“The experience, professionalism and efficiency I experienced working with Alex Doce at The Doce Group was unparalleled.”

Ricky Z. Miami, FL

“To call Alex amazing would be an understatement. I’ve never worked with anyone as knowledgeable and well-prepared.”

“Alex and his team were awesome. He was so patient with me throughout the entire process.”

Cori S. Miami Beach, FL

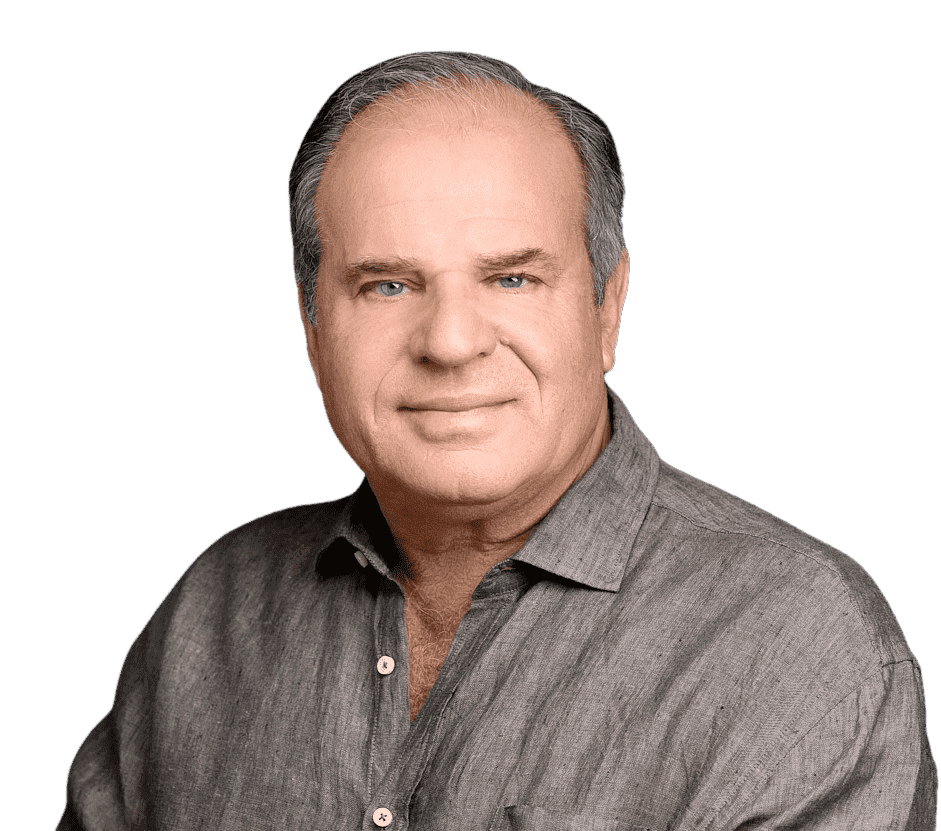

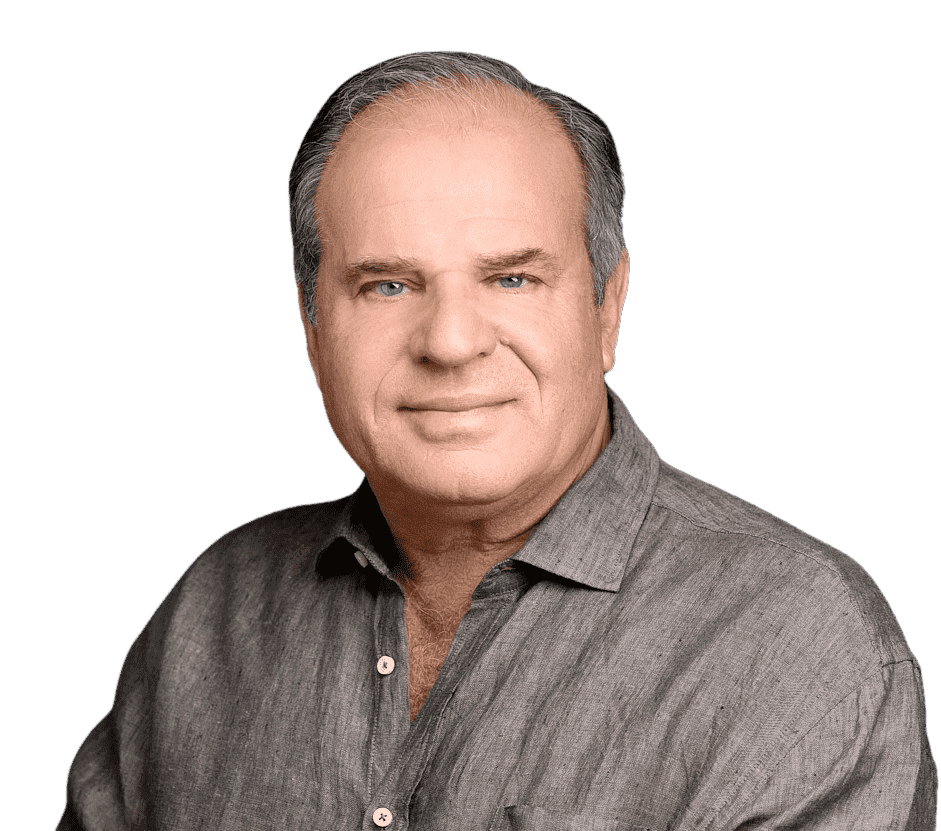

With over 36 years of experience in the mortgage industry, Alex has successfully helped more than 7,000 individuals and families finance their homes nationwide. Alex is currently the Branch Manager at the Doce Group at First Community Mortgage, where he leads a team of dedicated professionals who share his passion for helping people achieve their homeownership dreams. First Community Mortgage is the only two-time winner of Mortgage Bankers Association.

In short, Alex is reliable, knowledgeable, honest, and efficient. His expertise and excellent communication deliver the best experience a borrower could have.

Join Alex’s long list of satisfied clients and contact Alex today.

Depends on the loan: 0% (VA and USDA), 3.5% (FHA), 5-20% (Conventional).

Varies based on credit score, loan type, term, and market conditions. Rates are subject to change.

Higher scores typically lead to better rates and terms. Lower scores may face higher rates.

Programs like HomeZero and several State programs offer down payment assistance and favorable terms for first-time buyers.

Identification, Social Security number, proof of income, bank statements, employment verification, credit information, property details.

Usually 15 to 25 days, but can vary.

Alex Doce NMLS 13817.

The Doce Group NMLS 2638131.

For licensing information, go to: www.nmlsconsumeraccess.org.

Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Loan approval and terms are dependent upon borrower’s credit, documented ability to repay, acceptability of collateral property, and underwriting criteria.

The Doce Group © 2025. All Rights Reserved.