I often get asked if it’s possible to buy a primary home in Florida without verifying income. The good news is, the answer is yes! It is possible, and there are several good options to consider. Florida is one of the most desirable places to live in the United States, and its real estate market is no exception. The state’s beautiful weather, thriving job market, tax advantages, and vibrant communities make it a top choice for homeowners and investors alike.

Here we will explore how you can buy a principla residence home in Florida without verifying your income, the advantages of doing so, and some of the best alternatives to traditional financing. Whether you’re self-employed, have non-traditional income sources, or just want more privacy, there are plenty of ways to secure a mortgage in Florida without going through the standard income verification process.

Buying a Home in Florida Without Verifying Income

Traditional mortgage loans usually require proof of income through pay stubs, tax returns, or other documentation. However, there are alternatives that allow you to bypass this requirement. Let’s dive into some of the options available.

1. Non-QM (Non-Qualified Mortgages)

One of the best options for buying a home in Florida without verifying income is a Non-QM loan. These types of loans are designed for borrowers who do not fit the standard mold of traditional mortgage applicants. Non-QM loans don’t require the same documentation as a conventional loan, including income verification.

Some common types of Non-QM loans include:

- Bank Statement Loans: Bank statement loans are a great option for self-employed individuals or those with irregular income. Instead of providing traditional income documentation, such as pay stubs or tax returns, you simply submit your personal or business bank statements. Lenders will analyze your deposits over the past 3, 6, 12 or 24 months to assess your ability to repay the loan.

- Stated Income Loans: With stated income loans, you declare your income to the lender without needing to provide proof. This means you can bypass the usual requirements like tax returns, pay stubs, or W-2s. However, be prepared for lenders to offer slightly higher interest rates due to the increased risk associated with these loans.

- Asset-Based Loans: Asset-based loans allow you to use the value of your assets, such as savings, investments, or even real estate, as collateral. Instead of focusing on income verification, lenders will evaluate your assets to determine the loan amount. This is especially beneficial for individuals with significant assets but less consistent income.

Non-QM loans are an excellent way for self-employed individuals or people with irregular income to qualify for a mortgage in Florida. These can typically can be obtained with a 10-20% downpayment.

2. Hard Money Loans

Hard money loans are a viable option for those seeking to buy a home in Florida without verifying income, credit or assets. Unlike traditional mortgage loans provided by banks, these loans are typically offered by private lenders or investor groups. The primary feature of a hard money loan is that it is asset-based, meaning the loan is secured by the value of the property rather than the borrower’s financial history or income level.

This makes them particularly useful for individuals who may not have conventional income documentation but have significant equity in a property. While hard money loans tend to come with higher interest rates than traditional mortgages, they offer quicker approval times and are often more flexible in terms of repayment. These loans are particularly beneficial for those who need fast access to funds or have difficulty providing traditional income verification. These can typically can be obtained with a 30% or higher downpayment and can close as quickly as 7-10 days.

3. No Income Verification Mortgages

No income verification mortgages are another option for those looking to buy a home in Florida without verifying income or requiring a job. As the name suggests, these loans do not require borrowers to submit documents like pay stubs, tax returns, W-2s or be employed. This makes them attractive for individuals with non-traditional income sources, such as freelancers, self-employed individuals, or those with inconsistent earnings.

However, these loans typically come with higher interest rates and stricter terms to make up for the lack of financial documents, as lenders are taking on more risk. No income verification loans, including no income verification mortgages, can be a good option for buyers who need fast access to funds or want to avoid the paperwork required by traditional loans. While they may not work for everyone, they provide a unique path to homeownership for those who qualify. These usually require a down payment of 20% or more.

4. Private Lenders

Private lenders offer an alternative financing option for those looking to buy a home in Florida without undergoing the rigid requirements of traditional banks. These lenders can be individuals or private companies that are willing to take on more risk compared to conventional financial institutions. One of the main advantages of working with private lenders is their flexibility when it comes to income verification.

Often, private lenders will not require any documentation of your income and instead focus on the collateral, such as the value of the property you want to purchase. This makes private loans an excellent option for buyers with non-traditional income or less-than-perfect credit. However, because private lenders are taking on more risk, they may charge higher interest rates and offer less favorable terms. It’s important to carefully evaluate the terms of these loans, including the interest rates, repayment schedules, and any additional fees. These can typically can be obtained with a 25% or higher downpayment.

