Índice

- Consejo 1: Entienda qué es un préstamo para extranjeros

- Consejo 2: Conozca los requisitos básicos de admisibilidad

- Consejo 3: Prepárese para los anticipos y las reservas

- Consejo 4: Infórmese sobre los requisitos de documentación

- Consejo 5: Explore las opciones de programas de préstamos

- Consejo 6: Calcule la asequibilidad antes de comprar

- Consejo 7: Elija el tipo de propiedad adecuado

- Consejo 8: Trabaje con un especialista que entienda de préstamos a extranjeros

- Consejo 9: Comprenda por qué Florida es la primera opción para los compradores internacionales

- Consejo 10: Considere el estilo de vida y los beneficios a largo plazo

- Preguntas frecuentes para extranjeros que compran en Florida

- Por qué trabajar con The Doce Mortgage Group

- Una forma inteligente de comenzar la compra de su casa en Florida

Conferencias magistrales

- Los préstamos a extranjeros permiten destinar hasta $10M a segundas residencias o inversiones.

- Los pagos iniciales oscilan entre 25 y 35% y se requieren entre 6 y 12 meses de reservas.

- Florida atraerá a 21% de los compradores extranjeros de inmuebles en EE.UU. en 2025.

Florida sigue siendo el destino número uno para los extranjeros que compran viviendas en Estados Unidos, y en 2025 la demanda se mantiene fuerte. Los compradores internacionales se sienten atraídos por el clima cálido, el próspero mercado de alquiler y el potencial a largo plazo de revalorización de la propiedad. Tanto si se trata de adquirir una propiedad de vacaciones, una segunda residencia o una vivienda de inversión, existen opciones de financiación específicas para compradores internacionales. Una de las mejores maneras de empezar es informarse sobre préstamos a extranjerosque están diseñadas para hacer posible la compra de una vivienda en Florida incluso si no se tiene un historial crediticio estadounidense o un número de la Seguridad Social.

El proceso puede parecer abrumador al principio, pero con la orientación y preparación adecuadas, se convierte en algo sencillo. A continuación encontrará diez consejos esenciales que le ayudarán a navegar por el proceso, entender lo que se requiere, y aprovechar las oportunidades únicas que los bienes raíces de Florida ofrece a los compradores internacionales.

Consejo 1: Entienda qué es un préstamo para extranjeros

Un préstamo para extranjeros es un tipo especial de hipoteca creado para compradores que viven y trabajan principalmente fuera de Estados Unidos. Estos préstamos se consideran productos hipotecarios no cualificados, lo que significa que no siguen las mismas directrices estrictas que los préstamos hipotecarios estadounidenses estándar. Están diseñados específicamente para personas que pueden no tener una puntuación de crédito estadounidense, un número de la Seguridad Social o incluso una tarjeta de residencia.

Una de las principales ventajas es la accesibilidad. En 2025, los préstamos para extranjeros en Florida permiten financiar hasta $10 millones para propiedades elegibles, lo que da a los compradores la posibilidad de adquirir viviendas de alto valor en zonas privilegiadas como Miami, Fort Lauderdale, Naples y Orlando. Los plazos de los préstamos son flexibles, y los compradores pueden elegir entre opciones de tipo fijo o hipotecas de tipo variable en función de sus objetivos a largo plazo.

Estos préstamos se utilizan para segundas viviendas o propiedades de inversión, no para residencias principales. Muchos compradores internacionales adquieren casas de vacaciones que también alquilan, por lo que este tipo de financiación resulta especialmente atractivo. Al utilizar este programa de préstamos, los extranjeros acceden a uno de los mercados inmobiliarios más sólidos de Estados Unidos sin tener que depender únicamente de las compras en efectivo.

Consejo 2: Conozca los requisitos básicos de admisibilidad

Para poder optar a una hipoteca para extranjeros, debe cumplir ciertos requisitos. El primer paso es demostrar que tiene permiso legal para visitar EE.UU. Esto puede hacerse con un pasaporte válido y un visado o, en algunos casos, con una exención de visado. Dado que estos préstamos están destinados a compradores internacionales, se espera que usted viva y trabaje principalmente en el extranjero.

Otro factor importante es el cumplimiento de la normativa estadounidense. En 2025, las personas procedentes de países sometidos a sanciones de la OFAC no pueden optar a préstamos para extranjeros. Esta lista incluye actualmente a países como Corea del Norte, Siria, Irán y algunos otros, por lo que es importante confirmar la elegibilidad antes de presentar la solicitud.

