Table of Contents

- How the VA IRRRL Works in 2025

- Eligibility Rules for the VA IRRRL in Wilton Manors

- Key Benefits of Refinancing with the VA IRRRL in 2025

- Comparing the VA IRRRL to Other Refinance Options

- Why Wilton Manors Veterans Are Turning to VA IRRRL Loans

Top Reasons People Choose to Live in Wilton Manors - How Lower Rates Free Up Money for Life in Wilton Manors

- FAQ

- Why Work with The Doce Mortgage Group

- Ready to Lower Your Rate in Wilton Manors?

Keynotes

- VA IRRRL Loan in Wilton Manors lowers interest rates and monthly costs.

- Streamlined process makes refinancing simple, quick, and stress free.

- The Doce Mortgage Group helps veterans secure savings with expert guidance.

If you’re a veteran living in Wilton Manors and you already have a VA home loan in Florida, a VA IRRRL could help you lock in a lower interest rate in 2025. That stands for Interest Rate Reduction Refinance Loan, and it’s one of the fastest, easiest ways to refinance your current VA mortgage and start saving.

A VA IRRRL Loan in Wilton Manors is only for people who already used a VA loan to buy or refinance their home. It’s a special refinance option with fewer steps and less paperwork than a regular refinance. No appraisal in most cases, no income check, and often no credit pull. That means you could close fast and drop your rate without the usual hassle.

Right now, interest rates are trending lower in Florida, so it’s a good time to take action. If you’re still paying a higher rate from 2022 or 2023, this program could help free up hundreds of dollars a month.

Let’s take a closer look at how this works and why so many homeowners in Wilton Manors are using the IRRRL in 2025.

How the VA IRRRL Works in 2025

The VA IRRRL exists to help veterans refinance into a lower rate quickly. You don’t need to fully reapply for a new mortgage. If you’re eligible, you could refinance with fewer documents and little to no upfront cost.

Why 2025 Is a Good Year to Refinance

As of August 21, 2025, widely quoted 30 year VA rates are about 5.875% at major VA lenders, and national VA averages are near 6.9%. The Doce Mortgage Group VA IRRRL interest rate is at 5.50% today; many loans originated in 2022 and 2023 still carry rates around 6.5% to 7.5%. If that’s you, a VA IRRRL Loan in Wilton Manors could help cut your payment down significantly.

Let’s say you bought your home in 2022 with a $340,000 loan at 6.75%. By refinancing to about 5.50% in 2025, your payment drops by roughly $274per month, which is about $3,288per year.

What Makes It “Streamlined”?

This loan skips a lot of the normal steps. Here’s what you usually don’t need with a VA IRRRL in 2025:

- No income or employment verification

- No home appraisal

- No home inspection

- No full credit review in most cases

- No out-of-pocket costs if rolled into the loan

Most loans can close within 10 to 20 days, and since the VA backs the loan, you’re getting solid rates with minimal hassle.

Wondering how much you could save? Try out our Mortgage Calculator to see your potential monthly payment.

Eligibility Rules for the VA IRRRL in Wilton Manors

This refinance is only for people who already have a VA-backed mortgage. You don’t need to live in the home anymore, but you do need to show you lived there before.

Basic 2025 Requirements

To use the VA IRRRL Loan in Wilton Manors this year, here’s what you’ll need:

- You must already have a VA loan

- You must have made six monthly payments on your current mortgage

- At least 210 days must have passed since your first payment

- Your new loan must give you a lower monthly payment (unless you’re switching from an adjustable rate to a fixed rate)

Do You Need to Live in the House?

No. In most cases, you don’t have to live in the home anymore. You just need to confirm that it was your primary residence at one point.

This helps veterans who’ve relocated but want to refinance a home they still own in Wilton Manors.

Credit and Score Expectations

You usually don’t need a full credit report to qualify, but some lenders may still do a soft check. Most approvals go smoothly with a credit score above 620, but lower scores may still work depending on the case.

