Living in Boca Raton, Florida, offers a combination of luxury, convenience, and year-round sunshine. With its beautiful beaches, excellent schools, upscale shopping, and vibrant arts scene, Boca Raton is an attractive destination for those looking to settle down in a desirable location. Additionally, the city provides excellent recreational opportunities, a strong economy, and a safe, family-friendly environment.

If you’re looking to buy a home in Boca Raton, qualifying for a jumbo mortgage loan in Boca Raton Florida is an important step in making your dream home a reality. The good news is that there are ways to qualify without having to pay Private Mortgage Insurance (PMI), making your monthly payments more manageable.

What Makes a Mortgage Loan a “Jumbo” Loan?

A jumbo mortgage loan in Boca Raton Florida is a loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). For most of Florida, the conforming loan limit is $806,500 for a single-family home in 2025. However, homes in high-demand areas like Boca Raton often exceed this limit, requiring a jumbo loan to finance the purchase. These loans come with higher borrowing limits, allowing potential homeowners to purchase more expensive properties.

While jumbo loans can open the doors to more expensive homes, they come with their own set of challenges. One of the most common challenges is the requirement to pay PMI, which can significantly increase your monthly payment. Thankfully, there are strategies to qualify for a jumbo mortgage loan in Boca Raton Florida without having to pay this additional cost.

Why Choose a Jumbo Loan in Boca Raton?

Boca Raton’s housing market is known for its luxury homes, many of which exceed the conforming loan limits. If you’re considering buying a home in this area, a jumbo mortgage loan allows you to secure financing for properties that fall outside traditional lending limits. Some of the key reasons why you may want to choose a jumbo loan in Boca Raton include:

- Desirable location: Boca Raton boasts an enviable combination of excellent weather, a strong sense of community, and picturesque homes, making it an ideal place for those seeking luxury living. With its proximity to beautiful beaches, top-rated schools, and an array of recreational activities, it attracts individuals looking for a sophisticated lifestyle in a safe, family-friendly environment.

- Access to more expensive homes: Jumbo loans provide buyers with the ability to purchase high-value properties that surpass the limits set for traditional conforming loans. This allows buyers to enter the luxury real estate market in Boca Raton, where home prices often exceed the standard loan limits. As a result, jumbo loans offer more flexibility for those looking to buy larger or more opulent homes.

- Potential for better loan terms: Many jumbo loans come with attractive, competitive interest rates and flexible repayment terms that can help homeowners achieve their housing goals. These terms often give borrowers more control over the structure of their loan, including options for adjustable-rate or fixed-rate loans. By securing favorable loan conditions, buyers can enjoy more manageable monthly payments and potentially save money over the life of the loan.

- Investment opportunities: Real estate in Boca Raton is known for holding its value well over time. The city’s strong demand for luxury homes and limited inventory contribute to a stable housing market, making properties in the area an appealing investment opportunity. For investors, purchasing property in Boca Raton can result in both long-term appreciation and potential rental income, making it an attractive option for those looking to grow their portfolio.

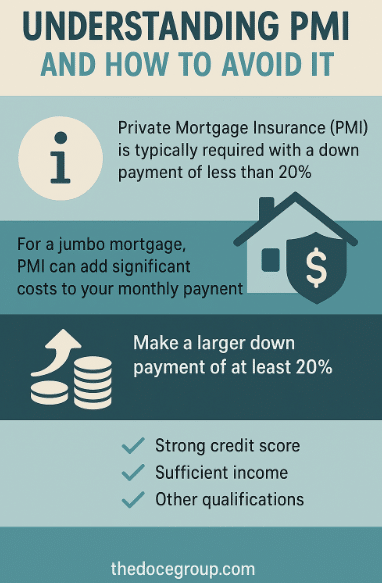

Understanding PMI and How to Avoid It

Private Mortgage Insurance (PMI) is a policy that protects the lender in case the borrower defaults on the loan. It is typically required when a borrower has a down payment of less than 20% of the home’s purchase price. For a jumbo mortgage loan in Boca Raton Florida, PMI can add a significant cost to your monthly mortgage payment. However, it is possible to qualify for a jumbo mortgage without paying PMI if you meet certain criteria.

The first step is to make a larger down payment. With a down payment of at least 20%, you may be able to avoid the need for PMI altogether. Additionally, you’ll need to ensure that you meet other qualifications, such as a strong credit score and sufficient income, to qualify for a jumbo loan without PMI.

