Índice

- ¿Qué es un préstamo DSCR y por qué funciona de manera diferente en Boca Raton

- Cómo puede calificar para un préstamo DSCR en Boca Ratón sin declaraciones de impuestos o recibos de pago

- Por qué un préstamo DSCR en Boca Ratón es inteligente en 2025

- Por qué Boca Ratón es un imán para los inversores inmobiliarios

- Mejores Barrios en Boca Raton para Propiedades de Inversión

- Consejos para inversores primerizos en DSCR en el sur de Florida

- FAQ: Préstamos DSCR en Boca Raton

- Hable con los expertos que conocen los préstamos de inversión en Boca Ratón

Conferencias magistrales

- Los préstamos DSCR en Boca Raton le califican por ingresos de alquiler, no por declaraciones de impuestos.

- La fuerte demanda de alquileres de Boca Ratón hace que las propiedades de inversión sean muy rentables.

- Doce Mortgage Group guía a los inversores en cada paso de la financiación DSCR.

Boca Raton es una ciudad que muchos inversionistas de bienes raíces están mirando de cerca y un préstamo DSCR en Boca Raton sin mostrar declaraciones de impuestos o talones de pago podría ser su boleto de entrada. Si usted está interesado en la financiación de la propiedad de inversión mediante la calificación sobre la base de los ingresos de alquiler en lugar de documentación de ingresos personales este artículo es para usted. En The Doce Mortgage Group ayudamos a la gente a explorar Préstamos DSCR en Florida para que pueda ver si esta opción se ajusta a sus objetivos de inversión.

¿Qué es un préstamo DSCR y por qué funciona de manera diferente en Boca Raton

Un préstamo DSCR es un préstamo con ratio de cobertura del servicio de la deuda. En lugar de la prueba estándar de ingresos a través de declaraciones de impuestos o talones de pago, usted califica basado en la cantidad de ingresos que la propiedad trae en relación con los pagos que debe hacer. El ratio se calcula dividiendo los ingresos netos de explotación por el servicio anual de la deuda. Si ese ratio es lo suficientemente alto, el préstamo puede funcionar.

He aquí cómo los préstamos DSCR tienden a trabajar y lo que importa cuando usted solicita un préstamo DSCR en Boca Ratón

- La propiedad debe generar ingresos por alquiler, después de los gastos de explotación

- El ratio DSCR mínimo suele oscilar entre 1,0 y 1,25 en función de las directrices y el tipo de propiedad.

- La mayoría de los programas de préstamos requieren una puntuación crediticia mínima de entre 640 y 680, dependiendo del producto. Sin embargo, también ofrecemos opciones de financiación para prestatarios cualificados con puntuaciones de crédito tan bajas como 620.

- El pago inicial suele oscilar entre el 15% y el 25% del precio de compra.

- Las propiedades elegibles suelen ser inversiones de 1 a 10 unidades o condominios que se alquilan bien.

Debido a que los valores de propiedad de Boca Raton son altos, con un precio medio de la vivienda alrededor de 650.000 dólares a partir de septiembre de 2025, el potencial de alquiler es fuerte. Un préstamo DSCR en Boca Raton da a los inversores una manera de aprovechar los ingresos por alquiler en un mercado de alto costo.

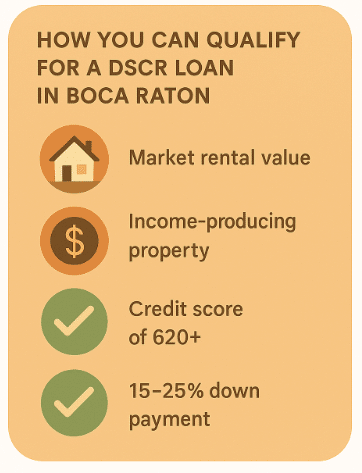

Cómo puede calificar para un préstamo DSCR en Boca Ratón sin declaraciones de impuestos o recibos de pago

A continuación le indicamos lo que los suscriptores suelen tener en cuenta cuando presenta una solicitud utilizando ingresos por alquiler en lugar de los documentos de ingresos tradicionales:

- Valor estimado de alquiler en el mercado, que también incluye los alquileres a corto plazo.

- Pruebas de que la propiedad produce o producirá ingresos.

- Buena puntuación crediticia, a menudo de 640 a 660 o mejor. Puede ser tan bajo como 620.

- Pago inicial del 15 al 25 por ciento.

Dado que no utiliza W2, recibos de nómina ni declaraciones de impuestos, tendrá que compensarlo con unos indicadores inmobiliarios más sólidos y unas finanzas limpias para la propiedad en sí.

Si quiere tener una idea de cómo serán sus pagos utilizando los ingresos por alquiler en Boca Ratón pruebe nuestro Calculadora de hipotecas para que pueda calcular las obligaciones mensuales en función del precio de la vivienda y los tipos de interés.

