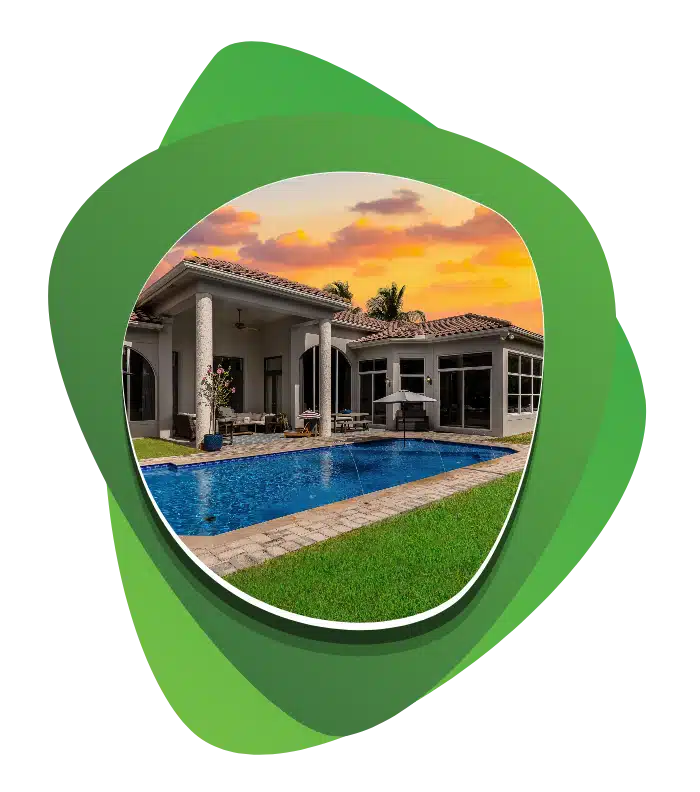

Make your luxury home dreams a reality with a Florida jumbo mortgage. Jumbo loans from The Doce Mortgage Group are designed to help you finance high-end properties that exceed standard agency loan limits. Think beyond conventional financing and boost your buying power in a competitive market with a Florida jumbo loan tailored to your needs and ambitions.

Access financing above conventional loan limits, perfect for high-cost areas and luxury properties.

Make your dream home more accessible with lower down payment options compared to standard loans.

Enjoy attractive interest rates and never spend more than you have to on your monthly mortgage payment.

Jumbo loans are an ideal solution for Florida homebuyers seeking to purchase high-end properties or homes in competitive markets where real estate prices exceed typical loan limits.

Finance that perfect penthouse with a Miami jumbo loan or buy a beachside with a jumbo loan in Fort Lauderdale – wherever you want to end up, The Doce Mortgage Group can give you the financial leverage to make it happen. Our jumbo loans offer higher borrowing limits so you can invest in luxury real estate without the constraints of standard mortgage loan products, offering the flexibility and security you need for such a big investment.

Our jumbo loan programs cater to a wide range of high-value properties in Florida, be it a primary residence, second home, or investment property. To qualify, borrowers undergo a thorough assessment of their creditworthiness, income stability, and overall financial health, with higher borrowing criteria that align with the higher risk of a non-conforming loan.

The Doce Mortgage Group is proud to be your partners in luxury real estate. Our expert advisors make it easy to secure a jumbo loan in Florida, providing a seamless and transparent process that paves the way to your luxury property. Whether you’re looking to compete in a high-demand zip code or eyeing a sprawling golf course estate, contact The Doce Mortgage Group today to explore custom Florida jumbo mortgage solutions.

A jumbo mortgage is a home loan that exceeds the conforming loan limit set by Fannie Mae and Freddie Mac. As of October 2025, any loan amount above $822,550 in most Florida counties is considered jumbo. These loans are used to finance high-value properties and generally require strong credit, larger down payments, and additional income verification.

The Doce Group offers jumbo mortgage programs throughout Florida, including Miami, Fort Lauderdale, Boca Raton, Palm Beach, and Naples.

Rates for jumbo loans in Florida vary based on Loan To Values, credit scores, property type and occupancy. Please contact Alex Doce at 800-355-ALEX, or via this page, to get today’s best rates.

In order to qualify for a jumbo loan, borrowers must have a good credit history, stable income and employment, and the ability to make a sizable down payment (usually 10%+) on a luxury property. Borrowers must also have a minimum 660 FICO credit score.

Yes — for lenders, jumbo loans carry more risk because they exceed Fannie Mae and Freddie Mac’s conforming loan limits and aren’t backed by those agencies. As a result, borrowers must meet stricter credit, income, and reserve requirements.

For qualified buyers, however, jumbo loans are not inherently riskier—they simply involve larger loan amounts and tighter approval standards to protect both borrower and lender.

You can refinance a jumbo mortgage to lower your rate, reduce payments, or access home equity. Jumbo refinances work like standard loans but require strong credit, adequate equity, and closing costs around 1–3% of the loan amount.

The Doce Group can help you explore current jumbo refinance options in Florida and determine potential savings.

Find out how much you can borrow, find the best program for your situation, get a rate quote.

Schedule a free consultation with a mortgage Pro to explore options and get clear next steps.

We’ll walk you through each step of the way and issue a pre-approval within 24 hours.