4.98

720+ Experience Reviews

5.0

170+ Zillow Reviews

5.0

100+ Google Reviews

4.8

50+ Yelp Reviews

5.0

30+ FaceBook Reviews

“Alex Doce and his team are exceptional to work with!! Alex made my dream come true with ease.”

Jacqueline P. New York, NY

“Alex and his team worked hard on making the impossible, possible for me. I was able to close on two separate loans in less than 30 days.”

Patricia B. Flushing, NY

“To call Alex amazing would be an understatement. I’ve never worked with anyone as knowledgeable and well-prepared.”

Kay P. Prior Lake, MN

“Alex and his team were awesome. He was so patient with me throughout the entire process.”

Cori S. Miami Beach, FL

“Working with Alex Doce is a life changing experience! His expertise and attention to detail is second to none.“

Matt S. Hollywood, FL

“This was my first time obtaining a mortgage for my new condo. Alex was of great help every step of the way.“

Helen H. Miami, FL

“You will not be disappointed! If Alex Doce tells you he can help, he will move heaven and Earth to make it happen!“

Ingrid U. Miami, FL

“Alex was amazing working with my parents to buy their new home. Five stars aren’t enough!“

Wendy W. North Miami, FL

“Alex works tirelessly to make sure things go as planned and to schedule. Trust in the Doce Group. You won’t find a better lender.“

Anthony G. Coral Way Miami, FL

“Alex is a great manager of a fantastic group of professionals who had our back and got the tough job done. I’m very impressed.“

Elena S. Cuyahoga Falls, OH

“Alex was absolutely excellent. He was knowledgeable and very easy to communicate with for all our mortgage questions. Best in town.“

