Quick Answer

Yes, a VA Loan In Hollywood Florida can make a waterfront property more affordable by allowing qualified veterans to buy with no down payment, no loan limits, and no monthly private mortgage insurance, and competitive 2025 interest rates. The Doce Mortgage Group can guide you through the process and help structure your loan to fit the Hollywood waterfront market.

Table of Contents

- What Makes A VA Loan In Hollywood Florida Unique?

- Can A VA Loan Cover Waterfront Homes In Hollywood Florida?

- Loan Amounts, Entitlement, And Down Payment Scenarios In 2025

- What Are The Requirements To Qualify For A VA Loan In Hollywood Florida?

- How Competitive Is A VA Loan Offer In The Hollywood Florida Waterfront Market?

- Are There Extra Costs With A VA Loan For Waterfront Homes?

- Can You Combine A VA Loan With Down Payment Assistance Programs In Hollywood Florida?

- How Does The VA Loan Appraisal Process Work For Waterfront Homes?

- Can You Use A VA Loan For A Hollywood Florida Condo Or Townhome On The Water?

- Why Do Veterans Choose Hollywood Florida For Waterfront Living?

- What Are The Best Neighborhoods For Waterfront Homes In Hollywood Florida?

- How Strong Is The Hollywood Florida Real Estate Market In 2025?

- FAQs About VA Loans in Hollywood, Florida

- How to Get Started

Keynotes

- Veterans with full entitlement face no loan limits when buying in 2025.

- The Doce Mortgage Group provides VA loan options up to $6 million.

- VA benefits make Hollywood waterfront homes more affordable and competitive.

Hollywood, Florida is known for its stunning beaches, Intracoastal Waterway, and highly desirable waterfront neighborhoods, making it a dream location for many veterans who want to settle in South Florida. But with home prices rising in 2025, the big question is whether a VA loan in Florida can really help make a waterfront home in Hollywood affordable.

The truth is that a VA Loan In Hollywood Florida is one of the strongest financing tools available for veterans because it comes with benefits like no down payment and no private mortgage insurance.

What Makes A VA Loan In Hollywood Florida Unique?

A VA Loan In Hollywood Florida is backed by the Department of Veterans Affairs and designed to make homeownership easier for service members, veterans, and qualified surviving spouses. The main benefits in 2025 include:

- No down payment required on most homes

- No monthly private mortgage insurance

- Competitive fixed and adjustable interest rates

- Flexible credit score requirements compared to other loan types

- Limits on closing costs that protect the buyer

For buyers who want to live in Hollywood, these features matter because the city has higher property values than many other parts of Florida. A VA loan helps offset some of that cost burden and opens the door to homes that may otherwise feel out of reach.

Can A VA Loan Cover Waterfront Homes In Hollywood Florida?

The short answer is yes, a VA Loan In Hollywood Florida can be used to buy a waterfront home. In September 2025, the median sale price in Hollywood was about $480,000, and current listing medians show Hollywood Lakes around $750,000 and Harbor Islands around $1.8 million.

Some veterans wonder whether VA loans can actually cover these higher prices. The good news is, the VA financing has no hard limit on the loan amount when buyers have full entitlement. As long as the borrower qualifies with sufficient income and credit, and the home appraises for the purchase price, a VA loan can be used to buy even a multi-million-dollar property.

The Doce Mortgage Group has structured VA loans up to $6 million, giving veterans confidence that the program works at a wide range of price points. For buyers who thought a home on the water in Hollywood was out of reach, this benefit changes the equation entirely.

Loan Amounts, Entitlement, And Down Payment Scenarios In 2025

Understanding entitlement is key to knowing how much you can borrow with a VA loan.

No Loan Limits With Full Entitlement

As of January 1, 2020, the Blue Water Navy Vietnam Veterans Act removed VA loan limits for eligible borrowers with full entitlement. This means that if you have full entitlement and enough income and credit to qualify, there is no maximum loan amount set by the VA. The VA guarantees 25 percent of any loan amount, no matter how high, provided the property appraises and you meet qualification standards. That’s why a VA Loan In Hollywood Florida can be used to finance homes that range from modest condos to luxury estates.

