Buying a home for the first time in Florida is an exciting milestone that every young couple dreams about. But for many, coming up with a down payment is a serious challenge that often prevents them from achieving their dreams. The good news is, there’s an exciting option you may not have heard about that can make it possible for you to secure a home loan with little or no down payment.

It’s called a no down payment mortgage, and it can help you achieve your homeownership dreams.

What is it and how can you get one? No need to worry. We’ve broken it all down for you and will show you exactly what you need to do in 3 easy steps.

Step 1: Learn the Facts About No Down Payment Mortgages in Florida

The first thing you need is some basic knowledge. You don’t need to be an expert, but the more you know, the more you can be sure you’re making the right decision for your specific situation.

Here are some of the most common questions about no down payment mortgages in Florida:

What is it?

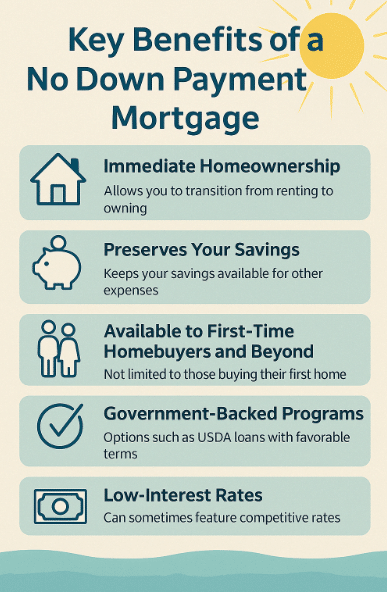

In simple terms, a no down payment mortgage is a loan that allows you to purchase a home without requiring an upfront payment. This means you can finance 100% of the home’s purchase price, making it an attractive option for individuals with limited savings. Typically, these loans are backed by government programs such as VA or USDA loans. This option is ideal for first-time homebuyers or those without significant savings, helping them secure homeownership sooner. The lack of a down payment makes it easier to afford a home without draining savings.

Who is eligible for a no down payment mortgage in Florida?

Eligibility for a no down payment mortgage in Florida depends on the specific loan program. For instance, USDA loans are available for rural areas, and VA loans are exclusively for veterans or active military members. General requirements may include a good credit score, proof of stable income, and the ability to repay the loan. First-time homebuyers are often prioritized, but repeat buyers may also qualify under certain conditions.

Can I get a no down payment mortgage with bad credit?

FHA loans are perfect for people with FICO scores as low as 580. This makes it possible for a broader group of buyers to qualify for a mortgage, including first-time buyers and those who may have less-than-perfect credit. While having good credit can improve your chances of approval, some no down payment loan programs are more lenient with credit scores. USDA and VA loans may allow for lower credit scores than traditional mortgages. However, a higher credit score typically results in better terms and lower interest rates. If your credit is less than perfect, it’s still worth applying and exploring these programs as they have more flexible qualifications.

What types of loans offer no down payment in Florida?

The most common no down payment loans in Florida are USDA and VA loans. USDA loans are for buyers purchasing homes in rural areas and offer favorable terms with no down payment required. VA loans are for veterans, active military members, and their families, also offering no down payment and competitive interest rates. Both loan options are government-backed and offer flexible eligibility criteria compared to conventional loans.

Are there any hidden fees with a no down payment mortgage?

No down payment mortgages can come with additional fees, such as mortgage insurance, closing costs, and funding fees. While you don’t need to save for a down payment, these costs should be considered when budgeting for homeownership. For USDA loans, there’s an upfront guarantee fee and annual insurance premiums. VA loans may also require a funding fee, but it can be rolled into the loan. Always review the full cost breakdown before committing to any mortgage.

Can I use a no down payment mortgage to buy any home in Florida?

No, there are restrictions on where you can buy a home with a no down payment mortgage in Florida. Both USDA and VA loan programs may have location-specific guidelines. It’s important to check the eligibility of the property you wish to buy, as not all homes will qualify under these programs.

What Are the Key Benefits?

Will I Qualify for a No Down Payment Mortgage?

FHA loans are one of the most accessible mortgage options for those looking to buy with little to no down payment. The Doce Mortgage Group offers 30-Year Fixed FHA Rates, which are great for those who want to keep their monthly payments stable over the life of the loan.

- Minimum credit score: 580

- Maximum Debt-to-Income (DTI) Ratio: 57%

- Up to 6% seller contributions: You can use this towards your closing costs, which helps reduce the amount you need to pay out of pocket at closing.

- No first-time homebuyer requirement: Unlike some other programs, you don’t need to be a first-time homebuyer to qualify for this loan.

- 3.5% or 5% second lien: This can be used to cover closing costs or even be forgiven after five years.

How Can I Calculate My Monthly Payment?