Sharon I. Miami, FL

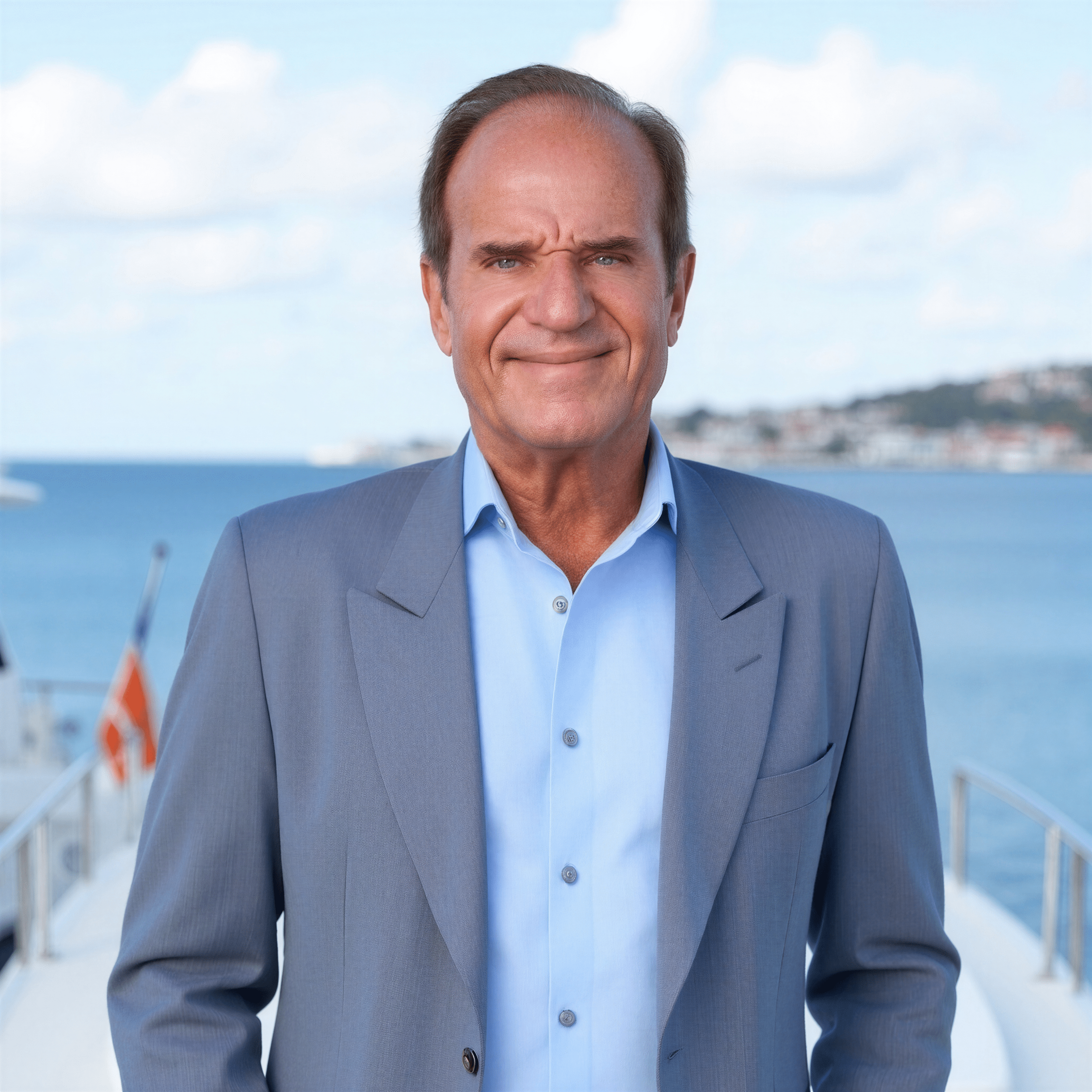

With 37+ years of experience and 7,000+ happy homeowners, Alex Doce knows how to simplify the mortgage process and get you the best possible terms.

At The Doce Mortgage Group, we don’t just secure home loans for clients—we help them make smarter real estate financing decisions with clarity, strategy, and personalized solutions.

Join other satisfied clients and contact us today.

“The experience, professionalism and efficiency I experienced working with Alex Doce at The Doce Mortgage Group was unparalleled.”

Ricky Z. Miami, FL

Every buyer is different. Your mortgage should be too. We tailor every Florida home loan around your goals and create a smooth, seamless experience from start to finish.

We understand Florida’s markets inside and out. Our team navigates rates, lending rules, and local trends to secure the smartest loan strategy for your situation.

At The Doce Mortgage Group, your success comes first. We simplify the process, build lasting relationships, and make every mortgage feel like a true partnership.

Great Rates

Up to 100% financing.

Lower mortgage insurance options.

Finance single or multi family units.

Access to lower rates.

Conventional Loans

Fast Closings.

Competes with cash offers.

Increase your chances of winning against higher offers.

$5,000 guarantee to seller if not closing within contracted deadlines.

Close as soon as 14 days.

Most Flexible Terms

Low or No Down Payments

Low Credit Score Requirements.

No Income Limits.

Low Down Payment for 1-4 unit homes.

Higher debt to income ratios to 57%.

100% Financing

Buy a home with no money down.

FICO scores as low as 580.

Do not need to be a first time home buyer.

No income limits.

For Large Loan Amounts

Higher loan amounts.

Below market rates.

Access to larger properties.

No need for Private Mortgage Insurance.

Available for primary residences, second homes or rental properties.

For Veterans

No Down Payment Required.

No Private Mortgage Insurance (PMI).

Competitive Interest Rates.

Relaxed Credit Requirements.

Higher debt to income ratios allowed.

Foreign National loans.

Bank Statement loans.

Asset Based loans.

DSCR loans.

No income verification loans.

Interest Only loans.

Temporary Buydown loans.

Let us take the burden off your shoulders. From application to closing, we make real estate financing simple and hassle-free.

As leading Florida mortgage advisors, Alex Doce and his team at The Doce Mortgage Group have been helping homebuyers, homeowners, and investors for over 38 years, with thousands of satisfied borrowers across the state.

Our team proudly serves clients in Miami, Miami Beach, Coral Gables, Fort Lauderdale, Pompano Beach, Jupiter, Pembroke Pines, West Palm Beach, Boca Raton, Delray Beach, Palm Beach, Naples, Cape Coral, Fort Myers, Englewood, Clearwater, Stuart, and The Florida Keys — as well as many other communities statewide.

Whether you’re purchasing your first home, refinancing, or investing, The Doce Mortgage Group provides personalized mortgage solutions designed to ensure a smooth, fast, and stress-free closing anywhere in Florida.

At The Doce Mortgage Group, we offer a wide variety of Florida mortgage programs to help homebuyers, homeowners, and investors find the right loan for their goals — from conventional options to specialized programs like DSCR and HomeZero™.

Backed by private lenders (not the government).

Higher loan limits that vary by county.

Flexible terms for primary, second home, and investment properties.

Insured by the Federal Housing Administration (FHA).

Low down payment (as little as 3.5%).

Lenient credit score requirements and competitive rates.

For eligible U.S. veterans, active-duty service members, and surviving spouses.