When Limits Still Apply

Loan limits may apply if you do not have full entitlement. This happens in scenarios like:

- You already have an active VA loan on another property

- You’ve defaulted on a VA loan in the past

- You’ve used part of your entitlement and it is still tied up in another property

In these cases, lenders use the conforming loan limit to determine whether a down payment is required. For 2025, the baseline conforming loan limit for a one-unit home in the contiguous United States is $822,550. The lender calculates your remaining guaranty, then applies the 25 percent guaranty rule to see if a small down payment is needed for your target purchase price.

Examples

- A veteran with full entitlement can purchase a $1.5 million waterfront property in Hollywood with no down payment if they qualify for the payment and the appraisal supports the value.

- A veteran with partial entitlement shopping for a $900,000 home may need to bring a down payment depending on how much entitlement is already used.

- In both scenarios, the VA guarantee significantly reduces risk for the financing, making approval more attainable than with other programs.

This flexibility is what makes VA loans so effective in Hollywood’s waterfront market. With full entitlement, buyers can go after properties that align with their lifestyle without worrying about a VA-imposed ceiling. With partial entitlement, the rules still allow for reduced down payments compared to conventional or FHA loans.

What Are The Requirements To Qualify For A VA Loan In Hollywood Florida?

To use a VA Loan In Hollywood Florida, veterans must meet both service and financial requirements. In 2025, the main qualifications include:

- Service requirements: At least 90 days of active service during wartime or 181 days during peacetime, or 6 years in the National Guard or Reserves.

- Credit score: While VA itself does not set a minimum, most programs in 2025 approve scores of 620 or higher.

- Debt-to-income ratio: Generally capped around 41 to 55 percent, though compensating factors like cash reserves can allow flexibility.

- Property requirements: The home must pass VA appraisal guidelines, which include safety and livability checks.

Hollywood’s waterfront homes are often older, which means some may need repairs to meet appraisal standards. Veterans should prepare for possible fixes like railings, roofing updates, or electrical adjustments.

If you’re ready to explore your eligibility, the fastest way to begin is through Our Application portal, where you can securely start the process and get pre-approved.

How Competitive Is A VA Loan Offer In The Hollywood Florida Waterfront Market?

Hollywood, Florida is a competitive place to buy property in 2025, and waterfront homes often receive multiple offers. Some sellers believe VA loans are harder to close because of the stricter appraisal standards. However, the truth is that a VA Loan In Hollywood Florida can be just as competitive as any other financing option if the buyer prepares the offer carefully.

In today’s market, Hollywood homes have been taking around 88 days to sell as of September 2025; updated waterfront homes can still move faster than the city median depending on price and condition. Sellers want confidence that the deal will close smoothly, so veterans using VA financing should focus on:

- Getting pre-approved before making an offer

- Offering strong earnest money deposits

- Working with an experienced real estate professional who understands VA loans

- Being flexible with closing timelines if needed

The VA appraisal does check for safety issues like peeling paint, faulty railings, or outdated electrical systems, but these aren’t meant to scare off sellers. They’re simply designed to protect veterans from unsafe properties. By presenting a solid, well-structured offer, veterans can compete head-to-head with conventional buyers.

If you’re looking to see how your budget compares to homes currently available, try using our Mortgage Calculator to run different price scenarios for waterfront properties.

Are There Extra Costs With A VA Loan For Waterfront Homes?

Another advantage of using a VA Loan In Hollywood Florida is avoiding many of the costs that come with other loan types. There’s no private mortgage insurance, no required down payment with full entitlement, and capped closing costs.

The one unique fee is the VA funding fee, which helps sustain the program for future borrowers. In 2025, the funding fee for a purchase is:

- 2.15 percent of the loan amount for first-time use with less than 5 percent down

- 1.5 percent of the loan amount with a down payment of 5 percent or more

- 1.25 percent of the loan amount with a down payment of 10 percent or more

Some borrowers are exempt from paying this fee, including veterans with a qualifying service-connected disability, active-duty service members awarded a Purple Heart, and certain surviving spouses.

For example, a first-time buyer purchasing a $600,000 waterfront property with no down payment would normally pay a funding fee of $12,900. If that buyer has a service-related disability rating, the fee is waived, reducing their cash to close and their financed balance.

