Quick Answer

In 2026, the minimum credit score to qualify for an FHA loan in Florida can be as low as 500, with down payments starting at 0 percent for eligible buyers with a minimum middle 600 score and flexible terms that make approval more accessible than conventional financing.

Table of Contents

- What Credit Score Do You Need To Get Approved?

- Do Lower Credit Scores Affect Your Loan Terms?

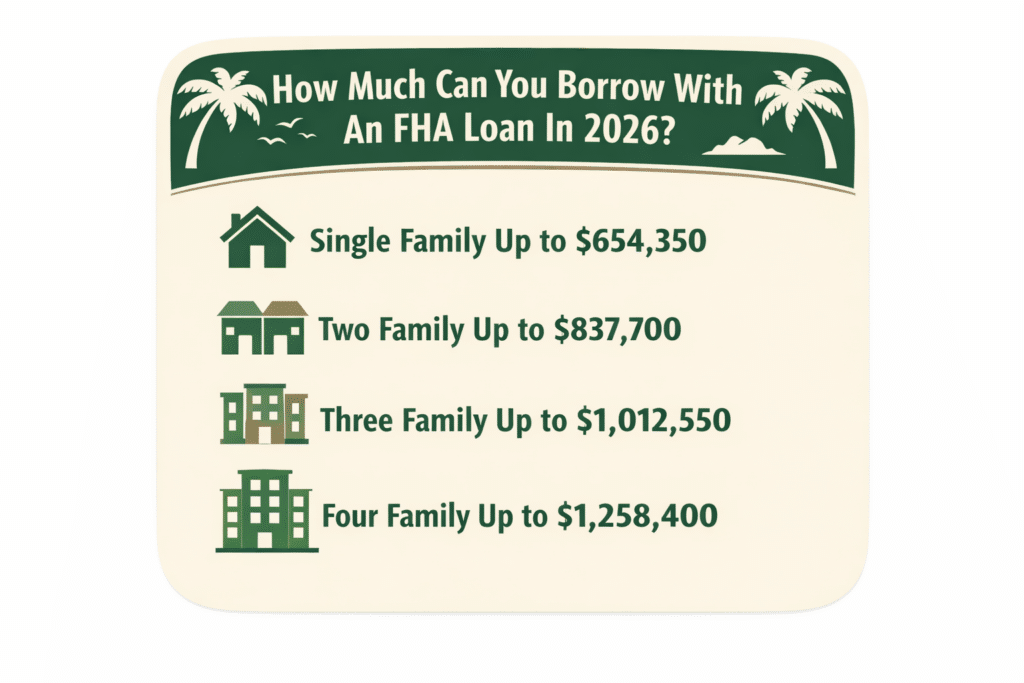

- How Much Can You Borrow With An FHA Loan In 2026?

- Can You Use Down Payment Assistance With FHA Loans?

- Are There Other Requirements Besides Credit?

- FAQ’s

- Why Choose The Doce Mortgage Group

Top 3 Take-a-Ways

- FHA loan limits in Florida reach into the mid $600,000s for single families, condominiums and townhouses.

- FHA supports higher debt to income ratios than conventional options.

- Down payment assistance and HomeZero help reduce upfront cash requirements

For many Florida buyers, FHA loans are one of the easiest paths into homeownership because qualification standards are more flexible than conventional options. With housing costs rising across the state and many first time buyers looking for ways to make a purchase work in 2026, questions around credit score minimums are becoming very common. The good news is FHA guidelines allow room for borrowers with less than perfect credit to qualify as long as they meet a few financial requirements.

What Credit Score Do You Need To Get Approved?

When it comes to credit flexibility, the FHA remains the most accessible path to homeownership in Florida. While most conventional loans in 2026 require a FICO score in the high-600s just to get competitive pricing, FHA guidelines are built for a much broader range of buyers.

What is “Typical” for FHA

Nationally, the industry “sweet spot” for FHA borrowers is a FICO score between 580 and 680. This range typically allows for the program’s famous 3.5% down payment. While HUD guidelines technically allow for scores as low as 500 (with 10% down), many banks and lenders apply “overlays,” meaning they won’t actually approve a loan for anyone with a score below 580 or 620.

Recent data shows that nearly 28% of all FHA buyers in 2025 had scores below 620, highlighting how vital this program is for first-time buyers and those with “thinner” credit files.

What The Doce Mortgage Group Can Do For You

At The Doce Mortgage Group, we believe homeownership should be accessible to all steady wage earners, not just those with perfect credit. Here is how we go beyond the typical lender:

- Credit Flexibility (500+): While most lenders stop at 580, we can facilitate FHA financing for Florida borrowers with FICO scores as low as 500.

- Low Down Payment Options: We specialize in the 3.5% down payment model, and for qualified borrowers, we can even explore options as low as 0% down through specialized assistance programs like our HomeZero Program.

- Bridge the Gap: We don’t just look at a number; we look at your whole story. Whether you are a first-time buyer or recovering from a past life event, we use FHA’s flexible guidelines to bridge the gap between your current credit and your new front door.

Do Lower Credit Scores Affect Your Loan Terms?

Credit still plays a role in how appealing your terms are. Borrowers with higher scores typically gain access to better interest rates and smoother underwriting. However, unlike conventional options where a lower score may disqualify you completely, FHA gives breathing room by allowing the government to take on the risk rather than the financial institution.

FHA loans in Florida also offer helpful features that protect buyers, including the ability to refinance later without a new appraisal and the ability to qualify with higher debt to income ratios. These benefits help borrowers who are building their financial profile over time without being locked out of ownership while they do it.

How Much Can You Borrow With An FHA Loan In 2026?

Loan limits adjust every year and vary by county. For 2026, the most recent FHA loan limits for Florida standard cost counties look like this:

Some counties in Florida with higher cost of living have larger caps. For example, Monroe County can go up to $967,150 for a single family residence. These higher limits allow FHA buyers more flexibility in coastal markets where inventory and pricing can create difficulty for lower and middle income buyers.

Can You Use Down Payment Assistance With FHA Loans?

Yes, FHA loans allow participation in Down Payment Assistance Programs, and many Florida counties currently offer incentives for qualified households. Whenever assistance programs are discussed, buyers should also know that The Doce Mortgage Group offers the HomeZero Program, which gives eligible buyers the chance to buy with 0 percent down. These two options together can make ownership achievable for buyers who have steady income but limited savings.

Are There Other Requirements Besides Credit?

FHA will review factors beyond credit, including:

- Proof of stable income

- Residency in the property as a primary home

- Acceptable debt to income ratios

- A property that meets FHA condition standards

These help protect the borrower and keep their long term housing situation stable.

FAQ’s

Do I need a large down payment?

No. FHA allows 0 percent down in some cases and 3.5 percent for many credit tiers.

Is FHA only for first time buyers?

No. FHA is available to anyone who meets the guidelines.

Can I use gift funds?

Yes. FHA allows family gift funds for down payments and closing costs.

Will credit disputes affect approval?

Sometimes. Disputed accounts may need to be resolved before FHA underwriting is completed.

Why Choose The Doce Mortgage Group?

At The Doce Mortgage Group, we specialize in FHA financing across Florida and take pride in guiding our buyers through the approval process with confidence and clarity. We were recently recognized by WalletHub as one of the best mortgage brokers in several cities throughout Florida, and our customer reviews reflect how seriously we take communication, service and long term client relationships.

If you’re ready to explore your FHA options, we would love to help you run numbers, compare programs and make sure the loan you choose sets up your financial goals. Call us today at 305-900-2012 to learn more about FHA qualification and get started.