You can have stellar credit and a great income, but if your debt-to-income ratio (DTI) is too high, it may still be challenging to obtain a mortgage. Your DTI, also known as your credit utilization ratio, helps your lender determine whether you are likely to become overextended after taking on the new loan.

Even if you do obtain a mortgage, it may come with higher interest rates than are desirable for your situation. So it’s vital to understand this number, what it means, and how you can adjust it to be more favorable to your home ownership dreams.

How do you calculate DTI?

To calculate your DTI:

- Add up all of your monthly bills from all of the debts showing on your credit report. Exclude installments with less than 10 payments left.

- Add in the proposed monthly PITI mortgage payment.

- Divide it by your gross income (not your net income), or the average of your last two years of adjusted gross income if self employed.

- Multiply the resulting decimal by 100 to get a percentage.

For example, if your monthly recurring debt payments total $1500 and you make $7000 a month, your DTI would be 21%.

Don’t want to do the math by hand? You can find plenty of DTI calculators online. If you need to figure out what your mortgage payment might be, you can use the Doce Group’s payment calculator to obtain an estimate.

What is a good debt-to-income ratio?

Every lender is different. Most lenders will accept a DTI of up to 50%, but lenders prefer to see a DTI of no more than 43%. Only 30% to 40% of that debt should come from your mortgage.

Are there benefits to getting your DTI even lower, say to 10%? Not really. Lenders treat any DTI lower than 43% about the same, and truly low DTIs are unlikely once your monthly mortgage payments get factored in.

How do I lower my debt-to-income ratio?

You can lower your debt-to-income ratio in the following ways.

- Pay off some debt and reduce your monthly recurring payments.

- Choose a less expensive home to lower your proposed mortgage payment.

- Look to increase your income without incurring new debts or expenses.

- Transfer balances from high-interest rate cards to low-interest rate cards to lower monthly payments.

There are no magic formulas or tricks you can use. Improving your DTI is a matter of improving your financial well-being or choosing a realistic home purchase.

Which bills count towards the debt-to-income ratio?

You may be relieved to learn certain bills don’t count towards your DTI. Underwriters exclude some bills from DTI, including:

- Utilities

- Medical bills, even if they’re in collections

- Child care costs

- Grocery bills

- Phone bills

- Insurance premiums

It’s important to review your finances and assess your readiness for homeownership before committing to a mortgage payment. DTI is one measurement lenders use to determine whether you have any breathing room in your budget, but given these exclusions, it’s still possible to have a great DTI and a budget that can’t withstand a single-car problem.

How do you calculate DTI on a variable income?

If you work on commission, work freelance, or have a variable income for any other reason, underwriters will use a somewhat more complex process.

- They will review 12 to 24 months of income history and the frequency of the payment.

- They then perform an income trending analysis by comparing your calculated monthly year-to-date income with your prior years’ earnings.

- If the trend is stable or increasing, they average the income amount. If the trend is declining but has stabilized, they’ll use the current lower amount. If the trend is declining, they may rule that your income is not stable enough to use.

They will also ask additional questions. For example, they will want to evaluate whether your income is likely to continue for at least three years. You may have to provide further verification and documentation of the income you are claiming.

There are a few special cases to consider as well. For example, if you have restricted stock incomes, the income must have been vested and distributed without restrictions. The calculation method will vary depending on whether the payment is made in shares or cash.

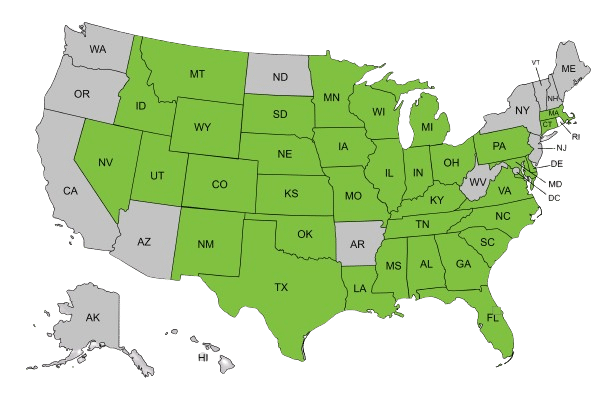

Achieve your homeownership dreams with help from Alex Doce today.

Get expert advice from Alex Doce at the Doce Group today! Click here to schedule a one-on-one consultation.

Alex Doce can help you determine your DTI for the house you want to purchase, set an appropriate budget, and find the right loan.