La comprobación de ingresos es otro requisito, aunque el tipo de documentación aceptada es flexible. Para muchos compradores, es aceptable una carta del contable o una verificación del empleador de su país de origen. Los programas DSCR no exigen la comprobación de los ingresos personales. Los activos líquidos también desempeñan un papel en el proceso de aprobación, ya que los prestamistas quieren ver que usted tiene suficientes reservas para hacer frente a los pagos.

Estos requisitos están diseñados para mantener el proceso justo y transparente para los compradores internacionales. Aunque puedan parecer pasos adicionales, suelen ser sencillos cuando se trabaja con un asesor especializado en ayudar a extranjeros a comprar propiedades en Florida.

Consejo 3: Prepárese para los anticipos y las reservas

Los préstamos a extranjeros suelen exigir pagos iniciales más elevados que las hipotecas tradicionales estadounidenses. En 2025, la horquilla estándar oscila entre el 25% y el 35% del precio de compra de la vivienda. Por ejemplo, si va a comprar una vivienda de $500.000, debe prever un pago inicial de entre $125.000 y $175.000.

Además del pago inicial, la mayoría de los programas también exigen reservas. Las reservas son fondos adicionales que se apartan para cubrir varios meses de pagos hipotecarios, normalmente de tres a doce meses. Estas reservas pueden mantenerse en una cuenta bancaria en su país de origen y no es necesario transferirlas a un banco estadounidense hasta que se acerque la fecha de cierre.

Contar con un pago inicial mayor y unas reservas adecuadas no sólo aumenta sus posibilidades de aprobación, sino que también le sitúa en una posición más fuerte para conseguir mejores condiciones de préstamo. Demuestra estabilidad financiera y reduce el riesgo global para el proveedor de la hipoteca. Para muchos compradores, preparar los fondos con antelación hace que el proceso de compra sea más fluido y menos estresante.

Si aún se encuentra en la fase de planificación, ahora es el momento de empezar a organizar los fondos para el pago inicial y los requisitos de reserva. Una vez que conozca el precio de la vivienda que desea comprar, puede solicitar un presupuesto. Obtenga un presupuesto gratuito para ver qué opciones de financiación tiene en función de las condiciones actuales del mercado.

