Quick Answer

A florida IRRRL loan, or Interest Rate Reduction Refinance Loan, is a simple VA-backed refinance option for veterans and active-duty service members who already have a VA loan. It helps lower your interest rate, reduce monthly payments, or switch from an adjustable rate to a fixed rate—usually without an appraisal, income check, or out-of-pocket costs.

Table of Contents

- What Does IRRRL Stand For and What Does It Actually Do?

- Who Qualifies for a Florida IRRRL Loan?

- What Are the Benefits of a Florida IRRRL Loan?

- Do I Need to Live in the Home to Use an IRRRL in Florida?

- How Much Could I Save with a Florida IRRRL Loan in 2025?

- What’s the Process to Get a Florida IRRRL Loan?

- Is There a Credit Check for a Florida IRRRL Loan?

- Can I Take Cash Out with an IRRRL Loan in Florida?

- How Is a Florida IRRRL Loan Different From a Regular VA Refinance?

- Does a Florida IRRRL Loan Have Closing Costs?

- Can I Use Down Payment Assistance with a Florida IRRRL Loan?

- Why Are Florida IRRRL Loans So Popular Right Now?

- Why Are Veterans Choosing to Refinance in Florida Specifically?

- Top Cities in Florida to Own Property with a VA Loan

- FAQ, Florida IRRRL Loan Questions Answered

- What’s My Next Step to Get Started?

Top 3 Take-a-Ways

- A florida IRRRL loan helps veterans lower mortgage rates or switch to fixed terms.

- No appraisal, income verification, or out-of-pocket costs are usually required.

- Refinancing can cut monthly payments and offset Florida’s rising home expenses in 2025.

If you live in Florida and already have a VA loan, there’s a refinance option made just for you. It’s called an IRRRL, which stands for Interest Rate Reduction Refinance Loan. A florida IRRRL loan helps veterans and active-duty service members lower their monthly mortgage payments or switch from an adjustable rate to a more predictable fixed rate.

This isn’t a loan to buy a new home, and it’s not a way to cash out equity. It’s a streamlined refinance for people who already have a VA-backed mortgage. If that’s you, this program could help you save hundreds every month without the long approval process you had to go through the first time.

Whether you’re in Miami, Tampa, Jacksonville, or a smaller Florida town, this loan makes it easy to improve your mortgage terms and protect your monthly budget. And since it’s based on your existing VA loan, qualifying is often much simpler than a standard refinance.

What Does IRRRL Stand For and What Does It Actually Do? Back to Contents

IRRRL stands for Interest Rate Reduction Refinance Loan. It’s a program backed by the Department of Veterans Affairs to help homeowners refinance an existing VA loan into a new one with a lower interest rate or better terms.

The main goal of a florida IRRRL loan is to reduce your monthly payment or move you from a riskier adjustable-rate mortgage into a safer, fixed-rate one. Most people use it to lock in a lower rate and get a more stable long-term mortgage.

There’s no home appraisal required, no income verification, and no full credit check. That makes it one of the fastest and most stress-free refinance options available. It’s built for one purpose: to make your VA loan work better for you now that rates or your financial goals have changed.

Who Qualifies for a Florida IRRRL Loan? Back to Contents

Not everyone can use the IRRRL program. It’s only for people who already have a VA loan on the property they want to refinance. If that’s you, and you’ve been making payments on time, you’re likely already qualified.

Here’s what you need to meet the requirements:

- You must already have a VA loan on the home

- You must have made your past 6 to 12 mortgage payments on time

- The new loan must offer a clear benefit like a lower rate or safer loan type

- You must have lived in the home at some point, even if you don’t live there now

That last point is key. You don’t have to currently live in the property. So if you’ve moved out and turned the home into a rental, you can still use a florida IRRRL loan to lower your payment.

Because Florida home insurance and tax costs have increased in recent years, lowering your mortgage can make a big difference. This program is one of the easiest ways for veterans to do that without going through a full loan approval process again.

What Are the Benefits of a Florida IRRRL Loan? Back to Contents

There’s a reason this loan is called “streamlined.” It’s faster, simpler, and designed to benefit you without tons of paperwork. Here are the biggest benefits of a florida IRRRL loan:

- No new appraisal needed

- No income verification required

- No home inspection or termite check

- Often no out-of-pocket costs

- Lower interest rate and monthly payment

- Faster closing time, often under 30 days

- You don’t have to live in the home right now

The process is much easier than a traditional refinance. And since the goal is to lower your payment or stabilize your mortgage, the VA doesn’t require you to prove your income again or submit a credit package.

Do I Need to Live in the Home to Use an IRRRL in Florida? Back to Contents

One of the best parts of this program is that you don’t need to currently live in the home. You just need to show that you lived there in the past. This is different from a regular VA purchase loan, where you’re required to move into the home after closing.

