Table of Contents

- What Is a Jumbo Loan and Why It Matters in Miami Beach

- Who Typically Needs a Jumbo Loan in Miami Beach

- How to Qualify for a Jumbo Loan in Miami Beach

- How Jumbo Loans Are Different From Standard Mortgages

- Why Miami Beach Waterfront Homes Are a Perfect Match for Jumbo Loans

- Jumbo Loan Rates in Florida (2025)

- The Process of Getting a Jumbo Loan in Miami Beach

- Miami Beach Real Estate Trends in 2025

- Why More Buyers Are Choosing Miami Beach

- Top Neighborhoods Where Jumbo Loans Are Common

- FAQs About Jumbo Loans in Miami Beach

- Why Work With The Doce Mortgage Group

- Luxury Living in Miami Beach Starts With the Right Loan

Keynotes

- Jumbo loans open doors to Miami Beach luxury waterfront properties.

- Competitive 2025 jumbo rates make high-value homes more accessible.

- Pre-approval strengthens your position in Miami Beach’s hot market.

In Miami Beach, luxury real estate meets the waterfront in ways few other cities can offer. From oceanfront condos with private elevators to bayfront estates with yacht docks, homes here often come with a big price tag. That’s exactly why a jumbo loan in Miami Beach is so important for buyers who want access to the best properties on the water.

If you’re shopping for a high-value home and want to explore financing options above the standard mortgage limits, you can get more info on this type of loan by visiting the Florida jumbo mortgage loans page from The Doce Mortgage Group.

What Is a Jumbo Loan and Why It Matters in Miami Beach

A jumbo loan is a home loan that goes beyond the limits set by the Federal Housing Finance Agency. For 2025, the baseline conforming loan limit is $819,000 in most areas. But homes in Miami Beach, especially those with waterfront access or in exclusive neighborhoods, often cost well over $1 million.

That means a jumbo loan is what you’ll likely need to finance your purchase. These loans are designed to help buyers purchase high-end properties that aren’t covered by standard mortgage programs.

In a place like Miami Beach, jumbo financing is common. Luxury condos on Collins Avenue or homes on the Venetian Islands can easily start at $2 million or more. Without a jumbo loan, those properties are out of reach for most buyers.

Who Typically Needs a Jumbo Loan in Miami Beach

A jumbo loan in Miami Beach is typically used by high-income professionals, retirees upgrading to luxury living, investors buying rental properties, and international buyers looking for second homes.

Here’s why:

- Single-family homes in Miami-Dade have median sale prices around $675,000, and many properties in beachfront neighborhoods cost well above that.

- Many oceanfront condos and single-family homes in top neighborhoods start at $1.5 million and go as high as $40 million.

- These prices are well above the conforming loan limits.

Buyers looking at premium neighborhoods like South of Fifth, Sunset Islands, or North Bay Road almost always need jumbo financing.

How to Qualify for a Jumbo Loan in Miami Beach

Since these loans go beyond the standard guidelines, they come with a few more requirements. But with solid financials, qualifying is very doable. Here’s what most buyers will need:

- Credit Score: A score of 700 or higher is usually needed. At the Doce Mortgage Group, Our jumbo loans allow for scores as low as 660!

- Down Payment: Expect to put down at least 10% to 20%.

- Income Documentation: You’ll need to show steady income with W-2s, tax returns, or business income if you’re self-employed.

- Low Debt-to-Income Ratio: A DTI of 43% or lower is preferred. If you can show a lower ratio, you might qualify for better terms. At the Doce Mortgage Group, our jumbo loans allow for DTI’s as high as 50%!

- Cash Reserves: We would require 3 to 12 months of mortgage payments saved in the bank after closing, depending on the program

The loan process also involves manual underwriting in many cases. That means someone is reviewing your full financial profile, not just running your info through a system. Being organized with your documents makes the process smoother.

If you’re looking to see where you stand, you can get a free quote now from The Doce Mortgage Group and find out how much home you can afford.