To calculate your monthly mortgage payment, you’ll need to consider factors such as the loan amount, interest rate, loan term, and property taxes. The good news is, you can quickly calculate your monthly payment using our simple Mortgage Calculator. Just input your loan details, and it will give you an accurate monthly payment estimate, helping you plan your budget with confidence.

You can also get a free quote to learn what your loan and monthly payment might look like.

Who Should Get a No Down Payment Mortgage?

A no down payment mortgage is an excellent option for those looking to buy a home but who may struggle to save for a large down payment. For many people, the requirement to save anywhere from 3% to 20% of the home’s purchase price can be a significant financial hurdle. On a $250,000 home, for instance, that means saving anywhere from $7,500 to $50,000 just for the down payment.

A no down payment mortgage is an excellent option for first-time homebuyers, as it allows you to purchase your first home without the burden of saving for a large down payment.

What if My Income Is too High?

Another major benefit is that there are no income limitations, so even if you’re a high-income earner, you can still qualify for this type of loan.

What if My Debt to Income Ratio is too High?

If your debt-to-income (DTI) ratio is too high, it may make it more difficult to qualify for a no down payment mortgage. Lenders typically prefer a lower DTI as it indicates a more manageable level of debt compared to your income. However, don’t worry. There are solutions! If possible, consider paying down some existing debt before applying. Also, if at all possible, think of ways to increase verifiable income as that will also improve your DTI ratio. You can also explore our other loan options, such as government-backed programs with more flexible DTI requirements. To learn more about calculating your DTI, visit our guide here.

Are There Any Down Payment Assistance Programs in Florida?

The Doce Mortgage Group offers Down Payment Assistance Programs to help buyers with the upfront costs of purchasing a home. These programs often provide grants or loans that can be used for the down payment and closing costs. Many of these programs are aimed at first-time homebuyers, but some are available to repeat buyers as well.

Some programs may allow you to receive a grant that doesn’t need to be repaid, while others may offer second mortgages that can be forgiven after a certain period. These programs vary by county and may have specific eligibility requirements, such as income limits or purchasing price caps.

By leveraging these assistance programs, you can drastically reduce your upfront costs and make your home purchase much more affordable.

What are the income requirements for a no down payment mortgage?

Income requirements for no down payment mortgages can vary depending on the loan program. For USDA loans, there is typically an income limit based on the area’s median income and household size. VA and FHA loans, however, do not have a strict income limit, but lenders may assess your ability to repay the loan based on your debt-to-income ratio. It’s important to demonstrate consistent, stable income to qualify for either loan program.

How long does it take to get approved for a no down payment mortgage?

The approval process for a no down payment mortgage can vary, but it typically takes a few weeks. Once you’ve submitted your application, the lender will review your financial information, check your credit, and confirm eligibility. USDA and VA loans may require additional processing time, especially if you’re applying for government-backed programs. However, with all your documents in order, the process can be completed more efficiently, typically taking 25-40 days.

Can I refinance my mortgage if I used a no down payment loan?

Yes, it is possible to refinance a no down payment mortgage once you’ve built some equity in your home. If you have a USDA or VA loan, refinancing options like the VA IRRRL (Interest Rate Reduction Refinance Loan) or USDA Streamlined Refinance are available with minimal paperwork and no appraisal requirement. However, to refinance into a conventional loan, you may need to build up at least 20% equity or meet other criteria.

Are there any disadvantages to a no down payment mortgage?

While no down payment mortgages provide an excellent opportunity to own a home without upfront costs, they may come with some downsides. You may face higher monthly payments compared to a traditional mortgage with a down payment. Additionally, some programs, such as USDA or VA loans, require mortgage insurance or a funding fee. It’s also important to consider the long-term impact of not having equity in your home from the start.

Can I use a no down payment mortgage to buy a second home or investment property?

No, a no down payment mortgage is typically intended for primary residences only. Government-backed programs like USDA and VA loans are designed to help individuals secure their first home or a primary place of residence. If you’re interested in purchasing a second home or investment property, you may need to explore other financing options, such as conventional loans, which usually require a down payment.

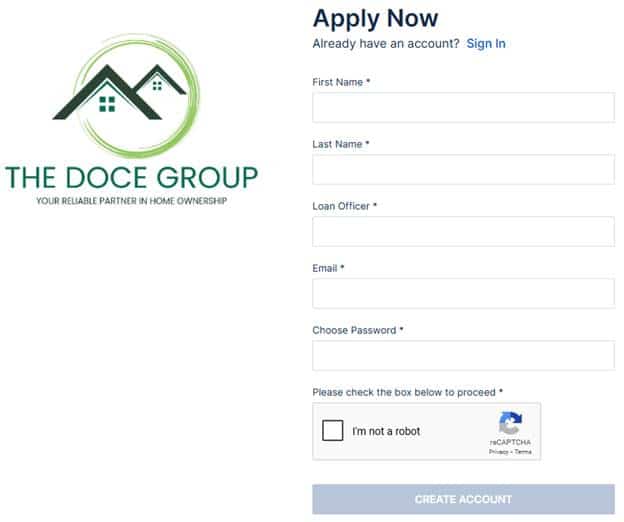

Step 2: Apply Using Our Simple Online Application Form

Applying for a no down payment mortgage is a straightforward process that can be completed online in just a few simple steps. To get started, all you need to do is fill out our simple online application form. You’ll just need to provide some basic information, such as your personal details, contact information, and employment history.

