Table of Contents

- Who Counts as a Non-U.S. Citizen Buyer?

- Can a Non-Citizen Actually Get Approved for a Mortgage in Florida?

- What Documents Do Non-U.S. Citizens Need to Apply?

- How Credit Works for Foreign Buyers

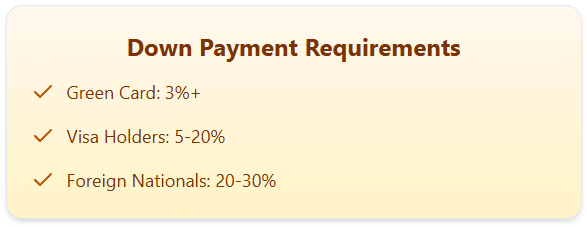

- Down Payment Requirements for Non-Citizens

- Income and Employment Requirements

- Can You Get Pre-Approved as a Non-Citizen?

- Types of Mortgages Available to Non-U.S. Citizens

- What Are the Costs and Fees Involved?

- Top Mistakes Foreign Buyers Make

- How The Doce Mortgage Group Helps Foreign Buyers

- Frequently Asked Questions (FAQ)

- Real Support for Global Homebuyers

Keynotes

- Non-U.S. citizens can qualify for home loans in Florida with the right documentation.

- Down payments range from 3% to 30%, depending on residency and credit profile.

- The Doce Mortgage Group offers expert help and custom loan programs for international buyers.

If you’re looking to buy a home in Florida but you’re not a U.S. citizen or U.S. resident, the good news is: yes, you absolutely can get a mortgage. Cities like Miami, Orlando, and Tampa have always been popular with international buyers, and in 2025, the demand hasn’t slowed down. Whether you’re relocating, investing, or just planting roots, there are real options available to finance your home, even without citizenship.

That said, the process looks a little different depending on your status. Permanent residents, visa holders, and foreign nationals all have paths to homeownership, but the steps, requirements, and loan options aren’t the same across the board.

Let’s break it all down in plain English.

Who Counts as a Non-U.S. Citizen Buyer?

There’s no one-size-fits-all label for “non-U.S. citizen.” If you’re not an American citizen but you want to buy property in Florida, you’ll fall into one of these three categories:

- Permanent Resident: You’ve got a Green Card, which means you’re a lawful permanent resident of the U.S.

- Non-Permanent Resident: You’re in the U.S. with a valid work visa, like an H-1B, H-1C, H-2, H-3 and H-4, E, G, L O, NATO or Canadian and Mexican NAFTA series. You may live here full-time or part-time.

- Foreign National: You don’t live in the U.S. permanently, and you don’t hold a visa or Green Card. You may live overseas and visit the U.S. occasionally.

Each group has different documentation and eligibility requirements when applying for a mortgage. But all three are allowed to buy property and apply for financing.

In fact, Florida remains one of the top states where international buyers purchase homes. According to 2025 data from the National Association of Realtors, 21% of all international home purchases in the U.S. happen in Florida, the highest share among all states.

Can a Non-Citizen Actually Get Approved for a Mortgage in Florida?

Yes, they can, but the process depends on your residency status.

Let’s break it down:

If You’re a Permanent Resident (Green Card Holder)

You’re treated almost the same as a U.S. citizen when applying for a mortgage. You’ll typically qualify for conventional loans or FHA loans with down payments as low as 3%, depending on your credit and income. Most major banks and mortgage companies work with Green Card holders without extra restrictions.

If You’re a Visa Holder (Non-Permanent Resident)

You can still get a mortgage, but it takes a little more paperwork. You’ll need to show a valid visa and prove you have a steady job and income, usually in the U.S. You may be asked to show that your visa won’t expire soon. Expect to make a down payment of around 5% to 20% depending on your situation.

If You’re a Foreign National

This category has the most requirements, but it’s still doable. You don’t need to live in the U.S. to get a mortgage here, but you’ll usually need to:

- Make a higher down payment (20% to 30%)

- Show proof of international income or assets, or choose a no income verification program

- Provide documents in English or translated by a certified translator

- Work with a mortgage company that offers foreign national loan programs

The good news is that The Doce Mortgage Group specializes in helping foreign buyers through this process, including providing access to custom loan programs tailored for international clients.

While many international buyers still pay all-cash (47% nationally according to 2025 data) Florida continues to lead U.S. markets for financed purchases. That means you don’t need to pay cash to buy a home, even if you live overseas or don’t have U.S. residency.

