Many of the financial systems in this country aren’t necessarily built for self-employed individuals. Many of them rely on the idea that most people receive a regular paycheck from their employer.

Nevertheless, it is possible to buy a house as a self-employed individual. You just have to take a few steps that more traditionally employed people don’t necessarily have to take.

#1) Stay in Business Long Enough

Your business must be active for at least 12 consecutive months before you can get a mortgage loan, and you need to be able to show at least 2 years of verified employment in the same line of work.

Ultimately, you need to demonstrate a track record of financial and career stability.

If your new business is in a different industry or field than your old business, you may need to wait until you’ve been in business for at least two years.

#2) Get Your Documentation and Finances in Order

Some people say “self-employed” when they mean “unemployed.” Thus, lenders require you to provide a history of uninterrupted income.

The simplest way to do this is with your business and personal tax returns and or bank statements. Gather two years of returns, or statements, and have them all in order. Variable income is okay, but it should be within ranges that will support the mortgage you’re aiming for and preferably not be declining.

#3) Choose the Right Home Loan

Some self-employed professionals will use a bank statement loan to gain a mortgage loan. The income verification on these loans is flexible. The downsides are they can require a larger down payment than other home loan programs, they have higher interest rates, and you can expect underwriters to go through your finances with a fine tooth comb.

Nevertheless, when you work with the right lender, the process can be simple and relatively headache-free, especially if you work with someone who will give you personalized guidance on reasonable mortgage loan and down payment expectations.

Apply for Your Home Loan Today

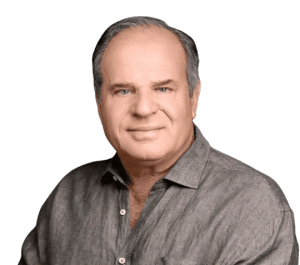

Schedule a free consultation with Alex Doce of The Doce Group to see if you are a good candidate for a bank statement loan. Your next home may be closer than you think!