Table of Contents

- Are FHA Loans Common in Hollywood Right Now?

- FHA Basics in 2025

- 2025 FHA Loan Limits for Broward County

- Who Qualifies for FHA in 2025

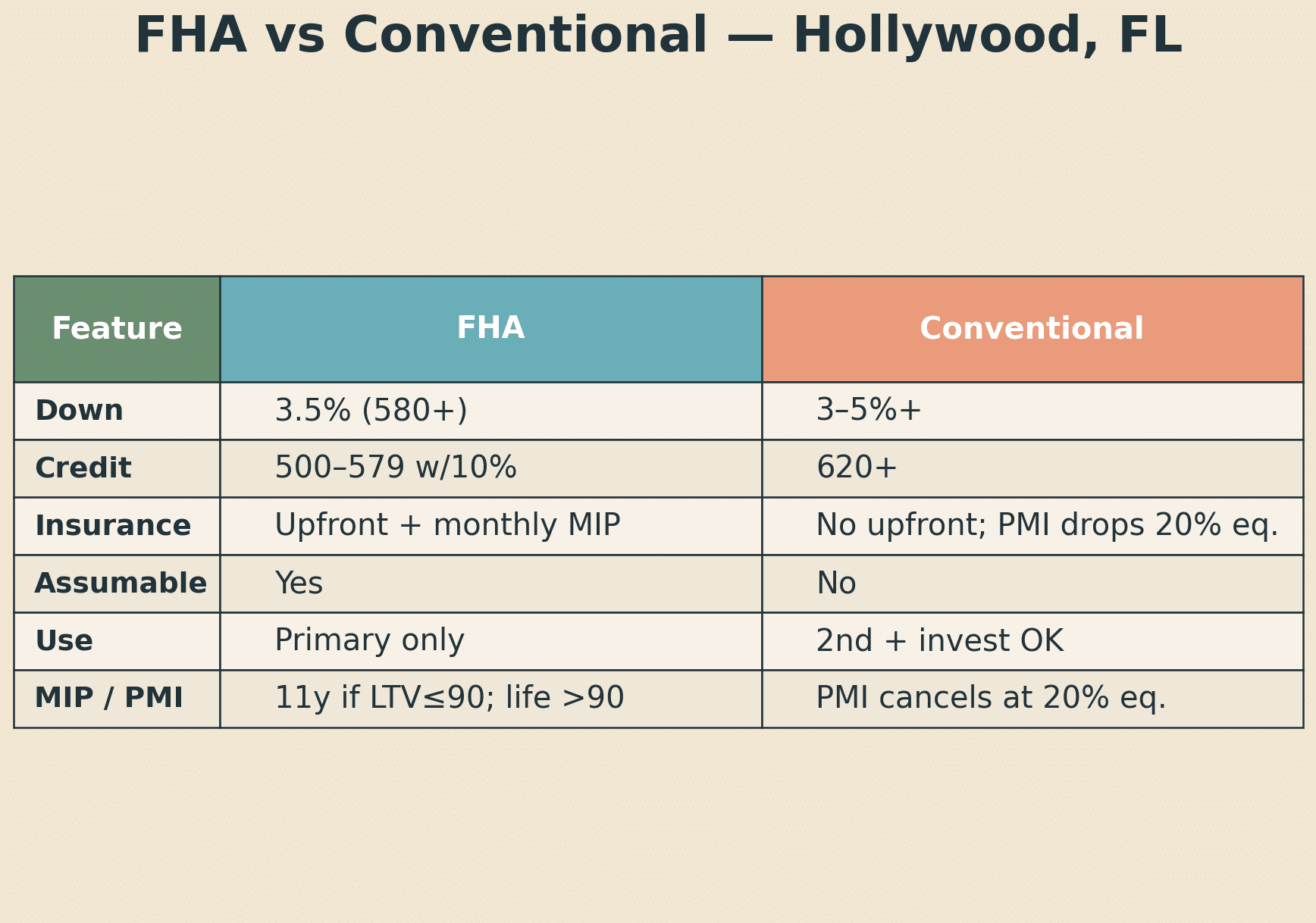

- FHA vs Conventional in Hollywood

- Condo and Townhome Buyers

- Down Payment Help That Pairs With FHA

- Total Cost of an FHA Loan

- Step by Step: How to Get Approved

- Hollywood at a Glance in 2025

- Top Reasons People Choose Hollywood

- Commute, Jobs, and Daily Life

- Neighborhood Highlights

- FHA-Friendly Home Shopping Tips

- FAQ: Fast Answers for 2025

- We Can Help

Keynotes

- FHA loans cover most Hollywood homes under 2025 loan limits.

