Quick Answer

Sunny Isles Beach is one of the best markets for a DSCR Loan in Florida because of its rising property values, strong rental demand, and international investment appeal. These factors make it easier for properties to meet DSCR requirements while offering investors steady cash flow and long-term growth potential.

Table of Contents

- What is A DSCR Loan In Sunny Isles Beach?

- Why Is A DSCR Loan In Sunny Isles Beach, Florida So Popular In 2025?

- How Do DSCR Loans Compare To Traditional Financing In Sunny Isles Beach?

- What Are The Requirements For A DSCR Loan In Sunny Isles Beach?

- Can A DSCR Loan Be Used For Luxury Condos And Short-Term Rentals In Sunny Isles Beach?

- What Are The Advantages Of Choosing The Doce Mortgage Group For A DSCR Loan?

- How Does Rental Demand In Sunny Isles Beach Support DSCR Loan Approval?

- Why Is Sunny Isles Beach Considered A Safe Market For Long-Term DSCR Loan Investment?

- What Lifestyle Benefits Make Sunny Isles Beach Attractive To Investors And Residents?

- How Do DSCR Loans Help Foreign Investors Enter The Sunny Isles Beach Market?

- Frequently Asked Questions About DSCR Loans In Sunny Isles Beach, Florida

- Next Steps

Keynotes

- Sunny Isles Beach condo values keep rising, boosxating DSCR loan opportunities.

- Strong rental demand supports easier DSCR loan qualification in 2025.

- International buyers drive steady investment growth in Sunny Isles Beach.

Sunny Isles Beach has long been one of the most desirable areas in South Florida for investors, and in 2025 it continues to shine as one of the best places to use a DSCR Loan in Florida. Real estate values, strong rental demand, and a thriving short-term rental market have created conditions where a DSCR Loan in Sunny Isles Beach, Florida offers unique advantages for buyers who want to maximize returns.

What is A DSCR Loan In Sunny Isles Beach?

A DSCR loan, or debt service coverage ratio loan, is designed for real estate investors who want to qualify for financing based on property cash flow rather than traditional income verification. Instead of showing pay stubs, W-2s, or tax returns, approval is based on whether the rental income produced by the property is strong enough to cover the monthly mortgage payment, property taxes, and insurance.

In simple terms, the higher the rental income compared to the monthly costs, the stronger the property’s DSCR ratio will be. Most programs require a ratio of at least 1.0, meaning the income covers the payment in full, but many investors aim for 1.2 or higher for better terms.

This approach is particularly helpful in Sunny Isles Beach because the market is driven by a mix of long-term renters and short-term vacation tenants. With high occupancy rates and strong rental pricing, many properties easily meet or exceed DSCR standards. This allows more buyers to enter the market and scale their portfolios without being limited by personal income documentation.

Why Is A DSCR Loan In Sunny Isles Beach, Florida So Popular In 2025?

There are several reasons why this financing option has grown so popular among investors in 2025:

- Rising Property Values: The median listing price in Sunny Isles Beach was about $799,000 in September 2025, up 14.3 percent year over year.

- Strong Rental Demand: 2025 short-term rental data shows a median occupancy around 72 percent in Sunny Isles Beach with an average daily rate near $215. For long-term rentals, the median asking rent for two-bedroom condos is about $4,700 per month. These numbers help investors achieve the ratios required for DSCR financing.

- International Investment Appeal: Sunny Isles Beach is one of the most international markets in South Florida, attracting buyers from South America, Europe, and Canada. Many foreign nationals don’t have U.S. income documentation, making the DSCR loan an ideal way to access financing and participate in this thriving market.

- Flexible Use Across Property Types: Whether someone wants to purchase a vacation rental, luxury condo, or multi-unit building, DSCR loans in 2025 allow for a wide variety of property types. This makes them especially useful in a market like Sunny Isles Beach, where the inventory includes both ultra-luxury towers and smaller boutique condos.

The combination of appreciating values, strong rental yields, and international demand explains why more investors are applying for a DSCR Loan in Sunny Isles Beach, Florida in 2025 than ever before.