Por qué un préstamo DSCR en Boca Ratón es inteligente en 2025

Boca Raton sigue siendo un mercado fuerte para las propiedades de inversión en 2025. Aquí hay algunos hechos que hacen un préstamo DSCR en Boca Raton especialmente atractivo ahora:

- Precio medio de venta de viviendas en Boca Ratón en julio de 2025 fue de alrededor de 560.000 dólares

- Casas en Boca Ratón estaban tomando una mediana de 58 días pendientes en agosto de 2025, más lento que hace un año, lo que da a los compradores más espacio para negociar

- El alquiler medio en Boca Ratón fue de unos 3.041 dólares en agosto de 2025, con apartamentos típicos de un dormitorio alrededor de 2.283 dólares y alquileres de tres dormitorios cerca de 3.897 dólares al mes.

Debido a esos números utilizando un préstamo DSCR en Boca Raton da a las personas que no tienen pruebas tradicionales de ingresos de nómina una oportunidad de invertir. Pueden apoyarse en los ingresos por alquiler y buena selección de la propiedad en su lugar.

Los inversores deben tener en cuenta que los préstamos DSCR suelen exigir al menos entre un 15% y un 25% de entrada. La posibilidad de apalancar menos dinero propio por adelantado puede agilizar la ampliación de una cartera. Si está considerando la posibilidad de realizar varias compras, merece la pena que hable con nuestro equipo para estudiar qué programas podrían ajustarse a sus objetivos.

Si desea estudiar si puede optar a estructuras de financiación exclusivas, puede Obtenga un Cita hoy mismo para ver qué cifras se ajustan a su situación concreta.

Por qué Boca Ratón es un imán para los inversores inmobiliarios

Boca Ratón es una ciudad del sur de Florida con un gran atractivo para los inversores inmobiliarios en 2025. El crecimiento de la población continúa en todo el condado de Palm Beach, y Boca se ha convertido en un centro para profesionales y jubilados. Según las estimaciones del Censo de EE.UU., el condado de Palm Beach ha crecido a más de 1,55 millones de residentes en 2025, con Boca contribuyendo una parte significativa de ese crecimiento.

El mercado laboral es igualmente atractivo. Boca Ratón ha experimentado un crecimiento constante en los sectores de servicios profesionales, sanidad y finanzas. Varias grandes empresas, como la sede corporativa de Office Depot y la Florida Atlantic University, consolidan la mano de obra de la ciudad. También ha surgido un sector tecnológico en expansión, que atrae a trabajadores jóvenes a la región.

Para los inversores, esto es importante porque el crecimiento del empleo impulsa la demanda de alquileres. De agosto a septiembre de 2025, los apartamentos de un dormitorio en Boca Ratón promediaban unos 2.283 dólares al mes, mientras que los alquileres de tres dormitorios promediaban unos 3.897 dólares. El fuerte potencial de ingresos compensa los precios más altos de las propiedades, que se sitúan en torno a los 650.000 dólares en septiembre de 2025.

Más allá de las cifras, el estilo de vida de Boca Ratón atrae a inquilinos de altos ingresos que valoran las playas, las compras de lujo y los servicios culturales. Las personas que se trasladan desde el noreste y el medio oeste a menudo buscan Boca como base de operaciones durante todo el año, creando un flujo constante de inquilinos calificados. Esto ayuda a que las propiedades permanezcan ocupadas, que es exactamente lo que usted quiere si está solicitando un préstamo DSCR en Boca Raton.

Si quiere explorar en serio este mercado, empiece por comprobar la asequibilidad con nuestro Calculadora de hipotecas para que pueda realizar escenarios basados en los tipos de interés y los precios inmobiliarios actuales.

Mejores Barrios en Boca Raton para Propiedades de Inversión

No todos los rincones de Boca Ratón son iguales desde la perspectiva de un inversor. Algunos barrios atraen a los jubilados, mientras que otros son más atractivos para los inquilinos más jóvenes o invitados a corto plazo. Saber dónde enfocar su búsqueda de propiedades puede marcar la diferencia en su ratio DSCR y el rendimiento general.

Los inversores suelen centrarse en varias áreas:

- Centro de Boca Ratón: Esta zona tiene una mezcla de condominios de lujo, apartamentos modernos, y la proximidad a Mizner Park. La demanda es alta tanto para alquileres a largo plazo como para alquileres a corto plazo.

- Distrito de Parques de Mizner: Un punto de atracción para profesionales que desean tener acceso a pie a restaurantes, tiendas y vida nocturna. Los condominios y las casas adosadas suelen generar alquileres muy caros.

- Boca Este cerca de la playa: Las propiedades cercanas al agua atraen mucho a los residentes estacionales y a los huéspedes de alquileres vacacionales. El potencial de alquiler a corto plazo es excelente, aunque hay que revisar cuidadosamente las normas municipales.

- Boca del Mar: Una zona suburbana con buenos colegios y servicios familiares. Las viviendas unifamiliares son populares entre los inquilinos a largo plazo.

Cada barrio responde a un perfil de inversión ligeramente distinto. Los alquileres a corto plazo prosperan más cerca del centro y de la playa, mientras que los inquilinos familiares estables a menudo buscan en el interior buenas escuelas y calles más tranquilas. Un préstamo DSCR en Boca Raton le da flexibilidad para elegir en base a su estrategia ya que la calificación es impulsada por los ingresos de alquiler proyectados.