This flexibility is perfect for veterans in Florida who have moved to a new home but kept their old one as a rental. For example, if you bought a house in Tampa in 2018 with a VA loan and moved to Orlando in 2023, you can still use a florida IRRRL loan to refinance your Tampa home and drop the rate.

As long as the home is already financed with a VA loan and you lived in it at one time, you’re eligible. That opens the door for veterans with rental properties to save even more.

How Much Could I Save with a Florida IRRRL Loan in 2025? Back to Contents

With mortgage rates dropping slightly from their 2023 peak, 2025 is a great time to refinance. As of November 14, 2025, the national average 30 year VA refinance rate is about 6.47%, and Florida’s 30 year conventional rate is about 6.34%, while many borrowers from earlier years still sit near 7%.

Here’s what that means in real dollars:

If you owe $300,000 and pay 7%, the principal and interest is about $1,996. If you refinance to 5.8%, the new payment is about $1,760. That’s a savings of about $236 each month, or about $2,832 per year.

This doesn’t even include savings on insurance or taxes, which are especially important in Florida. By lowering your rate now, you give yourself more breathing room in a time when other home-related costs are going up.

Want to see your own savings? Try out our easy-to-use Mortgage Calculator to find out how much you could cut from your payment.

What’s the Process to Get a Florida IRRRL Loan? Back to Contents

Here’s the good news. The process is fast and simple compared to a normal mortgage. In many cases, you can close your refinance in less than 30 days. Here’s how it works:

- Check if your current loan is a VA loan

If it is, and you’ve been paying on time, you’re likely eligible. - Get your Certificate of Eligibility (COE)

This document proves you’re eligible for VA-backed financing. We’ll help you get it fast. - Pick your rate and sign the paperwork

You’ll choose a lower rate and review the simple documents to start the refinance. - Close your loan and start saving

Most closings happen quickly since there’s no appraisal, inspection, or full income check.

The VA funding fee for an IRRRL is 0.5%, and it can usually be rolled into the new loan. So most borrowers don’t need to pay anything out of pocket.

Ready to take the next step? You can Get a Free Quote and see how much your new payment could be.

Is There a Credit Check for a Florida IRRRL Loan? Back to Contents

One of the best parts of a florida IRRRL loan is that you don’t have to go through a full credit check. There’s no need to verify your income, and most borrowers won’t need to pull a new credit report. That’s because this program is focused on refinancing people who already have a VA loan and are using it to improve their financial situation.

That said, some companies may still choose to look at your credit just to verify payment history. But this isn’t a full credit review like you’d get with a regular refinance. Even if your score isn’t where it used to be, you still have a strong chance of approval if you’ve been making your mortgage payments on time.

And here’s what’s key, especially in Florida: rising insurance rates and property taxes have already squeezed homeowners, so cutting your interest rate without jumping through more hoops is a smart way to get relief without starting over from scratch.

Can I Take Cash Out with an IRRRL Loan in Florida? Back to Contents

No. A florida IRRRL loan isn’t designed for pulling out cash. It’s strictly meant for reducing your mortgage interest rate or switching your loan from an adjustable rate to a fixed one.

If you’re looking to tap into your home’s equity and take out cash, there are other VA refinance options available. But this one is purely for lowering your monthly payments and improving loan terms.

That’s actually what makes it so fast and easy. The lack of cash-out means there’s less risk involved, which is why the VA allows it to move forward with no appraisal or income verification.

If you’re not sure which route is better for your needs, you can Get a Free Quote and we’ll help you figure out what’s best based on your goals.

