Table of Contents

- Can You Buy a Multifamily Home in Miami with an FHA Loan?

- 2025 FHA Loan Limits in Miami Dade for Two to Four Units

- Down Payment and Credit Rules for 2025

- Using Rental Income to Qualify in 2025

- Self Sufficiency Test for Three and Four Unit Properties

- Mortgage Insurance Costs in 2025

- Property Standards and the FHA Appraisal in 2025

- Pairing FHA with Florida Assistance Programs

- Who Benefits Most from an FHA Loan for a Multifamily Home in Miami?

- Why People Want to Live in Miami

- Neighborhoods and Property Types to Explore

- Market Trends Buyers Should Know in 2025

- Common Questions About FHA Multifamily in Miami

- Why Work with The Doce Mortgage Group?

- Taking the Next Step Toward Your FHA Multifamily Purchase

Keynotes

- FHA can finance two to four units if you live in one.

- 2025 Miami Dade limits: up to four unit loans of $1,258,400.

- Rental income counts at 75 percent, three and four unit homes must pass self sufficiency.

Can You Buy a Multifamily Home in Miami with an FHA Loan?

I’ve worked with a lot of people who dream about living in Miami, and I get it. The city’s got beautiful beaches, year-round sunshine, amazing food, live music, pro sports, and neighborhoods full of character. It’s a place where you can live in the middle of the action or find a quieter street just a few blocks away.

And here’s the good news: yes, you can use an FHA loan to buy a two to four unit property in Miami, as long as you live in one of the units yourself. FHA rules say you need to move in within about 60 days and plan to stay at least a year. That’s what makes it perfect for buyers who want to “house hack” — living in one unit while collecting rent from the others.

2025 FHA Loan Limits in Miami Dade for Two to Four Units

Before you start house-hunting, you need to know the FHA loan limits for 2025 in Miami-Dade. They’re set by HUD and updated each year. This year, the maximum base loan amounts are:

- One unit: $654,350

- Two units: $837,700

- Three units: $1,012,550

- Four units: $1,258,400

If you stay within these limits, you’re in FHA territory.

Want to see how those limits translate to a real mortgage payment? Pop your numbers into the Mortgage Calculator and see if it fits your budget.

Down Payment and Credit Rules for 2025

The down payment rules for an FHA loan haven’t changed much, but they matter a lot if you’re buying in Miami this year:

- If your credit score is 580 or higher, you can put down just 3.5% of the purchase price.

- If your score is between 500 and 579, you’ll need a 10% down payment.

FHA also lets you use gift funds for your down payment or closing costs, as long as the money comes from an approved source and is properly documented. That can be a huge help if a family member is willing to pitch in.

Using Rental Income to Qualify in 2025

One of the biggest perks of buying a two to four unit property with FHA is that you can use the rent from the other units to help you qualify for the loan. In most cases, lenders count 75% of the rent from the other units. That 25% they don’t count is just to cover the possibility of vacancies and expenses.

If the units already have tenants, the lender will use the rent listed in the leases. If they’re empty, the appraiser will give a “market rent” estimate based on similar properties in the area.

Self Sufficiency Test for Three and Four Unit Properties

If you’re looking at a triplex or fourplex, FHA has one extra rule called the “self-sufficiency test.” Don’t let the name scare you — it’s basically a math check.

Here’s how it works: the net rent from all the units (using that 75% rule) has to be equal to or greater than your full monthly mortgage payment. That payment includes your principal, interest, property taxes, homeowners insurance, and FHA mortgage insurance.

Let’s say you find a fourplex with projected total rent of $6,000 a month. FHA will count 75% of that, which would be $4,500, as qualifying income. If your mortgage payment is $4,300, you’re good. If it’s $4,600, you’ll have to either bring the payment down (with a bigger down payment or better rate) or show higher rents.

If you’re curious whether a specific property would pass, just enter it into our application portal. Our team can run the numbers before you even make an offer.

