Table of Contents

- What the Hometown Heroes Program in Florida Covers

- Who’s Eligible to Apply in 2025

- Why Florida Buyers Are Turning to the Hometown Heroes Program

- How to Apply for the Hometown Heroes Program in Florida

- Mortgage Tips for First Responders Using the Program

- Top Reasons People Are Choosing to Live in Florida

- Best Cities in Florida for First Responders and Essential Workers

- Real Stories From Florida First Responders

- FAQ About the Hometown Heroes Program in Florida

- You Deserve a Home. The Doce Mortgage Group Can Make It Happen

Keynotes

- 2025 funding renewed with $50 million for eligible Florida essential workers.

- Get up to $35,000 for down payment and closing costs statewide.

- Apply early with The Doce Mortgage Group to secure benefits before funds run out.

The wait is over. As of August 2025, the Hometown Heroes Program in Florida has been officially re-funded with $50 million in new funding. This means qualified first responders, teachers, nurses, law enforcement officers, and other essential workers can now apply for help buying a home in the community they serve.

The 2025 funding is available statewide and has already started making an impact. With housing prices still high across much of Florida, this program brings real financial relief for those who’ve been priced out or stuck renting. Eligible buyers who meet the hometown heroes income limits can now access up to $35,000 in assistance to cover down payment and closing costs.

This isn’t just another housing perk. It’s a practical, targeted tool to help everyday heroes own homes in areas where they work. But be warned: demand is strong and funds could go quickly. If you’ve been thinking about buying, now’s the time to move.

Let’s break down how it works, what’s covered, and how The Doce Mortgage Group can help you take full advantage.

What the Hometown Heroes Program in Florida Covers

The Hometown Heroes Program in Florida offers a powerful financial boost to eligible homebuyers. Here’s what’s included:

- Up to $35,000 in down payment and closing cost assistance

- Delivered as a 0% interest, non-amortizing second mortgage

- No monthly payments required

- Repayment only happens if you sell, refinance, or change ownership of the home

In short, this is money that sits quietly in the background while you live in your home. You’re not making any extra payments, and it doesn’t impact your monthly mortgage amount. It simply reduces what you need upfront, which is often the biggest hurdle for first-time buyers.

This program works with a range of mortgage types, including:

- FHA loans

- VA loans

- USDA loans

- Conventional loans

That flexibility makes it easier to find the loan product that best fits your situation. Whether you’re a Veteran using your VA benefits or a nurse going with a conventional loan, the Hometown Heroes benefit can apply.

Want to run the numbers and see how much house you can afford with this assistance? Use our Mortgage Calculator to test different loan scenarios.

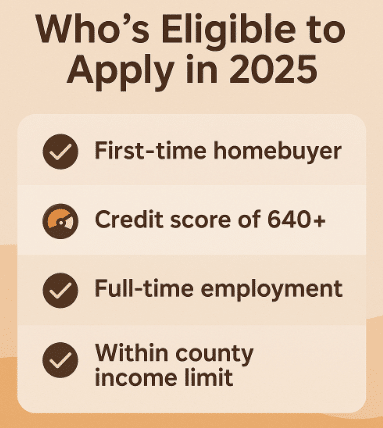

Who’s Eligible to Apply in 2025

To qualify for the Hometown Heroes Program in Florida, you’ll need to meet a few key requirements:

- You must be a first-time homebuyer, meaning you haven’t owned a home in the last 3 years

- Minimum credit score of 640

- Full-time employment in an approved occupation (first responders, court employees, educators, healthcare workers, child care, military, etc.)

- Income must fall within the county limits (these vary by location)

It’s important to double-check your eligibility before applying. If you’re unsure whether you qualify, you can always Get a Free Quote from our team and we’ll walk you through the process.

The program is also only available for primary residences, so you’ll need to live in the home as your main address. Investment properties and second homes don’t qualify.

If you meet those conditions, you could be just weeks away from owning a home, without having to drain your savings or borrow money from family.

Ready to see if you qualify? Start your application through Our Application portal to get pre-approved today.