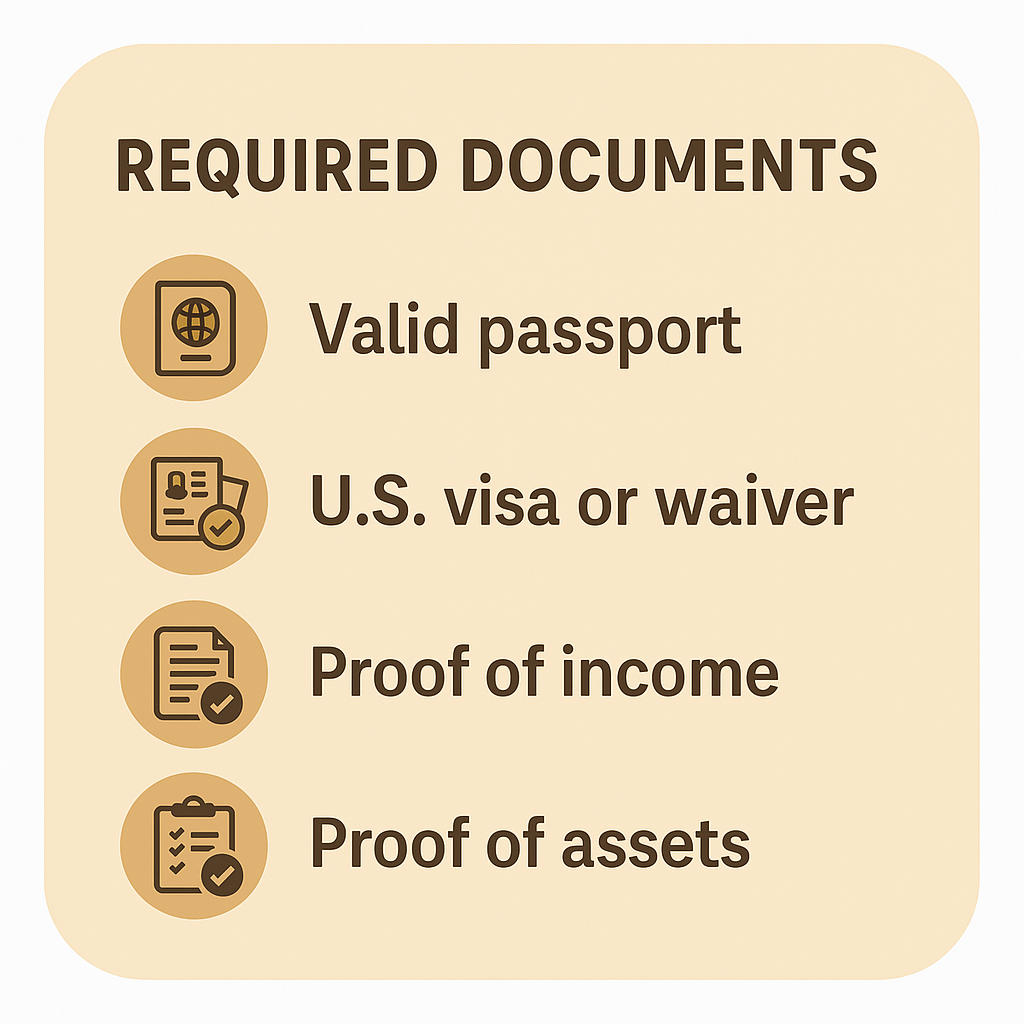

Consejo 4: Infórmese sobre los requisitos de documentación

Al solicitar un préstamo para un extranjero, la documentación es clave. La buena noticia es que los especialistas hipotecarios estadounidenses que trabajan con compradores internacionales aceptan una gran variedad de documentos, y muchos de ellos pueden proceder directamente de su país de origen.

Como mínimo, necesitará un pasaporte válido y un visado de turista para iniciar el proceso. A continuación, se le pedirá que acredite sus ingresos. Puede ser algo tan sencillo como una carta de la empresa en la que se confirme el cargo, el nivel de ingresos y la antigüedad. Si trabaja por cuenta propia, suele aceptarse una carta de un contable en la que se resuman los ingresos de su empresa en los dos últimos años. Los programas DSCR no exigen la comprobación de los ingresos personales.

La verificación de activos es otro requisito. Los extractos bancarios, ya sean de bancos estadounidenses o internacionales, pueden utilizarse para demostrar que dispone de los fondos necesarios para el pago inicial, las reservas y los gastos de cierre. En el caso de compradores sin historial de crédito en EE.UU., también puede solicitarse una verificación de crédito alternativa. Esto podría incluir un informe de crédito internacional o cartas de referencia de bancos extranjeros que confirmen su historial de pago puntual de obligaciones.

La variedad de documentación aceptable hace posible que compradores de todo el mundo cumplan los requisitos. La clave está en organizarse y presentar todo lo solicitado lo antes posible. Una vez presentados y revisados estos documentos, el proceso de aprobación suele avanzar más rápido de lo esperado.

Consejo 5: Explore las opciones de programas de préstamos

Una de las ventajas de comprar una casa en Florida como extranjero en 2025 es la variedad de opciones de programas de préstamos disponibles. La situación financiera de cada comprador es diferente, por lo que tener varios caminos para elegir hace que sea más fácil encontrar el ajuste correcto.

Una opción muy popular entre los inversores internacionales es el préstamo de documentación simplificada. Este programa está diseñado para compradores que no dispongan de declaraciones de la renta en Estados Unidos ni de la documentación financiera tradicional. En su lugar, se pueden utilizar cartas de verificación de ingresos extranjeros y extractos bancarios de su país de origen. Estos préstamos simplifican el proceso y permiten que más compradores cumplan los requisitos.

Otra opción es el préstamo con ratio de cobertura del servicio de la deuda, a menudo conocido como préstamo DSCR. Este tipo de préstamo basa la calificación en los ingresos por alquiler de la propiedad en lugar de en sus ingresos personales. En otras palabras, si la vivienda que va a comprar puede generar suficientes ingresos por alquiler como para cubrir el pago de la hipoteca, puede reunir los requisitos incluso sin los documentos de ingresos tradicionales. Los préstamos DSCR son especialmente atractivos para los compradores que invierten en mercados de alquiler a corto plazo como Miami Beach, Fort Lauderdale u Orlando, donde los alquileres vacacionales tienen una gran demanda.

