There are two things you need for a stellar real estate investment: the right property and the right mortgage loan.

Conventional loans and DSCR (Debt Service Coverage Ratio) loans are two popular options here in Florida with unique benefits to buyers who qualify. But to decide which one is right for you, you need to examine the specifics of a DSCR vs. conventional loan, including differences in loan structure, eligibility, and the types of properties they allow you to buy.

What is a DSCR Mortgage Loan?

A DSCR loan, or Debt Service Coverage Ratio loan, is a type of mortgage that allows you to borrow on the rental income potential of a property, rather than your personal finances. It’s a popular choice for Florida real estate investors, with flexible loan requirements and the ability to borrow up to $5,000,000 toward an income-generating property.

At the heart of DSCR loans is the debt service coverage ratio itself. This ratio is meant to inform lenders on the ability of a borrower to repay the loan based on its rental potential. The minimum DSCR is usually 0.75, meaning the rental income per month is equal to or more than the monthly loan payment. An example would be a property expected to earn $5,000 a month based on past rental history and a monthly loan payment of $4,000, which together result in a favorable 1.25 DSCR. In some cases, loans may be available with more flexible guidelines, including options that do not require a specific ratio, such as No Ratio DSCR loans.

What is a Conventional Mortgage Loan?

A conventional mortgage loan is the standard type of mortgage used by homebuyers, particularly when it comes to purchasing a primary residence or otherwise owner-occupied home. It can have a variable or fixed interest rate and terms of generally 15 or 30 years.

Unlike DSCR loans, conventional loans use personal finances to determine (a) whether a buyer qualifies and (b) how much they qualify for, as well as the interest rate and terms of their loan. To be eligible, you’ll need to meet lender requirements around job history, income, credit score, and debt-to-income ratio. You may also be required to put 20% or more down, or take on private mortgage insurance (PMI) for down payments below that threshold.

Conventional loans differ from USDA, VA, and FHA loans in that they are backed by private lenders, not the government. For this reason, they may have stricter qualifications and higher interest rates. On the other hand, there’s potential for lower fees and closing costs.

DSCR Loan Requirements in Florida

There is no income verification for a DSCR loan, but that doesn’t mean that anyone can qualify. To get a DSCR loan in Florida, you will generally need:

- Debt service coverage ratio of 0.75 or higher

- Minimum credit score between 620 to 680 (depending on the program)

- Down payment of 15-30%

- Intent to purchase a qualifying, income-generating property (single-family, condos, townhouses and 2-4 unit properties are allowed, but must be intended for use as a short- or long-term rental)

Florida is a popular spot for DSCR loans, used quite commonly in investment-heavy areas like Miami, Orlando, Tampa, and Fort Lauderdale. That’s largely due to the flexibility they offer for potential investors, including first-time buyers with no prior experience in these types of investments.

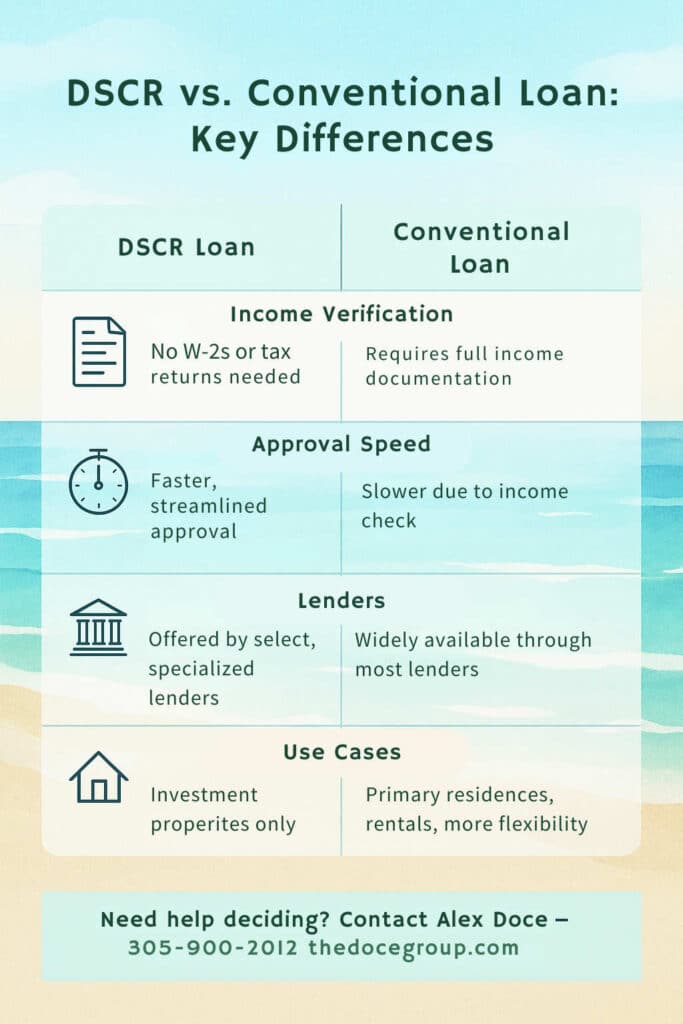

DSCR vs. Conventional Loan: Key Differences

Both DSCR loans and conventional loans have their benefits and drawbacks. Some of these are apparent just by looking at the differences between the two types of mortgage loans, which vary on a number of key points.

- Income Verification: Conventional loans require income verification via things like W-2s, pay stubs, or tax returns, while DSCR loans do not.

- Speed: DSCR loans tend to have more streamlined application and approval processes than conventional loans, and thus usually close faster.

- Interest Rates: Rates may be slightly higher for a DSCR loan than a conventional loan since they’re often considered riskier investments for lenders.

- Lenders: While conventional loans are available through most standard mortgage lenders, DSCR loans are more specialized and not all lenders offer them.

- Use Case: DSCR loans are only available for investment properties, while conventional loans can be put toward primary residences, rental properties, or other types of home purchases.

Choosing the Right Loan for Your Needs

Whether you go with a conventional mortgage loan or a DSCR loan ultimately comes down to what type of borrower you are.

Are you buying an income-producing property and planning to rely on cash flow from investments to finance your monthly payments? Then, a DSCR loan is the way to go. Are you planning to live in the home and invest based on your own strong personal income? A conventional loan should fit the bill.

Keep in mind that both types of loans are available for first-time buyers and experienced investors alike. Beyond qualifications like credit score and intent to purchase, look at what the loan has to offer you in terms of interest rates and other repayment specifics, and pay close attention to your total estimated costs over time. It should become clear pretty early on which one is better for you, or you may decide to go a different route entirely, such as an FHA or VA loan.

Get Your Best Loan with Alex Doce

DSCR loans and conventional loans differ primarily in eligibility requirements, rates, and the types of properties they can be put toward. Both have their pros and cons, too, depending on your end goal, of course.

Ultimately, it’s a lot to take in — and if you’re new to this or buying a rental property for the first time, it’s completely understandable to feel unsure about where to start. If that’s you, Alex Doce and The Doce Mortgage Group are your go-to source for finding the right mortgage loan, whether that’s a DSCR loan, a conventional loan, or any other type of loan you qualify for. Contact us to learn more about Florida DSCR loan requirements and get a free mortgage quote!

Contact Alex Doce today at 305-900-2012.