Índice

- ¿Qué es un préstamo Jumbo en Miami?

- Beneficios clave de un préstamo Jumbo en Miami

- ¿Quién califica para un préstamo Jumbo en Miami?

- ¿Cuánto se puede pedir prestado en Miami en 2025?

- Pagos iniciales, tipos de interés y normas PMI

- Cómo solicitar un préstamo Jumbo en Miami

- Por qué los préstamos Jumbo son populares en el mercado de lujo de Miami

- Uso de un préstamo Jumbo en Miami para segundas viviendas o propiedades de inversión

- ¿Se puede refinanciar un préstamo Jumbo en Miami? Por supuesto que sí.

- Consejos para obtener la aprobación rápida en el mercado competitivo de Miami

- Los mejores barrios de Miami para los compradores de préstamos Jumbo

- Vivir en Miami: Por qué se mudan tantos compradores

- Preguntas frecuentes sobre los préstamos Jumbo en Miami

- Por qué trabajar con The Doce Mortgage Group

Conferencias magistrales

- El Préstamo Jumbo en Miami financia viviendas por encima del límite conforme de $806,500.

- Los compradores pueden calificar con 10% abajo y sin PMI.

- The Doce Mortgage Group simplifica la financiación jumbo con experiencia local y programas a medida.

Si usted está comprando una propiedad en Miami, lo más probable es que esté mirando precios que van mucho más allá de la media nacional. Ahí es donde entra un Préstamo Jumbo en Miami. Este tipo de financiación está diseñado para los compradores que necesitan más de lo que ofrece una hipoteca estándar - especialmente común en una ciudad donde los condominios frente al mar, fincas de lujo y barrios de lujo dominan el mercado.

Un Préstamo Jumbo en Miami le ayuda a financiar casas de alto valor con opciones flexibles que se ajustan a los precios de la ciudad. ¿Y la mejor parte? A menudo puede calificar con tan sólo 10% de enganche y sin PMI. Si usted está explorando sus opciones, echa un vistazo a este Préstamo Jumbo en Miami para empezar con lo básico.

Vamos a desglosar todo lo que necesita saber.

¿Qué es un préstamo Jumbo en Miami?

Un préstamo jumbo es una hipoteca que supera los límites de préstamos conformes establecidos por la Agencia Federal de Financiación de la Vivienda (FHFA). En 2025, el límite básico de préstamos conformes en la mayor parte del país es $819,000, pero las casas en Miami a menudo se venden por mucho más que eso.

En el condado de Miami-Dade, donde el valor promedio de las viviendas sigue subiendo, los compradores con frecuencia necesitan préstamos por encima de este umbral. Ahí es donde un préstamo Jumbo en Miami se convierte en la opción a seguir.

Estos préstamos no están respaldados por Fannie Mae o Freddie Mac, lo que significa que siguen normas diferentes. Necesitarás unas finanzas sólidas, pero también obtendrás más poder adquisitivo.

Beneficios clave de un préstamo Jumbo en Miami

Un Préstamo Jumbo en Miami ofrece una tonelada de flexibilidad para los compradores que buscan casas por encima del límite estándar. Esto es lo que se destaca:

- Financie viviendas de lujo de hasta $5.000.000 con un solo préstamo y con tan sólo 20% de entrada.

- A partir de 10% de entrada, sin necesidad de seguro hipotecario privado (PMI)

- Tipos muy competitivos, a menudo iguales o mejores que los de los préstamos conformes en 2025

- Disponible para viviendas principales, segundas viviendas y propiedades de inversión

- En algunas zonas de alto coste de Florida, como el condado de Monroe, se aplican límites más elevados, de $967.150, mientras que Miami-Dade sigue la base de $819.000.

Ese tipo de poder da a los compradores una ventaja real en un mercado competitivo.

¿Quieres ver qué tipo de tarifa podrías conseguir? Obtenga un Cita ahora con The Doce Mortgage Group.

¿Quién califica para un préstamo Jumbo en Miami?

Para que le aprueben un préstamo Jumbo en Miami es necesario contar con una sólida situación financiera. Pero si usted cumple con los requisitos básicos, el proceso puede moverse rápidamente.

Esto es lo que necesitarás normalmente en 2025:

- Puntuación FICO mínima de 660 (aunque una puntuación más alta puede ayudar a obtener mejores condiciones)

- Ratio deuda-ingresos (DTI) máxima de 55%

- Historial laboral sólido: por lo general, dos años de ingresos estables.

