Saving thousands of dollars for a down payment on a house is one of the most daunting steps in the homeownership journey. It can even feel impossible.

Yet, if you can manage to do it, you’ll be in a much stronger and more competitive position than buyers who must rely on down payment assistance programs or zero-down home loan programs. There is nothing wrong with these programs, but they can restrict your options.

Saving for a down payment also means reducing the amount you’ll have to borrow, lowering your mortgage payment, and making homeownership far more feasible. But how do you do it?

Set a Goal

According to Realtor.com, the average home value in Fort Lauderdale is $650,000 as of this writing. You’ll also need to account for closing costs, which are typically 2% to 5% of the home loan amount.

The down payment you’ll need to save will depend on the type of loan you’re targeting.

- You’ll need to save 3.5% for most FHA loans.

- You’ll need to save 3-5% for a conventional loan, depending on whether you are a first time homebuyer. If you want to avoid paying for private mortgage insurance (PMI), you’ll want to put down 20%.

- To improve your interest rate, increase your equity, and make a more competitive offer, you may want to save as much as 10% down.

So, if you’re targeting an FHA loan, you’ll probably want to save at least $22,750 for the down payment alone, as that will give you 3.5% of the median home price. Adding 5% closing costs means saving an additional $32,500, which means saving $55,250. And don’t forget you may need to save for moving expenses, utility deposits, and emergency costs as well. Saving $70,000 to cover all these expenses could be a reasonable goal.

You might certainly target a cheaper home, but if you do, you’ll be in an even stronger position by saving enough to enter the home market at a higher price point if you have to.

It’s a significant sum, but it’s not impossible. You’ll need to take a deep breath and make a plan.

Get Your Financial House in Order

You’ll want your finances solid when you start the home-buying process anyway. Take the following steps.

- Open a dedicated savings account for your down payment, ideally, one that is not connected to your checking account so that it’s harder to dip into it. Get into the habit of adding a little money to it every month. If you have a way to make automatic deposits, get that set up so that saving becomes automatic.

- Choose a high-yield savings account if you can. A high-yield savings account can help you make your money work for you and shorten the amount of time that it takes to reach your savings goals.

- Make a budget.

- Eliminate all the little expenses that tend to add up, like subscriptions you haven’t thought about for a while. You might also reduce the number of times you eat less or your shopping budget.

- Starting a side hustle and devoting all that money to your down payment can help you save a significant amount of money much faster.

- Start paying down debt. Eliminate high-interest debt if you can. As you eliminate monthly payments, you can start devoting that money to your down payment fund. Start with credit card debt, as credit card debt can be the most toxic both to your credit score and to your ability to save money.

- Divert any windfalls you receive to your down payment fund. This could include gifts from family members and friends, raises, bonus checks, and other money that isn’t a part of your routine expenses right now.

Get laser-focused on the down payment process. If you have other savings goals, such as saving for a dream vacation or a car, then you might want to either put those on hold or shift that money to your home purchase fund instead.

Keep going.

Saving for a home purchase might take years, but it will be worth it when you have a home and have purchased one, knowing that you’re financially ready to do so.

And if all this seems utterly unrealistic for your income and situation, then down payment assistance and certain 0% loans may still be an option for you, which will require you to save far less money. It may also be possible to lower your closing costs by a significant margin if you take the proper steps.

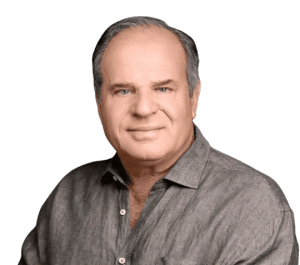

Want to explore your options? Contact Alex Doce at The Doce Group today. He can help you set a realistic goal or steer you towards programs that might be feasible for your financial situation.