For those exploring opportunities this year, it can be helpful to run numbers ahead of time using a Mortgage Calculator to estimate whether a property’s expected rental income will meet the required coverage ratio.

How Do DSCR Loans Compare To Traditional Financing In Sunny Isles Beach?

One of the biggest advantages of using a DSCR Loan in Sunny Isles Beach, Florida is how different the approval process is compared to conventional financing. Traditional mortgages require full documentation of income, employment history, and tax returns. For many investors, especially those who are self-employed or have fluctuating income, this can make qualifying very difficult.

With a DSCR loan, approval is tied directly to the property’s income potential. As long as the rental income covers the monthly housing payment, the deal can move forward. This approach gives investors more flexibility to grow their portfolios because they are not limited by how much they personally earn.

For example, consider an investor buying a two-bedroom condo in Sunny Isles Beach for $650,000. A traditional mortgage would require proof of strong personal income and tax returns that show stability. But if the condo is expected to rent for $4,000 per month and the total monthly mortgage cost is $3,200, the DSCR ratio comes in at 1.25. That would easily meet the requirement for approval, even if the investor’s personal income would not have qualified under conventional rules.

This comparison is why so many buyers, both domestic and international, are turning to DSCR loans in 2025. They make it possible to invest in a market where opportunities are abundant but conventional qualifications may fall short.

If you’re considering a purchase, one of the best ways to see how the numbers work is to Get a Free Quote. This gives you a clearer picture of potential loan terms and monthly payments based on your target property.