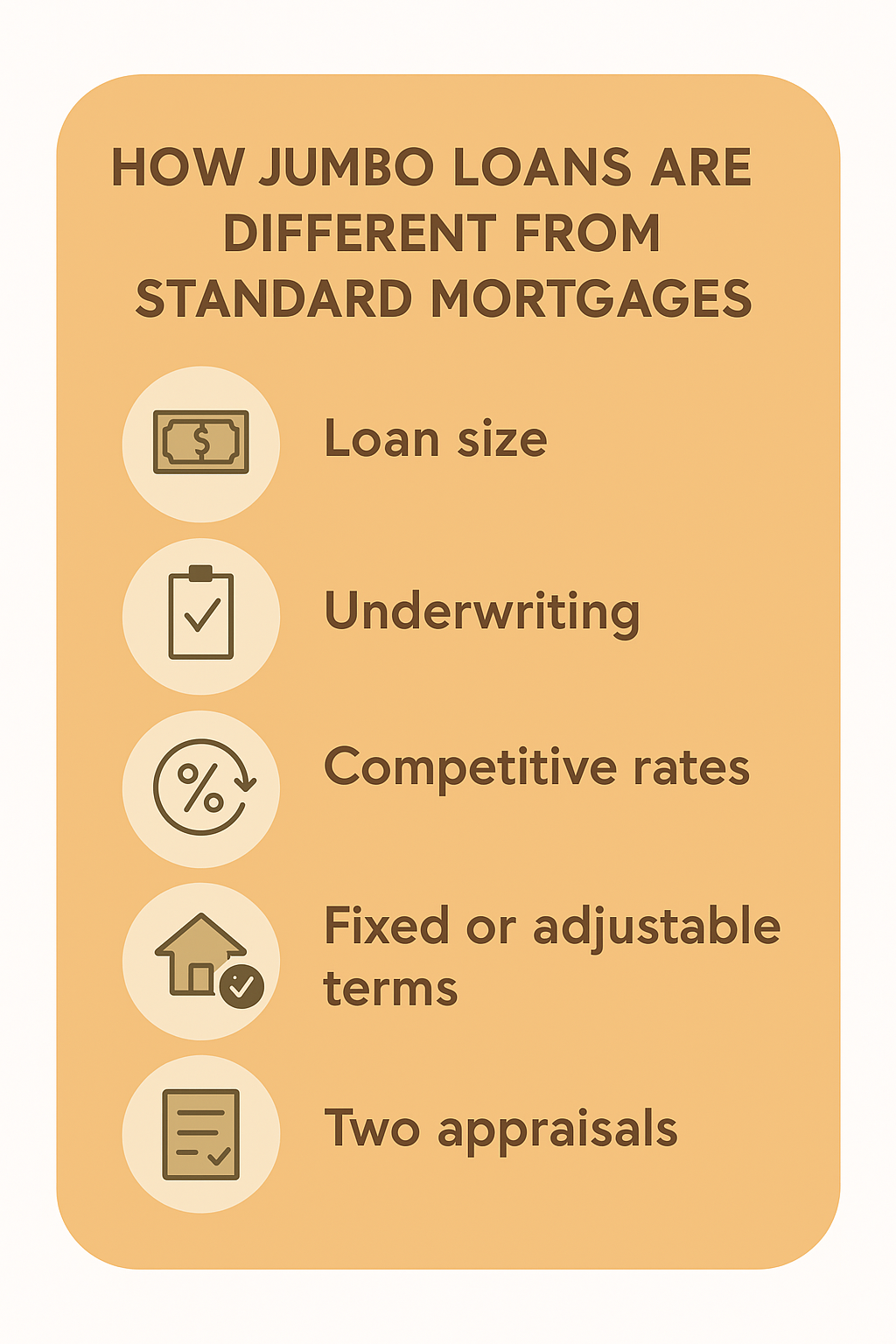

How Jumbo Loans Are Different From Standard Mortgages

Jumbo loans share some basics with standard mortgages, but there are a few key differences:

- Loan Size: They go beyond the local conforming limits. The maximum limit is currently $819,000.

- Underwriting: Approval is stricter and takes a deeper review of your financials.

- Rates: Jumbo loan rates used to be higher, but as of 2025, they’re very competitive.

- Terms: You can choose fixed or adjustable rates.

- Appraisals: For homes priced over $3 million, two appraisals may be required.

Because the loan amounts are larger, everything is reviewed more carefully—from income to assets to the property itself.