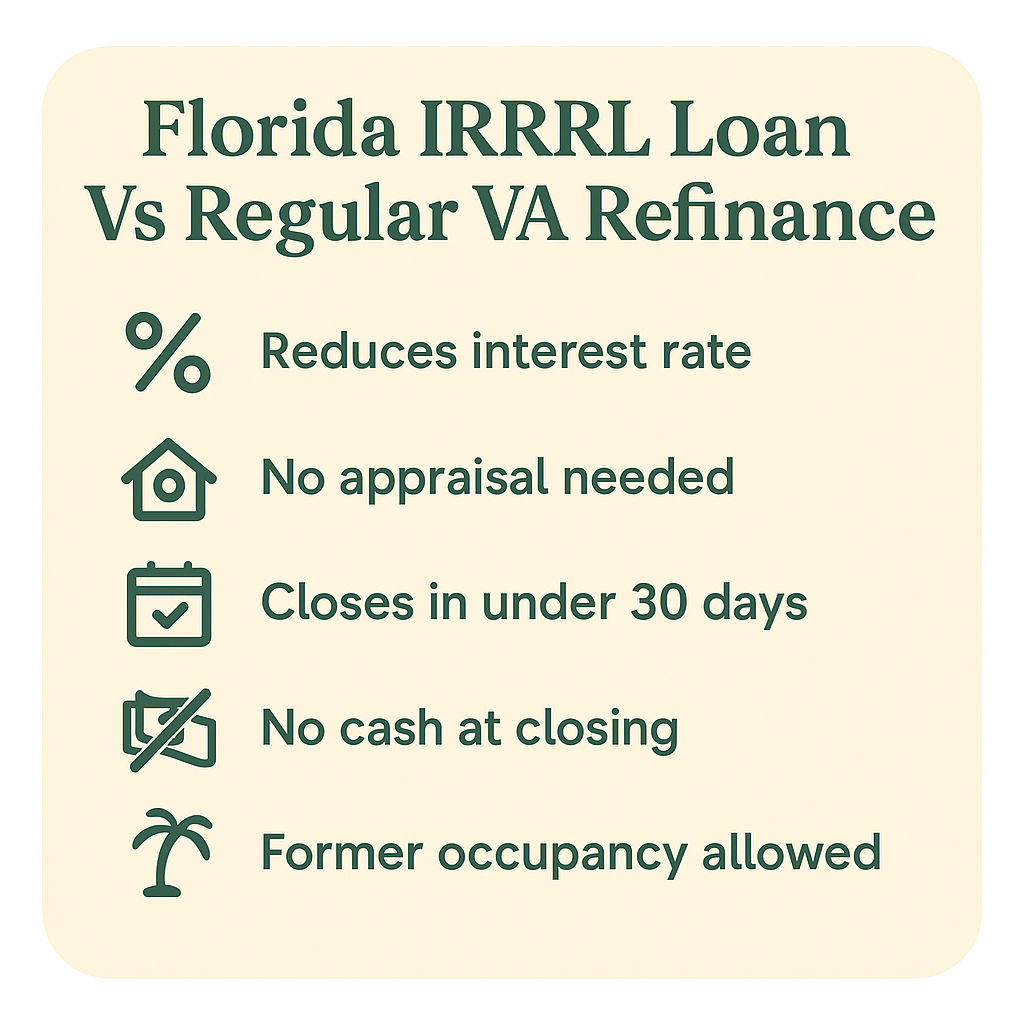

How Is a Florida IRRRL Loan Different From a Regular VA Refinance? Back to Contents

Not all VA refinances are created equal. Let’s compare a florida IRRRL loan to a full VA Cash-Out Refinance, so you know what to expect:

- Purpose:

IRRRL is for reducing your interest rate. VA Cash-Out lets you pull equity from your home.

- Requirements:

IRRRL needs no appraisal or income docs. Cash-Out Refinance requires full credit, income, and appraisal review.

- Timeline:

IRRRL closes in under 30 days. Cash-Out loans can take 45 to 60 days.

- Cash at Closing:

IRRRL gives you no cash. Cash-Out gives you access to equity funds.

- Occupancy Rules:

IRRRL allows former occupancy. Cash-Out loans require you to live in the home.

If all you want to do is lower your payment or get a fixed rate, an IRRRL is the easier and faster option. And in Florida’s current market, that’s often the smarter choice.

Does a Florida IRRRL Loan Have Closing Costs? Back to Contents

Yes, there are still closing costs with a florida IRRRL loan, but most people don’t pay them out of pocket. They’re usually rolled into the new loan balance, which means you don’t have to pay anything upfront.

Here are common closing costs you might see:

- Title and recording fees

- VA funding fee (0.5% of loan amount)

- Small processing or administrative fees

If your new interest rate is low enough, these costs can be covered by your monthly savings pretty quickly. And since the process skips over things like appraisals, home inspections, and income checks, it’s often cheaper overall than a full refinance.

If you’re ready to begin the process, visit Our Application portal to get started right now.

Can I Use Down Payment Assistance with a Florida IRRRL Loan? Back to Contents

This program doesn’t work with down payment assistance, because it’s a refinance, not a purchase loan. That said, if you’re planning to buy a home in Florida and need help with your upfront costs, The Doce Mortgage Group offers both Down Payment Assistance Programs and the exclusive HomeZero Program to help qualified buyers move forward with little or no money down.

But for a florida IRRRL loan, you don’t need any down payment. You’ve already bought the home. Now, this is just a way to improve your current loan and monthly payment with fewer requirements and faster results.

Why Are Florida IRRRL Loans So Popular Right Now? Back to Contents

In 2025, the average interest rate for a 30-year conventional loan in Florida is around 6.3%. But many veterans who got their VA loans before 2023 are still sitting on rates of 7% or even higher. With the current VA rate now closer to 5.8%, there’s a big opportunity to save.