- Flexible credit and low down payment attract first-time buyers.

- The Doce Mortgage Group simplifies FHA financing with local expertise and tailored guidance.

As of mid-2025, Hollywood, Florida’s real estate market is balancing out. The median home price in July 2025 was about $495,000, and homes took an average of 95 days to sell. That’s slower than last year, which means buyers aren’t facing as much pressure. For many people, FHA financing makes sense because it allows them to qualify without saving up the large down payments that conventional loans often require.

Nationally in Q1 2025, FHA’s purchase market share was about 15.6 percent by dollar volume and 18.2 percent by loan count, and recent HMDA data shows Broward County’s FHA share around 20.7 percent for 2024. That means an FHA loan in Hollywood, Florida has proven to be a popular path for buyers who want to get into the market without waiting years to save.

You can get a quick idea of what your payment might look like by trying the Mortgage Calculator. If you want exact numbers, you can Get a Free Quote from The Doce Mortgage Group and see your real options.

Are FHA Loans Common in Hollywood Right Now?

The answer is yes. FHA loans are widely used across Hollywood and Broward County. Recent filings indicate FHA represents about one in five Broward purchase loans, with HMDA data showing roughly 20.7 percent in 2024. With affordability being a major challenge in South Florida, FHA loans continue to be a lifeline for many families.

Hollywood’s home values fit well within FHA rules. With the median price just under half a million dollars, most homes fall under FHA’s 2025 loan limits. This means buyers who want to get an FHA loan in Hollywood, Florida can compete for single-family homes, condos, and townhomes in many neighborhoods.

FHA also remains popular in Hollywood because of the demographics of the city. Younger professionals, families, and new homeowners are attracted to the area’s lifestyle and location. Many don’t have the 20 percent down payment that conventional loans often prefer, so FHA’s 3.5 percent down payment is appealing.

If you’d like to see what you qualify for, you can Get a Free Quote or call 305-900-2012 to speak with a lending specialist.

FHA Basics in 2025

An FHA loan in Hollywood, Florida follows national FHA rules, but here’s a breakdown of what that means for you as a buyer in 2025.

Down payment and credit requirements

- 3.5 percent down with a credit score of 580 or higher

- 10 percent down with scores between 500 and 579

Mortgage insurance

- An upfront mortgage insurance premium of 1.75 percent, which can be rolled into the loan

- An annual premium of about 0.50 percent, added to monthly payments

Loan limits in Broward County (2025)

- One unit: $654,350

- Two units: $837,700

- Three units: $1,012,550

- Four units: $1,258,400

These limits cover nearly all homes in Hollywood, from starter condos to large single-family properties.

Condo rules

Many Hollywood buyers consider condos, but not every building is FHA eligible. The building must be HUD-approved or qualify for a spot approval.

You can estimate your payment anytime using the Mortgage Calculator. For faster results, you can apply directly in Our Application portal.

2025 FHA Loan Limits for Broward County

HUD updates FHA loan limits annually. Since Hollywood is part of Broward County, buyers use the county’s numbers for 2025.

- Single-family home: $654,350

- Duplex: $837,700

- Triplex: $1,012,550

- Four-unit property: $1,258,400

Hollywood’s median home price is well below the one-unit cap. That makes FHA financing a good fit for most buyers. For those interested in multi-family living, FHA allows you to buy a two- to four-unit home as long as you live in one unit. This strategy lets you build equity and earn rental income at the same time.

If you’re curious how far your budget stretches under these limits, you can Get a Free Quote.

Who Qualifies for FHA in 2025

An FHA loan in Hollywood, Florida is accessible to more buyers than many think. In 2025, FHA continues to be one of the most approachable mortgage options in Hollywood. With flexible credit and income standards, it’s a fit for first-time buyers, families, and anyone looking to keep more cash on hand. The program helps buyers purchase sooner without waiting years to save.

- Credit scores

- 580 or higher qualifies for 3.5 percent down

In 2025, FHA allows buyers with a score of 580 or more to put only 3.5 percent down. That makes it far more forgiving than conventional loans, which often demand stronger credit and bigger down payments, giving more Hollywood buyers a chance to qualify. - 500–579 may qualify with 10 percent down

Buyers in 2025 with scores between 500 and 579 may still qualify, but they’ll need 10 percent down. This guideline extends opportunity to households working to rebuild credit, providing a path to homeownership instead of locking them out of the market completely.

