Table of Contents

- How a VA Refinance Works in Miami

- Why Many Homeowners Choose This Path in 2025

- Who Qualifies for a VA Mortgage Loan in Miami

- Step by Step: Refinancing With The Doce Mortgage Group

- What is an IRRRL in Miami

- IRRRL or Cash Out: Choosing the Best Fit

- Costs and Fees You Should Expect

- Planning With 2025 Market Conditions in Miami

- Energy Efficiency Features That Pair Well With Refinancing

- Living in Miami: Neighborhoods, Jobs, and Lifestyle in 2025

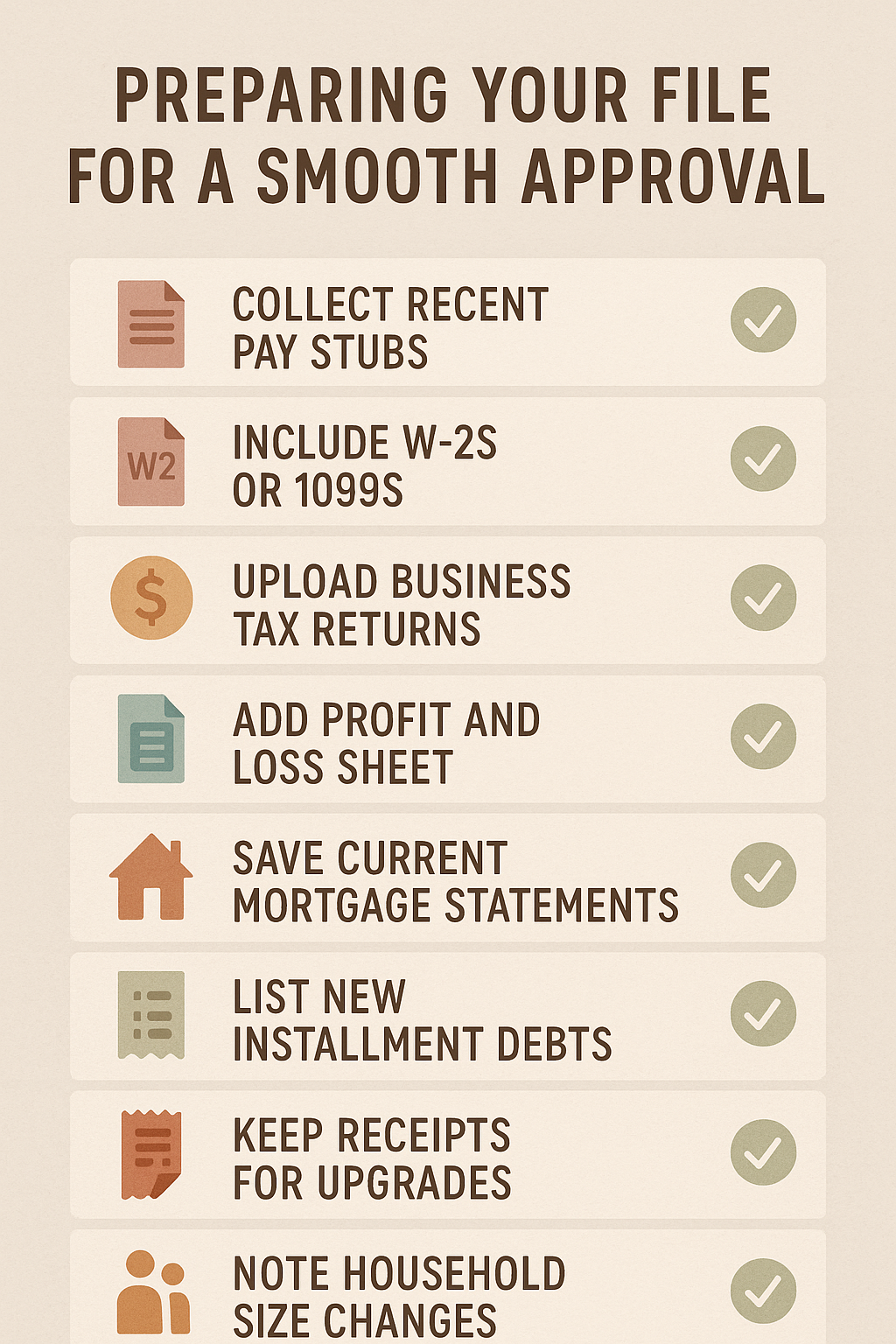

- Preparing Your File for a Smooth Approval

- Using Helpful Programs With Your Long Term Plan

- Frequently Asked Questions

- Why Work With The Doce Mortgage Group

Keynotes

- VA Mortgage Loan in Miami lowers payments and removes PMI from conventional and FHA loans.

- Refinance options include IRRRL, Cash Out, and energy improvements.

- The Doce Mortgage Group guides you through every step with expertise.

Miami is a sunny, energetic city where many homeowners use a Florida VA mortgage loan to lower payments, move to a steady fixed rate, or unlock equity for goals in 2025. This complete guide will explain how a mortgage refinance in Florida works, who qualifies, the main choices you will make, and smart planning steps that fit the local market.

How a VA Refinance Works in Miami

A refinance replaces your current mortgage with a new one that better fits your plans. With a VA Mortgage Loan in Miami, there are two main paths. The Interest Rate Reduction Refinance Loan focuses on a lower rate or a move from an adjustable rate to a fixed rate that stays steady. This is the simpler path when your current loan is already a VA loan. The other path is a Cash Out Refinance, which replaces your loan and lets you take cash from your home equity for larger needs like home updates, debt consolidation, or savings reserves. The Department of Veterans Affairs backs the benefit, while approved lenders make the loan. That backing is the reason pricing and fees can be very competitive for qualified borrowers.

A quick way to see how changes in rate and term affect your budget is to test a few options in the Mortgage Calculator.

Why Many Homeowners Choose This Path in 2025