If you’re unsure what kind of monthly payment comes with a jumbo loan, try using the mortgage calculator to run the numbers on a few home prices.

Why Miami Beach Waterfront Homes Are a Perfect Match for Jumbo Loans

In Miami Beach, high-value homes are everywhere—especially near the water. Jumbo loans were built for this market. They open up the ability to purchase homes in the best neighborhoods, where listing prices often start in the millions.

Neighborhoods where jumbo financing is common include:

- South of Fifth: Ultra-luxury condos like Apogee, Continuum, and Glass. Prices range from $3 million to $10 million or more.

- Venetian Islands: Waterfront homes with private docks and skyline views. Prices often start at $5 million.

- Sunset Islands: Gated island homes with direct ocean access. Typical prices range from $4 million to $20 million.

- North Bay Road: Celebrity-owned homes and wide-bay views. Prices go from $7 million to over $30 million.

Many of these properties feature:

- Direct waterfront access

- Private docks

- Rooftop pools

- Gated security

- Floor-to-ceiling glass walls with full ocean or bay views

A jumbo loan in Miami Beach is often the only way to finance these types of homes.

Want to start shopping with confidence? You can get pre-approved by starting your application now through our application portal.

Jumbo Loan Rates in Florida (2025)

As of October 2025, jumbo loan rates in Florida are estimated to fall in the range of 6.8% to 7.5% for 30-year fixed deals, with 15-year fixed versions somewhat lower (mid-6% range) and adjustable-rate jumbo options possibly starting in the low to mid 6% range. These are estimates and actual rates vary by individual credit and property factors.

Rates will vary based on:

- Your credit score

- The size of your down payment

- Whether the home is a primary residence or investment

- Fixed or adjustable rate structure

Since jumbo loans aren’t backed by Fannie Mae or Freddie Mac, lenders set their own terms. That means it’s smart to compare options and work with a team like The Doce Mortgage Group, who knows the Miami Beach market and has access to top-tier mortgage options.

The Process of Getting a Jumbo Loan in Miami Beach

Applying for a jumbo loan in Miami Beach is a detailed but manageable process, especially when you’re working with a team that knows the area and understands how these larger loans work. Here’s a simple overview of the steps you’ll take:

- Talk to a loan expert

The first step is speaking with a mortgage pro who can review your financials, ask about your goals, and recommend loan options that make sense for your price range. - Get pre-approved

Pre-approval gives you a clear idea of how much home you can afford. It also shows sellers that you’re serious and financially ready to buy. - Start your home search

Once you know your approved loan range, you can shop with confidence. Focus on Miami Beach neighborhoods that fit your lifestyle and budget. - Submit your full application

When you find the home you want, you’ll complete the full loan application with your income documents, asset statements, employment info, and credit report. - Appraisal and underwriting

The lender will order an appraisal of the home and begin underwriting. With jumbo loans, this step often includes a manual review of your full financial picture. - Clear to close

After approval, you’ll get a final loan amount, interest rate, and closing date. Then you’ll sign and move into your new home.

Want to take that first step now? You can start your jumbo loan application through our application portal and move one step closer to living on the water in Miami Beach.

Miami Beach Real Estate Trends in 2025

Miami Beach remains one of the hottest luxury real estate markets in the country, and 2025 is no exception. Prices continue to rise for oceanfront and bayfront properties, and inventory is tight in many of the most desirable areas.

Some of the key market trends this year include:

- Luxury home demand stays high: Buyers from New York, California, and international markets are all competing for the same limited number of homes near the beach.

- Cash buyers are active, but financing still plays a major role—especially for homes between $1.5 million and $10 million, where jumbo loans are common.

- Inventory is limited, especially in top areas like the Venetian Islands, North Bay Road, and South of Fifth.

- Second home purchases are up, with many buyers relocating part-time or full-time to South Florida for the weather and tax advantages.

In this competitive market, being pre-approved with jumbo financing gives you a serious edge. To run the numbers on a few home prices and loan options, try using the mortgage calculator.

Why More Buyers Are Choosing Miami Beach

It’s no mystery why so many people want to live here. Miami Beach offers a rare mix of tropical beauty, walkable city life, and upscale living.