2025 Funding Fee

There is a small one-time VA funding fee of 0.5% for most borrowers. That means $1,500 on a $300,000 loan. The good news? You don’t have to pay it upfront. It can be rolled into the loan balance. Also, veterans with a service-connected disability are fully exempt from this fee.

Want to know if you qualify? Get started now with a fast Free Quote.

Key Benefits of Refinancing with the VA IRRRL in 2025

The main reason veterans are jumping on a VA IRRRL Loan in Wilton Manors is simple: lower payments without the paperwork storm.

How Much Are People Saving?

Most veterans refinancing in Florida right now are seeing monthly savings between $180 and $400, depending on their original loan size and rate. Some are saving even more, especially those switching from an adjustable rate to a fixed one.

Main Benefits

- Lower interest rate with less work

- No income documents

- No new appraisal needed

- Closing costs can be rolled into the loan

- Fast closing process — most within 2 to 3 weeks

- Move from an ARM to a steady fixed rate

It’s easy to get started with Our Application portal and see your options today.

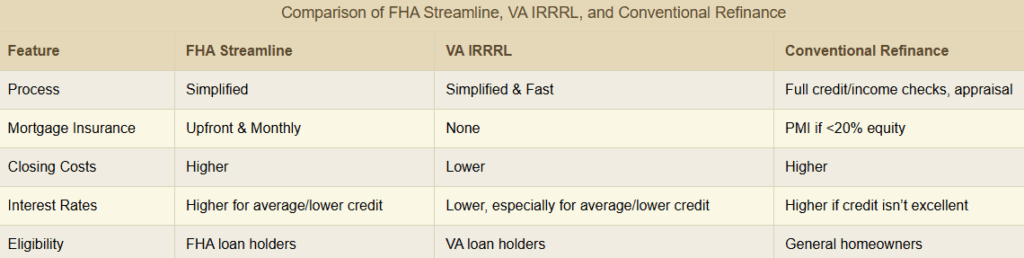

Comparing the VA IRRRL to Other Refinance Options

If you’re thinking about refinancing your mortgage in 2025, it’s smart to compare a few paths. While a VA IRRRL Loan in Wilton Manors is the go-to option for many veterans, it’s helpful to see how it stacks up against other choices like FHA streamline or conventional refi programs.

FHA Streamline vs. VA IRRRL

The FHA streamline refinance is similar in that it also offers a simplified process. But it comes with mortgage insurance — both upfront and monthly — which can add hundreds to your yearly cost.

With a VA IRRRL, there’s no monthly mortgage insurance, and closing costs tend to be lower. Plus, VA loans usually come with better rates than FHA, especially for borrowers with average or lower credit.

Conventional Refinance vs. VA IRRRL

A conventional refi can work for some, but it typically requires:

- Full credit and income checks

- A new appraisal

- More cash out of pocket

- A higher interest rate if your credit isn’t excellent

- PMI if less than 20% equity in the home

A VA IRRRL Loan in Wilton Manors offers a simpler and faster path. It’s especially helpful if you’ve had changes in your income or credit but want to save money now. In short, if you’re eligible, the VA IRRRL is hard to beat in 2025.

Want to get a side-by-side look at your refi options? Get a Free Quote and we’ll walk you through your choices.

Why Wilton Manors Veterans Are Turning to VA IRRRL Loans

In Wilton Manors, homeowners are feeling the pinch of higher insurance premiums, property taxes, and utility costs. That’s driving a lot of veterans to look for ways to reduce their monthly bills. A VA IRRRL Loan in Wilton Manors is proving to be one of the most effective tools to do just that.

Home Prices and Market Trends in 2025

In July 2025, the median sale price in Wilton Manors was about $536,000, down roughly 15.6% year over year. Refinancing into a lower rate gives homeowners some breathing room in a market where everything else is getting more expensive.

Rising Costs in South Florida

Property insurance in Broward County has climbed sharply again in 2025, with average annual premiums around $6,112 for a typical single family policy. On top of that, property taxes have ticked up alongside rising assessments. Refinancing into a lower interest rate can help offset these jumps in other housing costs.

