Table of Contents

- What Is an FHA Loan and Why It’s Popular in Hallandale Beach

- FHA Loan Requirements for Hallandale Beach Buyers

- FHA Loan Limits for Broward County in 2025

- What Documents Are Needed to Apply for an FHA Loan

- Using Down Payment Assistance with an FHA Loan

- Estimating Monthly Payments with an FHA Loan

- Why People Are Choosing to Live in Hallandale Beach

- Is an FHA Loan the Right Fit?

- Meet Alex Doce and the Team at The Doce Mortgage Group

- Hallandale Beach Homeownership Is Within Reach

Keynotes

- FHA Loans Open Doors: Flexible credit standards, low down payments, and down payment assistance make FHA loans a smart option for first-time buyers and working families in Hallandale Beach.

- Homes Fit Within FHA Limits: Most single family homes and townhouse properties in Hallandale Beach fall under the 2025 FHA loan limits, allowing buyers to finance without needing jumbo or conventional loans.

- Hallandale Beach Is a Smart Move: With walkability, strong resale values, and no state income tax, Hallandale Beach offers both lifestyle benefits and long-term investment appeal.

What Is an FHA Loan and Why It’s Popular in Hallandale Beach

A Florida FHA home loan is a type of mortgage insured by the Federal Housing Administration. This government-backed loan program was created to make homeownership more accessible for those who may not qualify for traditional conventional loans. The program is especially helpful for first-time buyers, lower-income families, and borrowers with less-than-perfect credit.

In Hallandale Beach, FHA loans are commonly used to purchase condos, townhomes, and single-family residences. Many buyers in this area benefit from the program’s flexibility, including:

- Minimum down payments starting at 0% for those using Down Payment Assistance Programs

- Lenient credit requirements, with approval possible with FICO scores as low as 550

- Government insurance that allows lenders to offer more favorable rates and terms

This makes FHA loans one of the most popular mortgage options among first-time buyers, retirees, and working professionals looking to move into the Hallandale Beach area. Even if you are not a First Time Homebuyer, you may still qualify for an FHA loan and enjoy the same flexible benefits.

FHA Loan Requirements for Hallandale Beach Buyers

To qualify for an FHA loan in Hallandale Beach, applicants must meet certain borrower and property requirements. These rules, which also apply if you are applying for an FHA loan in Hollywood, are set by the U.S. Department of Housing and Urban Development (HUD) to make sure the borrower is financially ready to handle a home loan and that the property is safe and suitable for long-term living

Borrower Requirements:

- A minimum FICO credit score of 550.

To qualify for an FHA loan, your credit score must be at least 550. If your score falls between 550 and 579, you’ll likely need to make a 10% down payment. However, if your score is 580 or higher, you may be eligible with just a 3.5% down payment or 100% financing with the HomeZero Program, making homeownership more accessible.

- A verifiable income source.

You must demonstrate a reliable income history, usually verified through at least two years of steady employment or self-employment. This is documented using W-2 forms, recent pay stubs, or federal tax returns. Lenders need to confirm your ability to make monthly mortgage payments consistently over time before approving your FHA loan.

- A manageable debt-to-income ratio.

FHA guidelines allow debt-to-income (DTI) ratios up to 57%, but some lenders prefer a DTI of 50% or lower. Your DTI compares your total monthly debt payments to your gross monthly income. Keeping this ratio within the preferred range improves your chances of approval and helps ensure long-term affordability.

- Legal residency.

To be eligible for an FHA loan, you must have a valid Social Security number and be either a U.S. citizen, lawful permanent resident, or non-permanent resident with legal work authorization. Documentation of your immigration status and residency will be required during the loan application process.

- The property must be your primary residence.

FHA loans are only available for owner-occupied properties. This means you must intend to live in the home as your primary residence within 60 days of closing. You cannot use an FHA loan to finance a second home, vacation property, or investment real estate.

Property Requirements:

- The home must meet HUD’s minimum property standards for safety, soundness, and livability.

