Table of Contents

- What Is a Florida Jumbo Loan?

- How Much Can You Borrow with a Jumbo Loan in Florida?

- What You Need to Qualify

- Down Payments and PMI: The Real Math

- Who Are Florida Jumbo Loans Really For?

- How to Apply for a Florida Jumbo Loan

- Top Cities Where Florida Jumbo Loans Make the Most Sense

- Why Buyers Are Choosing Jumbo Loans in 2025

- Why People Are Moving to Florida Now More Than Ever

- Why Work with The Doce Mortgage Group?

- Florida Jumbo Loans FAQs

- Your Luxury Home in Florida Is Closer Than You Think

Keynotes

- Jumbo loans in Florida start above $819,000 in most counties.

- You can buy with just 10% down and no PMI up to $2,500,000 loan amounts.

- The Doce Mortgage Group simplifies jumbo financing with fast approvals and expert guidance.

If you’re shopping for a luxury home in Florida, there’s a good chance you’ll need a jumbo loan to get it done. High-end properties in places like Miami, Coral Gables, Fort Lauderdale, and Boca Raton often cost more than what traditional loans will cover. That’s where Florida Jumbo Loans come in.

These loans help buyers break past the usual borrowing limits and unlock some of the most desirable homes in the state. Whether you’re eyeing a waterfront condo in Miami or a private estate in Naples, jumbo loans are how smart buyers make it happen.

What Is a Florida Jumbo Loan?

A Florida jumbo loan is a home loan that’s bigger than the limit set by Fannie Mae and Freddie Mac. That limit in 2025 is $819,000 for most Florida counties. In high-cost counties like Monroe County, that limit is $967,150.

So if you’re buying a home that costs more than those amounts, you’ll likely need jumbo financing.

Jumbo loans let you borrow up to $5,000,000 with one single loan with only 20% down. That means you don’t have to juggle two mortgages or find extra financing on the side. Even better, jumbo loans from The Doce Mortgage Group come with very competitive rates, often matching or even beating standard loan rates in 2025.

This type of loan is built for buyers who are ready to invest in a long-term home. They know what they want and don’t want limits holding them back.

How Much Can You Borrow with a Jumbo Loan in Florida?

In Florida, the amount you can borrow with a jumbo loan depends on your income, credit, and how much money you’re putting down.

Here’s what The Doce Mortgage Group offers in 2025:

-

- As little as 10% down to $2,500,000 loan amounts

-

- No private mortgage insurance (PMI) even with only 10% down

-

- Rates that rival conforming loans

A popular setup is putting 20% down to avoid a larger monthly payment, but you can still get in with just 10% down and skip PMI altogether. That’s a game-changer if you’re buying a $1.2M or $2.5M home.