Why Florida Buyers Are Turning to the Hometown Heroes Program

Florida home prices are still on the rise in 2025. According to recent market data, Florida’s statewide median sales price for single-family homes was $412,000 in June 2025, and recent July readings place the median sale price near $404,300. For many first-time buyers, especially those working in public service jobs, those numbers can feel out of reach.

That’s where the Hometown Heroes Program in Florida is making a huge difference.

Instead of spending years trying to save for a massive down payment, qualified buyers can now cut that number down by tens of thousands. With up to $35,000 in assistance, buyers can enter the market sooner and more confidently.

And it’s not just about the money. The program removes one of the most stressful parts of the buying process: wondering how you’ll cover the upfront costs. That peace of mind is a game changer, especially for essential workers dealing with demanding schedules and high-pressure jobs.

Here’s how the program makes homeownership more realistic:

- Covers both down payment and closing costs

- Keeps monthly mortgage payments lower by reducing your loan amount

- Helps first-time buyers compete in a competitive market

- Lets you buy in the area you work, rather than being pushed out to distant suburbs

- No Florida Note or Intangible Taxes to pay. An average savings of $2,500

Want to see how your numbers stack up? Get a Free Quote now to see what this could look like for you.

You can also explore other Down Payment Assistance Programs that might stack with or complement this one.

How to Apply for the Hometown Heroes Program in Florida

The good news? The application process is straightforward—especially when you work with a team that knows the ins and outs of the program.

Here’s a step-by-step of how to apply:

- Get Pre-Approved: You’ll need to start by getting pre-approved for a mortgage. This shows sellers you’re serious and helps you understand your budget.

- Confirm Eligibility: The Doce Mortgage Group will help you verify your occupation, income, and credit requirements.

- Submit Your Application: Once pre-approved and eligible, we’ll guide you through applying for the program and submitting all the needed paperwork.

- Shop for Homes: With funding in place, you can start looking for homes that fit your budget and lifestyle.

- Close and Move In: After closing, you’ll officially own your new home—with the benefit of thousands in financial assistance helping you get there.

The Doce Mortgage Group has helped hundreds of Florida buyers navigate this process quickly and smoothly. You won’t need to figure it all out alone. We’ll explain each step, review documents, and make sure everything’s on track.

If you’re ready to begin, you can apply now through Our Application portal. It only takes a few minutes to get started.

Mortgage Tips for First Responders Using the Program

Even with generous assistance from the Hometown Heroes Program in Florida, it’s still important to make smart decisions during the buying process. Here are a few tips to help you stay in control:

- Use the full benefit—Don’t leave any money on the table. If you qualify for the max $35,000, put it to work.

- Stick to a budget—Just because you’re approved for a higher amount doesn’t mean you have to spend it. Shop within your comfort zone.

- Use tools like the Mortgage Calculator to model your monthly payments before you commit.

- Compare loan types—Talk to your loan advisor about whether FHA, VA, USDA, or conventional is best for your situation.

- Don’t wait—The 2025 funding is limited. Once it’s gone, buyers will have to wait until next year.

And don’t forget, The Doce Mortgage Group is here to help every step of the way. We’ll explain the terms, help you make sense of your options, and handle the paperwork so you can focus on finding the right home.

Top Reasons People Are Choosing to Live in Florida

It’s no surprise that more people are packing up and heading to Florida. With its warm weather, strong job market, and no state income tax, Florida continues to be one of the top destinations for homebuyers in 2025.

And if you’re a first responder or essential worker, the Hometown Heroes Program in Florida gives you even more incentive to plant roots here.

Here are some of the biggest reasons people are buying homes in the Sunshine State:

- No state income tax, which means you keep more of your paycheck

- Year-round sunshine and access to beaches, lakes, and parks

- A growing economy with job growth across healthcare, education, tech, and public services

- Affordable communities still available outside major cities

- Top-rated school districts and family-friendly neighborhoods

Florida also offers something for everyone. Whether you’re drawn to big city energy or small-town peace and quiet, there are options that fit every lifestyle.

Best Cities in Florida for First Responders and Essential Workers

Palm Beach: Known for its upscale neighborhoods, beautiful beaches, and walkable communities. With the help of the Hometown Heroes Program in Florida, even homes in this high-demand area are becoming more accessible to essential workers.

