Table of Contents

- What an IRRRL in Fort Lauderdale Means for Veterans

- How Much You Can Save with an IRRRL in Fort Lauderdale

- Step-by-Step IRRRL Process in Fort Lauderdale

- Why Veterans Choose an IRRRL Over Other Refinance Options

- Eligibility Requirements for an IRRRL in Fort Lauderdale

- How IRRRLs Impact Homeowners in Fort Lauderdale’s Market

- Why Fort Lauderdale Veterans Benefit Most from Refinancing

- Living in Fort Lauderdale: Why Veterans Settle Here

- Examples of Top Neighborhoods in Fort Lauderdale for VA Homeowners

- Quality of Life in Fort Lauderdale

- Programs That Work Alongside IRRRL Options

- FAQ: IRRRL in Fort Lauderdale

- Why Veterans Trust The Doce Mortgage Group in Fort Lauderdale

Keynotes

- IRRRLs cut VA loan rates, helping Fort Lauderdale veterans save money fast.

- Simple process: no appraisal, income verification, or heavy paperwork required.

- The Doce Mortgage Group guides veterans through a smooth, stress-free refinance.

Fort Lauderdale is home to many veterans who have taken advantage of the VA loan program to buy their homes, and now in 2025, refinancing with an IRRRL in Fort Lauderdale can be one of the fastest ways to lower monthly mortgage payments. With interest rates shifting and home values in Broward County continuing to rise, veterans are finding that this streamlined option gives them a chance to keep more money in their pocket each month without going through the headaches of a full refinance.

What an IRRRL in Fort Lauderdale Means for Veterans

The Interest Rate Reduction Refinance Loan, known as an IRRRL, is a refinance option designed specifically for homeowners who already have a VA loan. It’s often called the VA streamline refinance because it doesn’t require the same paperwork as a traditional refinance. In most cases, there’s no need for an appraisal, no need to provide income documentation, and no need for a credit check.

Veterans in Fort Lauderdale choose an IRRRL because it’s designed to be fast, simple, and affordable. By lowering the interest rate, the new loan can reduce the monthly payment and make long-term homeownership in the area more comfortable. In 2025, VA loan rates remain below the national average for conventional loans, which makes refinancing through the VA program even more appealing for local military families.

How Much You Can Save with an IRRRL in Fort Lauderdale

The primary benefit of an IRRRL is savings. According to Freddie Mac, the average 30 year fixed mortgage rate in early 2025 hovered around 6.9 to 7.0 percent, while current VA IRRRL rates from major VA lenders are about 5.875 percent as of August 20, 2025.

Consider an example: a veteran in Fort Lauderdale who purchased a $350,000 home with a VA loan three years ago may have an interest rate near 7 percent. By refinancing with an IRRRL at about 5.875 percent, their monthly principal and interest payment could drop by about $325 based on a typical remaining balance after three years on a $350,000 VA loan, which is roughly $3,900 per year.

Another advantage is the VA funding fee. For IRRRLs in 2025, the fee is just 0.5 percent of the loan amount, which is significantly lower than the upfront fees on other refinance types. And in most cases, these costs can be rolled into the loan instead of being paid out of pocket, making the process more affordable for veterans who don’t want to use their savings upfront.

To see how much your payments might change, you can use this simple tool: the Doce Mortgage Group’s Mortgage Calculator. Running the numbers for your current loan balance can give you a clear picture of how an IRRRL in Fort Lauderdale could improve your budget.

Step-by-Step IRRRL Process in Fort Lauderdale

One of the reasons an IRRRL is so popular is how easy the process is compared to other refinance options. Veterans don’t have to go through the stress of re-qualifying with income checks or tax returns, and in most cases, an appraisal isn’t needed. Here’s how the process usually works in 2025:

- Application: Veterans contact a VA-approved mortgage broker to begin the process. This can often be done online or over the phone.

- Documentation: Minimal paperwork is required, usually just proof of an existing VA loan and mortgage statement. No need to verify income or assets.

- Loan Estimate: The lender provides details on the new rate, monthly payment, and closing costs.

- Closing: Most IRRRL refinances close within 10-20 days, and many veterans never need to leave their home during the process.

Since the program is designed to be fast, many veterans in Fort Lauderdale can lock in their new rate and close in less than a month, allowing them to start saving almost immediately.

If you’re ready to get started with your refinance, you can apply through Our Application portal and begin the process in just a few minutes.

Why Veterans Choose an IRRRL Over Other Refinance Options

For many homeowners, refinancing can feel overwhelming because of the amount of paperwork and time involved. Veterans in Fort Lauderdale often find the IRRRL program more appealing than other refinance options because it’s designed specifically with their needs in mind.

With a conventional refinance, borrowers usually have to provide pay stubs, W-2s, tax returns, proof of employment and pay for a new appraisal. They also face stricter credit score requirements. In 2025, Experian notes you generally need a credit score between about 620 and 680 for a conventional refinance.

