Respuesta rápida

You’ll know Florida is in a buyer’s market when there are more homes for sale than active buyers, prices begin to level off, listings stay on the market longer, and sellers start offering concessions like closing cost help or rate buydowns. As 2025 comes to a close, many Florida cities are showing these exact signs, giving homebuyers stronger negotiating power and better opportunities.

Índice

- How To Recognize A Buyer’s Market In Florida

- How Can You Tell When Florida Is Entering a Buyer’s Market?

- What Market Conditions Are Driving the Shift in 2025?

- Which Florida Cities Are Currently Showing Buyer’s Market Signals?

- How Do Mortgage Rates Affect Buyer’s Markets in Florida?

- How Can Buyers Take Advantage of a Softer Market?

- When Might the Florida Market Shift Back Toward Sellers?

- FAQ’s

- Why Choose The Doce Mortgage Group for Your Florida Home Purchase

Los 3 mejores Take-a-Ways

- Mortgage rates in the low sixes are creating more stable buying conditions.

- Florida’s inland cities now offer the best mix of affordability and inventory.

- Acting before 2026 may secure better pricing before competition rises again.

How To Recognize A Buyer’s Market In Florida

A buyer’s market happens when there are more homes available for sale than there are buyers ready to purchase them. This balance gives buyers more control during negotiations, with better pricing, more options, and fewer bidding wars. In Florida, where housing conditions vary by region, understanding when the market leans toward buyers can make a major difference in timing your purchase.

For several years, Florida’s real estate market heavily favored sellers. Prices climbed quickly between 2020 and 2023 as buyers flooded in from other states seeking sunshine, lower taxes, and remote work opportunities. But by 2025, that momentum started to ease. The statewide median sale price for a single-family home in mid-2025 was around $408,000, a slight dip from the previous year. At the same time, the number of active listings grew to nearly 160,000 homes, giving buyers more choices and more negotiating power.

This transition doesn’t look the same everywhere. In fast-growing cities like Miami, Tampa, and Orlando, homes are still selling, but at a slower pace and closer to list price rather than far above it. Inland markets such as Ocala, Lakeland, and Gainesville have seen inventory build up quickly. Sellers who once could pick from multiple offers are now waiting weeks or months to close.

A buyer’s market doesn’t mean prices collapse. Instead, it means buyers can finally shop without pressure. Sellers become more willing to negotiate on price, closing costs, or repairs. For Florida buyers, these conditions make it possible to secure a home with fairer terms and long-term value.

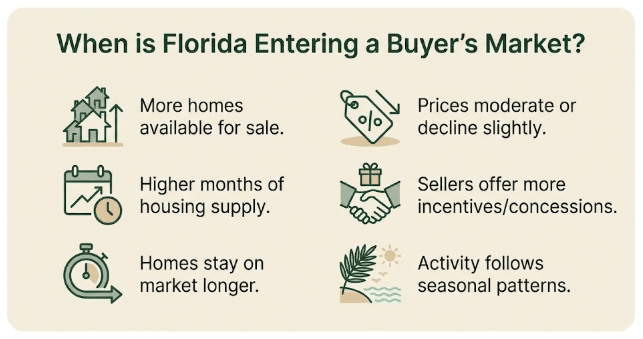

How Can You Tell When Florida Is Entering a Buyer’s Market?

You can identify a buyer’s market by watching a few key indicators. These patterns reveal how supply and demand are shifting and whether buyers are starting to gain leverage.

Rising Inventory Levels

One of the strongest signals is the number of homes on the market. In late 2025, active listings across Florida reached about 160,000, compared with roughly 115,000 a year earlier. When inventory rises faster than demand, sellers must compete to attract buyers, which typically leads to price adjustments.

Months of Supply

Economists measure housing balance through “months of supply,” which estimates how long it would take to sell all available homes at the current pace. A balanced market usually has six months of supply. In 2025, several Florida metros, including Jacksonville and Tampa Bay, reached or slightly exceeded that level.

Longer Time on Market

When homes sit unsold longer, that’s another sign of a cooling market. In fall 2025, the statewide median time on market was around 85 days. That’s nearly double the average from two years ago, showing that buyers now have time to evaluate options and negotiate.