También existen préstamos de sólo intereses, que ofrecen la flexibilidad de unos pagos mensuales más bajos, especialmente durante los primeros años de propiedad. Muchos compradores utilizan este tipo de préstamo cuando planean revender o refinanciar en un futuro próximo.

Por último, puede elegir entre hipotecas a tipo fijo para mayor estabilidad o hipotecas a tipo variable para pagos iniciales potencialmente más bajos. Cada opción tiene sus pros y sus contras, por lo que hablar con un especialista en hipotecas que entienda de préstamos a extranjeros puede ayudarle a seleccionar el mejor programa para sus objetivos.

Consejo 6: Calcule la asequibilidad antes de comprar

Antes de enamorarse de una propiedad en Florida, es importante saber cuánto puede permitirse. Las cantidades de aprobación de hipotecas dependen de su pago inicial disponible, reservas, verificación de ingresos y el tipo de préstamo que seleccione.

Una de las mejores herramientas para los compradores extranjeros es el Calculadora de hipotecas. Introduciendo el importe potencial del préstamo, el tipo de interés y los impuestos sobre la propiedad, verás una estimación de tu cuota mensual. Esta es una forma útil de comparar diferentes propiedades y comprender el compromiso financiero total.

También es inteligente tener en cuenta los costes que van más allá de la hipoteca. Los impuestos sobre la propiedad en Florida varían según el condado, pero la tasa media efectiva de impuestos sobre la propiedad en Florida es de alrededor del 0,86 por ciento, según los últimos datos comparativos publicados. En las zonas costeras, los compradores deben contar con primas más elevadas debido a la cobertura contra inundaciones y huracanes. Si va a comprar un condominio o una casa adosada, recuerde añadir también las cuotas de la asociación de propietarios a sus gastos mensuales.

Los precios de la vivienda en Florida siguen subiendo, con el precio medio de la vivienda en todo el estado a mediados de 2025 en torno a $415.000 de media. Las propiedades de lujo en Miami, Naples y Palm Beach suelen superar varios millones de dólares, mientras que las viviendas en ciudades más pequeñas y zonas suburbanas pueden situarse por debajo de la media estatal. Si conoce estas cifras con antelación, podrá preparar sus fondos y evitar sorpresas durante el proceso de compra.

Consejo 7: Elija el tipo de propiedad adecuado

Los extranjeros tienen muchas opciones en cuanto a tipos de propiedad en Florida. Cada tipo ofrece ventajas diferentes, y la elección correcta depende de sus objetivos de propiedad.

Las viviendas unifamiliares son una opción popular porque ofrecen intimidad y a menudo cuentan con espacio exterior. Estas casas son más fáciles de revender en el futuro y suelen revalorizarse constantemente.

Los condominios y las casas adosadas también resultan atractivos, sobre todo en ciudades como Miami, Fort Lauderdale y Orlando. Los condominios suelen incluir servicios compartidos, como piscinas, gimnasios o seguridad, lo que los hace atractivos para las vacaciones. Las casas adosadas combinan elementos de los condominios y las viviendas unifamiliares, ofreciendo más espacio pero manteniendo un entorno comunitario.

Las propiedades multifamiliares, incluidos los dúplex, tríplex y cuádruplex, son una buena opción para los inversores. Estas propiedades le permiten obtener ingresos por el alquiler de varias unidades, lo que puede aumentar el rendimiento de su inversión. Para muchos extranjeros, las propiedades multifamiliares son una forma de equilibrar el uso personal con la generación de ingresos.

Las propiedades especiales, como los condominios no garantizables o los condoteles, también están disponibles en determinados programas de préstamos. Estos pueden ser más difíciles de financiar con préstamos estadounidenses estándar, pero las hipotecas para extranjeros los hacen accesibles.

Dado que la elección del inmueble influye tanto en la financiación como en el potencial de inversión a largo plazo, es importante sopesar cuidadosamente las opciones. Si no está seguro, un asesor hipotecario puede explicarle los pros y los contras de cada tipo de propiedad y cómo se ajustan a sus requisitos de financiación.