If you’re ready to see what kind of loan options are available to you based on your status, you can Get a Free Quote with no obligation.

What Documents Do Non-U.S. Citizens Need to Apply?

Applying for a home loan in Florida as a non-U.S. citizen means you’ll need to gather a few extra documents. Lenders just want to see that you have legal status, steady income, and the ability to repay the loan.

Here’s what most non-citizen buyers will need:

- A valid passport

- A visa or Green Card (unless you’re a foreign national)

- A Social Security number or ITIN (Individual Taxpayer Identification Number)

- U.S. bank account info

- Proof of income or employment (U.S. or international)

- Credit report (U.S. or international)

If you’re buying as a foreign national, you’ll likely be asked to provide translated bank statements or letters from your home-country bank to show that you have the funds to cover the down payment and closing costs.

This process might sound overwhelming, but it doesn’t have to be. The Doce Mortgage Group walks you through every step and provides document translation services, so you’ll never be stuck wondering what to do next.

How Credit Works for Foreign Buyers

One of the biggest questions non-citizens ask is, “Do I need a U.S. credit score to get approved?”

Not always. If you’ve been living in the U.S. for a while and have opened credit cards or loans, then your credit score will play a major role in your approval and interest rate. But if you’re brand new to the U.S. or have never used credit here, you still have options through programs like first-time homebuyer grants and other assistance.

Here’s how credit typically works for non-citizen buyers:

- Green Card and Visa holders: Your U.S. credit score (if you have one) will be used. If you don’t have one, you may need to provide proof of international credit or make a larger down payment.

- Foreign nationals: Most don’t have a U.S. credit file. Instead, lenders may request:

- Bank reference letters

- Larger reserves or down payments to show financial strength

Some mortgage programs are designed specifically for buyers without U.S. credit. The Doce Mortgage Group works with international clients all the time and helps match you with the right loan program based on your unique financial situation.

Down Payment Requirements for Non-Citizens

How much you’ll need to put down depends mostly on your residency status and credit. Let’s break it down:

- Green Card holders: You may qualify for low down payment programs — even as low as 3% if your credit and income qualify.

- Visa holders: You’ll usually need to put down at least 5% to 20%.

- Foreign nationals: Plan on putting down 20% to 30%. Some specialized programs might require less if you have strong assets or income.

Ready to explore what your down payment could look like? Try our Mortgage Calculator and see how your budget lines up.

Income and Employment Requirements

Your ability to repay the loan is one of the most important things lenders look at, and that’s true whether you’re a U.S. citizen or not.

For non-citizen buyers, income documentation might look different depending on your visa status, where you work, and how long you’ve been earning income. But the basic idea is the same: you need to show that you make enough money to afford the monthly mortgage payment.

Here’s what lenders usually want to see:

- An employment verification letter

- Bank statements showing deposits

- If income is from outside the U.S.: translated documents and proof of currency conversion

In 2025, some programs are making it easier for foreign income earners to qualify, especially those with strong reserves or larger down payments.

The Doce Mortgage Group works with many clients who earn income outside the U.S., and they can help translate your financial documents into something lenders will accept, which can greatly benefit home buyers who have never worked in the U.S. before.

Can You Get Pre-Approved as a Non-Citizen?

Yes, and it’s actually a great move to make early in the process.

Getting pre-approved means a mortgage professional looks at your income, assets, visa or residency status, and credit profile to figure out how much home you can afford. It doesn’t lock you in, but it gives you a number to work with when house shopping.

For non-citizens, pre-approval helps in two big ways:

- It proves you’re serious to sellers and real estate agents.

- It spots potential issues early, like missing documents or credit challenges.

The process is quick and usually takes 1–2 days. Once you’re pre-approved, you’ll get a letter you can show when making offers on homes.

If you’re ready to take the first step, go ahead and fill out Our Application Portal to get started today.

Types of Mortgages Available to Non-U.S. Citizens

There’s no one-size-fits-all mortgage for international buyers — but there are more options than most people realize. Depending on your status and goals, you may qualify for:

ITIN Loans

For buyers who don’t have a Social Security number but do have an ITIN. These loans are available through select programs and usually require a larger down payment (often 20% or more).

Foreign National Loan Programs

Tailored to people who live abroad or who don’t hold legal residency in the U.S. These loans may not require U.S. credit but will require proof of income and larger reserves. Down payments typically start at 25%, but terms vary by situation.