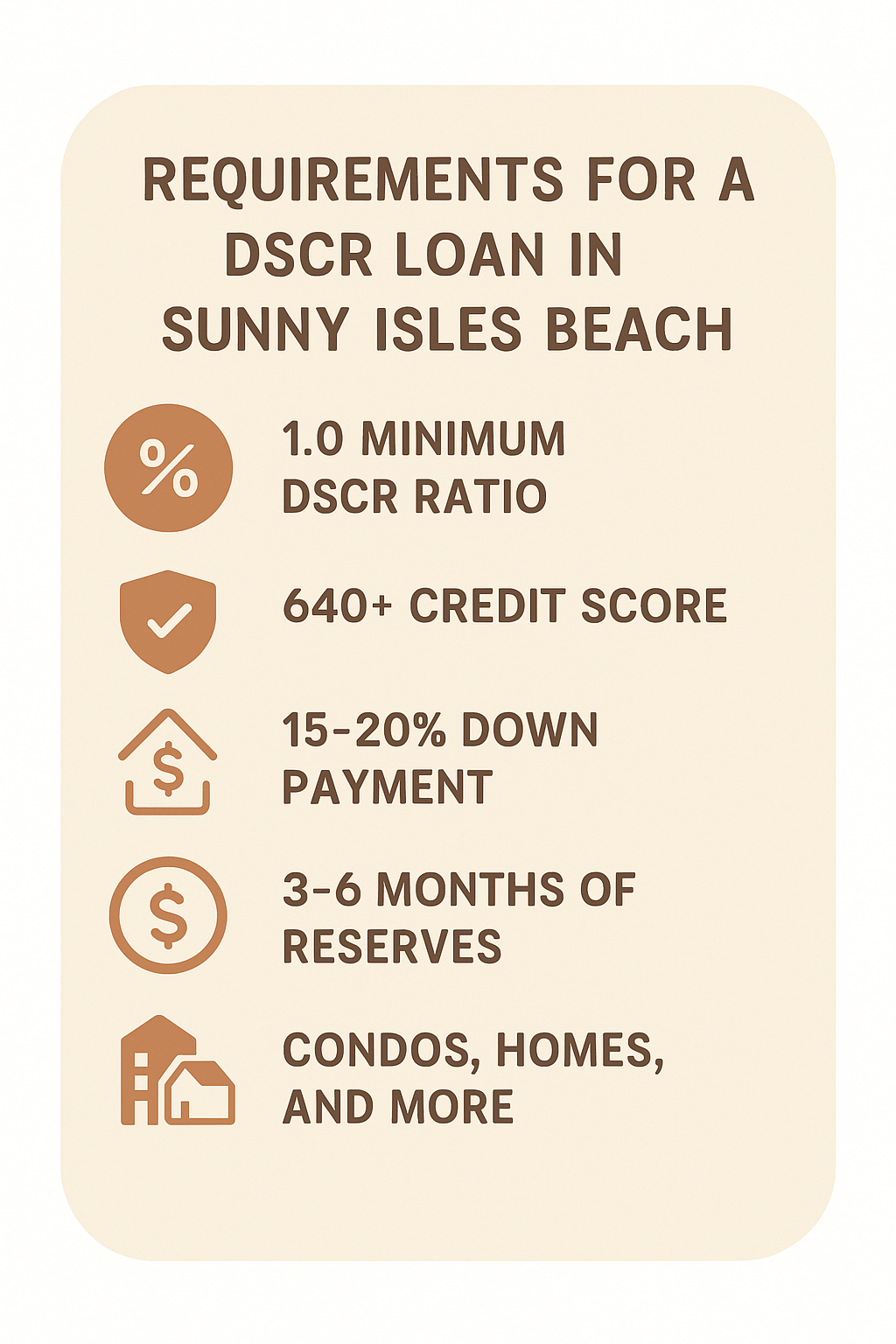

What Are The Requirements For A DSCR Loan In Sunny Isles Beach?

While DSCR loans are flexible, there are still requirements investors should understand before applying in 2025. The Doce Mortgage Group works with clients to make sure they know exactly what to expect when financing in Sunny Isles Beach.

Here are the main requirements:

- DSCR Ratio: Most programs require a minimum ratio of 1.0, but ratios of 1.2 or higher are common for better terms. This means the property’s rental income must be equal to or greater than the monthly payment. The Doce Mortgage Group also provides DSCR loans starting at 0, which do not rely on rental income for approval. With this option, even properties that generate little or no rental income can still qualify, giving investors greater flexibility when adding to their portfolios.

- Credit Score: Many programs in 2025 accept scores as low as 640, though higher scores may qualify for better rates.

- Down Payment: Standard down payments for DSCR loans typically start at around 20 percent, however, The Doce Mortgage Group offers DSCR loans with as little as 15% down.

- Reserves: Lenders often look for at least 3 to 6 months of reserves to cover housing costs.

- Property Types: DSCR loans in Sunny Isles Beach can be used on condos, single-family homes, townhouses, and multi-family properties.

What stands out in 2025 is that these requirements are designed with investors in mind. Instead of focusing on personal income, they prioritize property performance. This gives buyers a more streamlined process and the ability to close deals quickly in a competitive market.

If you want to take the next step, The Doce Mortgage Group makes it simple to apply online through Our Application portal.

Can A DSCR Loan Be Used For Luxury Condos And Short-Term Rentals In Sunny Isles Beach?

Sunny Isles Beach is known for its luxury high-rise condos and oceanfront developments, making it a hot spot for both long-term and short-term rental strategies. The good news for investors is that a DSCR Loan in Sunny Isles Beach, Florida can be used for both.

Luxury condos often come with high purchase prices, but they also generate premium rental income. For instance, a three-bedroom oceanfront condo priced at $1.2 million might rent for $8,000 per month on a long-term lease. If the monthly housing cost is around $6,400, the DSCR ratio would be 1.25, which meets the standard approval range.

Short-term rentals are also active in Sunny Isles Beach. With occupancy near 72 percent in 2025 and an average daily rate around $215, vacation rentals can generate solid cash flow when managed well. This is especially valuable for DSCR loan qualification, since higher rental income can make ratios more favorable.

There are, however, some key considerations:

- Some condo associations may restrict or prohibit short-term rentals, so it’s important to confirm building rules before purchasing.

- Insurance costs may be higher for properties used as vacation rentals.

- Investors should run conservative projections, assuming periods of vacancy, to make sure the DSCR ratio remains strong.