Here are just a few reasons buyers are making the move in 2025:

- Year-round sunshine

With over 240 sunny days a year and average temps around 75°F, the outdoor lifestyle here is unbeatable.

- Waterfront living

Many homes have ocean or bay views, and some include private docks and beach access.

- World-class restaurants and shopping

From rooftop sushi bars to designer stores in Bal Harbour Shops, Miami Beach has no shortage of high-end experiences.

- Fitness and wellness culture

Outdoor yoga, luxury gyms, bike paths, and a health-focused lifestyle are everywhere.

- Easy access to boating and yachting

Many residents have direct access to the Intracoastal Waterway or Biscayne Bay.

- No state income tax

Florida remains a popular choice for high-income earners thanks to its tax benefits.

If you’re planning to buy in a city with this much to offer, it helps to know your buying power ahead of time. You can get a free quote now to explore how much home you can afford with jumbo financing.

Top Neighborhoods Where Jumbo Loans Are Common

Miami Beach has several luxury neighborhoods where jumbo loans are the norm. Each one has its own vibe, price range, and benefits. Here’s a breakdown:

South of Fifth

This is one of the most exclusive areas in Miami Beach. It’s quiet, gated, and home to some of the most expensive condos in the city. Think Continuum, Apogee, and Glass—all with prices starting at $3 million and climbing fast.

Venetian Islands

These man-made islands stretch between Miami and Miami Beach, offering privacy, water views, and luxury single-family homes. Prices start around $4 million and go up to $20 million.

Sunset Islands

A favorite among celebrities and business owners, these four gated islands have bayfront estates with docks and private security. Homes here range from $5 million to over $25 million.

North Bay Road

Known for waterfront mansions and some of the widest bay views in the area. It’s also home to several high-profile owners. Homes here typically range from $7 million to $30 million.

Bal Harbour

This upscale area just north of Miami Beach features luxury condos, boutique shopping, and oceanfront estates. Jumbo financing is often needed for homes in Oceana and St. Regis, where prices regularly top $5 million.

In any of these neighborhoods, it’s smart to line up financing before you make an offer. You can get pre-approved today to be ready when the perfect property hits the market.

FAQs About Jumbo Loans in Miami Beach

What’s the minimum credit score for a jumbo loan?

Most buyers need a score of at least 700. Some exceptions apply with larger down payments or strong cash reserves.

Can I buy a vacation or second home with a jumbo loan?

Yes, jumbo loans are available for second homes and investment properties, though the guidelines may be slightly stricter.

What documentation do I need?

Standard documents include tax returns, W-2s or 1099s, pay stubs, bank statements, and possibly business financials if you’re self-employed.

Can I refinance an existing jumbo loan?

Absolutely. Jumbo loan refinancing is available if you want to lower your rate, change your term, or take cash out.

Can international buyers get jumbo loans?

Yes, many lenders work with foreign nationals, especially in Miami Beach, where international purchases are common.

How long does approval take?

The full loan process usually takes 25 to 45 days, depending on how quickly documents are submitted and the appraisal timeline.

Still have questions? You can call 305-900-2012 to talk to a local expert who specializes in jumbo loan financing in Miami Beach.

Why Work With The Doce Mortgage Group

Buying a luxury home in Miami Beach takes more than just a large down payment. It takes local experience, the right financing tools, and a team who understands how to get high-value deals done fast.

Here’s why buyers trust The Doce Mortgage Group:

- Deep experience with jumbo loan transactions

- Access to competitive jumbo rates and programs

- Quick turnaround times on approvals and closings

- Local insights into the Miami Beach luxury market

- Personalized service from start to finish

Want to see what others are saying? Read some of our customer reviews from real clients who’ve closed on their dream homes with The Doce Mortgage Group.

Luxury Living in Miami Beach Starts With the Right Loan

Living in Miami Beach is about more than just sunshine. It’s about lifestyle, views, and buying the kind of home that reflects how far you’ve come. A jumbo loan in Miami Beach is your gateway to that next-level living—whether it’s a waterfront estate, a penthouse with skyline views, or a second home steps from the sand.

With competitive rates, personalized support, and fast-track approvals, The Doce Mortgage Group is ready to help you get there.

Call us today at 305-900-2012 to get started on your jumbo loan and make that Miami Beach lifestyle a reality.