You’ll also need to provide some details about your current financial situation, including your income, monthly expenses, and any debts. This will help the lender assess your ability to repay the loan. In addition to your financial information, the application will ask for your social security number, date of birth, and address history for identity verification and background checks.

Applying online allows you to save time and begin the process from the comfort of your home. With the right details in place, you can easily take the first step toward owning a home with a no down payment mortgage.

Step 3: Contact a No Down Payment Mortgage Professional

Now that you’ve learned all about how a no down payment mortgage loan works, it’s time to bring in a professional who can help actually make it happen. That’s where I come in.

My name is Alex Doce with The Doce Mortgage Group and I’d love to help you secure a no down payment loan so you can purchase the house you’ve been dreaming of.

Call me now at 305-900-2012 and I’ll walk you through the entire process from start to finish.

Do I Really Need Help? Can’t I Just Do it on my Own?

Would you try to handle a complex lawsuit without an attorney? Would you file complex tax returns without the help of a certified accountant? Of course not. In the same way, you wouldn’t want to try to secure a no money down mortgage loan without an experienced loan expert who has the knowledge and experience to achieve the results you’re looking for.

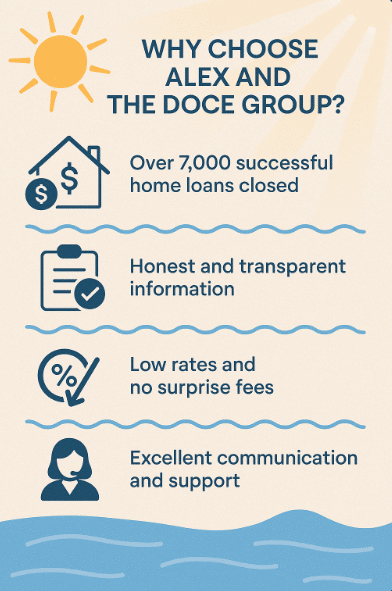

Why Choose The Doce Mortgage Group for Your No Down Payment Mortgage?

When you work with The Doce Mortgage Group, you’re getting over 35 years of knowledge and experience working for you. We’ve helped thousands of families achieve their homeownership dreams. We understand all the ins and outs of Florida’s mortgage market and can help you find the best solution for your situation.

Here’s why you should reach out to myself and the my whole team at The Doce Mortgage Group:

- Over 7,000 successful home loans closed: Over the past 35 years we’ve successfully helped over 7,000 families and individuals secure the home financing they need. Our extensive track record speaks to our ability to navigate complex situations and get deals done. Whether you’re buying your first home, refinancing, or securing an investment property, our experience ensures you’re in capable hands.

- Honest and transparent information based on current market conditions: We pride ourselves on offering clients clear, honest, and up-to-date information about the mortgage market. We take the time to explain how current market conditions can affect your loan options, ensuring you’re fully informed about interest rates, lending requirements, and other key factors.

- Low rates and no surprise fees at closing: The entire team at the Doce Mortgage Group works tirelessly to provide our clients with the most competitive mortgage rates available. By leveraging our strong relationships with top lenders, we’re able to secure low rates that help save you money over the life of your loan.

- Excellent communication and support throughout the process: One of the key aspects that sets us apart from other mortgage brokers is our commitment to communication. From your initial consultation to the closing table, we’ll be there to answer any questions and provide updates.

If you’re ready to get started with your new home purchase, contact Alex Doce today at 305-900-2012.

FAQs

Can I buy a house with no money down?

Yes, some loan programs make this possible. Options like USDA loans, VA loans, or certain assistance programs can let you buy a home without a down payment if you qualify.

What Florida home loans are available for first-time buyers?

In Florida, first-time buyers can apply for FHA loans, USDA loans, VA loans, and state-backed programs. Many of these offer low down payment options and help with closing costs.

What are the first-time home loan requirements?

Requirements depend on the loan program. Most lenders look at your credit score, income, and debt-to-income ratio. FHA loans, for example, need a 3.5% minimum down payment if your credit score is 580 or higher.

How can a first-time home buyer get a loan with no down payment?

First-time buyers may qualify for loans like USDA or VA that don’t need a minimum downpayment. Some local Florida programs also offer down payment assistance.