To qualify for FHA financing, the property must meet minimum standards set by the Department of Housing and Urban Development (HUD). These standards cover the home’s structural integrity, habitability, and health and safety features. Issues like peeling paint, roof damage, or exposed wiring must be repaired before closing.

- The property must pass an FHA-approved appraisal.

An FHA-certified appraiser must inspect the home to determine its fair market value and assess whether it meets HUD’s minimum property standards. This appraisal ensures the home is safe and livable and protects both the borrower and lender from overpaying for a property that’s in poor condition.

- FHA loans are only available for 1- to 4-unit homes.

Eligible properties include single-family homes, duplexes, triplexes, and fourplexes, provided the borrower lives in one of the units. Condos and townhomes may also qualify if they’re located in FHA-approved developments. This allows buyers to purchase multi-unit housing while still meeting occupancy requirements.

- Manufactured homes may also qualify if they are on a permanent foundation and meet local code.

FHA financing is available for manufactured homes, but only if they are permanently affixed to a foundation and comply with both HUD and local building codes. The home must be classified as real property, not personal property, and the site must meet FHA’s location and safety standards.

To find out if you qualify, you can Get a Free Quote with no commitment. This helps you understand how much you may be able to borrow and what steps to take next.

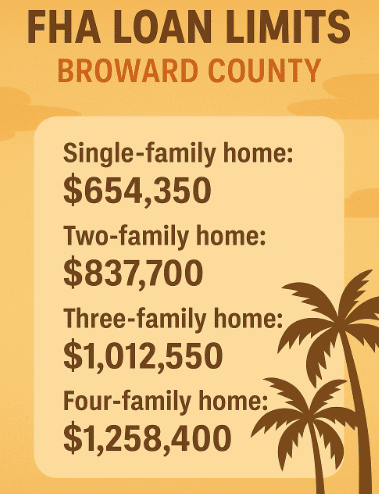

FHA Loan Limits for Broward County in 2025

FHA loans are subject to maximum borrowing limits, which vary based on location alnd property type. Since Hallandale Beach is located in Broward County, the limits for this area apply. These loan limits are based on median home prices and are updated annually to reflect current housing market conditions.

Source: HUD.gov

These limits are designed to help borrowers finance homes without needing to pursue a jumbo mortgage or conventional loan. The vast majority of homes and condos in Hallandale Beach fall well within these limits.

If your target home exceeds these limits, you can explore All Our Loan Types to see if a conventional or non-QM loan might be a better fit.

What Documents Are Needed to Apply for an FHA Loan

Before you begin your FHA application, it’s helpful to gather the necessary documentation. This makes the process smoother and gives your mortgage advisor a complete picture of your finances. Having everything ready also helps prevent delays in the approval process.

You’ll typically need to provide:

- Your government-issued ID

- Two years of W-2 forms or tax returns

- Thirty days of recent pay stubs

- Bank statements from the last 60 days

- Documentation for any additional income, including alimony, bonuses, or rental income

- Details about your current debts and monthly obligations

- A gift letter if someone is giving you funds toward your down payment

The Our Application portal makes it easy to securely upload your documents and get started online at any time.

Using Down Payment Assistance with an FHA Loan

FHA loans allow you to combine your mortgage with down payment assistance to reduce or eliminate your upfront costs. Many buyers in Hallandale Beach use local or statewide Down Payment Assistance Programs to help them cover their minimum 3.5% down payment or pay for closing costs.

These programs may offer:

- Forgivable loans

Forgivable loans provide down payment or closing cost assistance that doesn’t need to be repaid if you meet specific conditions, such as living in the home for a set number of years. These programs are often offered by state housing agencies or local governments to encourage long-term homeownership.

- Deferred payment loans

Deferred payment loans allow you to postpone repayment until you sell the home, refinance, or pay off your primary mortgage. They typically carry zero interest and no monthly payments, making them helpful for first-time buyers who need upfront assistance without adding to their immediate financial burden.

- Grant funds that do not require repayment

Some homebuyer assistance programs offer grants that don’t need to be repaid under any circumstances. These funds can cover down payment or closing costs and are often available through community organizations, nonprofits, or municipal housing programs. Grants reduce upfront expenses and lower barriers to homeownership.