Moderate or Declining Prices

For the first time in several years, prices are no longer climbing quickly. The median sale price for single-family homes in Florida held around $411,000 in late 2025, down about one percent year-over-year. That small dip reflects reduced urgency among buyers and growing flexibility among sellers.

Seller Concessions

In a buyer’s market, sellers often offer incentives such as covering closing costs, helping with rate buydowns, or making repairs before closing. These concessions are increasingly common across Florida, especially in suburban neighborhoods where listings are stacking up.

Seasonal Fluctuations

Florida’s real estate market is seasonal. Winter tends to attract more buyers from northern states, while the summer months often bring slower activity. Because of these patterns, it’s better to track year-over-year data instead of month-to-month numbers to know if the market is truly shifting toward buyers.

If you’re trying to estimate how current home prices could fit into your budget, use our Calculadora de hipotecas to see what your monthly payments might look like based on today’s conditions.

What Market Conditions Are Driving the Shift in 2025?

Several major factors are contributing to Florida’s buyer-friendly market in 2025.

Higher Mortgage Rates

After years of low borrowing costs, the average 30-year fixed mortgage rate now sits near 6.9 percent. This increase makes monthly payments much higher, which has cooled demand. A $400,000 mortgage at 6.9 percent costs nearly $2,600 per month, compared with about $1,700 when rates were near 3 percent. That difference has forced many potential buyers to pause, giving active buyers more leverage.

Slower Population Growth

Florida still attracts new residents, but not as many as during the peak of the pandemic. The state added roughly 295,000 residents between 2024 and 2025, compared with over 400,000 in earlier years. That slower growth has eased pressure on housing supply.

Rising Insurance Premiums

Home insurance has become one of Florida’s biggest affordability challenges. Premiums rose about 8 to 10 percent statewide this year, with coastal areas facing even higher costs. Those added expenses discourage some buyers and create downward pressure on prices.

New Construction and Oversupply

Builders who began large housing developments in 2023 are completing projects in 2025, adding more homes to the market. Cities such as Lakeland, Ocala, and Jacksonville have seen a surge in new subdivisions, giving buyers a wide range of options and the ability to negotiate incentives like appliance upgrades or closing cost credits.

Economic Stability with Cautious Spending

Florida’s economy remains healthy, but higher living costs and cautious consumer sentiment have reduced speculative buying. Investors who once purchased multiple homes have slowed down, creating more opportunities for end users to buy at realistic prices.

If you’re considering buying in 2026, this combination of high supply, stable rates, and moderate prices creates an ideal moment to evaluate your options. You can Obtenga un presupuesto gratuito to see what your purchasing power looks like right now.

Which Florida Cities Are Currently Showing Buyer’s Market Signals?

While Florida as a whole is trending toward balance, several cities already show clear signs of a buyer’s market.

Condado de Miami-Dade

Miami’s luxury segment has cooled first. Active listings rose about 35 percent year-over-year, and the median price for single-family homes now averages around $580,000. Higher insurance costs and a slower influx of out-of-state buyers have caused homes to stay on the market longer. Sellers are more open to negotiations and offering credits to attract buyers.

Orlando

Central Florida is seeing a steady shift as new construction increases and tourism hiring slows. The median price is about $390,000, and homes take close to three months to sell. Many sellers are providing rate buydowns or home warranties to stand out.

Bahía de Tampa

The Tampa metro area remains strong but has clearly softened. The median price sits near $415,000, and listing activity is up about 20 percent compared with 2024. Fewer bidding wars and longer listing times give buyers more leverage.

Jacksonville

Jacksonville is one of the most buyer-friendly markets in Florida. Inventory is up nearly 40 percent from last year, and homes are staying on the market around 90 days. Median prices have dipped slightly to about $370,000. Builders in nearby St. Johns County are offering closing credits and flexible financing terms to keep sales steady.

Inland cities such as Lakeland and Gainesville are also leaning toward buyers, with expanding new home developments and fewer multiple-offer situations. To strengthen your position before entering negotiations, you can apply through Nuestro portal de aplicaciones and get pre-approved quickly.

How Do Mortgage Rates Affect Buyer’s Markets in Florida?