- Prueba de bienes: a menudo suficientes para cubrir de 3 a 12 meses de pagos futuros.

- Historial de crédito limpio y uso responsable del crédito renovable

Algunos prestatarios pueden incluso optar a la ayuda con ingresos no tradicionales, como el trabajo por cuenta propia o los rendimientos de inversiones, si están debidamente documentados.

¿Cuánto se puede pedir prestado en Miami en 2025?

En 2025, la línea de base de préstamos conformes límite es $806,500, y Miami-Dade unifamiliar precio medio de venta fue de aproximadamente $660.000 en julio de 2025, con muchas áreas mucho más alto.

Si usted está mirando Coral Gables, Brickell, o casas frente al mar en Miami Beach, los precios alcanzan fácilmente $1 millones o más. Ahí es donde un préstamo Jumbo en Miami se convierte en la elección inteligente.

Estos préstamos te permiten pedir prestado:

- Hasta $5.000.000 con un solo préstamo

- Con tan sólo 20% de bajada para cantidades mayores

- Con 10% a 15% abajo para cantidades jumbo más bajos, dependiendo de su crédito y DTI

¿Tienes curiosidad por saber cuánto te puedes permitir? Pruebe nuestro Calculadora de hipotecas y hacer números en segundos.

Pagos iniciales, tipos de interés y normas PMI

Hablemos de dinero. Los pagos iniciales, las tasas y el PMI son tres de los temas más importantes para los prestatarios jumbo.

Requisitos del pago inicial en 2025:

- 10% de entrada para compradores cualificados hasta ciertos límites

- 15% de entrada más común para los préstamos jumbo de gama media

- 20% de entrada suelen ser necesarios para préstamos de hasta $5 millones.

No se requiere PMI: Así es: incluso con un pago inicial de 10% o 15%, no se verá obligado a pagar el seguro hipotecario privado. Eso le ahorra cientos cada mes.

Tipos de interés: A partir de septiembre de 2025, la media nacional de tipos fijos a 30 años para grandes préstamos se sitúa en torno al 6,34%. Eso es en realidad más bajo que algunas tasas conformes, gracias a los fuertes perfiles de los prestatarios y la demanda del mercado.

¿Quiere saber si tiene derecho a ayuda? Llámenos al 305-900-2012 para hablar de sus opciones de préstamo jumbo.

Cómo solicitar un préstamo Jumbo en Miami

El proceso de solicitud de un préstamo Jumbo en Miami es muy sencillo, especialmente cuando se trabaja con un equipo local que conoce el mercado.

Así es como suele ser:

- Obtenga la preaprobación para que conozca su presupuesto

- Envíe su solicitud a través de Nuestro portal de aplicaciones

- Cargue sus documentos (ingresos, patrimonio, DNI, etc.)

- Bloquee su tarifa una vez firmado el contrato

- Cerrar a la casa de sus sueños con confianza

Los préstamos Jumbo son rápidos cuando se tiene la documentación adecuada. La mayoría de las aprobaciones terminan en menos de 30 días, dependiendo de la complejidad de su archivo.

Por qué los préstamos Jumbo son populares en el mercado de lujo de Miami

La escena inmobiliaria de Miami está construida para los compradores que quieren algo especial - vistas frente al mar, áticos, comunidades privadas, o segundas residencias que se duplican como escapadas de vacaciones. El préstamo Jumbo en Miami es lo que hace posible este tipo de compra para muchos compradores.

Estos préstamos le dan la libertad de financiar los tipos de propiedades que definen el estilo de vida de Miami:

- Urbanizaciones cerradas frente al mar

- Condominios de gran altura con vistas al océano

- Casas históricas en Coconut Grove o Coral Gables

- Propiedades de inversión en zonas con fuertes ingresos por alquiler

Particulares con grandes patrimonios, empresarios y compradores internacionales son usuarios frecuentes de la financiación jumbo. Algunos trasladan aquí su residencia principal, mientras que otros diversifican sus inversiones inmobiliarias.

Uso de un préstamo Jumbo en Miami para segundas viviendas o propiedades de inversión

Miami no es sólo un punto de atracción para residentes a tiempo completo. También es un mercado importante para segundas viviendas, propiedades vacacionales y alquileres a largo plazo. Muchos compradores utilizan un préstamo Jumbo en Miami para financiar este tipo de compras.