Closing costs also tend to be more favorable for VA buyers because the program limits what can be charged. Buyers can expect to pay for items like appraisal, title work, recording fees, and insurance, but sellers are allowed to contribute toward these expenses. This flexibility can reduce out-of-pocket costs and keep the total investment lower than with other loan options.

Can You Combine A VA Loan With Down Payment Assistance Programs In Hollywood Florida?

Yes, it’s possible to combine a VA Loan In Hollywood Florida with additional support from assistance programs. While VA loans don’t require a down payment, some Florida programs can help cover closing costs or provide grants that ease the overall financial burden.

Three options veterans should know about are:

- Down Payment Assistance Programs: These can provide closing cost help, grant money, or forgivable loans that reduce the upfront expense.

- Florida Hometown Heroes program offers up to $35,000 in down payment and closing cost assistance through a 0% interest second mortgage, along with favorable loan terms, making homeownership more accessible for those who serve their communities.

- The Doce Mortgage Group HomeZero Program: Designed to eliminate down payments entirely, this program works alongside VA financing to maximize affordability.

For veterans aiming to stretch their budget toward Hollywood’s higher-priced waterfront properties, these programs can provide an extra financial cushion. This means more flexibility when deciding between a condo on the beach or a single-family home along the Intracoastal.

If you’d like to see how much assistance you may qualify for, you can Get a Free Quote and review personalized scenarios.

How Does The VA Loan Appraisal Process Work For Waterfront Homes?

Every VA purchase requires an appraisal to confirm the property’s value and ensure it meets minimum property standards. In Hollywood, this is particularly important because many waterfront homes are older or exposed to harsher conditions due to saltwater and humidity.

A VA appraisal focuses on two things:

- Confirming that the property value supports the loan amount

- Ensuring the home is safe, sound, and sanitary for the veteran buyer

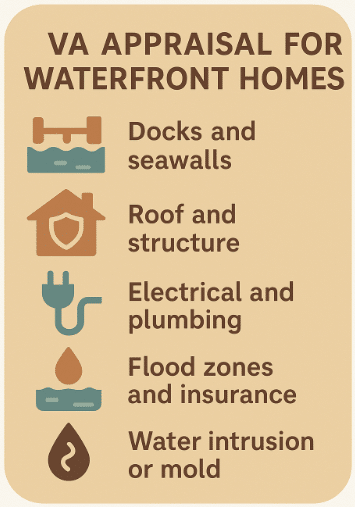

For waterfront homes, common issues appraisers check include:

- Condition of docks, seawalls, and bulkheads

- Roof age and structural soundness

- Electrical and plumbing systems

- Flood zone status and insurance requirements

- Signs of water intrusion or mold

If an appraiser believes the value may come in lower than the contract price, the Tidewater process allows the appraiser to request additional comparable sales before finalizing the report. This gives the veteran’s team a chance to support the value. If the property does not meet certain standards, the seller often has the option to make repairs so the deal can proceed.

This process is not meant to make buying harder — it’s designed to protect veterans from unsafe homes and overpaying for properties that don’t appraise. In competitive markets like Hollywood, knowing how to navigate the appraisal process can be the difference between keeping a deal on track and starting over.

Can You Use A VA Loan For A Hollywood Florida Condo Or Townhome On The Water?

Yes, a VA Loan In Hollywood Florida can be used to buy a condo or townhome, but the development must be on the VA’s approved condo list. In 2025, several waterfront communities in Hollywood are approved, especially those along the Intracoastal.

The biggest hurdle with condos is that the entire association must meet VA standards. This includes financial stability, occupancy rates, and property condition. If the community isn’t approved, The Doce Mortgage Group can often help submit documents to get it reviewed.

Townhomes usually qualify more easily since they’re treated like single-family homes. For veterans who prefer lower maintenance living while still enjoying waterfront views, condos and townhomes are a strong option.

If you’re curious about whether a specific community is eligible, you can Get a Free Quote and include the property details for review.

Why Do Veterans Choose Hollywood Florida For Waterfront Living?

Hollywood has become one of the most appealing spots in South Florida for waterfront living. Veterans often choose this city because it combines the feel of a smaller coastal town with quick access to major hubs like Miami and Fort Lauderdale. In 2025, Hollywood is ranked as one of the top affordable beach towns in South Florida compared to its neighbors.