Backed by the Department of Veterans Affairs.

No down payment and no mortgage insurance required.

Designed for rural and suburban homebuyers.

Backed by the U.S. Department of Agriculture.

Offer 100% financing (zero down payment).

Explore Over 65 Florida Down-Payment Assistance Programs.

Offers up to 103% financing for qualified borrowers.

Helps cover down payment and closing costs for eligible buyers.

Ideal for first-time homebuyers and moderate-income families.

Learn more: Zero Down Mortgage Florida – HomeZero™. Exclusive to The Doce Mortgage Group.

Tailored for real estate investors.

Approval based on property cash flow instead of borrower income.

No tax returns required.

Coverage ratio as low as zero.

For self-employed borrowers.

Uses 12–24 months of bank statements to verify income.

No W-2s or tax returns needed.

Qualification based on credit, assets, and property value.

Ideal for high-net-worth borrowers with non-traditional income.

Qualify using assets (savings, retirement funds, or investments) rather than monthly income.

Excellent for retirees or investors.

Designed for borrowers using an Individual Taxpayer Identification Number (ITIN).

Enables non-U.S. residents to purchase or refinance property in Florida.

Interest rate remains the same for the life of the loan.

Stable monthly payments and predictable budgeting.

Interest rate adjusts based on market conditions after an initial fixed period.

Typically offers a lower starting rate.

The required down payment varies based on the type of loan. In Florida, it can range from 3.5% for FHA loans and 3% for Conventional loans to 0% for our HomeZero program, USDA loans, VA loans, and most State Down Payment Assistance Programs.

It depends on factors such as your credit score, the type of loan, loan term, and current market conditions. The Doce Mortgage Group offers excellent rates with competitive closing costs.

Yes, lenders will use your credit score to assess your creditworthiness and the level of risk they would be taking by offering you a loan. Generally, those with higher credit scores are more likely to qualify for better interest rates and more favorable loan terms when they apply. On the other hand, a lower credit score may lead to higher interest rates and potentially more stringent lending conditions. Your score can also affect the types of loan products available to you.

Yes, there are several first-time homebuyer programs, like HomeZero and several state programs, that offer down payment assistance and favorable terms.

When applying for a mortgage, you’ll need to complete an online application and submit identification, Social Security number, proof of income, bank statements, employment verification, credit information, and property details. We use a smart application system that will read your completed application and send you an email seconds later with the list of required documents, based on your inputted data.

Our mortgage approval process usually takes 5 to 10 days. We close most loans within 20-30 days of a completed application.

Working with an experienced local mortgage broker like The Doce Mortgage Group helps ensure a fast, smooth, and stress-free closing — often quicker than large banks or online lenders

Yes — you can refinance your existing mortgage to better fit your current financial goals. Many homeowners in Florida choose to refinance to:

Secure a lower interest rate and reduce overall loan costs

Lower monthly mortgage payments and improve cash flow

Shorten the loan term to pay off the home faster and build equity more quickly

Access home equity through a cash-out refinance for renovations, debt consolidation, or investments

At The Doce Mortgage Group, we help borrowers compare multiple refinance options to find the best rates and terms available. Whether you want to save money, access equity, or restructure your loan, refinancing can be a smart move when done strategically.

To qualify for a mortgage loan in Florida, lenders generally review several key factors to determine eligibility and the best loan program for your situation:

Credit Score: Most conventional loans require a minimum score of 620, while FHA loans may be available with scores as low as 500.

Debt-to-Income Ratio (DTI): Preferably below 50%, showing that your monthly debts are manageable compared to your income.

Employment History: A stable job or consistent income for at least two years helps demonstrate financial reliability.

Proof of Income: Lenders typically require recent pay stubs, W-2s, and/or federal tax returns to verify earnings.

Down Payment: Varies by loan type — as low as 3% for conventional and 3.5% for FHA programs.

Property Appraisal: Confirms that the home’s market value supports the loan amount.

At The Doce Mortgage Group, we guide Florida homebuyers through every qualification step — from credit and income verification to selecting the best loan program for their goals.

No two homebuyers or homeowners are alike—so why settle for a one-size-fits-all loan? We take an individualized approach so that your loan fits your specific goals and financial situation. As a top Florida mortgage broker, we listen, strategize, and deliver solutions that work for you.

Find out how much you can borrow, find the best program for your situation, get a rate quote.

Schedule a free consultation with a mortgage Pro to explore options and get clear next steps.

We’ll walk you through each step of the way and issue a pre-approval within 24 hours.