Si está pensando en asegurar su próxima propiedad, puede iniciar el proceso a través de nuestro portal de solicitudes y vea lo rápido que puede obtener una preaprobación.

Consejos para inversores primerizos en DSCR en el sur de Florida

Si está considerando un préstamo DSCR en Boca Ratón por primera vez, hay pasos inteligentes que puede tomar para prepararse para el éxito. Incluso sin años de experiencia en inversiones, tener un plan hace que el proceso sea mucho más fácil.

Conozca sus números con antelación

Empiece por calcular los ingresos previstos por alquiler frente a los gastos. Los impuestos sobre la propiedad, los seguros, las cuotas de la comunidad de propietarios y los gastos de gestión reducen el flujo de caja. Cuanto más positivo sea el flujo de caja, mayor será el ratio DSCR.

Trabaje con un equipo experimentado

La competencia para la propiedad en Boca Raton es fuerte. Asociarse con profesionales que conocen los requisitos de préstamos DSCR, los valores locales y las tendencias de alquiler puede darle una ventaja. The Doce Mortgage Group ayuda a los inversores a alinear la financiación con el rendimiento de la propiedad para que puedan actuar con rapidez.

Planifique su pago inicial

Los préstamos DSCR suelen requerir un pago inicial del 15 al 25 por ciento. Contar con esos fondos le permitirá actuar con mayor rapidez una vez que encuentre la propiedad adecuada. A diferencia de algunos préstamos de vivienda principal, las opciones de pago inicial más pequeñas no son comunes para la financiación DSCR.

Obtenga una preaprobación antes de comprar

La preaprobación demuestra a los vendedores que está preparado y es capaz de cerrar el trato. También aclara su presupuesto antes de hacer ofertas. Usted puede Obtenga un Cita hoy mismo para ver qué cifras se ajustan a su situación.

Pensar en la estrategia a largo plazo

Algunos inversores en Boca Raton maximizar los ingresos a través de alquileres a corto plazo, mientras que otros prefieren estables, los inquilinos a largo plazo. Decida qué enfoque se adapte a su estilo de vida y la comodidad con la gestión de la propiedad. Los préstamos de DSCR permiten la flexibilidad para cualquier modelo.

FAQ: Préstamos DSCR en Boca Raton

¿Cuánto ingreso de alquiler necesito para calificar para un préstamo DSCR en Boca Ratón?

Normalmente, se necesita un ratio DSCR de al menos 1,0, lo que significa que los ingresos por alquiler cubren el pago de la hipoteca. Muchos prestamistas prefieren 1,2 o más, lo que supone un colchón. También ofrecemos préstamos sin ratio DSCR.

¿Qué tipos de inmuebles pueden optar a un préstamo DSCR?

Las viviendas unifamiliares, condominios, casas adosadas y propiedades multifamiliares de hasta diez unidades suelen ser elegibles. En Boca Ratón, pueden ir desde condominios de lujo cerca de Mizner Park hasta viviendas unifamiliares en el interior.

¿Puedo utilizar los ingresos de Airbnb para obtener un préstamo DSCR?

Sí, los ingresos por alquiler a corto plazo se pueden utilizar si se documentan correctamente. Muchos inversores en Boca Raton dependen de los ingresos de Airbnb o VRBO, especialmente cerca de la playa.

¿Son los tipos DSCR más altos que los de las hipotecas tradicionales?

Sí, los préstamos DSCR suelen tener tipos ligeramente más altos porque se basan en los ingresos de la propiedad y no en los ingresos personales. La contrapartida es flexibilidad y menos papeleo.

¿Pueden los extranjeros obtener un préstamo DSCR en Boca Ratón?

Absolutamente. Muchos compradores internacionales adquieren propiedades de inversión en el sur de Florida utilizando la financiación DSCR ya que no se requiere documentación de ingresos personales en EE.UU..

¿Necesito reservas para poder optar a la ayuda?

A menudo sí. Muchos programas de préstamos DSCR requieren varios meses de reservas, especialmente en los mercados de mayor costo como Boca Ratón.

Hable con los expertos que conocen los préstamos de inversión en Boca Ratón

Invertir en una ciudad como Boca Raton puede abrir las puertas a los ingresos de alquiler constante y la apreciación a largo plazo. Un préstamo DSCR en Boca Raton le da la flexibilidad para calificar basado en el rendimiento de la propiedad en lugar de declaraciones de impuestos o recibos de pago, por lo que es una herramienta inteligente para los inversores con ingresos no tradicionales o compradores internacionales que buscan aprovechar el crecimiento de la Florida.

En The Doce Mortgage Group, nos especializamos en guiar a los inversores a través del proceso para que puedan moverse rápidamente en mercados competitivos. No se conforme con nuestra palabra, puede ver opiniones de clientes de personas a las que hemos ayudado en toda Florida.

Llámenos hoy mismo al 305-900-2012 para hablar con un experto en préstamos DSCR y ver cómo podemos ayudarle a asegurar su próxima propiedad de inversión en Boca Ratón.