Veteran Population in the Area

Broward County is home to over 76,000 veterans, and Wilton Manors itself has a strong veteran and military-connected community. Many have used VA loans in recent years and now qualify for an interest rate reduction. A VA IRRRL Loan in Wilton Manors lets them save money without the full hassle of a new loan process.

Streamlining in a Competitive Market

With rising rents and limited housing supply in South Florida, many veterans are choosing to hold onto their homes and make them more affordable rather than move. The IRRRL makes that easier to do. It gives homeowners the financial edge to stay put and enjoy the life they’ve built in Wilton Manors.

If you’re ready to run the numbers, go ahead and Get a Free Quote to see what your savings could look like.

Top Reasons People Choose to Live in Wilton Manors

The city is known for its strong sense of community and local events. There’s always something happening: art walks, food truck nights, and festivals fill the calendar year-round.

Dining and Nightlife

Wilton Drive is packed with top-rated restaurants, cafés, and bars. Whether you want sushi, tacos, or a vegan brunch, it’s all right there. And when the sun goes down, the city’s nightlife is alive with clubs, live music, and patio hangouts.

Outdoor Living

Wilton Manors offers over 15 public parks, riverfront paths, and access to the Middle River for kayaking and paddleboarding. You’re also just a short drive from the beach, so it’s easy to spend weekends in the sand without ever leaving town.

Schools and Services

Families in Wilton Manors benefit from public and charter schools with high ratings, along with city services that support safety, recreation, and community wellness.

People love living here, and a VA IRRRL Loan in Wilton Manors helps make that lifestyle even more affordable.

How Lower Rates Free Up Money for Life in Wilton Manors

When you save hundreds each month through refinancing, that money can go right back into your daily life.

What You Could Do with the Extra Cash Savings

Here are a few examples of how monthly savings from a VA IRRRL could help in 2025:

- Cover higher insurance premiums

- Pay for groceries and utilities

- Put money toward childcare or after-school programs

- Handle home repairs or upgrades

- Build savings for travel or emergencies

Even $200 a month adds up to $2,400 a year, and that kind of buffer matters, especially with costs still rising across Florida.

Want to apply right now and take the first step toward saving? Use Our Application portal and get started in minutes.

FAQ

Can I get cash out with the VA IRRRL in 2025?

No. The VA IRRRL is only for lowering your rate or changing your loan term. If you need cash from your equity, a VA cash out refinance is a separate program.

How much can I lower my rate this year?

Most borrowers in Florida are lowering their rate by one percent or more compared to loans taken out in twenty twenty two or twenty twenty three.

How long does it take to close?

In most cases, you can close in about twenty days. Some loans close faster depending on your situation.

Do I need a new appraisal?

Usually not. The VA does not require a new appraisal for IRRRL loans in most cases.

Will I need to live in the home again?

No. You do not need to currently live in the home. You only need to show that you lived in it at some point in the past.

Can I refinance an investment property with the VA IRRRL?

Yes, but only if it was your primary home before. You cannot refinance properties you never occupied.

Why Work with The Doce Mortgage Group

The Doce Mortgage Group has helped veterans across Florida refinance with a VA IRRRL Loan in Wilton Manors and nearby cities. Our team is local, experienced, and focused on helping you save as much as possible.

Why Locals Trust Us

- We specialize in VA loan refinancing

- Our team knows the Wilton Manors market

- We offer a simple, no-stress process

- We help you find the lowest rates and save more

- We walk you through every step, from first click to final close

- We offer below average market interest rates

Don’t take our word for it. You can read real customer reviews and see how we’ve helped other homeowners across Florida.

If you’re also exploring help with upfront costs, you can learn about Down Payment Assistance Programs and The Doce Mortgage Group HomeZero Program.

Ready to Lower Your Rate in Wilton Manors?

Refinancing doesn’t have to be complicated or stressful. With a VA IRRRL Loan in Wilton Manors, it’s simple to drop your rate, lower your monthly payment, and start enjoying more of the city you love.

Call us today at 305-900-2012 to get started on your refinance, lower your rate, and enjoy life in Wilton Manors with a VA IRRRL.