En el primer trimestre de 2025, los inversores compraron alrededor del 30% de las viviendas del área de Miami, la proporción más alta entre las principales metrópolis, y Miami también ocupa el primer lugar en EE.UU. en cuanto a propiedad de segundas viviendas por parte de personas muy adineradas. Ahí es donde entran en juego los préstamos jumbo.

Esto es lo que debe saber:

- Puede utilizar un préstamo jumbo para financiar una segunda vivienda aunque su residencia principal esté fuera de Florida

- También puede utilizar uno para propiedades de inversión, incluidos los alquileres a corto plazo (siempre que la propiedad cumpla determinadas condiciones)

- Normalmente necesitarás un pago inicial mayor, entre 101 y 201 TTP3T.

- Sus ingresos por alquiler pueden tenerse en cuenta para cumplir los requisitos si tiene un contrato de arrendamiento o un historial de alquiler.

Muchos inversores prefieren los préstamos jumbo a los préstamos comerciales por los mejores tipos, los plazos fijos más largos y la flexibilidad con los tipos de propiedad.

Si piensa alquilar su vivienda a tiempo parcial, o simplemente quiere una casa de vacaciones que se pague sola cuando usted no esté, ésta podría ser una forma inteligente de financiarla.

¿Listo para hacer números? Pruebe nuestro Calculadora de hipotecas para ver cómo podrían ser sus pagos mensuales por una segunda vivienda.

¿Se puede refinanciar un préstamo Jumbo en Miami? Por supuesto que sí.

Si usted ya es dueño de una casa de alto valor en Miami, usted podría estar sentado en una gran oportunidad para refinanciar en 2025. Las tasas siguen siendo históricamente atractivas, y muchos propietarios están aprovechando este momento para:

- Reducir sus pagos mensuales

- Cambiar de un préstamo ARM a un préstamo fijo a 30 años

- Sacar dinero para invertir en otras propiedades

- Abandonar el PMI (si refinanciaron a partir de un préstamo conforme que lo exigía)

Refinanciar un Préstamo Jumbo en Miami funciona de manera similar a un refinanciamiento estándar - pero usted querrá trabajar con un equipo que entienda cómo estructurar archivos de préstamos grandes para una aprobación rápida.

La refinanciación también puede abrirle las puertas a la consolidación de otras deudas, a la remodelación de su vivienda o simplemente a la obtención de mejores condiciones en un préstamo antiguo que ya no se ajusta a sus necesidades.

