Table of Contents

- How a DSCR Loan in Miami Works in 2025

- Advantages of Using a DSCR Loan in Miami

- Current 2025 DSCR Loan Guidelines in Miami

- Why Investors Prefer DSCR Loans Over Other Financing

- Boosting ROI With a DSCR Loan in Miami

- 2025 Miami Housing Market Conditions

- Best Neighborhoods in Miami for DSCR Loan Investors

- Why Miami Continues to Draw Investors

- FAQ About DSCR Loans in Miami

- Partnering With The Doce Mortgage Group for Your Miami Investment

Keynotes

- DSCR loans qualify based on property income, not personal income.

- Flexible terms allow investment in various property types and neighborhoods.

- The Doce Mortgage Group can guide you to the right DSCR loan for your needs.

How a DSCR Loan in Miami Works in 2025

A DSCR Loan in Florida is a financing option designed for real estate investors who want to qualify based on the income a property produces rather than their personal income. DSCR stands for Debt Service Coverage Ratio, which is the relationship between a property’s annual rental income and its annual mortgage and operating expenses.

Lenders in Miami will calculate this ratio by dividing net operating income by total debt service. A DSCR of 1.0 means the property generates enough income to cover its mortgage payment. Many Miami lenders in 2025 look for ratios between 1.0 and 1.25, though certain programs may allow slightly lower if the borrower has strong credit or additional reserves. The Doce Mortgage Group offers DSCR loans with qualifying ratios starting at 0.75 and also provides No Ratio options for eligible investors.

Unlike traditional investment property loans that require W-2s, tax returns, and proof of employment, a DSCR loan focuses entirely on the property’s ability to pay for itself. This makes it appealing in Miami’s competitive real estate market where rental demand is high, short-term rental activity is strong, and investors often move quickly to secure a deal.

Advantages of Using a DSCR Loan in Miami

Investors are drawn to a DSCR Loan in Miami for several reasons. The structure of the loan offers flexibility and speed in a market where time and cash flow are often more important than traditional credit metrics.

Key benefits include:

- No need for personal income verification

- Qualification based on property cash flow alone

- Works for both long-term leases and short-term rentals like Airbnb

- Applicable to many property types, including condos, multifamily, single-family homes, and vacation rentals

- Faster closings, which help investors compete with cash buyers

In the City of Miami, the median listing price was $626,900 in July 2025. The city’s typical asking rent is about $3,095 as of July 31, 2025. Across the Miami rental market, apartments have been filling in ~36 days with ~21 applicants per unit at the start of the 2025 moving season. That level of demand supports strong rental income potential, which is exactly what DSCR lenders value most.

If you’re considering an investment property in Miami, you can Get a Free Quote or run numbers through our Mortgage Calculator to see how a DSCR loan could work for your budget.

Current 2025 DSCR Loan Guidelines in Miami

While terms vary by lender, most DSCR Loan in Miami programs in 2025 share common guidelines:

Loan Amounts

Investors can typically finance properties ranging from small condos to luxury multi-unit buildings. Loan sizes often start around $150,000 and can go into the multi-million range for high-value assets, which is important in Miami’s high-priced neighborhoods.

Credit Score Requirements

Many lenders prefer a minimum FICO score of 660, though some will approve scores as low as 620 for borrowers with a strong DSCR and extra reserves.

Down Payment Expectations

Down payments commonly start at 20% for DSCR loans, with 25% being typical for multifamily properties or short-term rental investments. The Doce Mortgage Group offers DSCR loasn with as little as 15% down, even for first time buyers.

Reserves

Lenders often require several months of mortgage payments in reserve. For example, you may need 3–6 months of reserves for a single property and more if you own multiple rentals.

Interest Rates

As of mid-2025, DSCR loan rates generally run 0.125% to 0.25 % higher than traditional investment loans. With the average 30-year fixed investment mortgage forecast to drop to 6.20% by the end of 2025, DSCR rates could land in the mid-to-high 6% range for well-qualified borrowers.

Property Considerations

Location plays a big role in DSCR terms. Prime rental zones like Brickell or Miami Beach may be viewed more favorably than areas with lower rental demand. Lenders also want to confirm zoning allows the intended rental type, especially for short-term or vacation rentals.

If you’re ready to see where you stand with these guidelines, you can begin your application now through Our Application portal for a fast pre-qualification.

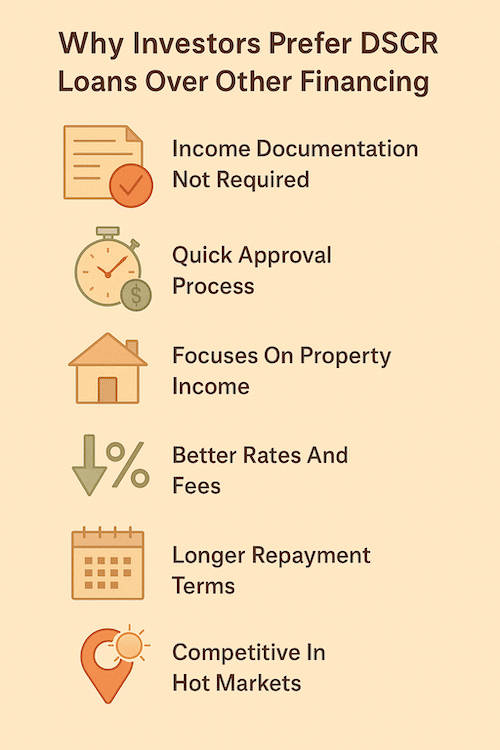

Why Investors Prefer DSCR Loans Over Other Financing

Many Miami investors find that a DSCR Loan in Miami gives them an edge over conventional financing. With a conventional investment loan, borrowers have to document income, provide multiple years of tax returns, and meet strict debt-to-income limits. These steps can slow down the process and sometimes disqualify otherwise capable investors.