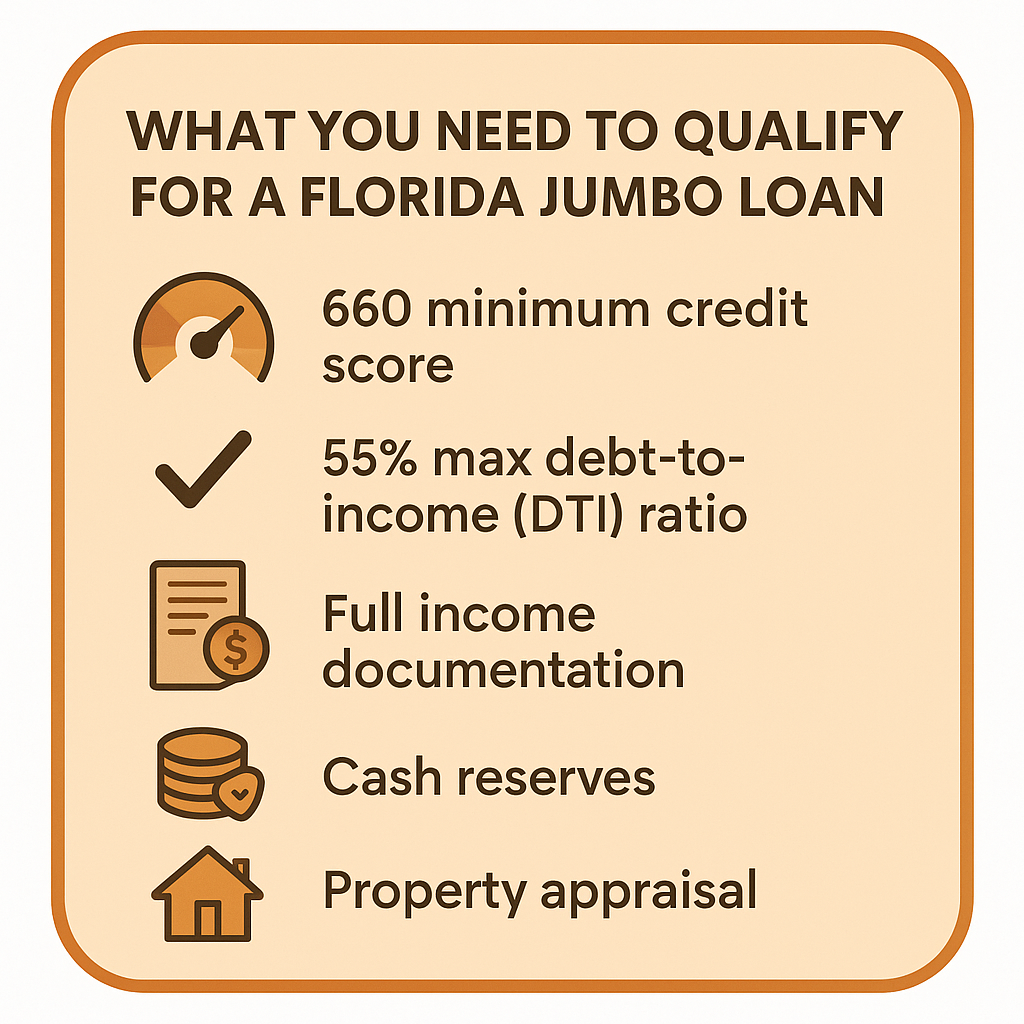

What You Need to Qualify

Florida Jumbo Loans have more flexible options than many people expect, but there are a few boxes you’ll need to check to qualify.

Here’s what’s usually required:

-

- 660 minimum credit score

-

- 55% max debt-to-income (DTI) ratio

-

- Full income documentation — tax returns, W-2s, bank statements, paystubs

-

- Cash reserves — depending on loan size, you might need 3 to 12 months of reserves

-

- Property appraisal — a licensed appraiser has to confirm the value of the home

If you’re serious about moving forward, the fastest way to get started is through Our Application Portal. It only takes a few minutes and helps you lock in the process faster.

Down Payments and PMI: The Real Math

One of the biggest reasons people hesitate on jumbo loans is the idea that they need to put down 30% or more. But that’s old thinking.

In 2025, The Doce Mortgage Group can offer jumbo loans with just 10% down, and still no PMI. That’s a rare combo, especially in a market where even basic homes are approaching the jumbo threshold.

Let’s say you’re buying a $1.3M home in Fort Lauderdale. You could:

-

- Put down $130,000 (10%)

-

- Finance the remaining $1.17M

-

- Still avoid PMI

-

- Lock in a competitive jumbo rate for 30 years

This opens the door to high-value properties without draining your savings account.

Who Are Florida Jumbo Loans Really For?

These loans aren’t just for the ultra-rich. In Florida, more and more regular buyers are using jumbo financing because prices are rising fast.

Florida Jumbo Loans are perfect for:

-

- People buying homes priced over $910,000

-

- High-income professionals like doctors, business owners, and executives

-

- Families moving up into larger homes in growing areas

-

- Retirees downsizing from the Northeast but still spending $1M+ on a luxury home

-

- Investors looking to purchase high-end short-term rentals or vacation homes

If your dream home sits above the conforming loan limits, it doesn’t mean it’s out of reach. It just means you need the right strategy and the right team to help you get there.

Want to know what your payments would look like? Our Mortgage Calculator can give you an idea of what you can afford before you fall in love with a home.

How to Apply for a Florida Jumbo Loan

Getting approved for a Florida jumbo loan isn’t as hard as many people think, especially when you’re working with a team that knows the local market. The Doce Mortgage Group makes the process quick, clear, and tailored to your situation.

Here’s how to get started:

-

- Complete your application – You can get things moving in just minutes through Our Application Portal.

-

- Submit your documents – That usually includes W-2s or 1099s, recent pay stubs, bank statements, and tax returns.

-

- Get pre-approved – This gives you a solid number to shop with and shows sellers you’re serious.

-

- Order your appraisal – The property needs to be appraised to confirm its value.

-

- Close and move in – Once approved, you’re ready to close and get the keys.

Top Cities Where Florida Jumbo Loans Make the Most Sense

Luxury real estate in Florida isn’t limited to just one part of the state. From the Gulf Coast to South Florida and up to Central Florida, prices are soaring in 2025 — which means jumbo loans are more common than ever.

Here are the top cities where jumbo financing is becoming the norm:

Miami

In 2025, the median single-family home price in Miami-Dade County is about $660,000, and many desirable waterfront homes start around $1.2 million. Whether you’re looking at Brickell, Coconut Grove, or Coral Gables, most buyers are using jumbo loans to compete in these neighborhoods.

Luxury condos and waterfront properties in Miami often range between $1 million to $4 million, depending on size and location. With that kind of price tag, jumbo financing isn’t optional — it’s expected.

Naples

Naples is one of the top retirement and second-home markets in the country. It’s also one of the wealthiest. Homes in Port Royal, Old Naples, and Pelican Bay often list in the $2 million to $5 million range.