Mortgage Insurance Costs in 2025

Every FHA loan, including an FHA loan for a multifamily home in Miami, comes with two types of mortgage insurance.

The first is the Upfront Mortgage Insurance premium. In 2025, it’s still 1.75% of your base loan amount. You can either pay it at closing or roll it into your loan.

The second is the annual mortgage insurance premium (MIP), which you pay monthly as part of your mortgage. In 2025, it’s 0.55% of your loan balance each year.

Want to see how this affects your payment? Just plug your numbers into the Mortgage Calculator to see the full monthly cost before you start house hunting.

Property Standards and the FHA Appraisal in 2025

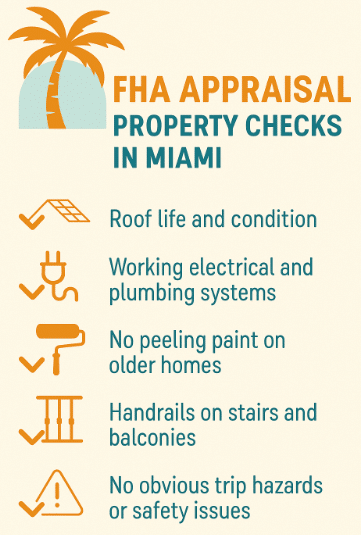

One thing to know about FHA loans — they’re picky about the property being safe and livable from day one. That’s where the FHA appraisal comes in.

In Miami, that often means checking things like:

- Roof life and condition

- Working electrical and plumbing systems

- No peeling paint on older homes

- Handrails on stairs and balconies

- No obvious trip hazards or safety issues

HUD updated its appraisal rules in June 2025, keeping the focus on health and safety while streamlining some older requirements. You can see the update here.

If you’re eyeing a property that needs work, don’t panic. Some repairs can be done after closing if they’re handled through an approved escrow account. But it’s smart to have the team at The Doce Mortgage Group review the listing early. Just send it through Our Application portal, and we’ll let you know if the property is likely to pass FHA standards.

Pairing FHA with Florida Assistance Programs

If you’re buying a 1-2 family property in Miami, coming up with the down payment can be the biggest hurdle. That’s where The Doce Mortgage Group’s HomeZero Program comes in. The HomeZero program provides you with a second loan to cover your down payment and most of your closing costs – either 3.5% or 5% of the total purchase price, depending on your needs and qualifications, making it possible to get into your property with little to no money upfront. Also allowing you to keep your savings for renovations, moving costs, or simply as a financial cushion. It’s especially helpful in a market like Miami, where competition for multifamily homes is strong and cash reserves give you an edge.

For 2025, program guidelines include certain income and purchase price limits, so getting pre-approved early is key. This helps you lock in eligibility before you start making offers.

If you’d like to see if you qualify, start your application through Our Application portal. The team can review your details, confirm your eligibility, and show you exactly how HomeZero can work with your FHA multifamily purchase.

Who Benefits Most from an FHA Loan for a Multifamily Home in Miami?

An FHA loan for a multifamily home in Miami can work for a wide range of buyers, but it’s especially helpful for:

- First time homebuyers who want to get into the market without a huge down payment can benefit from FHA’s low 3.5% requirement when their credit score is 580 or higher. This makes it possible to buy sooner instead of waiting years to save 20%.

- Buyers who have good but not perfect credit often find FHA loans more flexible than conventional options. With a 580+ score, you can qualify for competitive rates and predictable fixed monthly payments. This stability makes budgeting easier and gives you time to improve your credit while building equity in your Miami property.

- House hackers who plan to live in one unit and rent out the others can offset a large portion of their mortgage with rental income. FHA allows you to count a percentage of that rent toward qualifying, making it easier to afford a multifamily property. This approach helps build equity while reducing your monthly housing costs.

If you fall into one of these groups, it’s worth running numbers in the mortgage calculator to see how affordable it could be.

Why People Want to Live in Miami

Beyond the loan details, Miami itself is a big part of the decision. People choose to live here for the sunny climate, beautiful beaches, and year-round outdoor activities. The city’s food scene is full of flavors from around the world, and there’s always a festival, concert, or sporting event to check out.