What Lenders Look for Instead of Income Verification

When applying to buy a home in Florida without verifying income, lenders will typically focus on other factors that indicate your ability to repay the loan. Here are some of the key factors that lenders consider:

- Assets: Lenders may evaluate the value of your savings, investments, or other assets to determine if you have the financial means to repay the loan. If you have substantial assets, such as retirement funds, real estate, or other investments, this can serve as proof of your ability to repay the mortgage. Lenders may view these assets as a safety net, giving them confidence that you can afford the loan, even if your income isn’t fully verified.

- Credit Score: Your credit score is a key factor that influences your eligibility for a mortgage, especially when income verification is not required. A higher credit score indicates to lenders that you have a strong history of managing debt responsibly. Those with higher credit scores may be able to secure favorable loan terms and lower interest rates, even without providing traditional proof of income, as they are seen as less risky borrowers in the eyes of lenders.

- Down Payment: Offering a larger down payment can significantly improve your chances of qualifying for a mortgage without needing to verify income. A sizable down payment reduces the lender’s risk because it demonstrates your financial stability and commitment to the property. It also means you are borrowing less, which can make the loan easier to manage for both parties. The larger the down payment, the more likely the lender is to overlook the lack of income verification.

- Property Value: The value of the property you wish to purchase plays a significant role in determining the lender’s willingness to approve a mortgage without income verification. Lenders typically prefer to see that the home’s value is higher than the loan amount, providing them with a security cushion in case of foreclosure. If the property is worth more than what you’re borrowing, it offers the lender additional assurance that their investment is protected, making them more likely to approve the loan.

If you’re ready to see how much you can afford, be sure to check out our Mortgage Calculator.

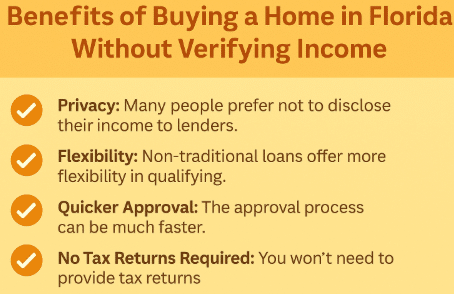

The Benefits of Buying a Home in Florida Without Verifying Income

There are several benefits to buying a home in Florida without verifying income. Here are some of the top advantages:

- Privacy: Many people prefer not to disclose their income to lenders for various reasons, including personal security or the desire to keep financial details private. Alternative financing methods, such as non-traditional loans, provide a way to keep income details confidential while still qualifying for a mortgage. This can be especially appealing to individuals who value their privacy in financial matters.

- Flexibility: Non-traditional loans offer more flexibility in terms of qualifying for a mortgage. For those who are self-employed, gig workers, or have inconsistent income, these loans provide an easier path to homeownership. Unlike traditional loans, which rely heavily on steady, verifiable income, alternative financing options take a more comprehensive view of your financial situation, making it easier to qualify.

- Quicker Approval: One of the main advantages of non-traditional loans is the faster approval process. Without the need for gathering extensive documentation, such as tax returns or pay stubs, the process becomes much more streamlined. This is ideal for buyers who need quick access to funds and don’t want to be bogged down by the lengthy paperwork involved in traditional loans.

- No Tax Returns Required: Non-traditional loans typically do not require you to provide tax returns, which can be a significant advantage for individuals with complex tax situations. For self-employed buyers or those who have irregular income, tax returns can be difficult to compile and may not fully reflect their true earning potential. Without this requirement, it becomes easier to secure a mortgage without the hassle of providing extensive documentation.

If you’re considering buying a home in Florida and want to explore your financing options, Get a Free Quote.

Are There Any Drawbacks?

While buying a home in Florida without verifying income has many advantages, it’s important to be aware of some potential drawbacks:

- Higher Interest Rates: Since the lender is assuming more risk by offering a loan without verifying income, they typically charge higher interest rates. This is done to offset the potential financial risk associated with lending to individuals without traditional income documentation. While this can make the loan more expensive over time, it provides an option for buyers who may otherwise struggle to secure financing.