Many of these options are available through The Doce Mortgage Group, and their team will help match you with the loan that fits your situation — whether you’re working in the U.S. on a visa or buying from overseas.

Need help figuring out which loan type works for you? Get a Free Quote and a member of the team will reach out to walk you through the options.

What Are the Costs and Fees Involved?

Buying a home always comes with more than just the down payment. If you’re a non-U.S. citizen buying property in Florida, here are the most common costs you’ll want to be prepared for:

- Closing Costs: These usually range from 3% to 6% of the purchase price. That includes appraisal fees, title insurance, legal fees, and more.

- Property Taxes: Florida has an average effective property tax rate of about 0.80% in 2025, though this varies by county.

- Private Mortgage Insurance (PMI): If you’re putting down less than 20% and using a conventional loan, you may need PMI, which adds a monthly fee to your payment.

- Escrow Deposits: Lenders often require a few months of taxes and insurance to be prepaid at closing.

- Currency Exchange Fees: If you’re wiring money from a foreign bank, expect to pay international transfer or conversion fees.

Some of these costs can catch buyers off guard, especially if you’ve never bought property in the U.S. before. The Doce Mortgage Group provides full loan estimates up front so you’ll know what to expect before you commit to anything.

Top Mistakes Foreign Buyers Make

Even if you’ve bought property before in another country, the U.S. mortgage system might feel unfamiliar. Here are a few mistakes international buyers often make:

- Waiting too long to open a U.S. bank account

Having a U.S.-based account makes everything easier — from paying fees to wiring your down payment. It also shows stability.

- Not understanding visa-based restrictions

Some loan programs have specific rules about which visa types are eligible. Working with a mortgage pro who knows the system matters.

- Skipping pre-approval

This is a big one. Without pre-approval, your offer on a house may not be taken seriously — especially in a competitive Florida market.

- Trying to handle it alone

Buying from overseas or with limited U.S. experience can be complex. Having a team that understands how to work with international buyers can save time and money.

Avoiding these common missteps starts with working with a mortgage company that knows what you’re up against.

How The Doce Mortgage Group Helps Foreign Buyers

The Doce Mortgage Group has years of experience helping non-citizens finance homes in Florida. They offer personal, hands-on support for every kind of international buyer — whether you’re here on a visa, have permanent residency, or are buying from abroad.

Here’s what makes them different:

- Custom loan programs for Green Card holders, visa holders, and foreign nationals

- Multilingual support for buyers who prefer help in Spanish, Portuguese, or other languages

- Fast, transparent communication so you’re never left in the dark

- Help accessing programs like the HomeZero Program and other Down Payment Assistance Programs to reduce your upfront costs

- Helpful tools like their online Mortgage Calculator to estimate your monthly payment and see what’s possible for your budget

Whether you’re buying a vacation home in Miami or a family home in Orlando, The Doce Group has the experience to make the process smooth and stress-free.

Real Support for Global Homebuyers

You don’t need to be a U.S. citizen to buy a home in Florida — you just need the right team to guide you. Whether you’re a permanent resident, visa holder, or foreign national, getting a mortgage is possible when you have the right programs, support, and a plan that fits your goals.

The Doce Mortgage Group helps buyers from all over the world find their place in Florida. From low-down-payment options to personalized mortgage guidance, their team is here to walk you through it all. Want to see what others are saying? Check out customer reviews from real clients who’ve worked with The Doce Group.

Call us today at 305-900-2012 to speak with a mortgage expert who can help you start your home purchase in Florida.

FAQs

Can I buy a house in Florida without a Green Card?

Yes. You don’t need to be a U.S. citizen or even a permanent resident to buy a home in Florida. Foreign nationals and visa holders can purchase property and qualify for mortgage programs that fit their situation.

What’s the minimum down payment for a foreign national?

Most foreign national loan programs require a minimum down payment of 25% to 30%. The exact amount depends on your credit, income, and the property you’re buying.

How long does the mortgage process take for non-citizens?

It usually takes 30 to 45 days, similar to regular mortgage timelines. If you’re buying from overseas or need translated documents, it might take a little longer — but The Doce Mortgage Group keeps everything moving on schedule.

Can I qualify if I’m self-employed or earn income outside the U.S.?

Yes. Many buyers are self-employed or earn foreign income. You’ll just need to provide documents showing stable income, like business records, bank statements, or CPA letters. The Doce Mortgage Group works with these kinds of buyers all the time.