The IRRRL program, on the other hand, allows borrowers to qualify without income verification, without employment checks, and in many cases, without a credit review. That streamlined process makes refinancing faster and less stressful. It’s also one of the main reasons the IRRRL program continues to be popular among veterans in Fort Lauderdale and across the country.

If you’re wondering how much you could save with this option compared to other refinance types, you can Get a Free Quote from The Doce Mortgage Group to see the difference.

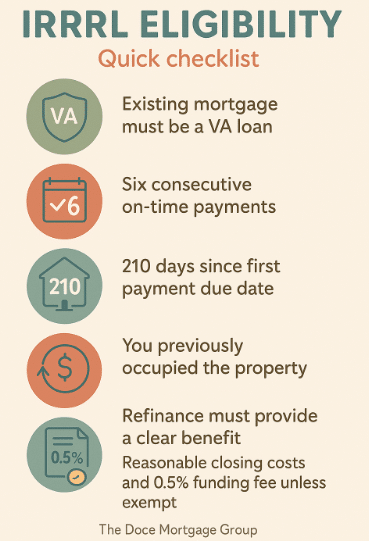

Eligibility Requirements for an IRRRL in Fort Lauderdale

Although the program is simple, there are still requirements veterans need to meet in order to qualify. The main point is that you must already have a VA loan. The IRRRL is only available as a refinance of an existing VA mortgage, not as a first-time loan.

Here are the key requirements in 2025:

- The existing mortgage must be a VA loan.

- You must have made at least six consecutive monthly payments and at least 210 days must have passed since the due date of your first payment on the loan being refinanced.

- You must have previously lived in the property, even if you no longer occupy it.

- The refinance must result in a tangible benefit, such as a lower interest rate or moving from an adjustable to a fixed rate.

- Closing costs cannot exceed what’s considered reasonable by the VA, and the funding fee of 0.5 percent applies unless the borrower has a service-connected disability exemption.

These requirements are far less strict than those for conventional refinances, which is why many veterans in Fort Lauderdale find the IRRRL option to be the best fit.

If you meet these conditions, you can apply today to begin the process.

How IRRRLs Impact Homeowners in Fort Lauderdale’s Market

The housing market in Fort Lauderdale has continued to show strength into 2025. According to Zillow, the average Fort Lauderdale home value is $516,037 as of late July 2025, which reflects a 4.5 percent decline over the past year. That growth has provided equity to many homeowners, including veterans who purchased with VA loans in recent years.

At the same time, mortgage rates have remained relatively high compared to the ultra-low rates of 2020 and 2021. Veterans who bought during those years might not need to refinance, but many who purchased more recently or who took on higher adjustable rates now see the benefit of locking in a lower fixed rate through an IRRRL in Fort Lauderdale.

The difference between keeping a 7 percent rate and refinancing to a 5.75 percent VA refinance rate could mean thousands in savings each year. In Broward County, where property taxes and insurance costs are higher than the national average, every bit of savings helps keep homeownership affordable.

This is one of the main reasons veterans turn to The Doce Mortgage Group. Their experience in the South Florida market allows them to help veterans navigate both the refinance process and the unique costs of owning in Fort Lauderdale. If you want to explore your options further, the team can Get a Free Quote for your property and give you exact numbers based on today’s market.

Why Fort Lauderdale Veterans Benefit Most from Refinancing

Veterans living in Fort Lauderdale often face higher-than-average living expenses. From insurance premiums to homeowner association fees in certain neighborhoods, costs add up quickly. Refinancing with an IRRRL allows many to bring down their monthly mortgage payment, giving them more breathing room in their household budgets.

Another benefit is stability. Many veterans originally purchased with adjustable-rate VA loans, which can rise over time. In 2025, with economic conditions keeping mortgage rates unpredictable, switching to a fixed rate through an IRRRL offers peace of mind. Knowing your payment won’t suddenly spike makes it easier to plan for the future and stay comfortable in your home.

For local veterans who plan to remain in Fort Lauderdale for the long term, this type of refinance is an especially smart financial move.

Living in Fort Lauderdale: Why Veterans Settle Here

Fort Lauderdale has become one of the most attractive places for veterans and their families in Southern Florida. Known for its beaches, boating, and cultural scene, the city offers a mix of lifestyle benefits along with access to important veteran support resources. For those who already purchased a home with a VA loan, refinancing with an IRRRL in Fort Lauderdale allows them to enjoy these benefits while lowering their housing costs.

The Fort Lauderdale metro unemployment rate was about 3.8 percent in July 2025, compared with Florida at roughly 4.1 percent and the nation at about 4.2 percent.Veterans who transition into civilian careers often find opportunities in healthcare, technology, and the port and shipping industries. The city is also home to a large hospitality and tourism sector, which provides thousands of jobs. Having stable employment makes refinancing even more appealing, since veterans can plan their budgets around predictable income and lower mortgage payments.