Consejo 8: Trabaje con un especialista que entienda de préstamos a extranjeros

Comprar una propiedad en otro país conlleva ciertos retos, y trabajar con el experto adecuado puede marcar la diferencia. Los especialistas en hipotecas para extranjeros, como The Doce Mortgage Group, están familiarizados con la documentación, la comprobación de ingresos y los requisitos legales a los que se enfrentan los compradores internacionales.

Una de las mayores ventajas de recurrir a un especialista es la agilización del proceso de solicitud. En lugar de navegar solo por un papeleo confuso, recibirá orientación sobre qué documentos necesita exactamente y cómo presentarlos. Esto ahorra tiempo y reduce la posibilidad de retrasos.

El Grupo Hipotecario Doce también ofrece un recurso en línea, Nuestro portal de aplicacionesque le permite iniciar el proceso desde cualquier lugar del mundo. Puedes subir documentos, seguir el progreso y comunicarte directamente con tu asesor hipotecario, por lo que te resultará cómodo sea cual sea tu zona horaria.

Otra ventaja de trabajar con un grupo hipotecario con sede en Florida es su conocimiento de las leyes de propiedad locales y del mercado inmobiliario. Tanto si compra en Miami, Orlando, Tampa o Naples, obtendrá un asesoramiento acorde con las condiciones locales y las oportunidades de inversión.

Al asociarse con un equipo con experiencia en ayudar a ciudadanos extranjeros, usted gana confianza en que su proceso de préstamo avanzará de la forma más eficiente posible. Este paso es a menudo lo que separa una experiencia estresante de una exitosa.

Consejo 9: Comprenda por qué Florida es la primera opción para los compradores internacionales

Florida sigue siendo el principal destino estadounidense para los compradores de viviendas internacionales, y las cifras de 2025 demuestran por qué. Según el informe 2025 de la Asociación Nacional de Agentes Inmobiliarios, los compradores extranjeros adquirieron alrededor de $56 billones en propiedades residenciales estadounidenses entre abril de 2024 y marzo de 2025, y Florida representó el 21 por ciento de esas compras. Esto significa que una de cada cinco ventas internacionales de viviendas tiene lugar en el Estado del Sol.

Una de las principales razones es el mercado de alquileres del estado. Ciudades como Miami, Orlando y Tampa atraen constantemente a millones de visitantes cada año, lo que mantiene alta la demanda de alquileres vacacionales y viviendas de larga duración. Para los inversores, esto se traduce en un fuerte rendimiento de los alquileres que ayuda a compensar los pagos y gastos hipotecarios.

Otro factor es la estructura fiscal de Florida. Al no tener impuesto estatal sobre la renta, los propietarios pueden retener una mayor parte de sus ganancias en comparación con otros estados. Esto resulta especialmente atractivo para los inversores internacionales de altos ingresos que desean maximizar sus beneficios.

Más allá de las ventajas financieras, Florida ofrece algo único para los compradores de todo el mundo: diversidad cultural y conectividad global. Los aeropuertos internacionales de Miami y Orlando, entre otros, ofrecen vuelos directos a Europa, Latinoamérica y Asia, lo que convierte a Florida en un destino accesible para los propietarios extranjeros. Combinado con su clima cálido y el fuerte crecimiento del empleo, Florida sigue estando a la cabeza de la inversión extranjera.

Consejo 10: Considere el estilo de vida y los beneficios a largo plazo

Aunque el aspecto financiero de la compra de una propiedad en Florida es importante, las ventajas del estilo de vida son igual de atractivas para los extranjeros. El estado ofrece una combinación de sol, playas y ciudades vibrantes que hacen que vivir o pasar las vacaciones allí sea muy deseable.

Florida tiene una media de 230 días de sol al año, y más de 250 días en el sureste de Florida, lo que crea un estilo de vida al aire libre durante todo el año. Desde la navegación y la pesca hasta el golf y el tenis, el ocio forma parte de la vida cotidiana. Ciudades costeras como Naples y Fort Lauderdale atraen a jubilados y residentes estacionales, mientras que Miami y Orlando atraen a familias y jóvenes profesionales en busca de emociones y oportunidades.

La educación y las oportunidades de negocio son otro factor. Florida alberga universidades de prestigio, centros de negocios internacionales y un sector tecnológico y sanitario en expansión. Para los compradores que quieren combinar el ocio con objetivos profesionales o educativos, tener una casa en Florida ofrece ambas cosas.