In contrast, DSCR loans focus on the property’s ability to generate income. If the numbers work, the deal can move forward quickly, even if the investor has fluctuating personal income. This is especially helpful for self-employed borrowers, business owners, or investors managing multiple properties.

Compared to hard money loans, DSCR loans usually have better rates, lower fees, and longer repayment terms. While hard money lenders can also close quickly, their short payoff timelines and higher interest rates can eat into profitability. DSCR financing often strikes the right balance between speed and long-term affordability.

In Miami’s competitive housing market, where cash buyers often dominate, DSCR financing can level the playing field. For example, an investor purchasing a two-bedroom condo in Brickell for $650,000 may be able to close in under 30 days with DSCR financing, matching the timeline of a cash buyer. That speed and certainty can make a seller more willing to accept their offer.

Boosting ROI With a DSCR Loan in Miami

The key to maximizing returns with a DSCR Loan in Miami is targeting the right neighborhoods and structuring the deal to generate strong cash flow. Since loan approval depends on rental income, investors need to choose properties with proven demand and competitive rates.

Choosing the Right Neighborhoods

Areas like Brickell, Wynwood, and Coconut Grove offer strong rental demand from young professionals and corporate tenants. Meanwhile, Miami Beach and Downtown attract both long-term renters and seasonal vacationers. Properties in these zones often command higher rents, which can improve DSCR ratios and overall returns.

Combining DSCR Loans with Assistance Programs

Some investors also combine DSCR financing with Down Payment Assistance Programs or our Zero Down Mortgage in Florida program option when eligible. While these programs are more often used by owner-occupants, there are cases where investors can benefit if they meet certain occupancy or partnership requirements.

Accurate Projections

A realistic rental projection is vital. Lenders will review market rental data to confirm the property can generate the income stated on the application. Factoring in maintenance, property taxes, insurance, and potential vacancy periods is important to avoid overestimating profitability.

Seasonal Demand Strategy

Miami’s tourism economy provides opportunities for higher nightly rates during peak travel months. Investors offering furnished short-term rentals can adjust pricing to match demand during events like Art Basel, the Miami Open, and peak winter tourist season.

For investors aiming to fine-tune their strategy, using the Mortgage Calculator can help model different rent scenarios and see how they affect your DSCR and return on investment.

2025 Miami Housing Market Conditions

Understanding the local market is essential for making smart DSCR-financed investments. Miami’s real estate environment in 2025 continues to evolve, with pricing, rental rates, and demand factors shaping investor strategies.

Home Prices

- The median sale price in the City of Miami was about $592,500 in July 2025, a 7.4% year-over-year decrease.

- Zillow reports the typical home value in the City of Miami at $581,222, a 1.7% drop over the past year (data through July 31, 2025).

- The median listing price in the City of Miami was $626,900 in July 2025, according to Realtor.com.

Rental Market

- The typical asking rent in the City of Miami is about $3,095 as of July 31, 2025.

- Apartments in the Miami market have been leasing in ~36 days with ~21 prospective renters per vacant unit at the start of the 2025 moving season.

- City asking rents by unit type are currently around $2,600 for 1-bedrooms and $3,300 for 2-bedrooms.

- The Miami metro remains one of the least affordable rental markets, with renters spending about 37.9% of income on a typical rental as of April 2025.

Demand and Growth

- Southeast Florida continues to draw domestic and international buyers; foreign purchasers account for about 10% of the region’s home sales.

- The Southeast Florida outlook calls for single-family prices to rise below 5% in 2025, and the 30-year mortgage investment property rate to be near 6.20% by year’s end.

- In February 2025 (Miami-Dade County), the median condo price was $455,000 (+8.3% YoY) and the median single-family price was $655,000 (+0.8% YoY).

Investor Takeaway

For DSCR investors, these conditions present both opportunities and challenges. Price adjustments in certain property segments could allow entry at a lower cost, while high rental demand supports strong income potential. However, competition from cash buyers and other investors remains strong, making fast, confident financing a must.

Best Neighborhoods in Miami for DSCR Loan Investors

One of the most effective ways to maximize the benefits of a DSCR Loan in Miami is to invest in neighborhoods that already have a track record of strong rental demand and appreciation. Miami offers a diverse range of investment environments, from luxury high-rises to historic districts with cultural charm.