Boca Raton: With top-rated schools, a strong healthcare sector, and a family-friendly atmosphere, Boca is a favorite among educators and nurses looking to buy close to where they work.

Pompano Beach: A growing city with rising property values and convenient access to both Fort Lauderdale and Miami. It offers a mix of affordability and location, especially attractive for police officers and EMTs.

Weston: This planned community is known for safety, excellent public schools, and plenty of green space. It’s a great option for first responders looking to settle in a peaceful, suburban setting.

Miami: One of the most in-demand markets in the state, Miami is still within reach for many buyers thanks to the Hometown Heroes Program in Florida. Whether you’re a firefighter, teacher, or public safety worker, the program can help make buying in the city possible.

Fort Lauderdale: With its growing hospital systems and strong public services, Fort Lauderdale is ideal for healthcare workers and law enforcement professionals. There are still pockets of affordability, especially for first-time buyers using assistance programs.

Hollywood: Located between Miami and Fort Lauderdale, Hollywood offers access to everything while keeping a slightly slower pace. It’s especially appealing for teachers and nurses commuting to nearby cities.

Each of these cities has communities that qualify for assistance, and most offer proximity to hospitals, schools, fire stations, and police departments—making them ideal places for essential workers to put down roots.

Want to know what areas you qualify for based on your budget and profession? Get a Free Quote today and find out where your best options are.

And when you’re ready to move forward, it only takes a few minutes to start an application through Our Application portal.

Real Stories From Florida First Responders

The impact of the Hometown Heroes Program in Florida can be seen in real lives. Here are a few examples of how this program has helped everyday heroes become homeowners in 2025:

Angela, an ER nurse in Tampa, had been renting for nearly a decade. Rising rents were squeezing her budget, and saving up for a down payment felt impossible. With the help of The Doce Mortgage Group and $32,000 in assistance from the program, she closed on her first home in May—just 10 minutes from the hospital where she works.

Carlos, a firefighter in Orlando, was struggling to find housing close to his station. Long commutes were wearing him down. After learning he qualified for the Hometown Heroes Program in Florida, he connected with The Doce Mortgage Group and secured a home near downtown with only $1,500 out of pocket at closing.

Tasha, a high school teacher in Jacksonville, used the full $35,000 available to cover her entire down payment and part of her closing costs. She now owns a 3-bedroom home in a quiet neighborhood—something she thought would take years to achieve.

These are just a few of the hundreds of success stories happening across the state right now.

FAQ About the Hometown Heroes Program in Florida

How long does it take to close using this program?

Most buyers close within 30 to 45 days. Working with an experienced lender like The Doce Mortgage Group helps speed things up.

Can I use this with a VA or USDA loan?

Yes. The Hometown Heroes Program in Florida works with VA, USDA, FHA, and conventional loans.

What happens if I sell or refinance?

The assistance is provided as a 0% second mortgage. It’s repaid only if you sell the home, refinance, or transfer the title.

Is this money forgivable?

It’s not forgivable, but it doesn’t accrue interest or require monthly payments. You pay it back only if you trigger repayment by selling, refinancing, or moving out.

How long will the 2025 funding last?

There’s no set expiration date, but once the $50 million in funding added in 8/18/25 is used, it’s gone for the year. Early applications have a better chance of being approved.

Still wondering if you’re eligible? Take the first step now and Get a Free Quote or call us to talk through your options.

You Deserve a Home. The Doce Mortgage Group Can Make It Happen

If you’re a first responder, teacher, nurse, or public servant in Florida, now is your window. The 2025 Hometown Heroes Program in Florida funding is open and being claimed fast. Whether you’re ready to buy this month or just want to explore your options, we’re here to help.

The Doce Mortgage Group has the experience, tools, and track record to guide you through the process from start to finish. Don’t wait for prices to rise again or risk losing access to funds that could change your life.

Want to hear what other buyers say about working with us? Check out our customer reviews and see what makes us different.

Call Today at 305-900-2012 to speak with a local expert, or Get a Free Quote and see how close you really are to owning a home.