- Employer-sponsored homebuyer incentives

Certain employers offer homebuyer assistance as part of their benefits package. These incentives may include matching funds, grants, or low-interest loans to help with down payments or closing costs. Programs are often used to attract and retain talent, especially in high-cost housing markets or community-focused professions.

You may also qualify for a Zero Down Mortgage in Florida if you combine FHA financing with an approved assistance program or our HomeZero program. This program has no income limits, is available also for non-first time home buyers, allows for FICO scores as low as 580 and gives up to 1.50% of the salesprice for closing costs assistance. This is especially helpful for renters who are ready to buy but haven’t yet saved enough for a traditional down payment.

Estimating Monthly Payments with an FHA Loan

Understanding your estimated monthly mortgage payment is an important step in the homebuying process. FHA loans include a few components in your payment, which can vary depending on the amount borrowed, your credit score, and local property taxes.

Your monthly payment will typically include:

- Principal

This is the part of your mortgage payment that directly reduces your loan balance. In the early years, a smaller portion of your payment goes toward principal, but over time, that amount increases. Paying down principal builds equity in your home and brings you closer to full ownership with every monthly payment you make.

- Interest

Interest is the lender’s fee for lending you money, calculated as a percentage of your remaining loan balance. In the early stages of your loan, most of your payment goes toward interest. As the balance decreases, interest costs go down. Lower rates mean lower interest payments over the life of the loan.

- Property Taxes

Property taxes are assessed annually by your local government and help fund schools, emergency services, and public infrastructure. The tax amount depends on your home’s assessed value and your local tax rate. Most lenders include these taxes in your monthly mortgage payment and pay them through an escrow account on your behalf.

- Home Insurance

Homeowners insurance protects against risks like fire, theft, and natural disasters. It’s required by lenders to safeguard the property serving as collateral for your mortgage. Insurance premiums vary based on your home’s location, size, and coverage options. Typically, the cost is collected monthly and paid through your escrow account along with taxes.

- FHA MIP

The FHA mortgage insurance premium (MIP) is a monthly fee added to your loan to protect the lender in case of default. Unlike private mortgage insurance, FHA MIP usually lasts for the full loan term. It’s required on all FHA loans and is paid monthly in addition to your principal and interest.

You can use our Mortgage Calculator to estimate your monthly payment based on today’s rates, your down payment, and your desired home price. This tool helps you see how different scenarios may impact your overall cost of ownership.

Why People Are Choosing to Live in Hallandale Beach

Hallandale Beach offers a rare combination of lifestyle, location, and affordability. It’s not just a beautiful place to vacation — it’s a smart place to live and invest. Here’s why more people are choosing to call it home:

- Central Location

Hallandale Beach offers quick highway access to Miami and Fort Lauderdale via I-95 and U.S. 1, making it ideal for commuters, day-trippers, and anyone who values regional convenience.

- Outdoor Lifestyle

With public beaches, marinas, and scenic parks, the city provides year-round opportunities for swimming, boating, jogging, and relaxing outdoors in South Florida’s famously warm, sunny climate.

- Walkable & Pet-Friendly

Sidewalk-lined streets, green spaces, and dedicated dog parks make Hallandale Beach perfect for pedestrians and pet owners, encouraging an active, healthy lifestyle for residents of all ages.

- All-in-One Entertainment

Gulfstream Park features live horse racing, dining, shopping, and casinos in one destination. It’s a popular local hub for weekend outings, nightlife, and family-friendly events.

- Waterfront Housing

Affordable condos and townhomes with ocean or canal views are available, making the area attractive to buyers and investors seeking rental income or seasonal property opportunities.

- Diverse Community

Hallandale Beach is home to an international mix of residents, bringing a vibrant cultural scene, multilingual atmosphere, and unique culinary offerings that enrich everyday life in the city.

- Investment Appeal

Real estate in Hallandale Beach enjoys strong resale values, making it a smart long-term investment. Market demand remains steady due to location, lifestyle amenities, and waterfront access.

