexible VA can be with credit and debt ratios. VA uses a residual income test that looks at money left over after all major bills. This can help buyers in Weston who have strong income and a few debts, since the test gives a fuller picture of real life cash flow. It is one reason a VA mortgage loan in Weston can feel more forgiving for families who are still paying for cars, student loans, or childcare.

Rate shopping matters across all programs. VA pricing is often competitive and lower than most other products because the guaranty lowers risk for lenders. This is one more reason a VA mortgage loan in Weston can deliver a strong combination of low cash to close and an affordable monthly payment.

Next step: get numbers tailored to your budget with Get a Free Quote.

Closing Costs, Seller Credits, And Ways To Reduce Cash To Close

Even with no down payment, buyers should plan for closing costs. Common items include lender fees, appraisal, title, recording, and prepaid taxes and insurance. The good news is that credits can lower the amount owed at closing on a VA mortgage loan in Weston.

Here are practical ways Weston buyers often reduce cash to close

- Ask for a seller credit when making the offer

- Use a targeted lender credit that trades a slightly higher rate for a lower cost at closing

- Time the closing date to reduce prepaid interest for the first month

- Shop homeowners insurance early to avoid paying more than needed

VA allows seller credits within program limits, which pairs well with strong pre approval and a clean offer. The Doce Mortgage Group helps structure these credits so a VA mortgage loan in Weston closes with less cash and less stress.

First Time Buyers And Extra Help In Florida

First time homeowners who qualify for VA can use the benefit right away. Weston is a good fit for buyers who want stable neighborhoods, parks, and schools, and a VA mortgage loan in Weston supports that goal with no monthly mortgage insurance. New buyers can also tap education courses and budgeting tools to get ready for ownership.

Households sometimes include co borrowers or family members who are not VA eligible. The team can still compare options for everyone around the VA path. Helpful links include First Time Homebuyer and Down Payment Assistance Programs for non VA buyers in the same household. If someone does not qualify for VA, the Zero Down Mortgage in Florida can be a back up plan to keep the purchase moving.

For the VA eligible borrower, the focus stays on strong approval and clean documents. That keeps a VA mortgage loan in Weston on schedule and ready for clear to close.

Ready to begin: submit a secure application through Our Application portal.

Step By Step: From Quote To Keys With The Doce Mortgage Group

Getting a VA mortgage loan in Weston is easier when the path is clear. Here’s how the team guides buyers from first questions to the moment they get the keys.

Step 1. Quick chat and budget map

The process starts with a short conversation about goals, service history, target neighborhoods, and comfort zone for a monthly payment. The team reviews basics and explains how the benefit works so a VA mortgage loan in Weston fits the plan.

Step 2. Fast preapproval and COE

Next comes a full preapproval. The lender requests the Certificate of Eligibility and reviews credit, income, assets, and obligations. Buyers get a written preapproval letter that shows agents and sellers they are ready. This step also confirms details like funding fee status and any partial entitlement so there are no surprises later on a VA mortgage loan in Weston.

Step 3. Shop with a payment benchmark

With preapproval in hand, buyers look at homes that match the budget. The team estimates payments that include principal, interest, taxes, insurance, and any HOA fees. That makes it easy to compare options in Weston communities and keep a VA mortgage loan in Weston aligned with day to day cash flow.

Step 4. Offer strategy that strengthens the bid

The lender and agent coordinate on price, timing, and credits. Many buyers ask the seller for a credit to offset closing costs. Others plan for a small appraisal gap reserve if the market is competitive. Clear terms and strong communication help the seller feel confident about accepting an offer backed by a VA mortgage loan in Weston.

Step 5. Appraisal, title, and underwriting

After the contract is signed, the lender orders the VA appraisal and the title work begins. If the appraiser starts the Tidewater process, the team helps gather comparable sales. Underwriting reviews the file and may request small updates. Buyers choose homeowners insurance and the lender locks the interest rate when the timing is right. The goal is simple approval and a smooth close for a VA mortgage loan in Weston.

Step 6. Clear to close and signing

Once conditions are met, the lender issues a clear to close. Buyers review the final figures on the closing disclosure. The funding fee is either financed or paid at closing based on the plan from Step 2. After signing, the loan funds and the keys are released. That is the moment a VA mortgage loan in Weston becomes a home.

What to have ready

- Government issued ID and recent income pay information or proof of service

- Two months of bank statements

- A simple list of monthly debts and any child care or support obligations

- Contact info for the real estate agent and insurance agent

Ready to see where you stand right now? Try the Mortgage Calculator to test price points and payments.