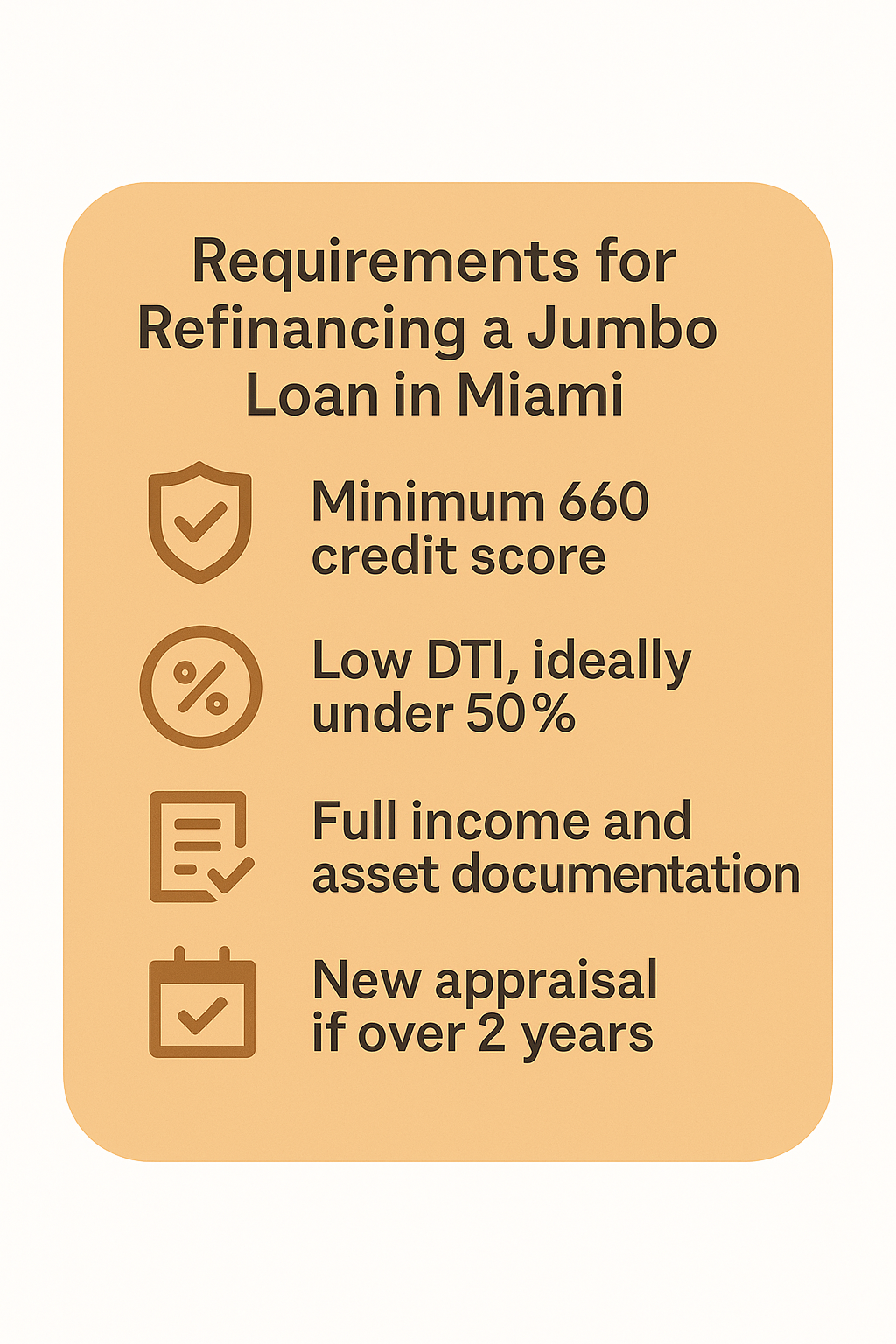

Necesitarás los mismos elementos básicos:

- Puntuación crediticia mínima de 660

- DTI bajo, idealmente por debajo de 50%

- Documentación completa de ingresos y activos

Si han pasado más de dos años desde su última tasación, es posible que necesite una nueva, especialmente si el valor de las viviendas en su zona ha subido. Y en muchas partes de Miami, definitivamente lo han hecho.

¿Quiere saber si una refinanciación tiene sentido para su situación? Obtenga un Cita de The Doce Mortgage Group.

Consejos para obtener la aprobación rápida en el mercado competitivo de Miami

Cuando se compra en el mercado de lujo, la rapidez es importante. Las viviendas en Miami pueden ser objeto de contrato en pocos días, especialmente en los barrios de moda. Para seguir siendo competitivos, los grandes compradores deben:

- Obtenga una preaprobación completa antes de buscar casa

- Trabaje con un profesional hipotecario local que entiende los tipos de propiedad únicos de Miami

- Tener todos los documentos preparadosincluyendo declaraciones de la renta, extractos bancarios e información laboral.

- Conozca su presupuesto y se adhieren a las propiedades dentro del rango

- Esté preparado para actuar con rapidezEspecialmente en propiedades de menos de $2 millones, que tienden a venderse rápidamente.

Si va a financiar un piso, pregunte si el edificio cumple los requisitos: algunos edificios altos requieren revisiones adicionales, y un equipo local como The Doce Mortgage Group puede guiarle en ese proceso.

¿Quiere adelantarse al mercado? Inicie ahora su solicitud utilizando Nuestro portal de aplicaciones y le guiaremos paso a paso.

Los mejores barrios de Miami para los compradores de préstamos Jumbo

Miami está lleno de barrios donde los precios de las viviendas comienzan muy por encima de la media nacional. Aquí están algunas de las zonas más populares para los compradores de préstamos jumbo:

Coral Gables

Conocido por sus calles arboladas, arquitectura mediterránea, y el encanto de lujo. En agosto de 2025, el precio medio de la vivienda era de $1,7 millones.

Cocoteros

Relajado pero lujoso, este barrio ofrece casas frente a la bahía, las mejores escuelas, y una mezcla única de nuevas construcciones y el encanto de la vieja Florida. En agosto de 2025, el precio medio de venta de las viviendas era de $2,0 millones.