Key Strategies for Avoiding PMI on a Jumbo Loan in Boca Raton

Here are several strategies that can help you qualify for a jumbo mortgage loan in Boca Raton Florida without paying PMI:

- Make a Larger Down Payment

One of the most straightforward ways to avoid PMI is by making a larger down payment. If you can put down at least 20% of the purchase price of the home, most lenders will not require PMI. This may mean waiting a little longer to save up for a larger down payment, but it can save you money in the long run by lowering your monthly mortgage payments.

- Look for Lenders Offering No-PMI Jumbo Loans

Some lenders offer special programs for jumbo loans that allow you to qualify without PMI. These loans may require a slightly higher interest rate, but they can still be a great option if you want to avoid the added expense of PMI. It’s important to compare different lenders and their loan options to find the best deal for your needs. At The Doce Mortgage Group you can finance jumbo loans with only 10% down and without PMI.

- Consider a 80/10/10 Loan

An 80/10/10 loan is a type of piggyback mortgage where you take out a first mortgage for 80% of the home’s value, a second mortgage for 10%, and you contribute the final 10% as your down payment. This strategy allows you to avoid PMI because the combined loan-to-value ratio (LTV) stays below 80%, meaning you do not need PMI on either loan.

- Shop Around for the Best Terms

Different lenders have different requirements for jumbo loans, and some may offer better terms than others. By shopping around, you can find a lender that offers competitive rates and does not require PMI for your specific loan situation. Be sure to compare different loan types, interest rates, and fees to find the best deal.

Top Reasons People Choose to Live in Boca Raton

Boca Raton is widely recognized as one of Florida’s most sought-after locations, offering a unique blend of luxury living, natural beauty, and a high quality of life. Whether you’re drawn to its stunning beaches, vibrant cultural scene, or top-notch amenities, Boca Raton has something for everyone. The city’s close proximity to Miami and Fort Lauderdale, combined with its well-established reputation for offering a family-friendly, safe environment, makes it a compelling choice for homeowners. For many, purchasing a home in Boca Raton represents the ideal combination of comfort, convenience, and lifestyle. The city’s thriving economy, excellent healthcare options, and abundance of outdoor activities further enhance its appeal, making it a top destination for both retirees and young professionals alike.

Boca Raton is a community that offers a fulfilling lifestyle, with a rich blend of leisure, education, and career opportunities. Below are some of the main reasons why so many people decide to buy a home in this beautiful Florida city:

- Beautiful Beaches: Boca Raton’s miles of pristine coastline are one of its most defining features. The city offers a mix of public and private beaches, all known for their clean, soft sands and clear waters. Residents can spend their days enjoying activities such as swimming, fishing, sunbathing, and beach volleyball. Boca Raton’s beaches also provide plenty of opportunities for boating, with numerous marinas offering boat rentals, fishing charters, and more. Whether you prefer a quiet retreat by the water or a day filled with recreational activities, Boca Raton’s coastline is the perfect place to unwind.

- Excellent Schools: Boca Raton is home to some of the best schools in Florida, with both public and private institutions that consistently receive high ratings. The city’s education system is renowned for its academic rigor, extracurricular activities, and exceptional teachers. Families with children can benefit from a range of top-rated schools that focus on a well-rounded education. In addition to traditional K-12 schools, Boca Raton also offers access to excellent higher education institutions, including the prestigious Florida Atlantic University. This strong educational infrastructure makes Boca Raton an ideal place for families to settle and raise their children.

- Upscale Shopping and Dining: Boca Raton is a hub for upscale shopping and dining, offering a wide variety of high-end stores, boutique shops, and world-class restaurants. Mizner Park, a popular outdoor shopping center, is home to luxury retailers, art galleries, and trendy cafes. Additionally, the city boasts several fine dining options ranging from international cuisine to innovative American fare. Whether you’re looking to shop for designer brands, enjoy a night out with exquisite meals, or explore local markets, Boca Raton provides an exceptional retail and dining experience that caters to every taste and preference.

- Great Weather: Boca Raton benefits from a tropical climate with warm temperatures throughout the year. Residents enjoy mild winters and long, sunny summers, making it a perfect location for those who love outdoor activities and sunshine. The consistent, pleasant weather makes the city a popular destination for “snowbirds,” or people who move to Florida during the colder months to escape harsh winters. This climate also contributes to a variety of outdoor recreational options, such as water sports, hiking, and golfing, making it an ideal place for year-round outdoor living.

