Purchasing your very first home is a big step, and it can be a scary one. As of this writing in 2024, media fearmongering isn’t putting too many potential first-time homeowners at ease.

Yet the story that gathers clicks and comments isn’t always the real story. Once you arm yourself with a bit of knowledge, you may find you’re closer than you’ve ever been to purchasing your first home.

Here are some key pieces of information to be aware of as you begin this process.

How do I know I’m financially ready to buy my first home?

While your mortgage amount may be lower than your rent payment, the total monthly cost of owning a home may be very different. Your monthly payment will often exceed your principal and interest amount.

Our payment calculator will help you calculate your total monthly payment. We include important details such as property tax amounts, homeowner’s insurance payments, PMI payments, and HOA fees. Running these numbers can help you get a good sense of what you can afford.

Some of the indicators you typically hear about are good indicators but don’t tell the whole story.

- It’s great to have a down payment if you can accomplish that, but 0% home loan programs exist, as do down payment assistance programs. If you can afford the monthly mortgage payments and one of these programs would make homeownership accessible to you, then your next home loan may be well worth considering.

- Achieving a higher credit score is helpful, but your credit doesn’t have to be perfect. Recent credit event loans exist. Some home loan options accept a lower credit score. While you want to keep an eye on interest rates, there may be diminishing returns on trying to whip your credit report into shape.

It may also be wise to set aside some money in savings that you won’t be using for your down payment, just in case of emergencies. The ability to create this sort of financial cushion is often another indicator that you may be ready to buy a home.

How do I know what my home-buying budget is?

You won’t know for sure until you get pre-approved for a loan, though you can make some estimates by calculating what your debt-to-income ratio (DTI) would look like with different mortgage amounts.

Ideally, your DTI after you take out your mortgage will be no more than 50%, and only 30% to 40% of that debt would come from your mortgage.

See also: How to Calculate Your Debt-to-Income Ratio

What is the difference between pre-approval and pre-qualification?

Home loan pre-qualification is a marketing tool. It’s a quick check against self-reported details. The purpose of pre-qualification is to get you to call a lender and start the process, no more and no less.

During the pre-approval process, you’ll provide proof of your financial situation and allow an actual mortgage lender to take a look at your income, credit, assets, and liabilities. You’ll then receive an offer letter that locks in your interest rate and tells you how much money the lender is willing to offer you.

Armed with that offer letter, you can shop for your first home with confidence, knowing the money will be there when you need it.

How do I get pre-approved for a home loan?

Get started by scheduling a consultation with Alex Doce. He’ll walk you through the process.

What is the best type of home loan for a first-time buyer?

Several loan options and programs might be a good fit for any first-time homebuyer. The key is to choose the loan that best meets your needs and circumstances.

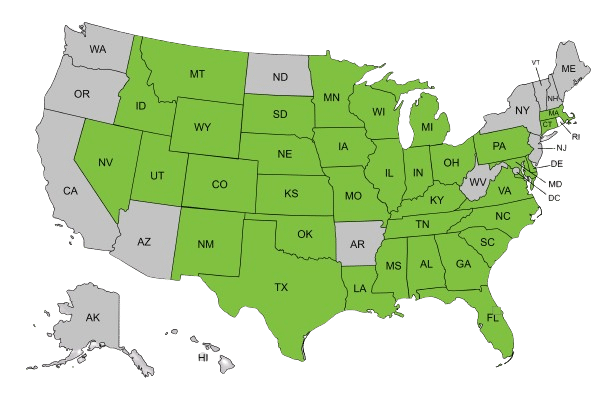

However, there are some loans that first-time home buyers tend to find more accessible than others. Government-backed loans like FHA, VA and USDA loans have lower or no down payment and credit guidelines, making them a good fit for many.

How do I get approved for a home loan if I’m self-employed?

Self-employment doesn’t prevent you from taking out a home mortgage. In most cases, you’ll need to provide income documentation. A good credit score and a down payment may also be helpful.

Speak to Alex Doce about the loan options that might be right for you.

What could cause my mortgage funding to fall through prior to closing?

There are a few reasons the loan could fall through.

- You make big purchases on credit before closing day, which alters your creditworthiness.

- You applied for more credit before closing day, altering your creditworthiness.

- The lender isn’t satisfied with the home appraisal. They want to see that the house’s worth is greater than or equal to the loan amount. If the house’s worth is significantly less than the loan amount, lenders won’t approve a loan for that home, even if they’d approve a loan for a different home.

- The lender uncovers a problem with the property title. A lender will not issue funds for that home until the title is clear.

Two of these scenarios are within your control, and the other two are rare. Most people choose their home and purchase it without any issues.

Get help from Alex Doce Today

Are you a first-time homebuyer with additional questions about the purchase process?

Get expert advice from the Doce Group today! Click here to schedule a one-on-one consultation.