The opportunity of owning a home is exciting. In a city like Boca Raton, with its stunning beaches, excellent schools, and thriving economy, it’s no wonder many people are drawn to buying property here. A VA loan offers veterans, active-duty military, and certain surviving spouses the chance to purchase a home with unique advantages. In this guide, I’ll walk you through the steps to qualify for a VA loan in Boca Raton and why this beautiful city might be the perfect place for you to settle down.

Why Boca Raton is a Great Place to Buy a Home

Boca Raton, Florida, is known for its upscale lifestyle and perfect mix of suburban tranquility and urban amenities. This city offers a vibrant community, excellent healthcare, and an abundance of cultural and recreational activities. With miles of pristine beaches, world-class shopping at Mizner Park, and a range of dining options, Boca Raton is ideal for those looking to enjoy both relaxation and excitement.

Additionally, the city’s top-notch educational institutions, such as Florida Atlantic University and a variety of public and private schools, make it an attractive option for families. The warm weather year-round and proximity to both Miami and Fort Lauderdale add to the area’s appeal.

Benefits of a VA Loan in Boca Raton

A VA loan in Boca Raton can provide first-time buyers with numerous advantages, especially if they qualify for the benefits of the program. Here’s why a VA loan may be the right option for you:

- No Down Payment: One of the most significant benefits of a VA loan is the ability to purchase a home without a down payment. For many first-time buyers, saving for a down payment can be a major obstacle to homeownership. With a VA loan, qualified buyers are not required to put money down upfront, which can make homeownership more accessible and affordable. This benefit eliminates one of the most significant hurdles, allowing more veterans and active-duty service members to own a home.

- Lower Interest Rates: VA loans are known for offering lower interest rates compared to conventional loans. This can translate into substantial savings over the life of the loan, especially for long-term borrowers. Since the VA guarantees a portion of the loan, lenders are able to offer better terms to qualified buyers. Lower interest rates mean lower monthly payments, making homeownership more affordable. This is a major advantage for first-time buyers looking to save money over time and secure a stable financial future.

- No Private Mortgage Insurance (PMI): Unlike many conventional loans that require private mortgage insurance (PMI) if the borrower puts down less than 20%, VA loans do not require PMI. This is a significant cost-saving feature. PMI can add hundreds of dollars to your monthly mortgage payment, so eliminating this requirement means that first-time buyers can keep more money in their pockets each month. This reduction in costs can make homeownership more financially viable and less stressful for qualifying veterans.

- Flexible Credit Requirements: Another key advantage of a VA loan is the more lenient credit requirements compared to traditional mortgages. While conventional loans often require higher credit scores for approval, VA loans have more flexible credit guidelines, making it easier for first-time buyers to qualify. This flexibility allows veterans and active-duty service members with less-than-perfect credit to still secure a home loan. It can also help borrowers with limited credit history, making it a great option for those who have struggled to build their credit.

- Capped Closing Costs: The VA places limits on the amount veterans can be charged in closing costs, which can reduce the financial strain that often accompanies buying a home. With conventional loans, closing costs can sometimes be overwhelming, but the VA helps ensure that veterans and active-duty service members are not overcharged. These caps are designed to protect buyers from excessive fees, which can help keep the overall cost of purchasing a home lower and make the process more affordable for first-time homebuyers.

- Higher Loan Limits: The Doce Mortgage Group offers VA loans up to $6,000,000. This higher loan limit is especially beneficial for veterans looking to purchase larger, more expensive homes in desirable areas like Boca Raton. With the ability to secure higher loan amounts, you have more flexibility in choosing the home that best suits your needs.

How to Qualify for a VA Loan in Boca Raton

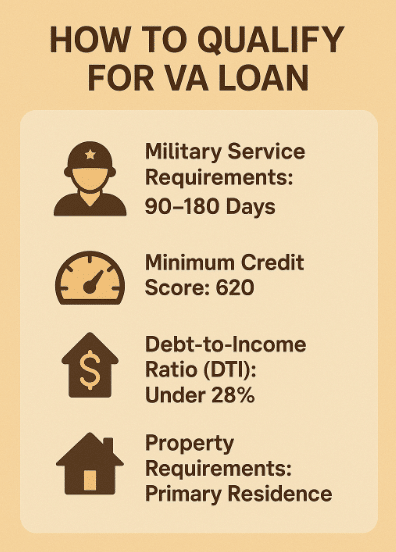

To qualify for a VA loan in Boca Raton, there are a few requirements that potential buyers must meet. While the process can seem complex, understanding these steps can simplify things and help ensure that you’re on the right track.