En cuanto a la inversión, el valor de la vivienda sigue subiendo. El precio medio de la vivienda en todo el estado a mediados de 2025 rondaba los $415.000, un aumento constante respecto a años anteriores. Los mercados inmobiliarios de lujo, especialmente en el sur de Florida, muestran una fuerte revalorización, lo que ofrece a los compradores internacionales la oportunidad de acumular capital a largo plazo.

Para muchos extranjeros, la compra de una propiedad en Florida supone crear un equilibrio entre estilo de vida e inversión. La posibilidad de disfrutar de la vivienda como propiedad vacacional y, al mismo tiempo, beneficiarse de la revalorización y de los posibles ingresos por alquiler hace que la decisión sea aún más gratificante.

Preguntas frecuentes para extranjeros que compran en Florida

¿Puede un extranjero obtener una hipoteca en Florida?

Sí. Los extranjeros pueden solicitar hipotecas diseñadas específicamente para compradores internacionales. Estos préstamos no requieren una puntuación de crédito en EE.UU., número de la Seguridad Social o tarjeta de residencia, aunque sí son necesarias una prueba de fondos y la capacidad legal para visitar EE.UU.

¿Qué tipo de propiedades puedo comprar?

Los préstamos para extranjeros pueden utilizarse para viviendas unifamiliares, condominios, casas adosadas, propiedades de varias unidades e incluso condominios o condoteles no garantizables. Las propiedades deben ser segundas residencias o propiedades de inversión.

¿Cuánto hay que pagar de entrada?

En 2025, el requisito de pago inicial suele ser del 25% al 35% del precio de compra, dependiendo de la propiedad y del programa de préstamo.

¿Hay límites de préstamo?

Sí. Los importes de los préstamos suelen oscilar entre 1.400.000 y 1.400.000 euros, lo que da flexibilidad a los compradores de todos los precios.

¿Qué documentos son necesarios?

Se requiere un pasaporte válido y un visado o exención de visado estadounidense, junto con una prueba de ingresos y bienes. Se aceptan cartas de verificación de ingresos de empleadores o contables, así como extractos bancarios. Si no se dispone de historial de crédito en Estados Unidos, pueden utilizarse informes de crédito internacionales o cartas de referencia, en caso necesario.

¿Hay restricciones por países?

Sí. Los prestatarios de países sancionados por la OFAC no pueden optar a préstamos a ciudadanos extranjeros. Esto incluye países como Corea del Norte, Siria, Irán y otros incluidos en la lista de la normativa estadounidense.

¿Puedo comprar una vivienda habitual con este préstamo?

No. Los préstamos a extranjeros son sólo para segundas residencias o propiedades de inversión, no para residencias principales.

Por qué trabajar con The Doce Mortgage Group

Navegar por el proceso hipotecario de EE.UU. puede parecer complicado, pero The Doce Mortgage Group tiene décadas de experiencia ayudando a los extranjeros a tener éxito. Nuestro equipo entiende las necesidades únicas de los compradores internacionales, desde la aceptación de documentación en el extranjero hasta guiar a los clientes a través de cada paso del proceso.

Ofrecemos una amplia gama de opciones de préstamos, incluidos los programas de documentación ligera, DSCR y sólo intereses. Con montos de préstamo disponibles hasta $10 millones, pueden acomodar a los compradores que buscan cualquier cosa, desde condominios de vacaciones hasta fincas de lujo. Para los compradores que quieren un asesor fiable con un sólido historial de éxito, The Doce Mortgage Group es un socio de confianza.

Los clientes anteriores destacan constantemente la profesionalidad, la eficacia y el servicio personalizado. No dude en consultar cientos de opiniones de compradores reales.

Una forma inteligente de comenzar la compra de su casa en Florida

Comprar una casa en Florida como extranjero es una oportunidad realista y gratificante en 2025. Con la preparación, financiación y orientación adecuadas, puede disfrutar tanto del estilo de vida como de las ventajas de inversión que ofrece la propiedad de una vivienda en el Estado del Sol.

La mejor manera de empezar es explorar sus opciones de financiación, utilizando herramientas como el Calculadora de hipotecas para estimar los pagos, o empezar con Nuestro portal de aplicaciones. Para números personalizados, también puede solicitar un Obtenga un Quote.

Llame hoy al 305-900-2012 para dar el primer paso hacia la compra de su casa en Florida.