Your mortgage note is a document that reflects all the terms and conditions of the mortgage loan agreement. You typically sign this document during the closing process.

Here is an example mortgage note.

The mortgage note is a promise to pay the loan. It is also the document that gives your lender the right to foreclose on your home if you fail to pay back the loan as agreed.

What information should be included in your mortgage note?

Read your mortgage note carefully before you sign it. Ensure all the information you see is accurate, as your signature will be legally binding. Every mortgage note should include the following information.

- Your monthly payment amount.

- The terms of your loan.

- Penalties that may be assessed for failure to pay as required.

- The total amount of the home loan.

- The down payment amount.

- Your interest rate, and whether it’s fixed or adjustable.

- Information about prepayment penalties.

- How you might receive notices about your mortgage.

The lender will receive the original copy of the mortgage note. You will not have an original copy until you pay off the loan.

Is a mortgage note the same as a promissory note?

Yes, a mortgage note is the same as a promissory note. It outlines acceptable payment methods, as well as your timeline for loan repayment. A promissory note is a protection for the lender that gives them the legal right to seek repayment in the event you default on the loan.

A mortgage is an instrument that places a lien or encumbrance on property associated with a mortgage debt. The mortgage note essentially hands a mortgage to the lender so they can place this lien.

Can a mortgage note be sold?

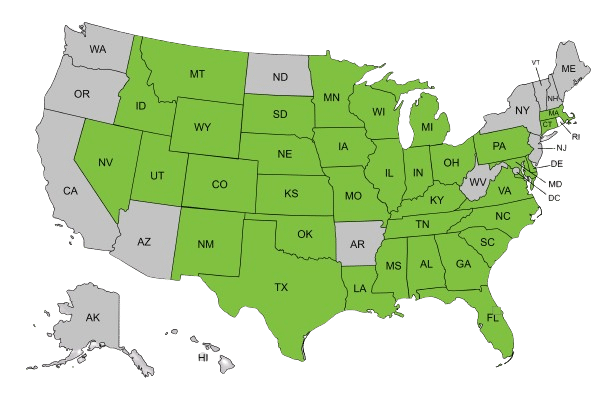

Yes. A mortgage note is a security instrument that may be bought and sold. In fact, some lenders specialize in originating mortgages but don’t want to manage them, so they sell them for others to deal with.

You will still be bound by the terms of the mortgage note until you pay it off, regardless of which financial institution owns the note. If you default on your loan, the new lender can begin the foreclosure process just as the old lender could have. The terms of your mortgage should not change at all.

Once you pay off the note, the lender will send it to you because you’ve purchased the note in full. It belongs to you now. You’ll receive the deed to your home at the same time. However, if you refinance the home, you’ll create a new mortgage note.

There is generally no way to stop mortgage lenders from selling or transferring your mortgage.

How do I know if my mortgage has been sold?

Federal law requires the new servicer to send you a notice of the change at least 15 days prior to the switch. Within 30 days, the owner of the new mortgage is required to send you its name, contact number, and address.

When you receive the notice, read it carefully so you know how and where to send your new mortgage payments.

What is the difference between a mortgage note and a deed?

The deed is a legal document that shows who has an ownership interest in a property. In Broward County, you can obtain a copy from the County Records office.

Do you have more questions about the mortgage note?

Get expert advice from the Doce Group today! Click here to schedule a one-on-one consultation.