1. Military Service Requirements

One of the primary eligibility factors for a VA loan is your military service. Here’s what you need to know:

- Active Duty Service Members: If you are an active duty service member, you may still be eligible for a VA loan, as long as you meet the minimum length of service requirements. This can include service members who are currently serving in any branch of the U.S. military. The VA loan program recognizes the sacrifices of active duty personnel and provides homeownership opportunities while you are still serving.

- Veterans: If you are a veteran who has served in the U.S. military, you could qualify for a VA loan if you have met the required number of service days, typically 90 days during wartime or 181 days during peacetime. The program is designed to reward veterans for their service by offering home loan benefits such as no down payment and lower interest rates.

- Surviving Spouses: In certain circumstances, surviving spouses of veterans who passed away in service or from a service-related injury may qualify for a VA loan. This benefit helps ensure that the families of fallen service members can access affordable homeownership options. Eligibility may depend on factors like the length of marriage and the cause of the veteran’s death, so it’s important to check specific requirements.

You can request a Certificate of Eligibility (COE) from the Department of Veterans Affairs to verify your eligibility.

2. Credit Score

While the VA doesn’t set a minimum credit score requirement, most lenders will look for a score of at least 620. The good news is, The Doce Mortgage Group’s offers 100% financing with FICO scores as low as 500!

3. Income and Employment Verification

Your lender will also require proof of income and employment to assess your ability to repay the loan. This typically includes:

- Recent pay stubs

- Tax returns

- W-2s

- Bank statements

A stable and consistent income history will increase your chances of approval.

4. Debt-to-Income Ratio (DTI)

Your DTI ratio is one of the most important factors that lenders use to determine your ability to repay the loan. While most lenders prefer a lower DTI, The Doce Mortgage Group allows for DTIs as high as 70%! This gives more flexibility to buyers who may have higher levels of debt but still wish to qualify for a VA loan. The higher DTI limit can be particularly helpful for those with student loans or other obligations but who have a solid income.

- Front-End DTI: Front-end debt-to-income (DTI) ratio focuses specifically on your housing-related costs, such as your monthly mortgage payment, property taxes, and homeowner’s insurance. This ratio is calculated by dividing these costs by your gross monthly income. Most lenders typically prefer a front-end DTI ratio under 50%, which ensures that your housing expenses remain manageable in relation to your overall income.

- Back-End DTI: Back-end DTI ratio takes into account all of your monthly debt obligations, including housing costs, credit card payments, student loans, and car loans. It is calculated by dividing your total debt payments by your gross monthly income. Most lenders look for a back-end DTI ratio under 50%, as higher ratios may signal financial strain and an increased risk of default.

5. Property Requirements

A VA loan in Boca Raton only be used for primary residences. The property must meet specific standards to ensure it’s safe, sanitary, and structurally sound. This is where a VA appraisal comes into play. The VA will inspect the home to ensure it meets these standards.

Top 10 Reasons People Want to Live in Boca Raton

- Beaches: Boca Raton is home to some of the most stunning beaches in South Florida, attracting residents and tourists alike. Spanish River Park and South Beach Park offer clear waters, soft sand, and a relaxed atmosphere, perfect for swimming, sunbathing, or beach volleyball. These beaches are well-maintained and have amenities such as picnic areas and walking paths, making them ideal for family outings or simply enjoying the natural beauty of the coastline.

- Excellent Schools: Boca Raton is renowned for its excellent educational opportunities, featuring a mix of top-rated public and private schools. Families in the area have access to award-winning institutions like Boca Raton Community High School and the International School of Boca Raton, which offer rigorous academic programs. The city also boasts numerous opportunities for higher education, including Florida Atlantic University, making it a perfect place for parents who value educational success for their children.

- Vibrant Downtown: The downtown area of Boca Raton is a lively hub full of upscale shopping, dining, and entertainment options. Mizner Park, a popular destination, is home to luxury boutiques, renowned restaurants, and cultural attractions like the Boca Raton Museum of Art. Whether you’re looking to shop for high-end fashion, dine at a gourmet restaurant, or attend a performance, the vibrant downtown scene provides endless opportunities for both relaxation and excitement.