Overall, the ability to use DSCR financing for both luxury condos and short-term rentals makes Sunny Isles Beach one of the most attractive markets in Florida for this type of investment.

If you’re considering buying into a luxury building or launching a short-term rental, it’s a smart idea to use the Mortgage Calculator to see how different rent projections affect qualification.

What Are The Advantages Of Choosing The Doce Mortgage Group For A DSCR Loan?

When you’re investing in Sunny Isles Beach, working with a group that specializes in Florida markets can make a big difference. The Doce Mortgage Group understands the unique needs of real estate investors and provides programs designed to fit this market.

One of the biggest advantages is flexibility. Whether you’re buying a one-bedroom condo to use as a rental or acquiring multiple units in a building, there are DSCR loan programs that can fit the property type and your long-term goals. Loan amounts can range from a few hundred thousand dollars to several million, which is important in Sunny Isles Beach where luxury properties command higher prices.

Another key advantage is the streamlined process. Because DSCR loans are based on property income instead of personal documentation, the approval timeline can be much faster. This is a huge benefit when competing for prime properties in Sunny Isles Beach, where the best units often attract multiple offers.

The Doce Mortgage Group also provides direct access to helpful tools like Our Application portal, which makes starting the process quick and easy. This allows investors to focus on selecting the right property without being slowed down by complicated paperwork.

For those who want personalized guidance, the team offers one-on-one support, helping clients run cash flow scenarios, compare options, and select the most strategic loan program. This kind of experience can make a difference when you’re looking at a competitive market like Sunny Isles Beach.

How Does Rental Demand In Sunny Isles Beach Support DSCR Loan Approval?

One of the main reasons Sunny Isles Beach is such a good fit for DSCR loans is the consistent rental demand. In 2025, the area continues to attract both vacationers and long-term residents, creating a strong base of tenants for investment properties.

Tourism in Miami-Dade County set a record with about 28.2 million visitors in 2024, and the 2025 outlook remains robust according to the visitors bureau. Sunny Isles Beach is a favorite among international tourists, thanks to its beaches, shopping, and luxury atmosphere. This translates into steady demand for short-term rentals, which often generate higher income than long-term leases.

On the long-term rental side, demand is also growing. Rising home prices across Miami-Dade make renting an attractive option for many residents. In Sunny Isles Beach, two-bedroom condos have a median asking rent around $4,700 per month, with larger waterfront units listed higher.

This rental income plays directly into DSCR loan qualification. If the monthly mortgage, insurance, and taxes total $3,400, but the property rents for $4,200, the DSCR ratio would be 1.24. That easily meets approval standards. Investors benefit because the strength of the rental market helps them qualify more easily while also providing positive cash flow.

If you’re running numbers on a potential purchase, The Doce Mortgage Group can help you project your coverage ratio and even prepare scenarios through their Mortgage Calculator.

Why Is Sunny Isles Beach Considered A Safe Market For Long-Term DSCR Loan Investment?

Investors often ask whether Sunny Isles Beach is a stable market for long-term investment. In 2025, the answer is yes, and several factors explain why.

First, property appreciation has been steady. Between 2020 and 2025, resale prices in Sunny Isles Beach increased from about $635 to $810 per square foot, roughly a 28 percent gain over five years, with recent reports showing year-over-year increases in 2025. This steady growth makes it less risky for investors planning to hold properties long-term.

Second, Sunny Isles Beach benefits from strong infrastructure and development. New luxury towers continue to reshape the skyline, and city investment in parks and public spaces adds to the appeal. With so much development, the area is considered one of the most desirable coastal communities in Florida.

Third, international demand creates an added layer of stability. Many foreign investors see Sunny Isles Beach as a safe haven for their capital. This helps keep the real estate market active even when domestic demand slows. In fact, in 2025, foreign buyers account for nearly 30 percent of luxury condo purchases in Sunny Isles Beach.

Finally, the consistent rental demand provides income stability. Whether investors choose short-term rentals targeting tourists or long-term rentals for residents, occupancy rates remain strong. This means cash flow continues even during slower real estate cycles.