Fort Lauderdale also provides easy access to VA healthcare facilities. The William “Bill” Kling VA Clinic in Sunrise and the Miami VA Healthcare System both serve veterans in the area, offering medical care, counseling, and other services. For many, living in a city where those services are nearby is an important factor when deciding where to settle long term.

Examples of Top Neighborhoods in Fort Lauderdale for VA Homeowners

Homeowners using VA loans and IRRRL refinances can be found throughout the city. Some of the most popular neighborhoods for veterans include:

- Wilton Manors: Known for its vibrant community atmosphere and close proximity to downtown. Average home value here is about $579,000 in 2025.

- Victoria Park: A historic neighborhood with a mix of single-family homes and townhouses. The median sale price in Victoria Park was about $860,000 in July 2025.

- Coral Ridge: A waterfront neighborhood popular with boat owners. Average home value in Coral Ridge is roughly $1.1 million in 2025.

For veterans who purchased in these neighborhoods a few years ago, rising prices mean their homes have appreciated in value. Refinancing with an IRRRL in Fort Lauderdale helps them lock in better terms while benefiting from the equity they’ve gained.

If you’re thinking about how refinancing could work for your specific neighborhood and budget, you can try The Doce Mortgage Group’s Mortgage Calculator to compare different loan scenarios.

Quality of Life in Fort Lauderdale

Beyond the financial side of homeownership, Fort Lauderdale’s lifestyle makes it a natural fit for many military families. With over 20 miles of beaches, the city provides year-round opportunities for outdoor activities like boating, fishing, and diving. It’s often called the “Yachting Capital of the World,” with one of the largest concentrations of marinas and boatyards in the country.

The city also offers access to the broader Miami metropolitan area without the same level of congestion and cost. Many veterans choose to live in Fort Lauderdale while commuting to Miami for work, enjoying the balance of affordability and access.

In terms of affordability, the average rent in Fort Lauderdale in 2025 is about $2,743 per month, according to RentCafe. That makes owning with a VA loan and refinancing with an IRRRL an even more attractive option, since many veterans can lower their mortgage payment below the cost of renting.

Programs That Work Alongside IRRRL Options

While the IRRRL is designed for veterans who already own a home with a VA loan, other programs can work alongside it or serve as alternatives for those looking to purchase again. The Doce Mortgage Group offers The HomeZero Program, which allows qualified buyers to purchase or refinance 100% of the home value or purchase price. For veterans who may be ready to upgrade or buy a second property to occupy, this program can make ownership more accessible.

Even for those staying put, understanding these programs is helpful. Veterans often pass along information to friends and fellow service members who are considering buying in Fort Lauderdale. By combining the IRRRL with other specialized programs, veterans in the area have multiple options to strengthen their financial stability and homeownership opportunities.

If you’re curious which program fits your needs best, you can Get a Free Quote and discuss your options with The Doce Mortgage Group.

FAQ: IRRRL in Fort Lauderdale

What’s the difference between an IRRRL and a standard VA refinance?

A standard VA refinance can be used to tap into equity or change loan terms, but it usually requires income documentation, an appraisal, and more paperwork. An IRRRL in Fort Lauderdale is meant to be faster, with minimal documentation and no cash-out option. It’s focused on lowering your interest rate or switching from an adjustable to a fixed loan.

How fast can I close an IRRRL in Fort Lauderdale?

Most refinances close within 15 days in 2025, with some finishing in as little as two weeks. Since the program is streamlined, delays are less common compared to traditional refinancing.

Are there closing costs with an IRRRL?

Yes, but they’re usually lower than with other refinance programs. The funding fee is only 0.5 percent, and many costs can be rolled into the new loan so veterans don’t have to pay out of pocket.

Can I refinance a second home with an IRRRL?

No. The property must have been your primary residence at some point to qualify. Even if you’ve since moved, you can still refinance as long as the home was originally occupied by you.

Does my credit score affect approval?

In most cases, no. The VA doesn’t require a credit check for IRRRL approval. Some lenders may review credit as part of their process, but it’s not the deciding factor. This makes the program more flexible for veterans who may not have perfect credit in 2025.

Why Veterans Trust The Doce Mortgage Group in Fort Lauderdale

Choosing the right lender makes a big difference in how smooth the refinance process will be. The Doce Mortgage Group has decadesw of experience helping veterans throughout Florida lower their rates and simplify their finances through the IRRRL program. Their local expertise means they understand both VA guidelines and the unique factors of Fort Lauderdale’s housing market, from rising property values to insurance requirements.

Veterans who have worked with The Doce Mortgage Group highlight their professionalism, personal service, and dedication. You can read through their customer reviews to see the positive experiences other homeowners have shared.

If you’re ready to start saving on your mortgage, lowering your interest rate, and making homeownership more affordable, now is the time to act. Call Us Today at 305-900-2012 to begin your VA refinance with a trusted local team in Fort Lauderdale.