- 580 or higher qualifies for 3.5 percent down

- Debt-to-income ratio

FHA’s standard debt-to-income cap in 2025 is 56.99 percent, meaning your monthly debts should take up about half of your income.

- Occupancy requirement

FHA requires that the property purchased in Hollywood is your primary residence for at least one year. In 2025, this rule remains unchanged, which means FHA loans can’t be used for vacation homes or rental investments. Borrowers must intend to live in the property full time.

- Income checks

FHA lenders in 2025 look for stability in income, but they don’t demand perfection. If you’ve switched jobs recently, especially within the same line of work, that’s usually acceptable. The key is showing that you have steady earnings and the ability to repay the loan on time.

If you’d like to see if you qualify, you can apply instantly through Our Application portal.

FHA vs Conventional in Hollywood

Many buyers wonder whether an FHA loan in Hollywood, Florida is better than going conventional. The answer depends on your situation.

Why FHA May be Better

- Lower down payment

FHA only requires 3.5 percent down for buyers with credit scores above 580, which means you can buy sooner without saving for years. This is especially helpful in markets like Hollywood, Florida where prices are rising steadily.

- More forgiving credit requirements

FHA is designed to open the door for more buyers, so credit flexibility is built in. Even with past credit issues, applicants with scores as low as 500 may qualify, giving people rebuilding their finances a real opportunity.

- Loans are assumable, which could help if you sell in the future

FHA loans are assumable, meaning a buyer can take over your mortgage exactly as is, including your interest rate and loan terms. If rates climb in the future, that can make your home more attractive to buyers.

- Mortgage Insurance Premium (MIP) rules

The ability to cancel MIP depends on the original loan-to-value (LTV). If the LTV was greater than 90%, MIP lasts for the life of the loan. If it was 90% or less, MIP can be automatically canceled after 11 years. Borrowers who want it removed sooner typically refinance into a conventional loan once they have at least 20% equity.

Why Conventional May be Better

- No upfront mortgage insurance premium

Unlike FHA, conventional loans don’t require the 1.75 percent upfront mortgage insurance fee, which lowers the initial cost of buying. This can save thousands at closing, making conventional financing more cost-effective if you qualify.

- Private mortgage insurance can be dropped after reaching 20 percent equity

With conventional loans, mortgage insurance isn’t permanent. Once you reach 20 percent equity, the lender can remove PMI, which reduces your monthly payment. FHA insurance typically lasts for the life of the loan if you put less than 10 percent down.

- More flexible for investment properties or second homes

Conventional financing allows borrowers to purchase investment properties and vacation homes, while FHA is restricted to primary residences. For buyers who plan to expand their real estate portfolio, conventional loans provide more flexibility and long-term options.

In Hollywood, where most homes fall within FHA limits, FHA is often the better choice for first-time buyers. Conventional may save money in the long run if you have excellent credit and can put more down.

You can compare the two options side by side by requesting a Free Quote.

Condo and Townhome Buyers

Hollywood’s condo market is strong, with a mix of high-rises near the beach and affordable inland communities. But if you’re planning to use an FHA loan in Hollywood, Florida, you need to check whether the building is eligible.

- FHA-approved condos are listed on HUD’s site

- If a building isn’t approved, you may still qualify with a spot approval

- Working with a lender familiar with Hollywood condos helps avoid surprises

The Doce Mortgage Group can confirm whether your condo qualifies before you make an offer.

Down Payment Help That Pairs With FHA

Florida offers multiple down payment assistance programs that can be combined with FHA loans.

- State options in 2025 include Florida Housing’s FL Assist up to $10,000, the Hometown Heroes Housing Program equal to 5 percent of the loan amount up to $35,000, and the City of Hollywood offers up to $50,000 in purchase assistance for eligible buyers.

- Some funds are forgivable after a set time.

- Others are repaid only when you sell or refinance.

The Hometown Heroes Program is especially valuable for teachers, healthcare workers, first responders, and other community professionals. It helps them secure housing close to where they work, while reducing upfront costs.

The Doce Mortgage Group also offers the HomeZero Program, which gives qualified non-first time home buyers the opportunity to purchase with zero down payment and added support toward closing costs. This program is designed for buyers who want to keep more cash on hand while still moving forward with homeownership and is more linient on FICO score requirments allowing for scores as low as 580, with no income limitations.

These programs make it easier for first-time buyers in Hollywood, Florida to get started.

Total Cost of an FHA Loan

An FHA payment includes more than just principal and interest. With an FHA loan in Hollywood, Florida, you’ll also pay:

- Annual mortgage insurance premium.