- Larger Down Payment: To make up for the lack of income verification, lenders may require a larger down payment. A bigger upfront payment reduces the loan-to-value ratio, providing the lender with a sense of security. The larger down payment shows financial stability and lessens the lender’s exposure to risk, making it easier for the borrower to qualify without verifying their income.

- Shorter Loan Terms: Loans that do not require income verification, especially those from private lenders, may come with shorter terms. While this can lead to quicker repayment, it also means higher monthly payments due to the compressed loan schedule. Borrowers may have to budget for larger monthly payments, but the benefit is that the loan is paid off faster, often with less total interest paid over the life of the loan.

It’s essential to weigh the pros and cons before deciding on this option.

Mortgage Options for First-Time Homebuyers in Florida

If you’re a first-time homebuyer in Florida, there are several mortgage options that could help you qualify for a home loan without verifying income. The First Time Homebuyer programs are specifically designed for individuals who have never owned a home and may need more flexibility when it comes to down payments and income verification.

Additionally, Down Payment Assistance Programs are available to help you reduce your initial financial burden, allowing you to buy a home with little or no money down. These programs are often combined with low-interest loans that can make buying a home much more affordable.

If you qualify for these programs, you could potentially buy a home with as little as a 3% down payment or even a Zero Down Mortgage in Florida.

Why Florida is a Great Place to Buy a Home

Florida offers a unique blend of natural beauty, cultural diversity, and a booming economy, making it an excellent place to buy a home. Some of the key benefits of living in Florida include:

- Year-Round Sunshine: Florida boasts warm weather all year, perfect for outdoor enthusiasts.

- No State Income Tax: Florida residents enjoy significant tax savings as there is no state income tax.

- Thriving Economy: With a growing job market, Florida attracts professionals from various fields.

- Beautiful Beaches: The state’s coastlines are some of the most beautiful in the world, perfect for relaxation and recreation.

- Diverse Communities: Florida is home to a mix of cultures and communities, offering something for everyone.

Top Reasons Why People Want to Live in Florida

There are many reasons why people are flocking to Florida. These are some of the most common motivations for buying a home in the Sunshine State:

- Lower Taxes: As mentioned, Florida has no state income tax, which is a major attraction for many homeowners.

- Great Weather: Florida’s tropical climate offers warm temperatures and sunshine year-round.

- Attractive Real Estate Market: The real estate market is booming, with affordable options and high demand.

- Outdoor Activities: Whether you love golf, fishing, boating, or just soaking up the sun, Florida offers a wide variety of outdoor activities.

- Retirement-Friendly: Florida is a popular destination for retirees due to its warm climate and lack of income tax on retirement benefits.

- Diverse Culture: The state has a rich mix of cultural influences, making it an exciting place to live.

How to Get Started

If you’re ready to buy a home in Florida without verifying income, start by reviewing your financing options. You can apply through Our Application portal to get started. Be sure to check out all our mortgage options available, including bank statement loans, asset based loans, and no-income verification mortgages.

Want to know what it’s like working with The Doce Mortgage Group? Check out our customer reviews to see how we’ve helped hundreds of clients buy their dream homes in Florida without the stress of traditional income verification.

Ready to Buy a Home in Florida?

Buying a home in Florida without verifying income is entirely possible, and there are several financing options that can make it happen. If you’re interested in exploring these options, don’t wait! Call Today at 305-900-2012 to speak with a professional at The Doce Mortgage Group and start your journey to homeownership in the Sunshine State.

FAQs

Can you buy a house with low income in Florida?

The USDA Rural Development Section 502 Direct Loan Program helps low and very low-income families in rural areas buy a home when they have no other affordable options.

How to get approved with no proof of income?

Other income sources can include retirement benefits, Social Security, disability payments, investments, or rental income. If you don’t have proof of income, a cosigner with good credit can improve your chances of getting approved. A strong credit score can also help when income can’t be verified.

What is the minimum income to buy a house in Florida?

In Florida, buyers need to earn about $114,771 a year in 2024 to afford a median-priced home, based on BankRate data. Back in 2020, the income needed was around $72,693 for a typical home.

How to get a personal loan with no income verification?

You can apply by showing other proof of financial strength, such as good credit, savings, or valuable assets. Some lenders may also accept a cosigner with strong credit.