Brickell

Often referred to as the “Manhattan of the South,” Brickell is Miami’s financial hub, filled with luxury condos, high-rise apartments, and world-class dining. The neighborhood draws high-income renters, including finance and tech professionals. Average rents here are above the citywide average, which can help push DSCR ratios higher. Investors can find opportunities in both newly built towers and older units that can be updated to command premium rents.

Wynwood

Known for its art scene, colorful murals, and creative spaces, Wynwood has transformed into a desirable area for young professionals and entrepreneurs. Rental demand is strong for modern lofts and smaller multifamily buildings. The neighborhood’s vibrant nightlife and walkability make it attractive for short-term rental operators, especially during events and festivals.

Coconut Grove

This waterfront neighborhood blends lush greenery with upscale living. It attracts families, professionals, and boaters seeking a quieter lifestyle while still being close to Downtown Miami. Single-family homes and luxury condos are popular here, and rental rates are strong, particularly for properties with water access or unique architectural character.

Little Havana

Famous for its Cuban culture, street life, and festivals, Little Havana offers more affordable entry points for investors compared to some luxury neighborhoods. Multifamily properties and small apartment buildings dominate the rental market. Investors targeting long-term tenants can achieve stable cash flow while benefiting from the area’s gradual appreciation.

Miami Beach

A global tourist destination, Miami Beach offers one of the strongest short-term rental markets in South Florida. Properties near the beach, nightlife districts, and convention centers command high nightly rates during peak tourist season. Zoning and licensing are important considerations here, so investors need to confirm regulations align with their rental plans before closing.

Choosing the right neighborhood often depends on your target tenant base, investment budget, and whether you plan to operate a long-term or short-term rental. A DSCR Loan in Miami gives you the flexibility to enter multiple types of rental markets, so you can diversify across neighborhoods if desired.

Why Miami Continues to Draw Investors

While the financing side of the equation is important, the other half of the story is Miami itself. In 2025, the city remains a magnet for both domestic and international buyers, supported by economic growth, cultural appeal, and lifestyle advantages that are hard to match.

Economic Drivers

Miami’s economy is powered by finance, technology, tourism, healthcare, and international trade. The Port of Miami is one of the busiest in the country, handling cargo and serving as a major cruise ship hub. Over the past decade, Miami has also developed a reputation as a fintech and startup-friendly city, attracting entrepreneurs and remote workers from around the world.

Tourism and Events

Year-round tourism keeps rental demand high. Events like Art Basel, the Miami International Boat Show, and the South Beach Wine & Food Festival draw large crowds who often prefer short-term rentals over hotels. This consistent flow of visitors creates opportunities for DSCR-financed properties to operate as profitable vacation rentals.

Lifestyle Benefits

Miami offers year-round sunshine, world-famous beaches, waterfront living, and a cosmopolitan urban environment. The combination of outdoor recreation and high-end amenities continues to attract people seeking both vacation and permanent residences.

Development and Infrastructure

Ongoing infrastructure improvements, including public transit expansions, road upgrades, and waterfront redevelopment, enhance both livability and long-term property values. These factors make it more appealing for investors to commit capital, knowing the city continues to evolve and grow.

FAQ About DSCR Loans in Miami

1. What DSCR ratio is required for approval in 2025?

Most lenders want to see a DSCR of at least 1.0 to 1.25. Some will go lower if the borrower has a higher credit score, more reserves, or is making a larger down payment. The Doce Mortgage Group offers DSCR loans with qualifying ratios starting at 0.75 and also provides No Ratio options for eligible investors.

2. Can a DSCR loan be used for Airbnb or vacation rentals?

Yes, many DSCR Loan in Miami programs allow short-term rentals as long as the property’s income projections meet the lender’s requirements and local zoning allows that use.

3. Are there property restrictions for DSCR loans?

While single-family homes, condos, and multifamily properties are eligible, lenders may avoid certain condo buildings that don’t meet financial or occupancy standards. Always check with your lender before making an offer.

4. What’s the minimum credit score needed?

Many programs start at 660, with some accepting 620 for stronger deals. Higher scores often mean better rates and terms.

5. Can foreign nationals apply for a DSCR loan in Miami?

Yes, foreign investors are often eligible. Lenders may require a higher down payment, sometimes 30% or more, depending on the borrower’s residency and credit profile.

Partnering With The Doce Mortgage Group for Your Miami Investment

The combination of a DSCR Loan in Miami and a strong local market creates opportunities for investors who want both cash flow and long-term growth potential. The Doce Mortgage Group specializes in connecting investors with the right financing programs for their goals, whether that’s a luxury condo in Brickell, a vacation rental in Miami Beach, or a long-term multifamily in Little Havana.

Our team understands the nuances of Miami’s neighborhoods, rental demand cycles, and DSCR loan requirements. This means you get guidance tailored to your investment strategy, not just a generic loan quote.

Client satisfaction is a core part of our process, and our customer reviews show the results of our hands-on approach. From the first conversation to closing, we work to help you secure the right property with the right financing terms.

If you’re ready to explore how a DSCR Loan in Miami can work for you, we can help you compare loan programs, run payment estimates, and get pre-qualified fast. Call Us Today at 305-900-2012to start building your Miami investment portfolio.