Miami is also a major hub for trade, tourism, and international business, which means there’s a strong job market. Miami International Airport and the cruise port make travel easy, and the variety of neighborhoods means you can find a place that matches your style, whether that’s high-rise living downtown or a quiet street in Little Havana.

If the idea of combining a Miami lifestyle with rental income sounds appealing, start by getting a free quote to see what kind of FHA multifamily loan you could qualify for.

Neighborhoods and Property Types to Explore

If you’re searching for a two to four unit property in Miami, certain neighborhoods tend to have more listings that work with an FHA loan for a multifamily home in Miami. Areas like Little Havana, Allapattah, and parts of Miami Beach often have duplexes, triplexes, and fourplexes on the market. These spots offer strong rental demand and put you close to the city’s main attractions.

When comparing properties, look at more than just the price tag. Pay attention to the building’s condition, walkability, school zones, and access to public transportation.

Market Trends Buyers Should Know in 2025

In 2025, Miami’s small multifamily market is still competitive. Inventory is tight, and well-priced properties in good condition don’t last long. According to recent local rental market data, average rents for two to four unit buildings in Miami have gone up over the past year, and vacancy rates remain low. That’s great for buyers who plan to use rental income to qualify for an FHA loan for a multifamily home in Miami.

Home prices are still rising, though at a slower pace than in the previous few years. Be sure to budget for higher property insurance costs in Florida and factor in Miami-Dade’s property taxes, which can vary depending on the neighborhood and any exemptions you qualify for.

You can estimate your full payment, including taxes, insurance, and FHA mortgage insurance, by entering your details into our Mortgage Calculator.

Common Questions About FHA Multifamily in Miami

Here are some of the top questions buyers ask about using an FHA loan for a multifamily home in Miami:

- Can I buy a multifamily with FHA if I already own another property? Yes, you can, but FHA rules still require the new purchase to be your primary residence. This means you’ll need to live in one of the units full-time. The lender will verify your intent to occupy during the approval process.

- How long do I have to live there? FHA expects you to stay in the property for at least 12 months after closing, but it is not mandatory. This rule is in place to prevent buyers from using FHA loans for investment properties. After the first year, you can move and keep it as a rental if you choose.

- Can I use Airbnb or short-term rentals? FHA generally requires rental agreements of at least 30 days. Short-term stays under a month typically don’t meet the guidelines since the FHA treats rentals under 30 days as transient use. If you’re considering Airbnb or similar platforms, talk with Alex Doce first to confirm whether it fits FHA’s occupancy and rental requirements in 2025.

- What repairs can be financed? Health and safety repairs, like fixing a leaking roof or updating unsafe wiring, can sometimes be rolled into the loan through the FHA 203(k) program. This option, listed on the All Our Loan Types page, lets you buy and renovate under one mortgage.

- Can I use gift funds? Yes, FHA allows gift funds for your down payment and closing costs as long as they come from an approved source like a family member or employer. The funds must be documented with a gift letter and bank records to show the money is truly a gift, not a loan.

If you have any other questions, feel free to give us a call today at 305-900-2012.

Why Work with The Doce Mortgage Group?

Buying a multifamily property in Miami is a big move, and having an experienced lender on your side makes a huge difference. The Doce Mortgage Group understands both the FHA guidelines and the Miami market, which means they can help you avoid surprises during the process.

We’ve been helping buyers secure the right financing for years, and our clients have given us hundreds of positive reviews!

Taking the Next Step Toward Your FHA Multifamily Purchase

Living in Miami while renting out your extra units can help you cover your mortgage and build equity at the same time. With the right property and a 2025 FHA loan for a multifamily home in Miami, you can enjoy the lifestyle that Miami has to offer, all while generating a steady, reliable rental income.

Call today at 305-900-2012 to start your pre-approval, or Get a Free Quote online so you’re ready to act fast when the perfect property hits the market.