Using a VA Mortgage Loan in Miami can reduce monthly costs, remove private mortgage insurance, and bring predictable payments. In 2025, many households are focused on stability and cash flow. A move from an adjustable rate to a fixed rate can bring a real sense of calm, especially if you plan to stay in the home for a while. You can also restructure the term. Shorter terms can help you pay off the home faster, while a longer term can lower the monthly payment.

Common money wins include:

- No monthly PMI even with less than twenty percent equity

- A funding fee that is clearly listed and sometimes waived for eligible borrowers

- Predictable lender fee rules that help keep costs in line

- Flexible options that match payment goals and savings goals

Who Qualifies for a VA Mortgage Loan in Miami

You may qualify if you are a Veteran, an active duty service member, a member of the National Guard or Reserves who meets service length rules, or an eligible surviving spouse. Most borrowers will need a Certificate of Eligibility to confirm the benefit. The Doce Mortgage Group can help pull that certificate on your behalf. Lenders review income, credit, and the property. The VA does not set a single national minimum credit score. Individual lenders use their own guidelines, so it can help to talk through your profile before you file a full application.

Step by Step: Refinancing With The Doce Mortgage Group

Here is a simple path many Miami borrowers follow when using a VA Mortgage Loan in Miami.

- Talk with an advisor about your goals and your current mortgage.

Start by meeting with a VA loan advisor who can review your existing mortgage, discuss your financial goals, and outline which refinance option best fits your situation in Miami.

- Share basic docs like pay stubs, W-2s or 1099s, and a recent mortgage statement.

Gather your income documents, recent mortgage statements, and any other records that prove your financial picture so the lender can quickly verify your eligibility and prepare your refinance file.

- Get pre approved so you can see rate and payment targets.

Once your documents are reviewed, the lender will provide pre approval, showing you the interest rate options and monthly payment ranges you may qualify for based on your VA benefits.

- Complete your application through Our Application portal.

When you’re comfortable with the direction, you can securely submit your full refinance application through Our Application portal, where you’ll upload documents and authorize the lender to move forward.

- The lender reviews your file and orders an appraisal when needed.