- Property taxes, using Broward’s new homebuyer estimator average millage of about 19.9407 mills, roughly 1.994 percent, though actual bills vary by city and exemptions.

- Homeowners insurance.

On a $480,000 home with 3.5 percent down, a total monthly payment may be around $3,200–$3,400 in 2025. The exact number depends on your interest rate and insurance.

Run the numbers yourself with the Mortgage Calculator.

Step by Step: How to Get Approved

Here’s the process for FHA in Hollywood in 2025:

- Pre-approval with a competent mortgage broker

- Find a home and make an offer

- FHA appraisal for value and safety

- Lender underwriting and approval

- Closing in about 20–30 days

The Doce Mortgage Group helps buyers through each step. To begin, apply using Our Application portal.

Hollywood at a Glance in 2025

Hollywood is a city of variety. Median prices around $495,000 make it more affordable than Miami or Fort Lauderdale, yet it offers the same coastal lifestyle. Homes are taking longer to sell in 2025, giving FHA buyers more time to compete.

Top Reasons People Choose Hollywood

Hollywood offers:

- The Broadwalk along the beach

- Dozens of parks and nature preserves

- An active arts and dining scene

- Family neighborhoods with access to charter and magnet schools

These amenities make Hollywood attractive for families, retirees, and young professionals alike.

Commute, Jobs, and Daily Life

Hollywood’s location is ideal. It sits between Miami and Fort Lauderdale, with access to:

- I-95 and the Turnpike

- Fort Lauderdale-Hollywood International Airport

- Miami International Airport in 25 minutes

- Tri-Rail and Brightline rail systems

This makes Hollywood a smart choice for people who work in either city but want more affordable housing.

Neighborhood Highlights

- Hollywood Beach: Condo living and ocean views

Hollywood Beach offers condo living right along the Atlantic, with easy access to the Broadwalk, waterfront dining, and ocean views that make it one of the city’s most desirable neighborhoods.

- Hollywood Hills: Larger single-family homes

Hollywood Hills is known for spacious single-family homes, tree-lined streets, and a suburban feel while still being close to shopping, schools, and major highways for convenient commuting.

- Emerald Hills: Golf course lifestyle, with FHA-eligible townhomes and condos

Emerald Hills blends golf course views with upscale homes, while still offering FHA-eligible condos and townhomes, giving buyers a chance to enjoy the area’s lifestyle at a lower price point.

- Boulevard Heights: Affordable single-family homes

Boulevard Heights provides some of Hollywood’s most affordable single-family homes, making it attractive for first-time buyers and families looking for FHA financing options in a community-focused neighborhood.

Hollywood offers something for every budget, and FHA financing works in many of these neighborhoods.

FHA-Friendly Home Shopping Tips

To improve your chances with an FHA loan in Hollywood, Florida:

- Check if condos are FHA-approved

- Budget for minor repair requests from the appraisal

- Use an agent experienced with FHA transactions

We Can Help

The Doce Mortgage Group has helped countless buyers secure FHA financing in Hollywood. You can see what others are saying by reading reviews.

Whether you want to test numbers with the Mortgage Calculator, apply in Our Application portal, or Get a Free Quote, the process is simple.

Call Us Today at 305-900-2012 to see how an FHA loan in Hollywood, Florida can help you buy your next home.

FAQs

What are the benefits of the FHA loan in Florida?

Florida FHA loans usually offer lower down payments. With a credit score of 580 or higher, you may only need 3.5% of the home’s price. If your score is below 580, you’ll need a larger down payment.

Are FHA loan Florida requirements different from other states?

The basic rules are the same in every state, but Florida has its own loan limits. For 2025, the FHA loan limit for a single-family home starts at $524,225 and goes up to $967,150 in high-cost counties. For a two-unit home, the limit is $671,200 and can reach $1,238,150 in some areas.

What credit score do you need to buy a house in Florida with an FHA loan?

The credit score you have will affect how much you need for a down payment on an FHA loan in Florida. If your score is 580 or higher, you may qualify with only 3.5% down. With a score between 500 and 579, you will need at least 10% down. If your score is below 500, you usually won’t be approved for an FHA loan.

Can I buy a condo with an FHA loan in Hollywood, Florida?

Yes, but the condo building must either be listed as HUD-approved or qualify for a single-unit spot approval. FHA has specific rules for condos to make sure the building’s finances and management are stable. Before making an offer, check eligibility with your lender to avoid delays.