- Outdoor Recreation: Boca Raton is an outdoor enthusiast’s paradise. From lush parks and scenic walking trails to renowned golf courses and nature reserves, the city offers numerous recreational options for residents. The Boca Raton Resort & Club is known for its prestigious golf courses, while the city’s parks provide ample space for hiking, cycling, and picnicking. For those who enjoy nature, there are a number of local wildlife areas where you can observe native species in their natural habitats. Whether you enjoy a leisurely stroll in the park or more active pursuits like tennis and biking, Boca Raton provides plenty of outdoor activities to keep you fit and engaged.

- Vibrant Arts Scene: Boca Raton has a thriving arts and cultural scene, which is a big draw for many residents. The city is home to numerous theaters, art galleries, and museums, where residents can enjoy performances, exhibits, and cultural events throughout the year. The Boca Raton Museum of Art offers diverse exhibits, from contemporary works to classical art, while the Wick Theatre showcases Broadway-style productions. For those interested in performing arts, the city offers access to local symphonies, ballet performances, and more. This vibrant arts scene not only enriches the community but also attracts visitors from around the world, creating a cosmopolitan atmosphere in the heart of Boca Raton.

- Safe and Family-Friendly: Boca Raton is one of the safest cities in Florida, with a low crime rate and a strong community focus on safety and well-being. The city’s family-friendly atmosphere makes it a perfect place for raising children, with excellent parks, recreational programs, and family-oriented events. The presence of well-maintained streets, secure neighborhoods, and active local law enforcement contributes to the city’s reputation as a place where residents can feel safe. This peace of mind, combined with Boca Raton’s overall high standard of living, makes it an appealing choice for families, retirees, and professionals alike.

What Do Lenders Look for When Approving a Jumbo Loan in Boca Raton Florida?

Lenders will consider several factors when determining whether you qualify for a jumbo mortgage loan in Boca Raton Florida. These factors include:

- Credit Score: A higher credit score can increase your chances of getting approved for a jumbo loan. Most lenders require a credit score of at least 700, but some may require a score of 740 or higher for the best rates. At The Doce Mortgage Group you can finance jumbo loans with scores as low as 660.

- Down Payment: A larger down payment can help you avoid PMI and may make it easier to qualify for a jumbo loan. Ideally, aim for a 20% down payment, though some programs allow for lower down payments.

- Debt-to-Income Ratio (DTI): Your DTI ratio compares your monthly debt payments to your monthly income. Lenders typically prefer a DTI ratio of 43% or lower. At The Doce Mortgage Group you can finance jumbo loans with DTIs as high as 50%.

- Income and Employment History: Lenders will want to verify that you have a stable income and employment history to ensure that you can afford the monthly mortgage payments on a jumbo loan. At The Doce Mortgage Group you can finance jumbo loans without having to verify your income and without requiring a job.

How to Get Started with Your Jumbo Loan Application

The application process for a jumbo mortgage loan in Boca Raton Florida is relatively straightforward, though it requires documentation of your financial situation. Here’s how to get started:

- Gather Your Financial Documents: Be prepared to provide documents such as tax returns, pay stubs, bank statements, and proof of assets. Since jumbo loans are not backed by the government, lenders will want to verify that you are financially capable of handling the loan.

- Calculate Your Payments: Use a Mortgage Calculator to estimate your monthly payments, including principal, interest, property taxes, and insurance.

- Apply Online: Start the application process by visiting Our Application portal. You’ll be able to submit your application and get a sense of your eligibility for a jumbo mortgage loan.

- Get Pre-Approved: Before starting your home search, it’s a good idea to get pre-approved for your jumbo loan. This can help you narrow down your options and give you an edge when negotiating with sellers.

Making Your Dream Home a Reality in Boca Raton

Purchasing a home in Boca Raton can be a smart investment, offering access to an excellent quality of life in a desirable location. By qualifying for a jumbo mortgage loan in Boca Raton Florida without paying PMI, you can keep your monthly payments manageable and save money in the long run. To get started, Get a Free Quote today and learn more about how a jumbo loan can help you make your dream of owning a home in Boca Raton a reality.

Why Choose The Doce Mortgage Group?

The Doce Mortgage Group offers personalized service and expert guidance to help you secure the best jumbo mortgage loan in Boca Raton. Their team specializes in jumbo loans, providing tailored solutions that fit your financial goals. With access to competitive rates and flexible terms, they ensure you get the best deal possible.

Their fast, efficient process means a smooth and timely experience, with professional support every step of the way. The Doce Mortgage Group has earned a solid reputation for excellence, with many satisfied clients who appreciate their dedication and attention to detail. Check out hundreds of satisfied customer reviews to see why so many people trust The Doce Mortgage Group for their home financing needs.

Call Us Today at 305-900-2012 or Get a Free Quote to start on the path towards owning the home of your dreams in Boca Raton.