Your lender carefully checks your file, verifies income, and orders an appraisal if required to confirm the current value of your Miami home before advancing to the next stage.

- Your file moves through underwriting to final approval.

Underwriters will assess your eligibility, confirm your documents, and review all conditions to make sure everything meets VA and lender standards before granting the final refinance approval.

- You sign closing documents and the new loan replaces the old one.

At closing, you’ll review and sign your final paperwork. The new VA loan officially replaces your old mortgage, locking in your updated rate, terms, and payment schedule.

If you prefer to see choices and fees in writing first, request a personalized breakdown with Get a Free Quote.

What is an IRRRL in Miami

The Interest Rate Reduction Refinance Loan, known as the IRRRL, is one of the simplest refinancing tools available through the VA program. It’s designed exclusively for borrowers who already have a VA loan and want to replace it with a new one that has better terms. The IRRRL can lower your interest rate, move you from an adjustable-rate mortgage to a fixed-rate mortgage, or shorten the term of your loan. Because the VA already backs your current loan, the process usually requires less paperwork, no income verification in many cases, and often no appraisal. For Miami homeowners, this makes it a faster, easier path to lower monthly payments and gain more financial stability.

IRRRL or Cash Out: Choosing the Best Fit

The Interest Rate Reduction Refinance Loan is the faster path when your current mortgage is already a VA loan. Many Miami borrowers use it to switch to a fixed rate or to lower the rate they pay today. Paperwork is lighter since you already have a VA loan in place. If your main goal is a smaller payment and stability, this option often fits.

A Cash Out Refinance with a VA Mortgage Loan in Miami is different. You replace the loan and take equity as cash at closing. Homeowners often use this for a new roof, a kitchen update, paying off higher interest balances, or building a savings cushion. A local advisor can help you balance the loan amount, the new payment, and future plans so the change supports your goals.

Costs and Fees You Should Expect

VA lending is known for clear fee rules. With a VA Mortgage Loan in Miami, the lender can charge an origination fee up to one percent of the loan amount. Third party costs often include the appraisal, credit report, title, and recording. There is also a VA funding fee on many refinances. For an IRRRL, that fee is typically one half of one percent. Many service connected Veterans and eligible surviving spouses receive a funding fee waiver. Your advisor will review this early so you know the exact amount and whether a waiver applies.

If cash to close is a concern, ask The Doce Mortgage Group about credits, timing strategies, and programs that can reduce upfront cash. You can also review the The Doce Mortgage Group HomeZero Program to see where reduced cash options may apply in your long term plan.

Planning With 2025 Market Conditions in Miami

In 2025, Miami continues to show strong buyer interest, steady listing activity, and healthy demand across many neighborhoods. Those trends support appraised values during a refinance and can help you select the right time for a Cash Out plan. If you want a quick sense of how much equity you may have, scan recent sales in your area, compare similar homes, and then speak with a loan advisor about what number to use for planning. A small change in value can affect the final loan amount, so it is worth a careful look.

Energy Efficiency Features That Pair Well With Refinancing

Miami homeowners care a lot about cooling costs and comfort. A small energy feature tied to the IRRRL allows reimbursement up to six thousand dollars for certain efficiency upgrades made shortly before closing. Common examples include better attic insulation, a smart thermostat, or energy efficient windows. These smaller steps can help smooth summer peaks and keep rooms more comfortable.

If you plan larger improvements, talk with your advisor about whether a Cash Out Refinance with a VA Mortgage Loan in Miami will serve you better. Larger projects like solar, a new HVAC system, or a major window package are often easier to manage with a Cash Out. When you are ready, begin a secure file in Our Application portal.

Living in Miami: Neighborhoods, Jobs, and Lifestyle in 2025

Part of the value of a VA Mortgage Loan in Miami is that it helps you stay rooted in a city with a wide mix of neighborhoods and activities. You can enjoy food and music across Little Havana, live close to galleries in Wynwood, or take in the city lights from Brickell. Outdoor time is easy with warm winters that invite boating, fishing, and walks along the water. Summer brings lively festivals and family events all across the county.