For anyone looking to get started, it’s worth reaching out to The Doce Mortgage Group to Get a Free Quote and see how your target property qualifies.

What Lifestyle Benefits Make Sunny Isles Beach Attractive To Investors And Residents?

Beyond the financing advantages, Sunny Isles Beach continues to draw attention for its lifestyle. Investors who purchase property here aren’t only buying into a rental market, they’re also aligning with one of Florida’s most desirable communities.

Sunny Isles Beach is known as the “Florida Riviera” because of its pristine beaches and luxury high-rise condos that dominate the coastline. In 2025, the city remains one of the top destinations for both residents and tourists who want oceanfront living paired with modern amenities.

Quality of life is another big factor. The area offers:

- Easy access to Aventura Mall, one of the largest shopping centers in the United States

- Top-rated schools, including charter and private options for families

- Fine dining and cultural attractions throughout Miami-Dade County

- Outdoor activities like boating, fishing, and water sports directly from the beach

These lifestyle benefits make properties in Sunny Isles Beach highly desirable, which supports both property values and rental demand. When people are drawn to live and vacation in a city, the real estate market gains long-term stability. That’s exactly why investors continue to choose a DSCR Loan in Sunny Isles Beach, Florida.

How Do DSCR Loans Help Foreign Investors Enter The Sunny Isles Beach Market?

Foreign investors have always played a major role in Sunny Isles Beach. Buyers from Latin America, Canada, and Europe often purchase condos and vacation properties here. In 2025, international interest remains strong, with nearly one-third of all condo transactions involving foreign nationals.

One of the challenges for international buyers is qualifying for traditional financing. Without U.S. income documentation or tax returns, many are shut out of conventional loan programs. A DSCR loan solves this problem by focusing on the property’s rental income instead of the buyer’s personal paperwork.

For example, a Canadian investor looking to buy a two-bedroom condo that rents for $4,500 per month can qualify as long as the income covers the housing costs. The approval doesn’t depend on Canadian tax documents or proof of employment, which simplifies the process.

This makes DSCR loans one of the most popular financing strategies for foreign buyers in Sunny Isles Beach. With the city’s ongoing international appeal, this financing structure continues to grow in popularity.

If you’re an international investor exploring Sunny Isles Beach, starting with Our Application portal can help streamline the process and give you clear insight into your options.

Frequently Asked Questions About DSCR Loans In Sunny Isles Beach, Florida

What is the minimum DSCR ratio in 2025?

Most programs require at least 1.0, meaning the rental income covers the payment. Ratios above 1.2 often qualify for more favorable terms.

Can I use a DSCR loan to refinance an existing property in Sunny Isles Beach?

Yes, refinancing is an option, and many investors use DSCR loans to access equity or improve loan terms.

Do DSCR loans allow cash-out refinancing?

Yes, cash-out refinancing is possible. Investors often use this to fund additional property purchases or renovations.

Are short-term rentals allowed with a DSCR loan?

Yes, as long as the property meets building and city regulations. Many investors use DSCR loans specifically for vacation rentals.

How much down payment is typically needed?

Down payments for DSCR loans usually start at about 20 percent, however, The Doce Mortgage Group offers DSCR loans with as little as 15% down

What’s the approval timeline for a DSCR loan?

In many cases, approvals can move more quickly than conventional financing because there is less focus on personal income documentation.

Next Steps

Investing in Sunny Isles Beach is about more than finding the right property. It’s about working with a partner that understands both the market and the financing tools available. The Doce Mortgage Group has built a reputation for helping investors navigate the Florida real estate market with clarity and confidence.

Check out hundreds of our client reviews to see why thousands of home buyers have trusted us over the past 3 decades.

With property values rising, rental demand staying strong, and international buyers continuing to choose Sunny Isles Beach, there’s no better time to explore your options with a DSCR Loan in Sunny Isles Beach, Florida. Whether you’re purchasing your first investment property or expanding your portfolio, this loan structure gives you the flexibility to qualify based on property income instead of traditional income verification.

Call us today at 305-900-2012 to discuss how you can get started.