Highlights that attract veterans include:

- The Hollywood Beach Broadwalk, a 2.5-mile stretch along the ocean with shops, restaurants, and biking paths

- Family-friendly neighborhoods near excellent schools and parks

- Proximity to both Fort Lauderdale-Hollywood International Airport and Miami International Airport

- A vibrant mix of cultural events, outdoor activities, and diverse dining options

For veterans retiring or relocating with their families, Hollywood offers both the coastal lifestyle and the conveniences of a larger metro area nearby.

What Are The Best Neighborhoods For Waterfront Homes In Hollywood Florida?

Several neighborhoods in Hollywood stand out for veterans looking at waterfront homes with a VA Loan In Hollywood Florida:

- Hollywood Lakes: Known for its charming older homes and proximity to the Intracoastal and Hollywood Beach. Many homes here were built mid-century and may require updates but come with beautiful water views.

- Harbor Islands: A gated luxury community featuring modern waterfront estates, private docks, and resort-style amenities. Prices here are higher, often reaching into the millions, but some homes may still be partially covered with VA financing.

- South Lake and North Lake: These areas feature larger waterfront homes, many with boat access, and a more residential feel than the beachside condos.

- Hollywood Beach condos: High-rise buildings directly on the sand with VA-eligible communities for buyers who want maintenance-free living.

Each neighborhood offers a different lifestyle, from quiet residential streets to bustling beachfront activity. Veterans should think about whether they prefer boating access, walkability, or privacy when choosing an area.

If you’re exploring neighborhoods now, it’s smart to start the process through Our Application portal, which gives you an accurate pre-approval and makes your offer more competitive when you find the right home.

How Strong Is The Hollywood Florida Real Estate Market In 2025?

Hollywood, Florida continues to be a competitive real estate market in 2025, especially for waterfront properties. The average home price in Hollywood has risen to around $520,000, while waterfront homes in prime neighborhoods can easily exceed $1 million. According to recent housing reports, waterfront homes in Broward County have appreciated by about 6 percent over the past year, with strong demand coming from both local buyers and out-of-state relocations.

Waterfront properties tend to move quickly. While the citywide median days on market was about 88 days in September 2025, desirable updated waterfront listings can still sell faster than the city median. This fast-moving environment means veterans using a VA Loan In Hollywood Florida should be prepared with pre-approval and strong offers to avoid missing out.

Another important factor in 2025 is flood insurance. Many waterfront homes fall within flood zones, and insurance costs can be significant. Veterans should review quotes early in the buying process so they understand their full monthly budget.

For those wanting to run numbers, our Mortgage Calculator is a simple way to estimate monthly payments based on different property prices.

FAQs About VA Loans in Hollywood, Florida

Do VA loans have a maximum amount in 2025?

No. With full entitlement, there is no loan limit. The VA guarantees 25 percent of any amount, and The Doce Mortgage Group offers VA loans up to $6 million. Loan limits only apply if entitlement is partial.

Can I buy a duplex or multi-family property with a VA loan in Hollywood?

Yes. You can purchase up to a 4-unit property with a VA loan, provided you live in one unit as your primary residence.

How long does it take to close a VA loan in Hollywood Florida?

Most VA loans close in 30 to 45 days, which is in line with conventional loans.

Do VA loans have income limits in Florida?

No. Approval is based on service history, credit, debt-to-income ratio, and residual income, not income caps.

Can I refinance my Hollywood waterfront home with a VA loan?

Yes. The VA offers Interest Rate Reduction Refinance Loans (IRRRL) and cash-out refinance programs to help lower payments or access equity.

How to Get Started

The Doce Mortgage Group has helped thousands of veterans across Florida achieve homeownership, including many in Hollywood. how smooth and stress-free the process feels thanks to personalized guidance and clear communication. You can read what other veterans and families have said about their experience on our reviews page.

Veterans considering a waterfront home in Hollywood should take the first step now by applying online, running payment scenarios, or calling for guidance. With home prices rising and competition strong in 2025, getting started early can make the difference between securing your dream property or missing out.

Call us today at 305-900-2012 to start your path toward owning a waterfront home in Hollywood, Florida with the benefits of a VA loan.