The job picture in 2025 continues to be steady across many sectors. Hospitality and healthcare remain strong, while finance and tech roles continue to grow in the urban core. A solid job base supports property values and helps the refinance process since underwriters review income and stability. If your hours or role changed recently, share that early so the file is structured the right way.

Curious how a refinance affects your long term plan in the city you love Call 305-900-2012 to walk through options with a local expert.

Preparing Your File for a Smooth Approval

A few simple steps will help you move quickly from quote to closing with a VA Mortgage Loan in Miami.

- Collect recent pay stubs and two years of W-2s or 1099s.

- If self employed, gather business returns and a year to date profit and loss.

- Save mortgage statements for all properties.

- List any new installment debts that started this year.

- Keep receipts if you recently made energy upgrades and want to discuss the small IRRRL reimbursement feature.

- Note any change in household size or occupancy plans.

Using Helpful Programs With Your Long Term Plan

Florida borrowers sometimes pair future purchases with assistance programs, and planning that now can help you set goals for the next move. If you are mapping a later purchase for a family member or planning a future relocation, you can review statewide aid with Down Payment Assistance Programs. Your advisor can explain where that type of help fits and where it does not. Even if the current task is a refinance, having a map for the next three to five years can guide your choices on loan term and cash out amount.

Frequently Asked Questions

What is a VA Mortgage Loan in Miami when used for refinancing?

A VA Mortgage Loan in Miami for refinancing is a benefit-backed loan that lets eligible Veterans, service members, and surviving spouses replace their existing mortgage with a new one. This can lower monthly payments, switch to a more stable fixed rate, or allow access to equity through a Cash Out Refinance, giving long-term financial flexibility.

Can I refinance if my credit is not perfect?

Yes, you can. The VA itself does not require a specific minimum credit score, though lenders will apply their own standards when reviewing applications. Even if your credit history isn’t flawless, many lenders are flexible, especially when working with Veterans. An experienced advisor can help you find a lender that fits your profile.

How much is the funding fee on an IRRRL?

The funding fee for an Interest Rate Reduction Refinance Loan is usually just one half of one percent of the loan amount. For example, if your refinance is $200,000, the fee would be $1,000. Many Veterans with service-connected disabilities, along with eligible surviving spouses, qualify for a waiver and do not pay the fee.

What lender fees can I expect?

With a VA Mortgage Loan in Miami, lender fees are tightly regulated. The VA allows a one percent origination fee plus certain third-party costs like appraisals, title services, and recording fees. This structure helps keep overall costs lower compared with conventional loans, and your loan advisor will give you a full breakdown before closing.

Can I refinance a non VA loan into a VA loan?

Yes, you can use a VA Cash Out Refinance to replace an existing mortgage that isn’t backed by the VA. This allows you to convert your loan into a VA Mortgage Loan in Miami, giving you access to competitive rates, capped lender fees, and the elimination of private mortgage insurance.

Can I roll some costs into the loan?

In many cases, certain closing costs and fees can be rolled into your refinance instead of being paid upfront. This option helps reduce the immediate out-of-pocket expense at closing. However, not every fee can be included, so your loan officer will explain which ones are eligible and which must be paid directly.

Will small energy upgrades really help?

Yes, they can. Through the VA’s energy improvement feature, homeowners can include up to six thousand dollars of recent efficiency upgrades in their refinance. Adding things like better insulation, energy-efficient windows, or a smart thermostat can reduce monthly bills and improve comfort. Even modest changes can make a noticeable difference in Miami’s warm climate.

Why Work With The Doce Mortgage Group

The Doce Mortgage Group helps Miami borrowers use a VA Mortgage Loan in Miami with confidence. When you choose to work with us, you’ll get guidance on your Certificate of Eligibility, a layout of rate and term choices, help with documents, and consistent communication from start to finish. If upfront costs are a concern, we will review strategies and timing that can lower cash to close.

Still not sure? Read what hundreds of clients have to say about their experience with our team.

If you’re ready to get started, give us a call at 305-900-2012 to start your refinance and make your Miami home more affordable!