With prices rising steadily year over year, Naples buyers are relying on jumbo loans to buy second homes or transition into upscale retirement living.

Fort Lauderdale

Once seen as Miami’s little brother, Fort Lauderdale has stepped into its own spotlight. Waterfront homes along the Intracoastal now average $1.5 million and up, with many going well beyond that. In 2025, jumbo loans are powering much of the market in this area.

Orlando

Believe it or not, Orlando has seen one of the biggest luxury home booms in Florida. In areas like Winter Park, Lake Nona, and Windermere, luxury homes regularly sell for $900K to $2.5M.

With tech companies and medical campuses growing in Orlando, high earners are planting roots — and they’re using jumbo loans to do it.

Tampa Bay

Tampa’s growth has been explosive. In 2025, luxury homes in South Tampa and Davis Islands are selling for $1.2M and up, while beachfront homes near Clearwater can reach $3 million or more.

Buyers here want space, views, and access to a booming economy. Jumbo loans help cover all of that without multiple mortgages or massive down payments.

Why Buyers Are Choosing Jumbo Loans in 2025

It’s no secret that Florida’s luxury market has exploded. But it’s not just about big houses — it’s about smart financing.

In 2025:

-

- Many homes sold in Miami-Dade in 2025 are priced above the conforming loan limits, especially in high-end neighborhoods

-

- Luxury home inventory is down in Naples, driving prices up 9% year-over-year

-

- More high-income remote workers are relocating to Florida for tax benefits and lifestyle

People aren’t just paying more because they have to. They’re buying luxury homes because Florida offers a lot more value per dollar than places like New York, California, or Chicago. And Florida Jumbo Loans give them the power to buy what they want — without overcomplicating the process.

Want to estimate your monthly payment on a $1.5M or $2M property? Use our Mortgage Calculator. It’s a great way to plan before scheduling showings.

Why People Are Moving to Florida Now More Than Ever

Financing aside, people want to live in Florida. A lot of them.

Florida welcomed more than 300,000 new residents in the past year, and the trend is still going strong in 2025. Here’s why:

-

- Warm weather year-round – Average winter temps in Miami hover around 76°F

-

- Coastal lifestyle – Boating, fishing, and ocean views are a daily reality

-

- Strong job growth – Especially in finance, tech, and healthcare

-

- Top-rated schools and private academies in cities like Naples and Tampa

-

- Better bang for your buck compared to other coastal states

Why Work with The Doce Mortgage Group?

When you’re buying a high-value home, the right mortgage team matters more than ever. At The Doce Mortgage Group, you’re not dealing with a call center or a one-size-fits-all company. You’re working with real experts who know how jumbo loans work in Florida — and how to get them approved quickly.

Here’s what makes The Doce Mortgage Group stand out in 2025:

-

- Fast approvals with a focus on Florida Jumbo Loans

-

- Flexible options for buyers with complex income or large assets

-

- Direct access to jumbo programs with as little as 10% down to $2,500,000 loan amounts

-

- No PMI, even on high-balance loans

-

- Competitive rates that rival standard mortgage rates

-

- Personal service from start to finish

Florida Jumbo Loans FAQs

What credit score do I need for a jumbo loan in Florida?

You’ll need a minimum FICO of 660. A higher score may help you qualify for better rates or lower your required reserves.

Can I use gift funds for the down payment?

Yes, in many cases, gift funds are allowed for part or all of your down payment. The exact guidelines depend on the loan amount and program.

Do jumbo loans have higher interest rates?

Not anymore. In 2025, jumbo loan rates are often equal to or even better than conforming loan rates, especially with strong credit and income.

Can I buy a second home or investment property with a jumbo loan?

Yes. Florida Jumbo Loans are available for second homes and investment properties, though the down payment and reserve requirements may be higher.

Are there prepayment penalties?

No, The Doce Mortgage Group does not offer jumbo loans with prepayment penalties. You’re free to pay off early without fees.

Can self-employed buyers qualify?

Absolutely. Self-employed buyers make up a large percentage of jumbo borrowers. You’ll need to provide tax returns and bank statements, but strong income can go a long way.

How long does it take to close?

Many jumbo loans through The Doce Mortgage Group close in 20 to 30 days, depending on how fast documents are submitted and the appraisal is completed.

Your Luxury Home in Florida Is Closer Than You Think

Florida Jumbo Loans open the door to some of the best homes in the state, and the process is more accessible than most people realize.

You don’t need a massive down payment. You don’t need perfect credit. And you don’t need to settle for anything less than your dream property.

Whether you’re moving to Miami, upgrading in Naples, or buying a second home in Orlando, The Doce Mortgage Group has the tools to get you financed quickly and affordably. Their jumbo loan programs are built around real Florida buyers.

Want to hear what other homeowners say about their experience? Check out hundreds of our customer reviews.

Call us today at 305-900-2012to speak with a Florida jumbo loan expert and start your luxury home purchase today.