Living In Weston: Neighborhood Vibe And Daily Life

Weston feels calm and friendly, with lots of trees, lakes, and wide sidewalks. Weekend plans are easy with neighborhood parks, ball fields, and bike paths. Many communities are gated, yet shopping and dining are still close by. This mix is a big reason a VA mortgage loan in Weston fits buyers who want comfort, convenience, and value. Families like how easy it is to get to community sports, after school activities, and local events without long drives. Retirees enjoy quiet streets and access to golf and nature. With a VA mortgage loan in Weston, eligible buyers can focus on the home and lifestyle rather than saving for a large down payment.

Schools And Education Options

Parents look for strong schools, and Weston delivers with well regarded public options and nearby magnets and charters. Many neighborhoods sit within short drives of elementary, middle, and high schools, which makes daily routines simple. After school programs cover arts, athletics, and STEM clubs, so kids can explore interests that match their goals. For buyers using a VA mortgage loan in Weston, the school mix helps families settle in with confidence. College bound students have access to test prep centers and tutoring nearby, and there are private schools in surrounding areas for families who want other choices.

Commuting, Jobs, And Quality Of Life

Weston sits near major routes that lead to job centers in Sunrise, Fort Lauderdale, and Miami. Many residents split time between office and remote work, which makes home features like a quiet office and reliable internet worth the focus. The city’s design keeps traffic calmer inside neighborhoods, while main roads connect to freeways for regional trips. Parks and fitness paths encourage active routines, and that daily convenience is one more reason a VA mortgage loan in Weston appeals to buyers planning to stay for years.

Next step: see how price, taxes, and insurance shape your budget with the Mortgage Calculator.

Home Prices, Inventory, And Market Trends In 2025

Weston’s housing mix includes single family homes, townhomes, and condos at a range of price points. Inventory has improved compared to prior years, which gives buyers a little more choice. That said, clean listings in popular communities still move quickly. A strong preapproval makes it easier to write a confident offer with a VA mortgage loan in Weston. The team helps match price and payment so buyers focus only on homes that fit the plan. For those who expect changes in income or family size in the next year, the lender can model different down payment and rate scenarios to keep a VA mortgage loan in Weston aligned with long term goals.

Quick option: if you are ready to move, apply now through Our Application portal.

Common Questions From Weston Veterans

Can VA be used for a duplex or townhome

Yes. VA allows many property types, including townhomes, planned unit developments, and some multi unit homes that meet program rules. A lender can confirm details for a specific address so a VA mortgage loan in Weston stays on the right path.

Can closing costs be covered with credits

Often yes. Buyers can request a seller credit and may also use a lender credit. The team helps structure offers so allowable credits lower cash to close on a VA mortgage loan in Weston.

Can the VA loan be used again after selling a prior home

Yes. The benefit can be restored in many cases. Once entitlement is restored, a buyer can move forward on a new VA mortgage loan in Weston.

What if a buyer has partial entitlement from a current VA loan

The lender calculates remaining guaranty and confirms if any down payment is needed. Even with partial entitlement, a VA mortgage loan in Weston can remain very competitive.

How can buyers strengthen an offer

Clean preapproval, fast timelines, and strong communication help. The team can also review appraisal gap strategies and seller credits that keep a VA mortgage loan in Weston attractive to the seller.

What about condos that are not VA approved yet

The lender can review project documents and explore approval options. Many buyers still close on their preferred home with a VA mortgage loan in Weston after the HOA provides the needed details.

What if the appraised value is short

The Tidewater response gives one more chance to share better comparable sales. If needed, the team can revisit credits or small price changes to keep a VA mortgage loan in Weston moving.

Do VA loans work well for first time buyers

Yes. The combination of no required down payment and no monthly mortgage insurance makes a VA mortgage loan in Weston a smart entry point for eligible buyers.

Interested in more loan paths for family members

If a co buyer is not VA eligible, the team can compare alternatives and still keep the household plan on track.

Explore options: review programs that fit different goals in All Our Loan Types.

Why Choose The Doce Mortgage Group?

Weston veterans like working with The Doce Mortgage Group because the process feels easy from start to finish. The team knows the local market, understands VA rules, and is quick to respond when questions come up. They give clear numbers, help pull your COE, explain funding fee exemptions, and even work through condo approvals when needed.

Alex Doce has guided hundreds of buyers through smooth closings, and the group’s many positive reviews show how much clients appreciate their friendly, hands-on approach. Call Us Today at 305-900-2012 to get answers, compare loan options, and start moving toward your new home.