On top of that, Florida has seen a steady increase in property insurance premiums, with some areas seeing rates climb 30% or more compared to 2022. That’s made monthly housing costs harder to manage for homeowners across the state. Lowering your mortgage payment with a florida IRRRL loan can help balance out those increases.

And for those who no longer live in the home but kept it as a rental, the IRRRL program is still available. That flexibility isn’t something you’ll find with most refinances, making it ideal for Florida’s active military community and veterans who move often.

Why Are Veterans Choosing to Refinance in Florida Specifically? Back to Contents

Florida is one of the most popular states in the country for veterans, and it’s not just for the beaches. Here’s why so many military families choose to live and refinance here:

- No state income tax

That means bigger take-home pay and easier retirement budgets.

- Homestead exemptions for veterans

Eligible veterans in Florida get additional property tax breaks.

- Military bases and strong VA support

From Naval Station Mayport to MacDill Air Force Base, Florida has a strong military presence.

- Rising home values

Multiple datasets show Florida home values were down year over year through much of 2025, with Zillow reporting about a 5.4% statewide decline as of October 31, 2025.

- Flexible IRRRL occupancy rules

Many veterans use this to refinance homes they’ve moved out of, making the most of rental opportunities in growing markets like Tampa, Orlando, and Cape Coral.

Florida also has more veterans than any state except Texas and California. That makes programs like the IRRRL especially important here, because so many homeowners can actually use them.

If you want help running the numbers or understanding your options, you can always Get a Free Quote from our team.

Top Cities in Florida to Own Property with a VA Loan Back to Contents

Florida is a prime state for VA-backed homeownership. It’s veteran-friendly, tax-efficient, and full of opportunity. If you already own a property with a VA loan and are thinking about a florida IRRRL loan, here are some of the top cities where it’s paying off:

- Tampa

With MacDill Air Force Base nearby and a booming rental market, Tampa is a great place for veterans who want to refinance, especially if they’ve turned their home into a rental.

- Jacksonville

Home to Naval Station Mayport and one of the state’s most affordable large cities, Jacksonville offers great value for VA homeowners.

- Orlando

Strong growth, steady tourism, and rising home values make refinancing here a smart move.

- Cape Coral

As of late 2025, Cape Coral home values are down about 10% year over year, which can affect refinance and equity decisions.

- Miami

While the market is more competitive, Miami offers high rental demand and long-term investment potential for veterans who’ve moved but held onto their properties.

These cities are just a few examples where veterans are using IRRRL loans to lower payments, boost cash flow, and gain more financial freedom. And with Florida’s military benefits and no income tax, refinancing here makes even more sense.

FAQ, Florida IRRRL Loan Questions Answered Back to Contents

How soon can I use an IRRRL after getting my original VA loan?

You must have made at least six consecutive on time monthly payments, and at least 210 days must have passed from the due date of the first payment on the current loan.

Can I use a florida IRRRL loan more than once?

Yes. You can use the IRRRL program more than once, as long as each refinance brings a real financial benefit.

What if my home value dropped?

No appraisal is required, so a drop in value won’t stop you from using the program.

Can I switch from an ARM to a fixed rate with an IRRRL?

Yes. This is one of the most common reasons people choose an IRRRL. Switching to a fixed rate provides long-term stability.

Is a termite inspection required?

No. Unlike VA purchase loans, the IRRRL does not require termite or pest inspections.

What’s the VA funding fee for a florida IRRRL loan in 2025?

It’s 0.5% of the loan amount, and most borrowers roll it into the new loan, so there’s usually no upfront cost. This fee is exempt for most disabled Veterans.

What’s My Next Step to Get Started? Back to Contents

If you’ve read this far, you’re probably serious about lowering your mortgage payment or getting better terms on your current VA loan. I’ve helped a lot of veterans and military families across Florida refinance through the IRRRL program, and I can tell you it’s one of the most straightforward ways to save money and take control of your finances.

Our team at The Doce Mortgage Group handles everything for you, start to finish. There’s no guesswork, no long wait times, and no hoops to jump through. Just a simple process that works for real people with real goals.

If you want to know what other veterans and homeowners are saying about working with us, check out our customer reviews. You’ll see why so many people trust us with one of their biggest financial decisions.

Also, I’m proud to share that we were recently recognized as one of the Best Mortgage Brokers in several cities in Florida by WalletHub. This list features the most prestigious mortgage professionals in the state, ranked by the number of positive reviews, and Alex is listed at the very top. It’s an honor that reflects our commitment to making this process as smooth and stress-free as possible.

Whether you’re just doing some research, ready to start, or just need a little help sorting through your options, we’re here for you.

Call us today at 305-900-2012 to find out if a Florida IRRRL loan is right for you.