- Tax Advantages

Florida’s no state income tax policy and competitive local property taxes make Hallandale Beach financially attractive for both primary homeowners and real estate investors.

- Easy Travel

Residents enjoy fast access to Miami and Fort Lauderdale airports, both within a 30-minute drive—ideal for frequent travelers, business professionals, or hosting out-of-town guests.

- Quality Services

The area features excellent healthcare facilities, well-rated schools, and strong public services, making it a convenient and reliable place to live, work, and raise a family.

From retirees looking for a comfortable condo near the beach to families purchasing their first home, Hallandale Beach is becoming one of South Florida’s most talked-about real estate markets.

Is an FHA Loan the Right Fit?

An FHA loan can be an excellent choice for many buyers in Hallandale Beach. This loan type works especially well for:

- Buyers who haven’t yet saved a large down payment

- People recovering from past credit issues

- Those looking for a lower monthly payment option

- Buyers using gift funds or down payment assistance

- Families purchasing condos or modestly priced homes

If you’re unsure whether an FHA loan is the best fit for you, a quick Get a Free Quote can help compare your options. You may find that FHA offers the best combination of low interest rates, reduced upfront costs, and approval flexibility.

For those purchasing a higher-priced home or looking to avoid mortgage insurance, there may be better options available. We encourage you to review All Our Loan Types to see what fits your budget and goals.

Meet Alex Doce and the Team at The Doce Mortgage Group

Alex and his team at The Doce Mortgage Group have a long track record of helping Florida homebuyers. Based right here in South Florida, they understand the unique needs of Hallandale Beach buyers, from financing condos to assisting with down payment assistance applications.

The team at The Doce Mortgage Group is known for:

- Fast pre-approvals and personalized service

- Bilingual support in English, Italian and Spanish

- Extensive knowledge of FHA, VA, and conventional loans

- Help with credit challenges and custom solutions for complex situations

- Online tools to make applying and uploading documents easy

Working with the right mortgage team can make all the difference. Whether you’re buying your first home or refinancing your current one, the guidance and transparency offered by The Doce Mortgage Group help make the experience faster, simpler, and more affordable.

Hallandale Beach Homeownership Is Within Reach

Homeownership in Hallandale Beach doesn’t have to feel out of reach. With an FHA loan, many buyers are discovering they can purchase a home with flexible credit standards, low upfront costs, and affordable monthly payments. The combination of government-backed security and local expertise makes it easier than ever to buy in one of South Florida’s fastest-growing cities.

The Doce Mortgage Group is here to help you every step of the way. From your first pre-approval to the day you get your keys, our team offers guidance, fast answers, and mortgage options tailored to your unique situation. Check out what past customers have to say in their Customer Reviews to see how we’ve helped others like you.

Call Us Today at 305-900-2012 to speak with a loan expert who understands the Hallandale Beach market and can help you move one step closer to homeownership.

FAQs

What requirements are needed for FHA?

To qualify for an FHA loan, you usually need a credit score of at least 580 to make a 3.5% down payment. If your score is between 500 and 579, you may still qualify, but you’ll need to put down more money.

What is the FHA loan limit in Broward County, Florida?

The FHA loan limit in Broward County, Florida for 2025 is $624,000 for a single-family home. This means buyers using an FHA loan can borrow up to that amount when purchasing a one-unit property. For multi-unit properties, such as duplexes or triplexes, the loan limits are higher. These limits are set each year to match local housing costs and make homeownership more affordable.

Is it hard to qualify for FHA?

FHA rules say you need at least a 500 credit score if you put 10% down, and 580 if your down payment is between 3.5% and 10%. Many lenders may ask for a higher score to approve your loan. If your credit is low, it’s a good idea to work on improving it before applying.

How long does it take to get approved for FHA?

From pre-approval to closing, a home loan usually takes about 30 to 60 days to get approved. The timeline can change based on how quickly you provide documents, the lender’s review process, the home appraisal, and the title check. Delays can happen if extra paperwork is needed, but being prepared with your income, credit, and bank information can help speed things up.