- Outdoor Activities: Boca Raton offers abundant outdoor activities for residents to enjoy year-round. Golf enthusiasts can take advantage of the city’s world-class golf courses, while nature lovers can explore the many scenic trails and parks, such as the Gumbo Limbo Nature Center and the Boca Raton Greenway. The warm climate and variety of recreational spaces also make it a perfect place for kayaking, biking, hiking, and other outdoor sports, providing something for everyone.

- Proximity to Major Cities: Boca Raton’s location offers the best of both worlds: the peaceful lifestyle of a small city with quick access to bustling metropolitan areas. Just a short drive south, Miami offers vibrant nightlife, cultural events, and business opportunities. Fort Lauderdale, to the north, is another nearby destination known for its arts scene, shopping, and waterfront dining. The city’s proximity to these major hubs makes it an ideal place for professionals who want a quieter home life but still seek urban amenities.

- Strong Real Estate Market: Boca Raton’s real estate market is thriving, with a mix of luxury homes, townhouses, and condominiums available for both first-time buyers and experienced investors. The demand for property in the area continues to rise due to the city’s appeal as a top destination for retirees, families, and professionals. The diverse range of housing options ensures that there is something for everyone, whether you’re looking for a cozy starter home or a luxurious waterfront property.

- Safety and Community: Boca Raton is known for its safe, family-friendly environment, boasting some of the lowest crime rates in South Florida. The city’s commitment to public safety is evident in its well-trained police force and active community engagement initiatives. The strong sense of community makes it a perfect place for families to raise children or for retirees looking for a peaceful and welcoming neighborhood. With its safe streets and tight-knit atmosphere, residents can enjoy a high quality of life.

- Cultural Attractions: Boca Raton is not just a place for outdoor activities and great shopping; it also has a rich cultural scene. In addition to the Boca Raton Museum of Art, Mizner Park Amphitheater hosts concerts, theater productions, and festivals throughout the year. With a mix of cultural institutions, art galleries, and performance spaces, Boca Raton offers a wealth of cultural experiences to its residents.

- Shopping and Dining: Boca Raton is a shopper’s paradise, with a variety of high-end retail outlets and dining experiences. In addition to Mizner Park, which features luxury boutiques and renowned restaurants, there are other shopping centers like Town Center at Boca Raton and Royal Palm Place. Whether you’re after designer brands, gourmet dining, or casual cafes, the city offers an extensive selection of choices that cater to all tastes and preferences.

- Healthcare and Wellness: Boca Raton is known for its outstanding healthcare facilities, which are a major draw for both retirees and families. The city is home to several top-rated hospitals and medical centers, such as Boca Raton Regional Hospital, which offer a wide range of services from routine check-ups to advanced surgical procedures. The focus on health and wellness extends to numerous fitness centers, spas, and wellness programs, making it easy for residents to maintain a healthy and active lifestyle.

These factors contribute to the city’s reputation as one of the best places to live in South Florida.

How to Apply

Once you have confirmed your eligibility and gathered all necessary documents, the next step is to apply for your VA loan in Boca Raton.

Make sure to provide all required documents promptly to avoid delays in the approval process. It’s also wise to get a pre-approval letter before you start looking for homes. This letter indicates that a lender has reviewed your financial situation and is willing to lend you a specific amount, giving you an advantage when making an offer on a property.

If you’re ready to get started, you can apply today!

Explore Available Loan Options

At The Doce Mortgage Group, we understand how important it is to find the right loan to fit your needs. We offer a variety of loan options for veterans, including VA loans with flexible terms. You can start by calculating your potential monthly payments using our Mortgage Calculator.

Additionally, you may qualify for programs like Down Payment Assistance Programs or even a Zero Down Mortgage in Florida, making it easier to step into your new home.

Don’t just take our word for it. Take a look at our customer reviews to hear how we’ve helped others achieve their dreams of homeownership in Boca Raton and beyond.

If you’re ready to take the first step towards homeownership in Boca Raton, The Doce Mortgage Group is here to help. Get a Free Quote today and see how affordable a VA loan can be. Or call us at 305-900-2012 to speak with one of our experts and begin your journey toward owning your dream home!