Mortgage rates shape nearly every aspect of real estate activity. When rates rise, demand slows, and when they drop, demand increases again. In 2025, average rates near 6.9 percent have cooled the market but also created stability. Buyers know what to expect, and sellers have adjusted to the new normal.

Many Florida sellers are now using creative tools to attract buyers. Temporary and permanent rate buydowns are common in 2025, especially in new construction communities. A rate buydown can reduce a buyer’s monthly payment for the first two or three years of the loan, making ownership more affordable.

Even though borrowing costs are higher than in 2021, Florida buyers are finding solutions to manage payments. Many are using Programas de ayuda al pago inicial o el Programa HomeZero del Grupo Hipotecario Doce to minimize upfront expenses and begin building equity sooner.

Experts predict rates could gradually ease in late 2025 or early 2026, potentially sparking more buyer activity. Purchasing now while prices are steady and refinancing later when rates fall could be one of the smartest long-term strategies for Florida homebuyers.

How Can Buyers Take Advantage of a Softer Market?

A softer market gives buyers time to think strategically. Instead of rushing, you can compare multiple properties and negotiate favorable terms. Here are several ways to make the most of the current conditions:

- Negotiate beyond price. Ask sellers to cover closing costs, provide repair credits, or include a home warranty.

- Leverage the inspection period. Use inspection results to request repairs or credits. Sellers are far more willing to accommodate reasonable requests today.

- Consider total value. Look at more than the asking price. A slightly higher-priced home with new systems or appliances could save you money long term.

- Get fully pre-approved. Having verified financing through Nuestro portal de aplicaciones gives your offer credibility and helps you move quickly.

- Shop during slower months. Florida’s summer market is quieter, which often gives you even stronger negotiating power.

With inventory up and competition low, buyers who act carefully can secure excellent homes while conditions still lean in their favor.

When Might the Florida Market Shift Back Toward Sellers?

Florida’s current market cycle won’t last forever. Housing typically moves in repeating phases of expansion and contraction. The state is now in a contraction stage where prices stabilize, but as interest rates decline and migration continues, conditions will eventually tighten again.

Analysts expect the balance to start shifting toward sellers by late 2026 or early 2027. If mortgage rates fall below 6 percent, a wave of pent-up buyers could reenter the market, reducing inventory and reigniting competition. High-growth metros such as Orlando, Miami, and Tampa are likely to feel that rebound first.

The best approach is to buy while selection is wide and sellers remain motivated. Acting during a buyer’s market allows you to negotiate strong terms and later benefit from appreciation when the cycle turns. To understand your budget under today’s rates, you can use the Calculadora de hipotecas and explore different loan scenarios.

FAQ’s

What defines a balanced real estate market in Florida?

A balanced market typically has about six months of housing supply. Anything higher favors buyers, while anything lower gives sellers more control.

How can I tell if a seller’s price is flexible?

If a home has been listed for 60 days or longer or has seen multiple price reductions, that usually means the seller is willing to negotiate.

Are condos or single-family homes better to buy in a buyer’s market?

Condos often show bigger price adjustments because there’s usually more supply. Single-family homes hold their value better but still offer room for negotiation.

Will prices keep dropping through 2026?

Most experts expect prices to stay flat or decline slightly before rising again once rates drop and buyer demand returns.

How long do buyer’s markets usually last?

They often last between one and three years, depending on inventory levels, construction activity, and economic growth.

What financing options can help me stand out as a buyer?

Pre-approval, rate buydowns, and programs like the HomeZero Program can strengthen your offer and help you close faster.

Why Choose The Doce Mortgage Group for Your Florida Home Purchase

At The Doce Mortgage Group, we understand Florida’s housing market better than anyone. We’ve guided thousands of buyers through changing market conditions, always focusing on transparency, education, and finding the best program for each client.

Our expertise and service have earned us national recognition. We were honored by WalletHub as one of the Best Mortgage Brokers in several cities throughout Florida, highlighting our reputation for reliability and professionalism across the state.

We take pride in simplifying the process for our clients, offering competitive programs and fast pre-approvals that give buyers a clear edge when negotiating. You can read our opiniones de clientes to see how we’ve helped families across Florida achieve their homeownership goals.

If you’re ready to make the most of today’s buyer-friendly market, Llámenos hoy mismo al 305-900-2012 to start your home-buying strategy.