Brickell

El centro financiero de la ciudad, con elegantes rascacielos y áticos altísimos. Muchas unidades superan $1 millón, con propiedades de ultra-lujo que alcanzan $10 millones o más.

Key Biscayne

Una comunidad insular a pocos minutos del centro de la ciudad, llena de condominios de alta gama y casas frente al mar. En agosto de 2025, el precio medio de venta de las viviendas rondaba los $2,2 millones.

Miami Playa

Vida frente al mar, joyas Art Deco, y condominios de lujo hacen de esta una de las zonas más calientes para los compradores de préstamos jumbo. Las casas aquí se venden regularmente por $3 millones y más.

¿Listo para financiar la casa de sus sueños en una de estas zonas? Obtenga un Cita para ver qué opciones tienes.

Vivir en Miami: Por qué se mudan tantos compradores

El atractivo de Miami va mucho más allá del clima cálido. Para los compradores de altos ingresos, los inversores y las familias que se trasladan, la ciudad ofrece:

- Sin impuesto estatal sobre la rentapor lo que es una decisión inteligente para empresarios y emprendedores.

- Clima tropical todo el añoperfecto para los amantes de la playa y los paseos en barco

- Mercados laborales en augeEspecialmente en los sectores tecnológico, financiero, inmobiliario y hostelero.

- Diversidad culturalcon comunidades vibrantes, comida internacional y escenas artísticas

- Fácil acceso internacionalCon el Aeropuerto Internacional de Miami a sólo unos minutos

De 2020 a 2024, Miami-Dade agregó alrededor de 143,000 residentes, con un crecimiento impulsado en gran medida por la migración internacional. Estos compradores están impulsando la demanda en el espacio de lujo - y muchos de ellos están utilizando un préstamo Jumbo en Miami para hacer la compra.

¿Cree que Miami podría ser su próximo destino? Llámenos hoy mismo al 305-900-2012 para hablar de cómo la financiación Jumbo podría ayudarle a conseguirlo.

Preguntas frecuentes sobre los préstamos Jumbo en Miami

¿Cuánto cuesta un préstamo jumbo en Miami en 2025?

Cualquier préstamo superior a $819.000 se considera un préstamo jumbo en la mayoría de los condados, incluido Miami-Dade. Muchos compradores aquí utilizan préstamos jumbo para casas con precios de $1 millón a $5 millones.

¿Puedo obtener un préstamo jumbo con 10% abajo?

Sí. Muchos compradores pueden cumplir los requisitos con tan solo 10% de entrada, y no se requiere PMI. Sólo necesitarás un crédito sólido y unos buenos ingresos.

¿Los préstamos "jumbo" tienen tipos más altos que los préstamos normales?

No siempre. En 2025, los tipos de Préstamos Jumbo en Miami son competitivos, a veces incluso más bajos que los préstamos conformes para compradores cualificados.

¿Puedo utilizar un préstamo Jumbo para comprar una propiedad de inversión?

Sí. Muchos inversores utilizan préstamos jumbo para comprar propiedades de alquiler o segundas residencias en Miami, especialmente en áreas con una fuerte demanda de Airbnb o alquileres de temporada.

¿Necesito un crédito perfecto para que me aprueben?

No. Se requiere una puntuación crediticia mínima de 660, pero las puntuaciones más altas pueden desbloquear mejores condiciones. Unos ingresos sólidos y una relación deuda-ingresos baja también ayudan.

Por qué trabajar con The Doce Mortgage Group

Si usted esta pensando en usar un prestamo Jumbo en Miami, usted va a querer un equipo que realmente conozca este mercado. The Doce Mortgage Group ha ayudado a cientos de compradores en el sur de la Florida a ser aprobados rápidamente, con una visión local real y un servicio personalizado.

Ofrecemos:

- Aprobaciones rápidas y tarifas muy competitivas

- Una experiencia en línea completa a través de Nuestro portal de aplicaciones

Pero no se fíe sólo de nuestra palabra. Echa un vistazo la opinión de nuestros clientes. Han compartido sus experiencias reales, y estamos orgullosos de la confianza que han depositado en nosotros.

Si quieres avanzar en serio, no hay razón para esperar. Utilice nuestra calculadora de hipotecas para estimar sus pagos, o siga adelante y inicie su solicitud ahora. O llámenos hoy al 305-900-2012 para hablar con un experto en préstamos jumbo de Miami y dar el siguiente paso hacia la propiedad de sus sueños.